|  |

STATISTICAL BRIEF #317

|

|

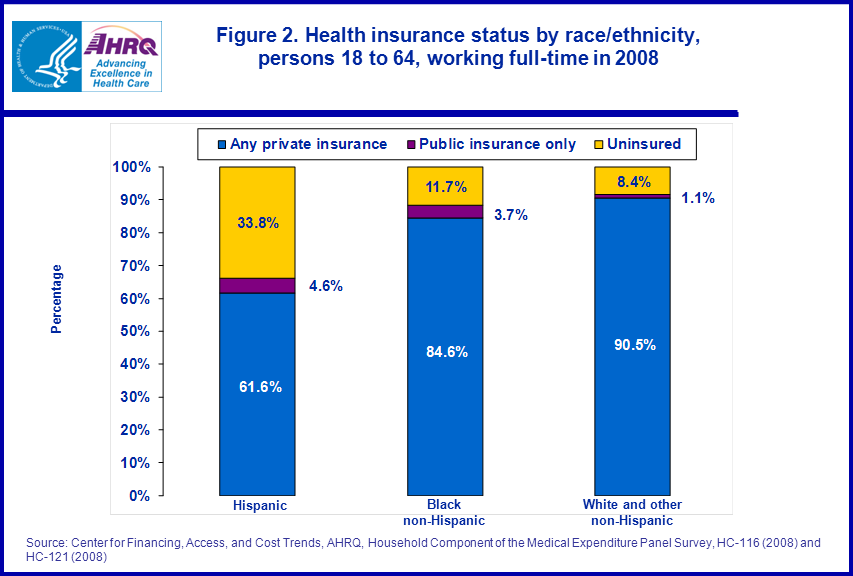

Hispanic workers ages 18– 64 were less likely than other race/ethnicity groups to have private insurance and more likely to be uninsured (figure 2). Less than two-thirds (61.6 percent) of Hispanics had any private coverage, compared to 84.6 percent of black workers and 90.5 percent of white/other workers. More than one-third (33.8 percent) of Hispanic workers were uninsured compared to 11.7 percent of black workers and 8.4 percent of white/other workers. Hispanic workers (4.6 percent) and black workers (3.7 percent) were both more likely than white/other workers (1.1 percent) to have public coverage.

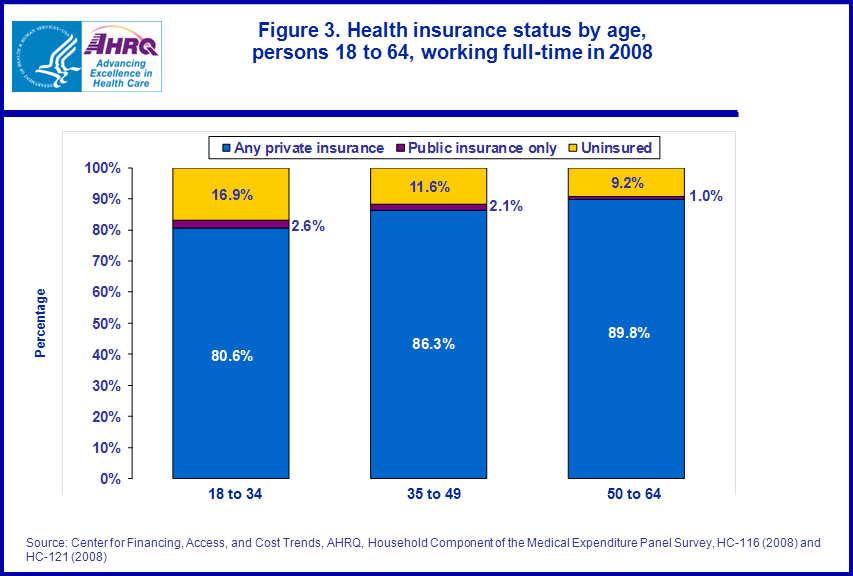

The rate of private insurance coverage increased with age as 80.6 percent of workers ages 18 to 34, 86.3 percent of workers ages 35 to 49 and 89.8 percent of workers ages 50 to 64 had private insurance at some point during the year (figure 3). The percentage of workers who were uninsured declined with age as 16.9 percent of workers ages 18 to 34 were uninsured for the entire year compared to 11.6 percent of workers ages 35 to 49 and 9.2 percent of workers ages 50 to 64.

