Chartbook #22: Medical Expenditure Panel Survey Insurance Component 2017 Chartbook

Acknowledgments

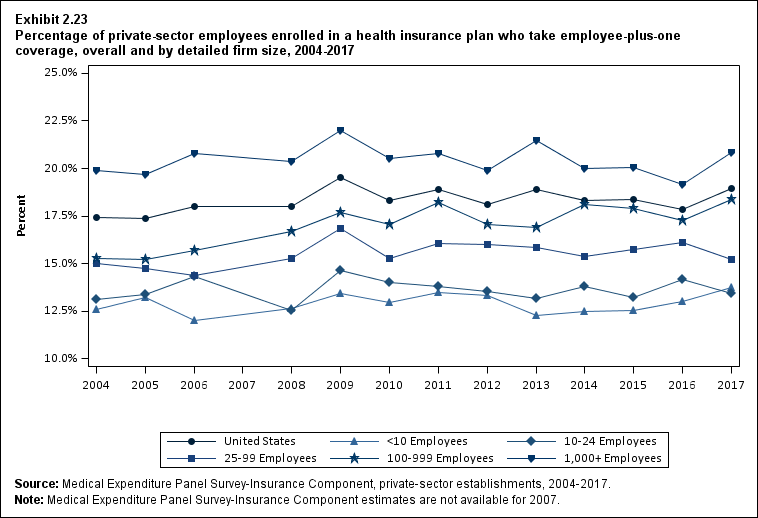

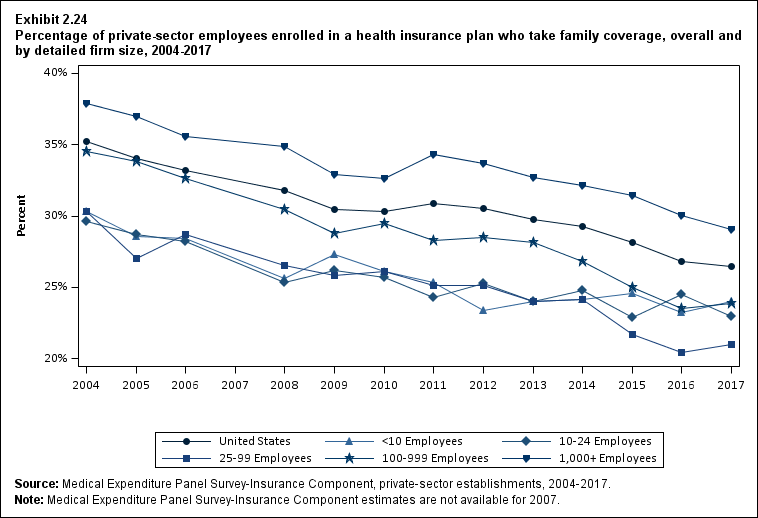

This chartbook was prepared by Jessica Vistnes, G. Edward

Miller, Philip Cooper, Patricia Keenan, and Asako Moriya of the Center for

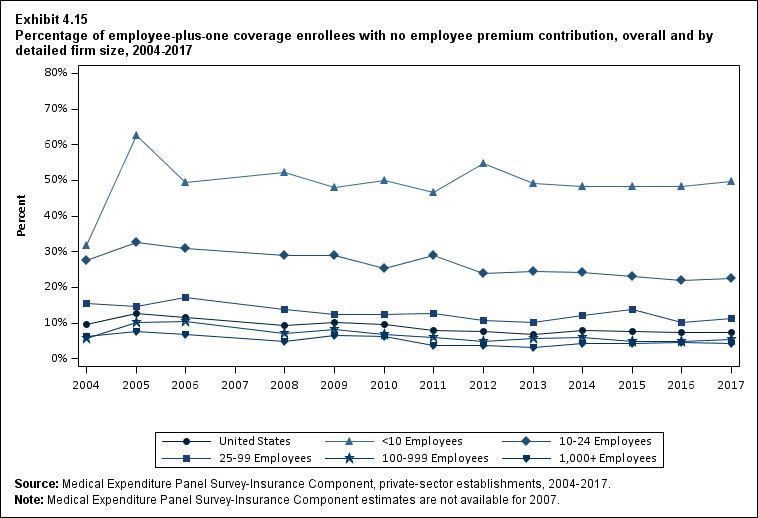

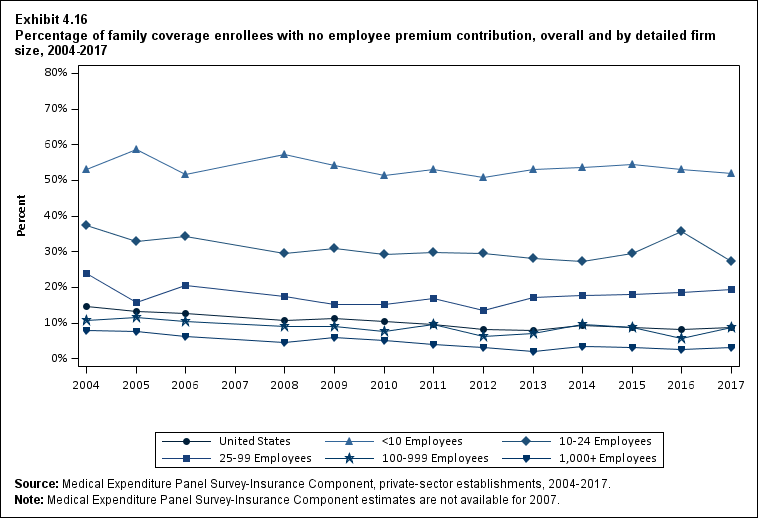

Financing, Access, and Cost Trends (CFACT) in the Agency for Healthcare

Research and Quality (AHRQ). Primary editing was performed by Jessica Vistnes

and Edward Miller.

