Center for Health Statistics (NCHS) of the Centers for Disease Control and Prevention provides consultation and technical assistance related to the selection of the MEPS household sample. As soon as data collection and editing are completed, the MEPS survey data are released to the public in staged releases of summary reports, micro data files, and tables via the MEPS Web site: www.meps.ahrq.gov. Selected data can be analyzed through MEPSnet, an online interactive tool designed to give data users the capability to statistically analyze MEPS data in a menu-driven environment.

Additional information on MEPS is available from the MEPS project manager or the MEPS public use data manager at the Center for Financing, Access, and Cost Trends, Agency for Healthcare Research and Quality, 540 Gaither Road, Rockville, MD 20850;

301-427-1406, or email MEPSProjectDirector@ahrq.hhs.gov.

AHRQ Publications Clearinghouse

Attn: (publication number)

P.O. Box 8547

Silver Spring, MD 20907

800-358-9295

703-437-2078 (callers outside the United States only)

888-586-6340 (toll-free TDD service; hearing impaired only)

To order online, send an email to: ahrqpubs@ahrq.gov.

Be sure to specify the AHRQ number of the document or CD-ROM you are requesting. Selected electronic files are available through the Internet on the MEPS Web site: http://www.meps.ahrq.gov/

For more information, visit the MEPS Web site or email mepspd@ahrq.gov.

Introduction

The Medical Expenditure Panel Survey Insurance Component (MEPS-IC) is an annual federal survey of employers that is a major source of information on employer-related health insurance in the United States. The survey is sponsored by the Agency for Healthcare Research and Quality (AHRQ) and conducted by the U.S. Census Bureau. It is designed to collect employment-related health insurance information, such as whether insurance is offered and if so, the annual premiums, enrollments, employee contributions, and types of offered plans, deductibles, coverage and copayments. Plan characteristics such as firm size, type of industry, average payroll per employee, and other items are also collected.

The survey was first administered in 1997, with data collected for the entire 1996 calendar year. Since then, a large number of tables of estimates are published on the MEPS Web site for each survey year (http://meps.ahrq.gov/mepsweb/data_stats/quick_tables.jsp#insurance). These tables provide estimates at the national, State, and Census geographic division levels as well as for selected metropolitan statistical areas (MSA). Data from the MEPS-IC are only released in aggregate tabular format because of Census confidentiality restrictions.

This report describes the survey design, sampling allocation, and sample selection process for the 2011 MEPS-IC. A glossary of terms related to the MEPS-IC is available at: http://meps.ahrq.gov/mepsweb/survey_comp/ic_ques_glossary.shtml

Return to Table of Contents

Sample Design Process Overview

The MEPS-IC is a nationwide sample of private-sector establishments and State and local governments. Data are collected from samples selected from two sampling frames that, together, cover nearly all of the employers in the United States, with the exception of the Federal Government and the U.S. military which are excluded from the sample. The two sampling frames are as follows:

Private sector

The U. S. Census Bureau’s Business Register (BR) is a confidential list of private-sector establishments, developed and maintained by the Census Bureau that is continually updated. It is the source of official Census Bureau figures on the number and employment size of establishments in the United States. For the private sector, an establishment is defined as a particular workplace or location, while a firm is a business entity consisting of one or more business establishments under common ownership or control. There were about 7 million private-sector establishments in the U.S. in 2011. In this report, establishments within firms that have more than one establishment are referred to as multi-units while other establishments are referred to as single-units.

State and local government (public) sector

The frame of State and local governments for the MEPS-IC is derived from the U.S. Census of Governments (COG). The COG is conducted every five years by the Census Bureau and is updated continually between Census years. For the public sector, a parent government is defined as a State or local governmental entity, while dependent agencies are associated with a parental governmental agency and includes entities such as community colleges, libraries, school boards, etc. The sampling unit for governments is the parent agency along with its dependent agencies (if any). Note that dependent agencies are not sampled separately. There were about 90,000 State and local governments in the U.S. in 2011. For more information about the COG, see: http://www.census.gov/econ/overview/go0100.html.