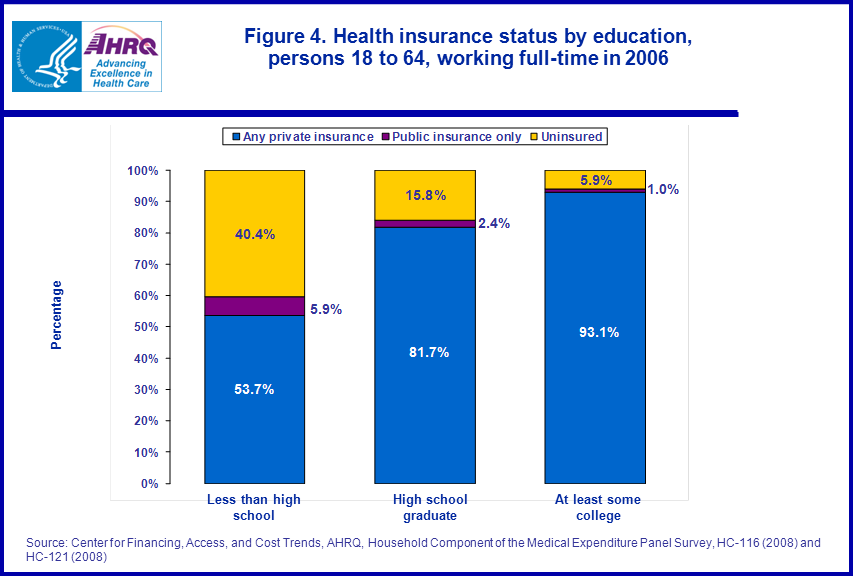

Full time workers ages 18– 64 with less than a high school education were less likely than others to have any private health insurance (figure 4). Only 53.7 percent of those with less than a high school education had any private coverage, compared to 81.7 percent of high school graduates and 93.1 percent of those who attended at least some college. By contrast, workers with less than a high school education (5.9 percent) were more likely than high school graduates (2.4 percent) and workers with at least some college education (1.0 percent) to have public coverage. The rate of uninsurance for workers with less than a high school education (40.4 percent) was more than twice the rate for high school graduates (15.8 percent) and more than six times the rate for workers with some college education (5.9 percent). High school graduates were also less likely to have private insurance only, more likely to have public insurance and more likely to be uninsured than workers who attended at least some college.