The authors appreciate the efforts of Eneli Coakley, Zhengyi

Fang, and Bidong Liu of Social & Scientific Systems, Inc. in preparing the

exhibits in the chartbook, the data production work of Brandon Flanders of the

U.S. Census Bureau, and the production assistance of Doreen Bonnett, Nicole

Shulman, and Michelle Roberts of AHRQ.

Reviewers of this publication were Joel W. Cohen, Director

of CFACT; Steve Machlin, Director of the Division of Statistical Research and

Methods in CFACT; Steve Hill and Julie Hudson, Senior Economists in the Division

of Research and Modeling in CFACT; and Sandy Decker and Paul Jacobs, Service

Fellows in the Division of Research and Modeling in CFACT.

Introduction

Background

Data Presentation

References

Executive Summary

Section 1: Health Insurance Offer Rates

Section 2: Employee Eligibility and Enrollment

Section 3: Health Insurance Premiums

Section 4: Employee and Employer Premium Contributions

Section 5: Employee Cost Sharing

The data used in this report are from the Insurance

Component of the Medical Expenditure Panel Survey. Information about this survey,

including sample design, data collection, sample sizes, and response rates, can

be found at https://meps.ahrq.gov/survey_comp/Insurance.jsp.

This document is in the public domain and may be used and

reprinted without permission except those copyrighted materials noted for which

further reproduction is prohibited without specific permission of copyright

holders.

Agency for Healthcare Research and Quality

5600 Fishers Lane

Rockville, MD 20857

www.ahrq.gov

Medical Expenditure Panel

Survey Insurance Component 2017 Chartbook. Rockville, MD: Agency for Healthcare

Research and Quality; October 2018. AHRQ Publication No. 18(19)-0034. https://meps.ahrq.gov/mepsweb/data_files/publications/cb22/cb22.shtml.

Return to Table of Contents

The Medical Expenditure Panel Survey Insurance Component (MEPS-IC)

is an annual survey of private employers and State and local governments. The

MEPS-IC produces national and State-level estimates of employer-sponsored

insurance, including offered plans, costs, employee eligibility, and number of

enrollees. The MEPS-IC is sponsored by the Agency for Healthcare Research and

Quality and is fielded by the U.S. Census Bureau.

This chartbook provides both single-year and multiyear trend

analyses using private-sector MEPS-IC data from 2004 to 2017. To best convey

key information from the MEPS-IC, the report is presented in five sections: Health

Insurance Offer Rates; Employee Eligibility and Enrollment; Health Insurance

Premiums; Employee and Employer Premium Contributions; and Employee Cost

Sharing. Each section provides charts and discussion with links to MEPS-IC data

tables that contain the estimates and standard errors for each exhibit.

Many of the estimates in this publication are categorized by

firm sizes that are relevant to recent changes in national healthcare policy. Note

that the firm-size categories used in the charts and tables are based on actual

employment counts rather than full-time equivalent (FTE) counts, because the MEPS-IC

does not collect FTE employment figures.

Each section discusses the estimates to highlight trends and

differences by employer and workforce characteristics. If a comparison of

estimates is presented in the discussion, any differences are statistically

significant at the 0.05 level, unless otherwise noted. In some cases,

differences noted in the text, in estimates as well as statistical significance

of comparisons, may vary slightly from calculations performed using data in the

exhibits or MEPS-IC data available on the MEPS website due to rounding.

In addition, compared with tests performed in the 2016

MEPS-IC Chartbook, tests performed in this year's chartbook used estimates

containing additional digits after the decimal place. This change may have

resulted in different conclusions than the 2016 chartbook regarding comparisons

of estimates. All dollar estimates are nominal (not adjusted for inflation).

Return to Table of Contents

The IC is one of three annual component surveys that make up

MEPS. The other two components are the Household Component (HC) and the Medical

Provider Component (MPC). The HC is a nationally representative survey of the

U.S. civilian noninstitutionalized population that collects data at both the

person and household levels. The MPC collects information from a sample of

physicians, hospitals, home health agencies, and pharmacies that provided

services to HC respondents.

The MEPS-IC uses two independent samples: the private sector

and the public sector. The private-sector sample is composed of about 42,000

business establishments from more than 7 million establishments found on the

Business Register at the U.S. Census Bureau, with 5.4 percent of the sample

determined during the data collection process to be out of scope. In 2017, the

response rate for the private sector was 65.8 percent of the remaining in-scope

sample units.

An establishment is a single business entity or location. Firms

(also often referred to as companies) can include one or more establishments. An

example of a multi-establishment firm is a chain of grocery stores, where the

establishments of the firm are the sites of the individual grocery stores. The

charts and tables in this publication report characteristics within firm-based

size categories.

The public-sector sample of the MEPS-IC selects almost 3,000

State and local government agencies. However, this report focuses only on the private

sector. Additional information on MEPS-IC sampling can be found in Sample Design of the 2017 Medical

Expenditure Panel Survey Insurance Component (Davis, 2018).

There was no MEPS-IC survey to collect 2007 data due to the

transition from retrospective to current-year data collection. This

methodological change improved the accuracy and timeliness of the IC estimates.