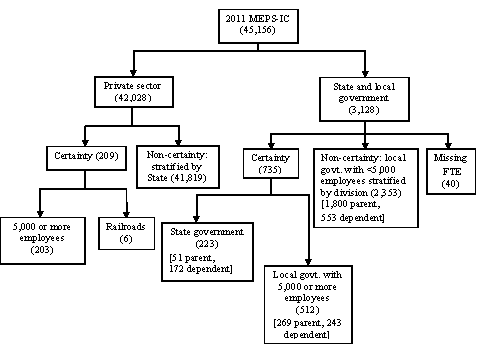

These two prongs of the survey undergo separate sample selection and estimation processes. The combined sample consists of an independent random sample of about 45, 000 employers (see Figure 1). The samples are specifically designed to enable national and State estimates each year.

The overall sampling goal for the MEPS-IC is to produce valid estimates for the private sector for all 50 States and the District of Columbia, State and local governments by Census division, and for the nation as a whole. There were several precision goals for the 2011 MEPS survey in terms of relative standard errors (RSE) as shown in Appendix A. Figure 1 below provides an overview of the sampling process and sample sizes in 2011 while section 2 of this report describes the processes in more detail.

Return to Table of Contents

Figure 1. 2011 MEPS-IC Sample Allocation Summary

Private Sector

Frame

The private sector frame is created from the Census Bureau’s Business Register (BR) and is constructed each year in March, following the timing of payroll imputation processing which is usually not completed until February. For the 2011 MEPS frame, a single-unit establishment was included if its 2010 annual payroll was greater than zero while multi-units with 2009 annual payroll greater than zero are included. Two different years were used to develop the 2011 MEPS frame because a major change to the frame construction occurred in 2008 when the survey switched from retrospective (with the interview conducted in the calendar year following the survey reference year) to current (with the interview year the same as the survey reference year) (Kearney and Sommers, 2006). This change impacted the choice of data to use to determine whether establishments are in-scope and which data are available to place them in strata. As a result, subsequent data years are used for single-unit and multiunit establishments since multiunit imputation processing has not been completed at the time of frame construction.

The following types of establishments on the BR are considered out-of-scope: U.S. Post Offices;

private households; public administrations; insurance and employee benefit funds; trusts, estates, and agency accounts; offices of bank holding companies; and offices of other holding companies. Unincorporated self-employed establishments with no employees (SENEs) are excluded from the MEPS-IC frame. In 1996 a sample of SENEs was selected using a frame constructed from the Internal Revenue Service. Based on the results for this sample, SENEs were not considered for inclusion in subsequent survey years. Further details on the 1996 SENE sample can be found in Appendix B.

Special processing occurs for railroads and single-unit agriculture production establishments. Railroads are handled in a special way because these data do not correspond to any one State (or site) and are often at the firm level instead of the establishment level. Thus, state-level data for railroads are not available on the Business Register. Because of this, all railroad firms are included in the sample (i.e., treated as certainties) and account for about six sampled cases each year. In addition, non-railroad establishments of these firms are excluded from the frame. Single-unit agriculture production establishments are temporarily pulled from the MEPS frame before the private-sector sample is drawn because there are no edits for them on the BR. These establishments are edited separately, known out-of-scopes are removed, and employment is imputed if it is missing or zero using annual payroll data, average quarterly wage factors and other data from the Bureau of Labor Statistics. After the editing process, these agricultural establishments are added back to the MEPS frame in preparation for sampling. On average, about 750 of these cases are sampled each year.

When frame construction is complete, it is randomly divided into four nationally representative panels and single-unit establishments are randomly assigned to one of the panels. Multi-unit establishments on the prior year’s frame are assigned to the same panel as the prior year, while single-units are randomly assigned to one of the four panels. Each year, two of the four panels are selected for the survey with one panel overlapping the prior year. This strategy helps to reduce the reporting burden for multi-units by reducing their chances of being repeatedly included across years into the MEPS-IC sample.

Return to Table of Contents

Private-Sector Sample Allocation and Selection

The private-sector sample is drawn at the establishment level, not at the firm level, so it is possible to have more than one establishment sampled from the same firm. There is a certainty stratum which contains establishments with employment of 5,000 or more. All of these establishments in the U.S. are selected and are not part of the State allocation process for the non-certainty sample described below. Railroad establishments are also selected with certainty and included in their own certainty stratum.