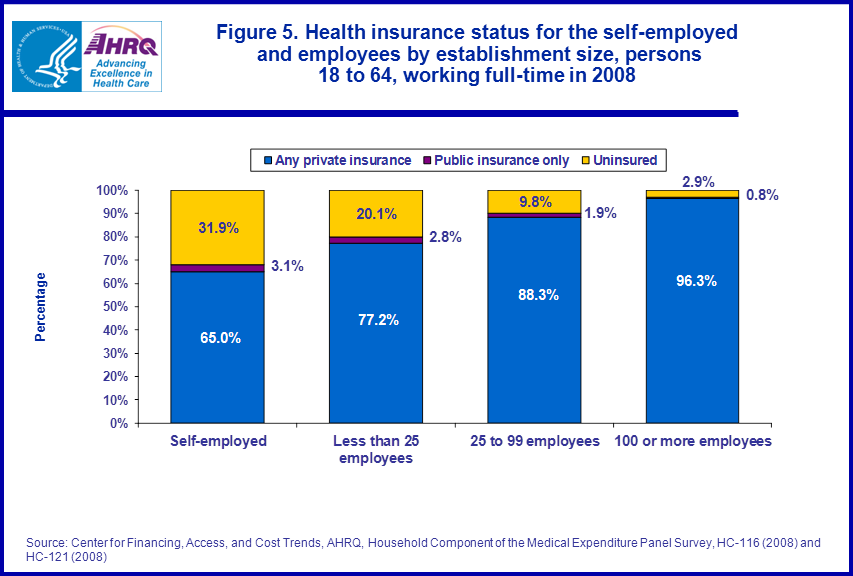

Self-employed workers were the least likely (65.0 percent) to be covered by private insurance and the most likely (31.9 percent) to be uninsured for the entire year (figure 5). Among those who worked for an employer, rates of private insurance increased with firm size as 77.2 percent of workers in small establishments (less than 25 employees), 88.3 percent of workers in medium size establishments (25 to 99 employees) and 96.3 percent of workers in large establishments (100 or more employees) had private insurance at some point during the year. About one of every five (20.1 percent) workers in small establishments were uninsured for the entire year which was more than twice the rate for employees in medium size establishments (9.8 percent) and nearly seven times the rate for employees in large establishments (2.9 percent). Self-employed workers (3.1 percent), employees in small establishments (2.8 percent) and employees in medium size establishments (1.9 percent) were all more likely than workers in large establishments (0.8 percent) to have public coverage only during the year.

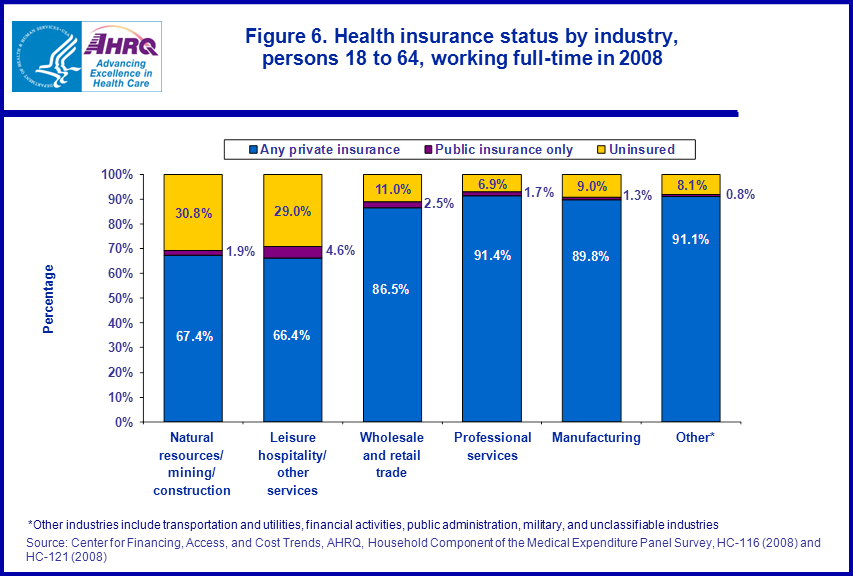

Insurance also showed substantial variation across industry categories (figure 6). Workers ages 18– 64 employed in leisure/hospitality/other services and natural resources/mining/construction were less likely than other workers to have any private insurance during the year (66.4 percent and 67.4 percent, respectively) and more likely than other workers to be uninsured for the entire year (29.0 percent and 30.8 percent, respectively). Workers employed in professional services, manufacturing, wholesale and retail trade and other industries1 were much more likely to have private coverage (86.5 to 91.4 percent across the four industry categories) and much less likely to be uninsured (6.9 to 11.0 percent across the four industry categories).

Data Source

The estimates shown in this Statistical Brief are drawn from analyses conducted by the MEPS staff from the following public use files: 2008 Full Year Consolidated Data File (HC-121); 2008 Jobs File (HC-116). Item nonresponse rates for the items reported in this Brief ranged from 0 percent to 6.3 percent. No adjustments were made for item nonresponse.Definitions

AgeDefined using the last available age for each sampled person.