More information about this design change can be found in Switching From Retrospective to Current-Year Data Collection in the

Medical Expenditure Panel Survey -

Insurance Component (Kearney & Sommers, 2007).

Return to Table of Contents

For purposes of the analyses presented in this chartbook,

the District of Columbia is treated as a State. In addition, exhibits are

organized by category (e.g., premium type, firm size), so references to

exhibits in the text may not be in numeric order (e.g., Exhibits 3.1, 3.3, and

3.5 instead of 3.1, 3.2, and 3.3).

Return to Table of Contents

Davis K. Sample design of

the 2017 Medical Expenditure Panel Survey Insurance Component. Methodology

Report #31. Rockville, MD: Agency for Healthcare Research and Quality; July

2018. https://meps.ahrq.gov/data_files/publications/mr31/mr31.shtml.

Accessed August 17, 2018.

Kearney A, Sommers J. Switching from retrospective to current-year data collection in

the Medical Expenditure Panel Survey - Insurance Component. ICES-III: Third

International Conference on Establishment Surveys, Conference Proceedings, Montréal,

Québec, Canada; June 2007.

Return to Table of Contents

Overview

Employer-sponsored insurance

(ESI) is the primary source of health insurance coverage for individuals under

age 65. This chartbook uses data for private-sector establishments in the

Medical Expenditure Panel Survey-Insurance Component (MEPS-IC) to describe

trends in employer coverage, premiums, and benefits from 2004 to 2017. The MEPS-IC

is an annual survey of private employers and State and local governments and is

designed to be representative of all 50 States and the District of Columbia. The

large sample size (about 42,000 private-sector establishments), combined with a

response rate of 65.8 percent in 2017, permits analyses of variations in ESI by

firm size and across States that are not readily available from other sources.

Examining trends by firm size and across States is important

due to variation in insurance markets along these dimensions. Historically, insurance

markets have differed by firm size due to smaller firms' more limited ability

to pool risk and their higher administrative costs compared with larger firms. State

variation in ESI markets may reflect differences in employment patterns,

healthcare prices, and utilization, as well as differences in State approaches

to regulating private insurance and administering Medicaid.

The period presented in the chartbook, 2004 to 2017, shows

trends through a period of change in national healthcare policy that could have

affected national ESI trends, as well as trends by firm size. This chartbook describes

trends and patterns in ESI overall, by firm size, and by State. All differences

noted are at the 0.05 significance level unless otherwise specified. All dollar

estimates are nominal (not adjusted for inflation).

Summary of Findings

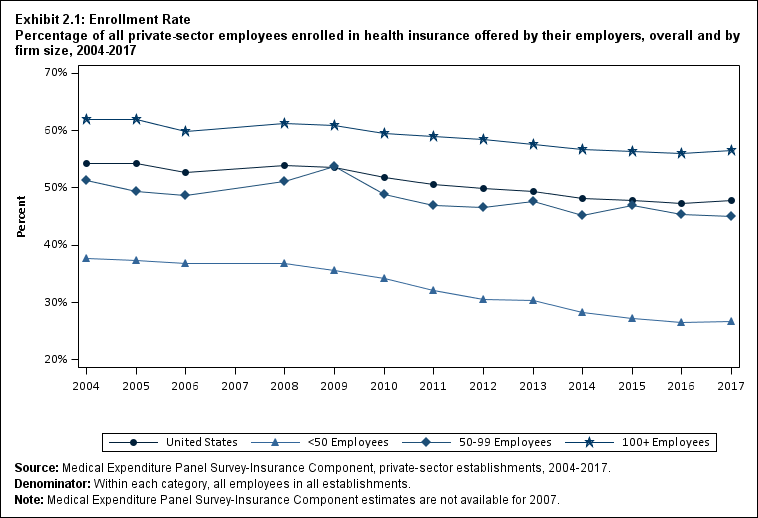

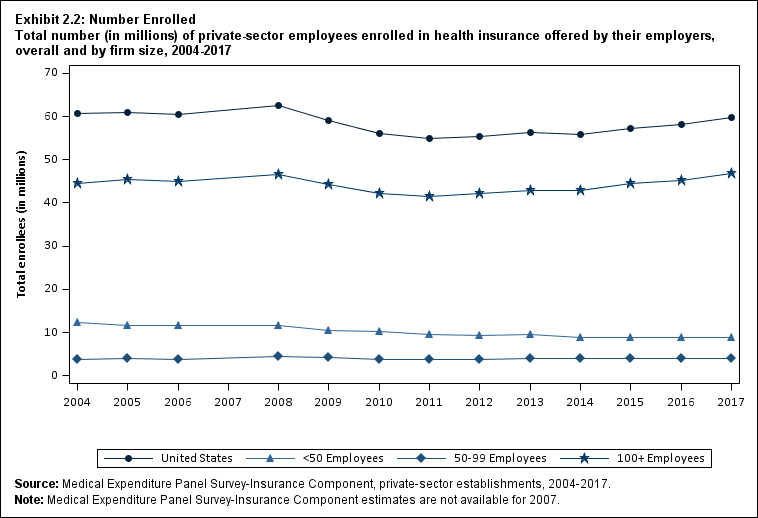

Employee Enrollment in Health Insurance

Between 2016 and 2017, there was no significant change in

the overall percentage of private-sector employees enrolled in a health

insurance plan offered by their employers ("enrollment rate"). There was also

no significant change in the enrollment rate in any firm-size category.