For the non-certainty establishments, the optimal national allocation to States would be to allocate them proportional to the number of establishments within each State. However, for most States this would result in far too small a sample to meet State estimation goals. From experience with past MEPS-IC surveys, it has been determined that a sample of approximately 500 establishments per State yields estimates that meet most State estimation goals using State stratification and allocation processes. To meet State precision goals, an equal size sample could be allocated to each State. An allocation of equal sample to each State would produce State estimates that meet State estimation goals, but would be 50 percent less precise nationally than proportional allocation and would not produce national estimates that meet the precision target. Therefore, a compromise allocation was developed which starts by proportionally allocating about 21, 000 sample establishments (based on the assumption of an 80 percent response rate) among the States. The allocation is then augmented for the 42 smallest States so that each of the 11 smallest States receive 495 additional sample establishments and each of the next 31 largest States receive 535 additional sample units. The nine largest States receive their entire sample allocation from the proportional allocation of the 21, 000 units. This allocation has an error for national estimates about 20 percent higher than if the entire sample were proportionally allocated. However, these estimates do meet national and State estimation goals (Appendix A).

Table 1 provides the 2011 MEPS private-sector sample allocation for non-certainties by State. The total allocated sample size is 41,819.

| State | Allocated sample size* | Total responding |

| Alabama | 726 | 565 |

| Alaska | 690 | 575 |

| Arizona | 726 | 552 |

| Arkansas | 726 | 573 |

| California | 2,712 | 1,991 |

| Colorado | 726 | 555 |

| Connecticut | 728 | 555 |

| Delaware | 672 | 483 |

| District of Columbia | 674 | 490 |

| Florida | 1,216 | 891 |

| Georgia | 744 | 545 |

| Hawaii | 700 | 508 |

| Idaho | 672 | 517 |

| Illinois | 1,087 | 804 |

| Indiana | 726 | 554 |

| Iowa | 726 | 569 |

| Kansas | 726 | 569 |

| Kentucky | 726 | 579 |

| Louisiana | 744 | 558 |

| Maine | 726 | 582 |

| Maryland | 726 | 516 |

| Massachusetts | 726 | 556 |

| Michigan | 825 | 632 |

| Minnesota | 726 | 561 |

| Mississippi | 726 | 632 |

| Missouri | 726 | 567 |

| Montana | 672 | 567 |

| Nebraska | 726 | 576 |

| Nevada | 744 | 565 |

| New Hampshire | 728 | 585 |

| New Jersey | 772 | 541 |

| New Mexico | 744 | 584 |

| New York | 1,658 | 1,125 |

| North Carolina | 726 | 577 |

| North Dakota | 690 | 563 |

| Ohio | 923 | 717 |

| Oklahoma | 726 | 558 |

| Oregon | 744 | 572 |

| Pennsylvania | 974 | 751 |

| Rhode Island | 674 | 489 |

| South Carolina | 744 | 577 |

| South Dakota | 672 | 547 |

| Tennessee | 726 | 562 |

| Texas | 1,563 | 1,212 |

| Utah | 726 | 587 |

| Vermont | 672 | 551 |

| Virginia | 726 | 557 |

| Washington | 726 | 565 |

| West Virginia | 744 | 582 |

| Wisconsin | 726 | 570 |

| Wyoming | 672 | 544 |

| Total | 41,826 | 31,998 |

* Allocated total does not sum to 41,819 due to rounding.

After the State sample sizes are determined, the sample is allocated into 14 strata within each State. The 14 strata are defined by a combination of establishment size and firm size. The 2011 MEPS strata boundaries and allocations are listed in Table 2 below. Note that these stratum boundaries are evaluated periodically and subject to slight modifications in different years.

| Stratum | Firm size (number of employees) | Establishment size (number of employees) | Total allocation across States |

| 11 | 1–12 | 1–2 | 7,273 |

| 12 |

| 3–5 | 5,602 |

| 13 |

| 6–12 | 5,488 |

| 21 | 13–88 | 1–18 | 3,362 |

| 22 |

| 19–38 | 3,257 |

| 23 |

| 39–88 | 2,099 |

| 31 | 89–708 | 1–47 | 2,882 |

| 32 |

| 48–172 | 1,630 |

| 33 |

| 173–708 | 653 |

| 41 | 709+ | 1–21 | 3,365 |

| 42 |

| 22–90 | 2,744 |

| 43 |

| 91–279 | 1,956 |

| 44 |

| 280–908 | 817 |

| 45 | | 909–4, 999 | 691 |

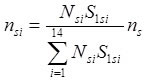

The Neyman optimal allocation formula (Cochran, 1977) was used to obtain the State-level non-certainty allocation for the ith stratum within each State:

where

Nsi is the number of establishments in the ith stratum in the sth State,

ns is the State sample size,

S1si is the average standard deviation for the sth State and the ith stratum calculated based on the percent of all establishments that offer health insurance and

nsi is the allocation to the ith stratum in the sth State based on establishments that offer health insurance.