Education

Measured as the highest level of education each individual has attained. We use the following three education categories:

- Less than high school– having less than 12 years of education.

- High school graduate– having 12 years of education.

- At least some college– having more than 12 years of education.

A particular workplace or location. A small establishment is defined as having fewer than 25 employees; a medium-sized establishment has 25 to 99 employees; a large establishment has 100 or more employees.

Employee

A person on the actual payroll.

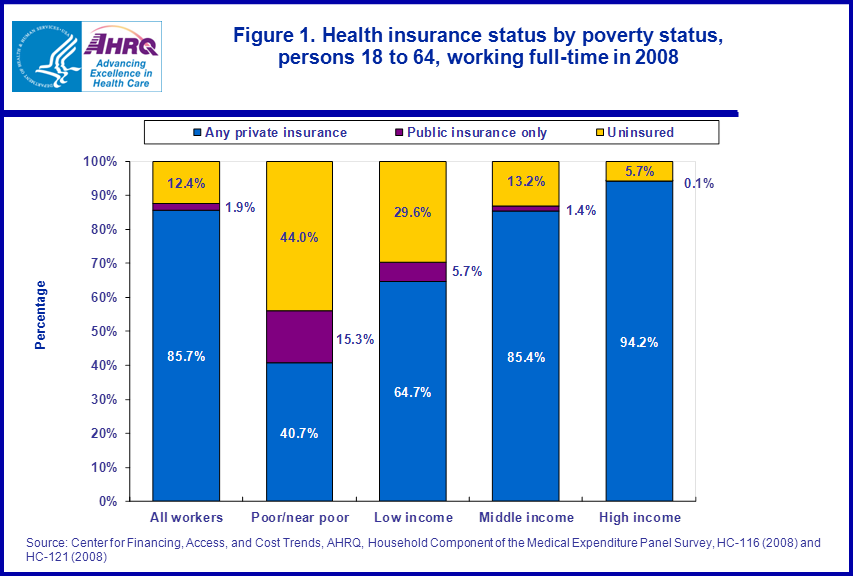

Family income

Income categories are defined by the ratio of family income to the federal income thresholds, which control for family size and age of the head of family. Poverty status was based on annual income in 2008. Family income (poverty status) categories are defined as follows:

- Poor/near poor: persons in families with income less than or equal to 125 percent of the federal poverty line, including those who had negative income.

- Low income: persons in families with income over 125 percent through 200 percent of the federal poverty line.

- Middle income: persons in families with income over 200 percent through 400 percent of the federal poverty line.

- High income: Persons in families with income over 400 percent of the federal poverty line.

A person who worked full time (35 or more hours per week) for all 12 months of the year.

Health insurance status

Insurance for each person is categorized into one of the following three mutually exclusive categories:

- Any private insurance: this group includes those who, at any time in the survey year, had individual or group plan coverage for medical or related expenses or who were covered by TRICARE (which covers retired members of the uniformed services and the spouses and children of active-duty military). Private health insurance plans may include prepaid health plans such as health maintenance organizations but they exclude extra cash coverage plans, medical benefits linked only to specific diseases (dread disease plans), and casualty benefit plans (such as automobile insurance).

- Public insurance only: this group includes persons who were never covered by private insurance or TRICARE during the year but who were covered at any time by Medicare, Medicaid, SCHIP or other State and local medical assistance programs.

- Uninsured: this group includes all persons who did not have private or public insurance coverage at any time in the calendar year.

Industry categories are defined as follows (Industrial Classification System Code Value in parentheses):

- Natural resources/mining/construction includes the industry categories natural resources (0170-0290), mining (0370-0490) and construction (0770).

- Leisure/hospitality/other services includes the industry categories leisure and hospitality (8560-8690), and other services (8770-9290).

- Wholesale/retail trade includes the industry category wholesale and retail trade (4070-4590 and 4670-5790).

- Professional services includes the industry categories professional and business services (7270-7790) and education, health, and social services (7860-8470).