The enrollment rate reflects the combination of employers'

decisions about offering health insurance and employee eligibility for such

coverage, as well as employees' decisions to take up coverage if eligible.

Offer rates, eligibility rates, and take-up rates, as well as coverage rates

among employees offered insurance, are described further below.

Availability of Coverage: Offer Rates

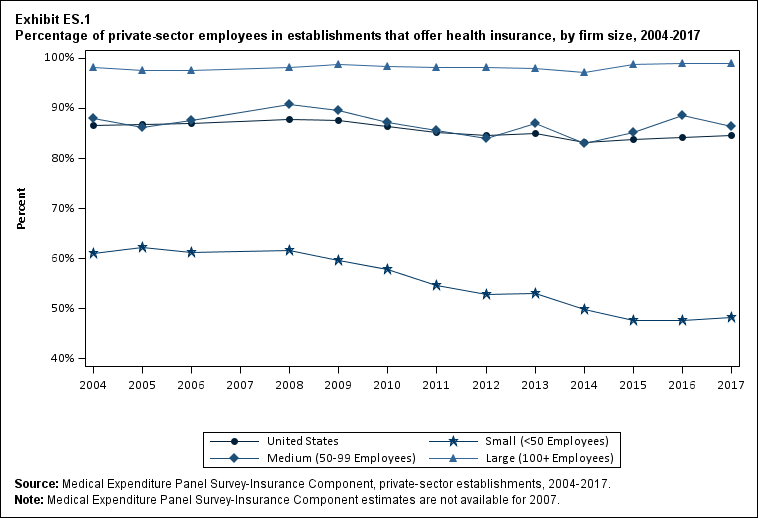

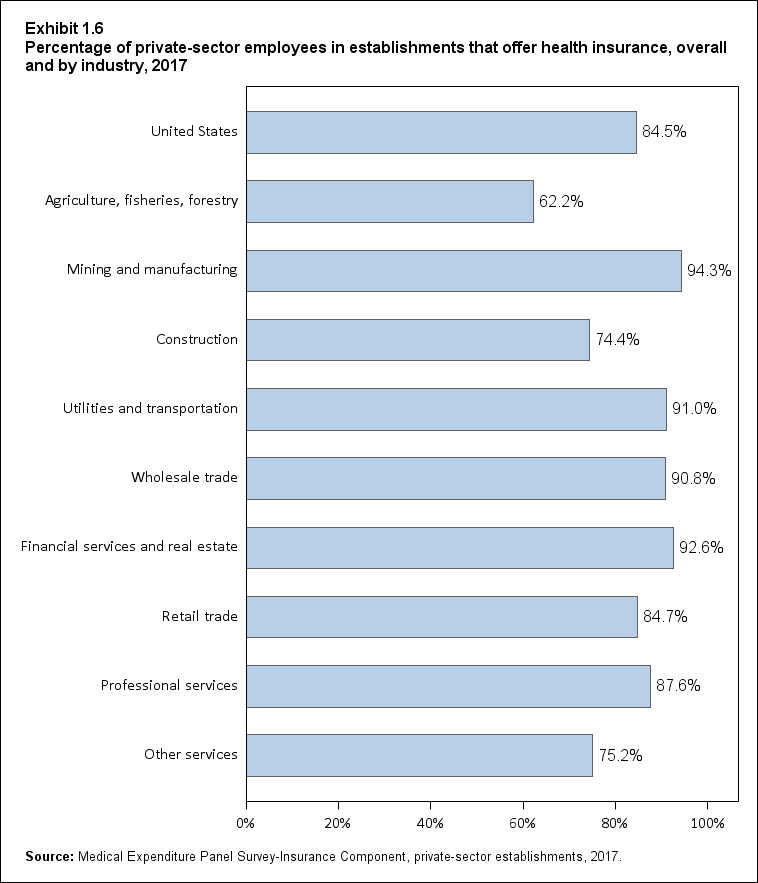

There was no significant change in the overall percentage of

employees working at establishments where insurance was offered ("the offer

rate") between 2016 (84.3 percent) and 2017 (84.5 percent). In addition, there

were no significant year-to-year changes between 2014 and 2016 (Exhibit ES.1).

While there were no significant year-to-year changes between 2014 and 2017,

offer rates increased from 83.2 percent in 2014 to 84.5 percent in 2017, after

decreasing by 1.7 percentage points from 2013 to 2014. These changes resulted

in no significant difference in offer rates between 2013 and 2017. Between 2004

and 2013, the overall percentage of employees who worked for employers that

offered health insurance declined from 86.7 percent to 84.9 percent, with

almost all of the decline occurring between 2009 and 2012.