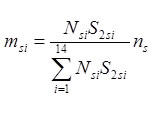

After this allocation is completed, a second allocation is performed where a different key MEPS-IC estimate (total enrollees) is used to calculate the average standard deviation.

Nsi is the number of establishments in the ith stratum in the sth State,

ns is the State sample size,

S2si is the average standard deviation for the sth State and the ith stratum calculated based on total enrollees and msi is the allocation to the ith stratum in the sth State based on total enrollees.

The final allocation, rsi, is the weighted allocation obtained by taking the weighted value of the optimal allocations for the two variables as follows:

rsi = .44 nsi + .56 msi

The weighting factors for the final allocation (.44 and .56) were determined based on an evaluation of the best overall balance in precision of estimates for the two variables.

Once these allocations are completed, each establishment in a stratification cell is given the same chance of selection equal to

psi = rsi/Nsi where rsi is the final allocation within the State.

At this point, in order to reduce the reporting burden on large firms—where a single respondent may sometimes be able to provide the information for more than one establishment owned by that firm, the probabilities are adjusted.

The values of the psi's for all establishments linked to the same firm on the frame are summed. This yields the number of establishments that are expected to be selected for that firm. For a small number of firms, this expected value is large and potentially a burden for the responding firms. Moreover, since the insurance offered to employees of establishments within very large firms is often similar, it is more efficient to reduce sample within these firms to both minimize burden and increase sample for other establishments.

To reduce this expected number of establishments, the probabilities of selection are reduced to a level that minimizes response burden using adjustment factors that are based on firm size. To make up for this reduction in sample, the probability of selection for all other establishments in a stratification cell that contains an establishment with a reduced probability of selection is increased (see example in Appendix C). The increase is calculated by the amount necessary to have the sum of the probabilities of selection within the strata equal rsi. Once these probabilities of selection are finalized, the allocated samples are selected using systematic sampling. To perform this selection, the file is sorted by State, strata, industry, and number of employees. This assures a good balance of establishments within strata. MEPS-IC industry codes are listed in Appendix D.

Prior to 2007, a birth sample was included in the sample allocation in order to capture any newly created establishments after the frame was constructed, but prior to data collection. However, the switch to current year data collection in 2008 eliminated the need for an annual birth sample. In 2011, research was conducted to determine a method for incorporating 200 birth cases into the sample in future surveys. Due to the continued focus by data users on small businesses, as well as health care reform changes, it was recommended that these birth cases be allocated to strata 21, 22, and 23 (see Table 2) and the sample allocated evenly to selected States determined to benefit most from the additional sample.

While the primary focus for this report is the 2011 survey design, there have also been significant changes to the sampling design since 2003. A history of the changes to the sample allocations can be found in Appendix E.

The sample sizes for private-sector establishments, reported by single-unit and multi-units beginning with the 1996 survey, can be found at the following link: http://meps.ahrq.gov/mepsweb/survey_comp/ic_sample_size.jsp

In some years slight modifications are made to the MEPS-IC to improve various aspects of the survey. For details see Section VIII at the following link: http://meps.ahrq.gov/mepsweb/survey_comp/ic_technical_notes.shtml

Return to Table of Contents

State and Local Government

Frame

The frame for the MEPS State and local government sample is the Census of Governments (COG) which is conducted every five years and continually updated. The COG is the only source of periodic information that identifies and describes all units of governments in the U.S. It provides benchmark figures of public finance and public employment, including how governments are organized, how many people they employ and payroll amounts, and the finances of governments. The COG occurs every five years for years ending in “2” and “7” and the 2007 COG was used for the 2011 MEPS-IC frame. The Federal Government, the U.S. military, and U.S. Post Offices are considered out-of-scope for the survey.

State and local government sample allocation and selection

The 2011 MEPS-IC State and local government sample consists of three components:

certainties, non-certainties and sampled missing Full-Time Equivalent (FTE) employment cases. The certainty governments comprised the 51 State governments (including Washington, D.C.) and any local government with more than 5, 000 employees (735 cases in 2011). All certainty cases are assigned a sample weight equal to 1.0.