- Manufacturing (1070-3990).

- Other includes the industry categories transportation and utilities (0570-0690 and 6070-6390), financial activities (6870-7190), public administration (9370-9590), military (9890), and unclassifiable industries (9990).

A person 18 to 64 years of age.

Race/ethnicity

Classification by race and ethnicity is mutually exclusive and based on information reported for each family member. Respondents were asked if each family member s race was best described as white, black, Asian, American Indian, Alaska Native, native Hawaiian, Pacific Islander, or multiple races. All persons whose main national origin or ancestry was reported as Hispanic, regardless of racial background, are classified as Hispanic. All non-Hispanic persons whose race was reported as Asian, American Indian, Alaska native, native Hawaiian, or multiple races are classified in the other race category. For this analysis the following classification by race and ethnicity was used: Hispanic (of any race), black non-Hispanic and white/other non-Hispanic.

Worker

Includes employees and the self-employed.

About MEPS-HC

MEPS-HC is a nationally representative longitudinal survey that collects detailed information on health care utilization and expenditures, health insurance, and health status, as well as a wide variety of social, demographic, and economic characteristics for the U.S. civilian noninstitutionalized population. It is cosponsored by the Agency for Healthcare Research and Quality and the National Center for Health Statistics.For more information about MEPS, call the MEPS information coordinator at AHRQ (301) 427-1656 or visit the MEPS Web site at http://www.meps.ahrq.gov/.

References

For a detailed description of the MEPS-HC survey design, sample design, and methods used to minimize sources of nonsampling error, see the following publications:Cohen, J. Design and Methods of the Medical Expenditure Panel Survey Household Component. MEPS Methodology Report No. 1. AHCPR Pub. No. 97-0026. Rockville, MD: Agency for Health Care Policy and Research, 1997. http://www.meps.ahrq.gov/mepsweb/data_files/publications/mr1/mr1.pdf

Cohen, S. Sample Design of the 1996 Medical Expenditure Panel Survey Household Component. MEPS Methodology Report No. 2. AHCPR Pub. No. 97-0027. Rockville, MD: Agency for Health Care Policy and Research, 1997. http://www.meps.ahrq.gov/mepsweb/data_files/publications/mr2/mr2.pdf

Cohen, S. Design Strategies and Innovations in the Medical Expenditure Panel Survey. Medical Care, July 2003: 41(7) Supplement: III-5–III-12.

Cohen, S., Rhoades, J. Estimation of the long term uninsured in the Medical Expenditure Panel Survey. Journal of Economic and Social Measurement, 32(2007):235-249.

Ezzati-Rice, T.M., Rohde, F., Greenblatt, J., Sample Design of the Medical Expenditure Panel Survey Household Component, 1998 – 2007. Methodology Report No. 22. March 2008. Agency for Healthcare Research and Quality, Rockville, MD. http://www.meps.ahrq.gov/mepsweb/data_files/publications/mr22/mr22.pdf

Suggested Citation

Carroll, W.A. and Miller, G.E. Health Insurance Status of Full Time Workers by Demographic and Employer Characteristics, 2008. Statistical Brief #317. March 2011. Agency for Healthcare Research and Quality, Rockville, MD, http://www.meps.ahrq.gov/mepsweb/data_files/publications/st317/stat317.pdfAHRQ welcomes questions and comments from readers of this publication who are interested in obtaining more information about access, cost, use, financing, and quality of health care in the United States. We also invite you to tell us how you are using this Statistical Brief and other MEPS data and tools and to share suggestions on how MEPS products might be enhanced to further meet your needs. Please e-mail us at mepspd@ahrq.gov or send a letter to the address below:

Steven B. Cohen, PhD, Director

Center for Financing, Access, and Cost Trends

Agency for Healthcare Research and Quality

540 Gaither Road

Rockville, MD 20850

1 Other industries include transportation and utilities, financial activities, public administration, military, and unclassifiable industries.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|