Return to Table of Contents

Exhibit ES.1 Percentage (standard error) of private-sector employees in establishments that offer health insurance, by firm size, 2004-2017

| Number of Employees |

2004 |

2005 |

2006 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

| U.S. |

86.7% |

86.9% |

86.9% |

87.7% |

87.6% |

86.5% |

85.3% |

84.7% |

84.9% |

83.2% |

83.8% |

84.3% |

84.5% |

| (Standard Error) |

(0.3%) |

(0.5%) |

(0.2%) |

(0.3%) |

(0.2%) |

(0.2%) |

(0.2%) |

(0.3%) |

(0.3%) |

(0.3%) |

(0.2%) |

(0.2%) |

(0.2%) |

| <50 |

61.0% |

62.2% |

61.2% |

61.6% |

59.6% |

57.8% |

54.7% |

52.9% |

53.1% |

49.8% |

47.6% |

47.7% |

48.3% |

| (Standard Error) |

(0.5%) |

(0.6%) |

(0.4%) |

(0.5%) |

(0.5%) |

(0.5%) |

(0.4%) |

(0.6%) |

(0.7%) |

(0.6%) |

(0.6%) |

(0.6%) |

(0.6%) |

| 50-99 |

88.0% |

86.2% |

87.6% |

90.7% |

89.6% |

87.3% |

85.6% |

84.1% |

87.0% |

83.0% |

85.3% |

88.6% |

86.3% |

| (Standard Error) |

(1.4%) |

(1.7%) |

(1.2%) |

(0.9%) |

(1.3%) |

(0.9%) |

(1.0%) |

(1.4%) |

(1.0%) |

(1.3%) |

(1.2%) |

(1.0%) |

(1.2%) |

| 100+ |

98.2% |

97.5% |

97.7% |

98.2% |

98.8% |

98.5% |

98.1% |

98.2% |

98.0% |

97.3% |

98.8% |

98.9% |

98.9% |

| (Standard Error) |

(0.3%) |

(0.7%) |

(0.4%) |

(0.3%) |

(0.1%) |

(0.2%) |

(0.2%) |

(0.2%) |

(0.2%) |

(0.2%) |

(0.2%) |

(0.1%) |

(0.2%) |

|

Source: Medical Expenditure Panel Survey-Insurance Component, private-sector establishments, 2004-2017.

Note: Medical Expenditure Panel Survey-Insurance Component estimates are not available for 2007.

|

Return to Table of Contents

There were no significant

changes in offer rates at medium (50 to 99 employees) and large (100 or

more employees) employers from 2016 to 2017 (88.6 percent in 2016 and 86.3

percent in 2017 for medium employers and 98.9 percent for large employers in both

years). There were also no significant changes in the offer rates at small

employers (fewer than 50 employees) between 2016 (47.7 percent) and 2017 (48.3

percent) or between 2015 and 2016. This period of relative stability for small

firms followed a 7-year period between 2008 and 2015 during which offer rates

declined from 61.6 percent to 47.6 percent. From 2016 to 2017, offer rates in the smallest firms (fewer

than 10 workers) increased by 2.4 percentage points to 30.8 percent, the first

significant year-to-year increase in offer rates at firms of this size in the

2004 to 2017 period (Section 1, Exhibit 1.2).

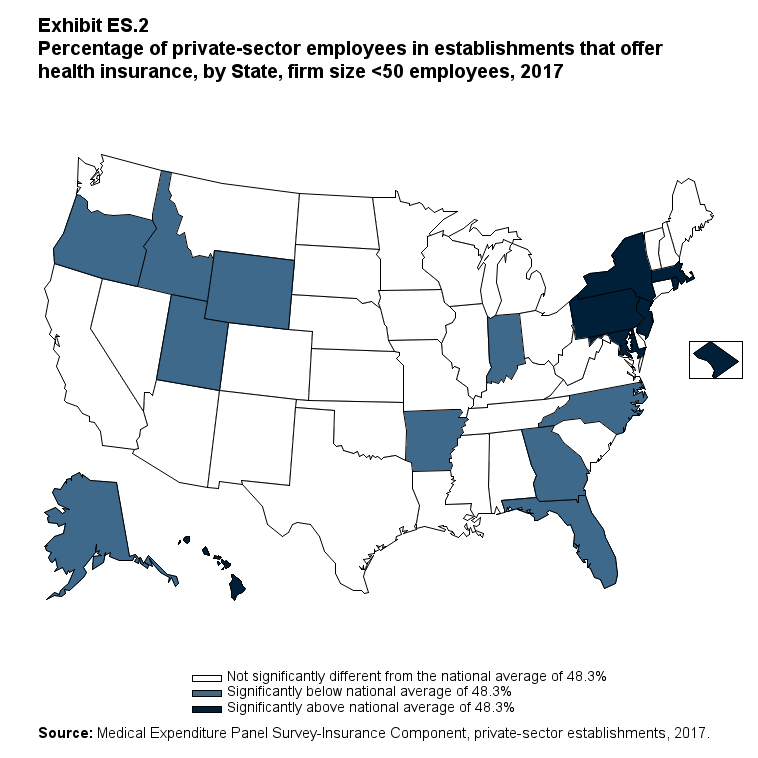

Since almost all large firms offer health insurance

coverage, offer rates among small firms are an important factor contributing to

overall State ESI offer rates, along with the distribution of employers by firm

size in the State. Nationwide, a little less than half (48.3 percent) of

employees of small firms (fewer than 50 employees) worked at establishments

that offered insurance. However, the availability of workplace coverage varied

substantially across the country (Exhibit ES.2).

States with

small-employer offer rates exceeding the national average were the

District of Columbia, Hawaii, Maryland, Massachusetts, New Jersey, New York,

Pennsylvania, and Rhode Island. (Exhibit ES.2). States with small-employer

offer rates below the national average were Alaska, Arkansas, Florida, Georgia,

Idaho, Indiana, North Carolina, Oregon, Utah, and Wyoming (Exhibit ES.2).