The non-certainty government sample covers all other governments (except for missing FTE cases described in last paragraph of this section below) and is stratified by the nine Census divisions. The divisions are defined in Table 3 below.

| Census division | States |

|---|

| New England | Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island, Vermont |

| Middle Atlantic | New Jersey, New York, Pennsylvania |

| East North Central | Illinois, Indiana, Michigan, Ohio, Wisconsin |

| West North Central | Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota, South Dakota |

| South Atlantic | Delaware, District of Columbia, Florida, Georgia, Maryland, North Carolina, South Carolina, Virginia, West Virginia |

| East South Central | Alabama, Kentucky, Mississippi, Tennessee |

| West South Central | Arkansas, Louisiana, Oklahoma, Texas |

| Mountain | Arizona, Colorado, Idaho, Montana, Nevada, New Mexico, Utah, Wyoming |

| Pacific | Alaska, California, Hawaii, Oregon, Washington |

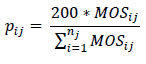

A non-certainty sample size of 200 governments is allocated to each Census division for a total of 1, 800. To perform the selection using probability proportional to size (PPS) sampling, each government is given a measure of size equal to the square root of its total FTE employment (which includes any dependent agency employment). The selection probability

(pij)

for a single government is determined as the total final Census division non-certainty State government allocation (i.e., 200), times the government’s measure of size, divided by the sum of all measures of size for all governments within the Census division on the frame.

where

MOSij is the square root of the non-certainty government FTE employment for the ith government unit in the jth Census division

nj is the total number of units in the jth Census division.

The non-certainty government sample within each Census division is selected using a systematic PPS methodology from a file sorted by State, type of government (county, city, township, school district, special district) within the State, and by FTE employment within type of government. For every selected case, a sample weight equal to the inverse of the selection probability (p) is assigned.

Table 4 provides the 2011 non-certainty sample allocations for the public sector.

| Census division | Selected sample | Total sample (parent and dependent agencies) | Total responding |

| New England | 200 | 273 | 263 |

| Middle Atlantic | 199 | 230 | 220 |

| East North Central | 200 | 229 | 228 |

| West North Central | 201 | 222 | 215 |

| South Atlantic | 200 | 368 | 334 |

| East South Central | 200 | 283 | 272 |

| West South Central | 199 | 254 | 249 |

| Mountain | 200 | 271 | 233 |

| Pacific | 201 | 223 | 207 |

| Total | 1,800 | 2,353 | 2,221 |

Finally, it should be noted that cases that have missing FTE employment on the frame are placed into a separate file for processing before the non-certainty sample is drawn. A systematic sample of 40 cases is drawn from the cases in this file. To perform this selection, the file is first sorted by State, type of government, and total employees within type of government (if available). Every sampled case determined to be in-scope is assigned a sample weight equal to the number of missing FTE cases divided by 40.

Summary

In this report, we described the survey design, sampling allocation, and sample selection processes for both the private sector and State and local governments within the MEPS-IC. This information is important for researchers using the data who wish to understand its sampling structure. The details presented in this report apply specifically to the 2011 data year. Insurance Component data files are not available for public release;

however an extensive series of published tables is available at http://meps.ahrq.gov/mepsweb/survey_comp/Insurance.jsp

References

Cochran, WG. Sampling Techniques. New York: John Wiley and Sons; 1977.

Kearney A., Sommers JP. Switching from Retrospective to Current Year Data Collection in the Medical Expenditure Panel Survey-Insurance Component. 2006. In JSM Proceedings. Business and Economic Statistics Section. Alexandria, VA: American Statistical Association.

Sommers JP. List Sample Design of the 1996 Medical Expenditure Panel Survey Insurance Component. Rockville (MD): Agency for Health Care Policy and Research;

1999. MEPS Methodology Report No. 6. AHCPR Pub. No. 99-0037.

Appendices

Return to Table of Contents

Appendix A. 2011 MEPS-IC Relative Standard Error Estimation Goals

SE Estimation |

Private | State and local government |

Characteristics |

National | State | National | Division |

| Average premiums | 0.005 | 0.030 | 0.0075 | 0.0375 |

| Average contributions | 0.015 | 0.090 | 0.020 | 0.100 |

| Proportions | 0.0075 | 0.300 | 0.010 | 0.050 |

Return to Table of Contents

Appendix B. 1996 SENES

The 1996 MEPS-IC was first administered in 1997 and included an independent random sample of the self-employed with no employees (SENEs). The frame for this sample was the 1994 Internal Revenue Service list of SENEs (Sommers, 1999). The goal was to make a quality national estimate of the SENE population, where quality was defined as a relative standard error of 5.0 percent or less. A national sample of 1, 000 SENEs was selected, and divided into five strata based on total income. A one-third loss rate was assumed for nonresponse and out-of-scopes. The target response rate was 75.0 percent. However since many of the sample SENEs were determined not to be legitimate businesses and the response rate was fairly lower (about 40 percent), a decision was made to not sample these cases in future surveys.