Exhibit ES.2 Percentage of private-sector employees (standard error) in establishments that offer health insurance, by State, firm size <50 employees, 2017

| Alabama |

44.7% |

Kentucky |

53.9% |

North Dakota |

54.0% |

| (Standard Error) |

(4.0%) |

(Standard Error) |

(4.4%) |

(Standard Error) |

(3.5%) |

| Alaska |

30.6%* |

Louisiana |

51.4% |

Ohio |

48.3% |

| (Standard Error) |

(3.5%) |

(Standard Error) |

(3.9%) |

(Standard Error) |

(3.4%) |

| Arizona |

45.5% |

Maine |

44.7% |

Oklahoma |

46.0% |

| (Standard Error) |

(4.4%) |

(Standard Error) |

(3.8%) |

(Standard Error) |

(3.8%) |

| Arkansas |

33.5%* |

Maryland |

57.8%* |

Oregon |

37.5%* |

| (Standard Error) |

(4.0%) |

(Standard Error) |

(4.0%) |

(Standard Error) |

(3.3%) |

| California |

50.2% |

Massachusetts |

66.3%* |

Pennsylvania |

56.4%* |

| (Standard Error) |

(2.1%) |

(Standard Error) |

(3.6%) |

(Standard Error) |

(3.0%) |

| Colorado |

45.1% |

Michigan |

52.2% |

Rhode Island |

59.6%* |

| (Standard Error) |

(3.7%) |

(Standard Error) |

(3.8%) |

(Standard Error) |

(4.0%) |

| Connecticut |

54.2% |

Minnesota |

49.6% |

South Carolina |

43.0% |

| (Standard Error) |

(3.8%) |

(Standard Error) |

(3.8%) |

(Standard Error) |

(3.5%) |

| Delaware |

48.3% |

Mississippi |

50.6% |

South Dakota |

44.9% |

| (Standard Error) |

(4.4%) |

(Standard Error) |

(4.0%) |

(Standard Error) |

(3.4%) |

| District of Columbia |

67.0%* |

Missouri |

48.3% |

Tennessee |

47.1% |

| (Standard Error) |

(4.8%) |

(Standard Error) |

(4.2%) |

(Standard Error) |

(4.2%) |

| Florida |

38.7%* |

Montana |

42.1% |

Texas |

43.0% |

| (Standard Error) |

(3.3%) |

(Standard Error) |

(3.6%) |

(Standard Error) |

(2.7%) |

| Georgia |

38.0%* |

Nebraska |

46.7% |

Utah |

33.7%* |

| (Standard Error) |

(4.0%) |

(Standard Error) |

(3.9%) |

(Standard Error) |

(3.6%) |

| Hawaii |

89.2%* |

Nevada |

43.2% |

Vermont |

42.1% |

| (Standard Error) |

(2.4%) |

(Standard Error) |

(4.9%) |

(Standard Error) |

(3.4%) |

| Idaho |

34.9%* |

New Hampshire |

48.2% |

Virginia |

49.3% |

| (Standard Error) |

(3.6%) |

(Standard Error) |

(4.0%) |

(Standard Error) |

(4.4%) |

| Illinois |

49.3% |

New Jersey |

56.6%* |

Washington |

51.2% |

| (Standard Error) |

(4.2%) |

(Standard Error) |

(3.3%) |

(Standard Error) |

(3.8%) |

| Indiana |

40.2%* |

New Mexico |

44.7% |

West Virginia |

44.6% |

| (Standard Error) |

(3.6%) |

(Standard Error) |

(3.8%) |

(Standard Error) |

(4.2%) |

| Iowa |

47.9% |

New York |

59.6%* |

Wisconsin |

40.6% |

| (Standard Error) |

(3.8%) |

(Standard Error) |

(2.7%) |

(Standard Error) |

(4.0%) |

| Kansas |

50.3% |

North Carolina |

33.6%* |

Wyoming |

38.9%* |

| (Standard Error) |

(3.6%) |

(Standard Error) |

(3.3%) |

(Standard Error) |

(3.5%) |

|

Source: Medical Expenditure Panel Survey-Insurance Component, private-sector establishments, 2017.

Note: * Statistically different from the national average of 48.3 percent at p < 0.05.

Note that the standard error on the national estimate of 48.3 percent is 0.62 percent.

|

Return to Table of Contents

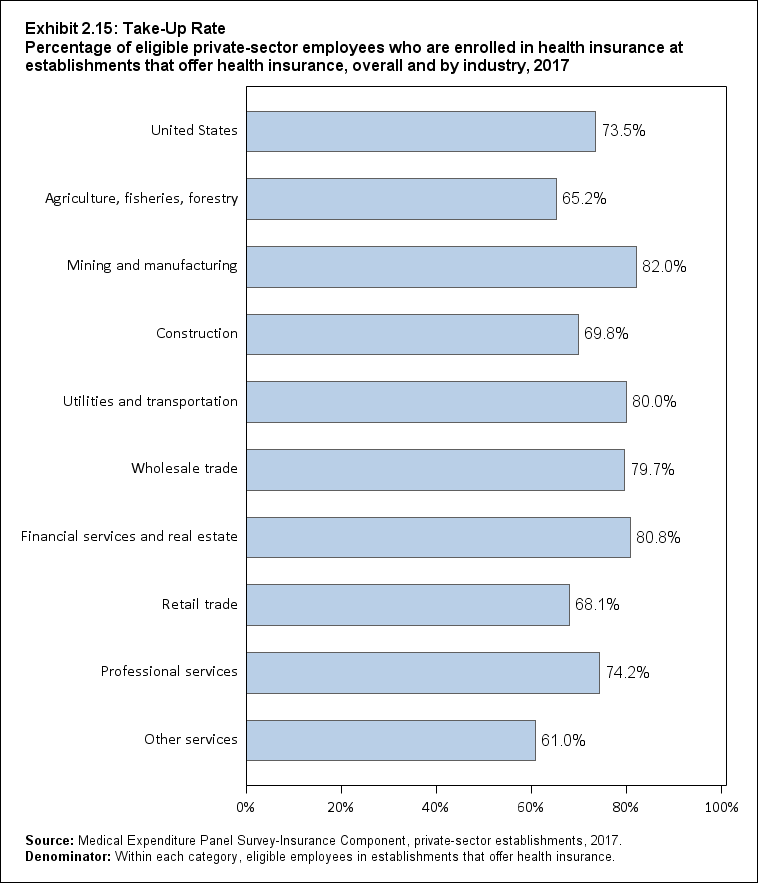

Employee Coverage, Eligibility, and Take-Up

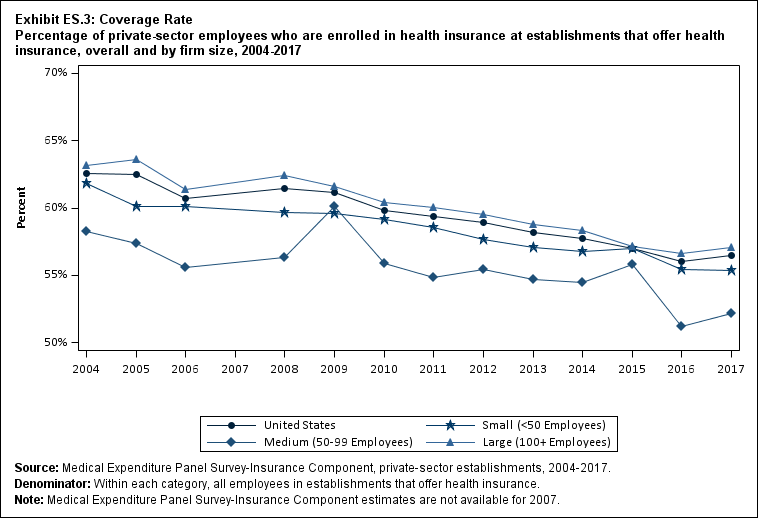

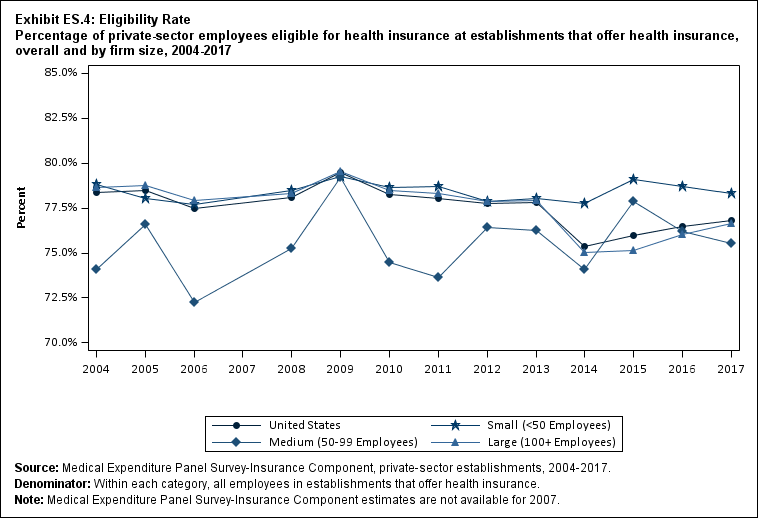