Return to Table of Contents

Appendix C. Example of Revised Selection Probabilities for Two Private-Sector Firms

Firm | Selection probability | Revised selection probability |

Firm ABC |

|

|

Establishment #1 | 0.55 | 0.34 |

Establishment #2 | 0.75 | 0.53 |

Establishment #3 | 0.75 | 0.53 |

Firm DEF |

|

|

Establishment #1 | 0.20 | 0.85 |

Total | 2.25 | 2.25 |

Let’s say Firm ABC has three establishments.

If we sum the selection probabilities in column two for the firm, it yields the expected number of establishments to be selected (2.05) for Firm ABC.

However, two establishments may be a response burden for the Firm.

Thus we reduce the selection probabilities for all establishments for Firm ABC, and make up for this reduction by an increase for Firm DEF.

Return to Table of Contents

Appendix D. Private-Sector Industry Codes

From 1996 to 1999, the industry categories in the MEPS-IC were based on Standard Industrial Classification (SIC) codes. Beginning in 2000, the industries were converted to the North American Industry Classification System (NAICS). Even categories that retained the same name are not comparable for the two coding systems, due to the reclassification of specific businesses from one industry category to another. Making year-to-year comparisons of MEPS data by industries across the 1999–2000 boundary is not recommended.

SIC codes 1996–1999 MEPS | NAICS codes (2000–current) | NAICS sector |

Agriculture | Agriculture | 11 |

Fishing | Fishing | 11 |

Forestry | Forestry | 11 |

Mining | Mining | 21 |

Manufacturing | Manufacturing | 31, 32, 33 |

Construction | Construction | 23 |

Retail trade | Retail trade | 44, 45 |

Wholesale trade | Wholesale trade | 42 |

Transportation | Transportation | 48, 49 |

Utilities | Utilities | 22 |

Communications | Financial services | 52, 55 |

Finance | Real estate | 53 |

Insurance | Professional services | 51, 54, 61, 62 |

Real estate | Other services | 56, 71, 72, 81 |

Services | n/a | n/a |

Return to Table of Contents

Appendix E. History of Changes to the MEPS-IC Sample Allocation

Year | Changes |

2003 | Private sector – The strata within each State were redefined and a separate certainty stratum was created. Logistic regression was used to assign establishments to strata in order to obtain a reduction in variance. http://meps.ahrq.gov/mepsweb/data_files/publications/mr18/mr18.shtml#WithinStates Additional funding due to the dropping of the HC-IC link sample allowed for sufficient sample in every State for the purpose of making State-level estimates. Virginia purchased additional sample for their State to support sub-state estimates. See following link for full list of additional samples purchased by States in earlier years. http://meps.ahrq.gov/mepsweb/survey_comp/ic_technical_notes.shtml#stateestimates State and local governments –

The nine Census divisions were used as non-certainty strata instead of States. |

2004 | Private sector – Within each State, allocation to the strata was determined separately to avoid assigning to a stratum a sample size that was larger than the number of establishments available within that stratum. Due to budget restrictions, the non-certainty strata sample was reduced across all States by approximately 4 percent. |

2005 | Private sector

– The allocation was increased for Alaska and Louisiana for this year only. A total of 770 establishments were added to the sample evenly divided between the two States. The extra sample was allocated across the strata that are less likely to have health insurance or likely to contain only small businesses.

|

2006 | Private sector –

Budget constraints required an additional reduction of 100 establishments from the total allocation. Also, the one-time increase in the allocation for Alaska and Louisiana was dropped.

|

2007 | Due to the transition from retrospective to current year data collection, there was no survey to collect data for 2007. |

2008 | Private sector

– Allocation returned to the original stratification method used prior to 2003, with establishment and firm size classes used for placing establishments into strata. The allocation at the State level was the same as in 2006, and a majority of States had 14 strata. However, smaller States had 8 strata since the strata in these States were collapsed due to small allocations in 1996–2002. |

2009–2010 | Private sector

– All States were assigned 14 strata and the strata boundaries were redefined. |

2011 | Private sector

– Funding provided for an additional 200 sample cases to be included in the overall sample. |

Return to Table of Contents