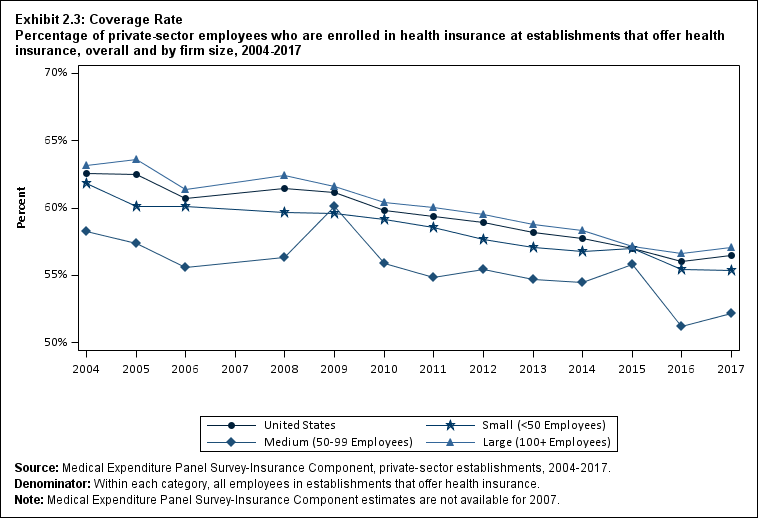

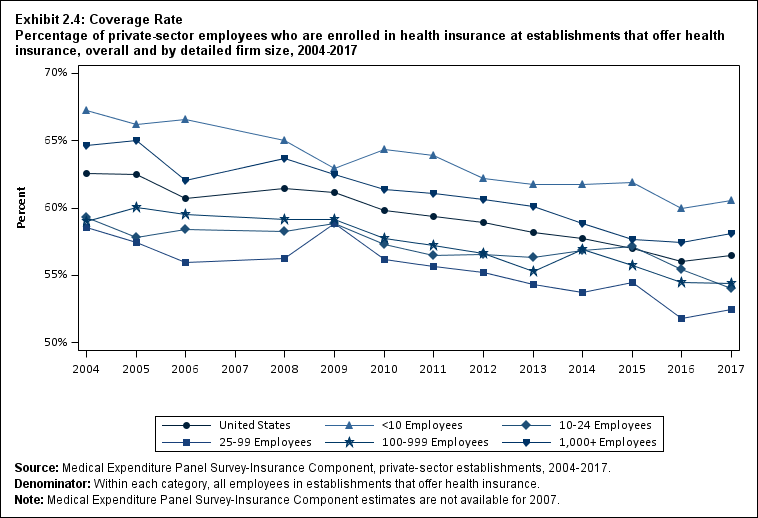

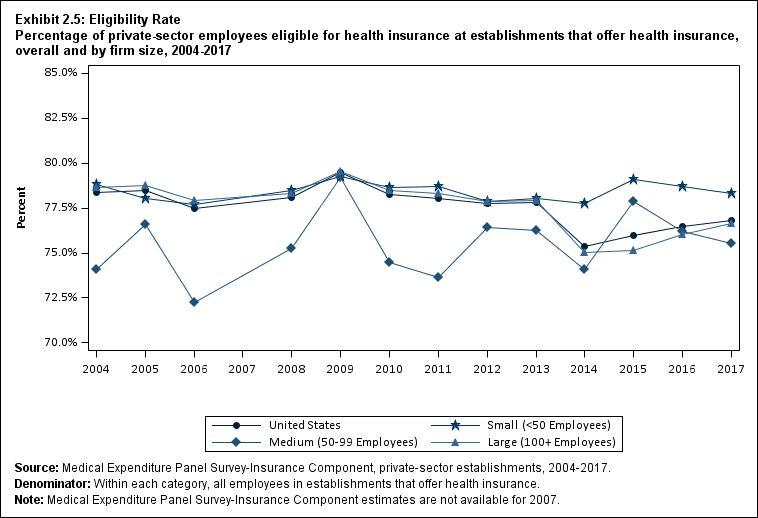

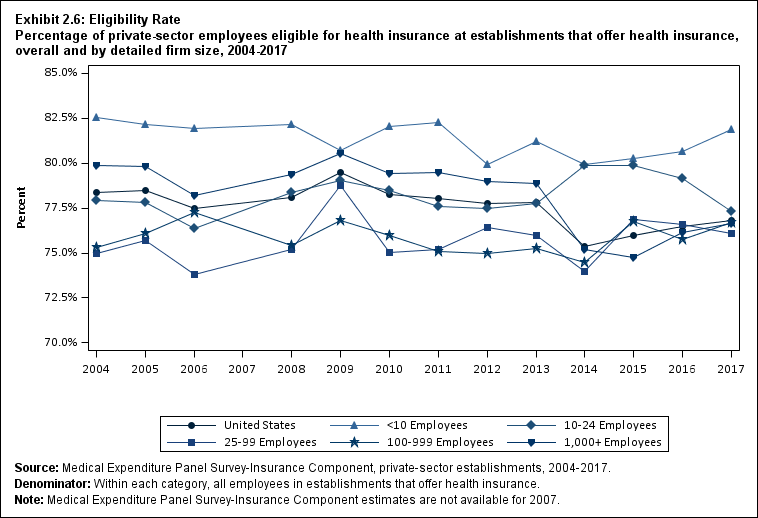

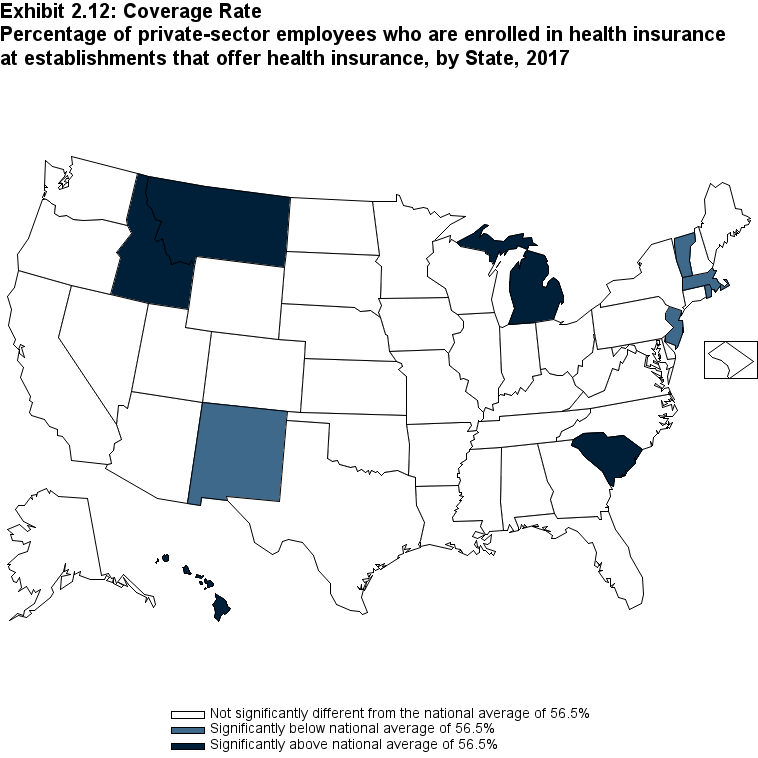

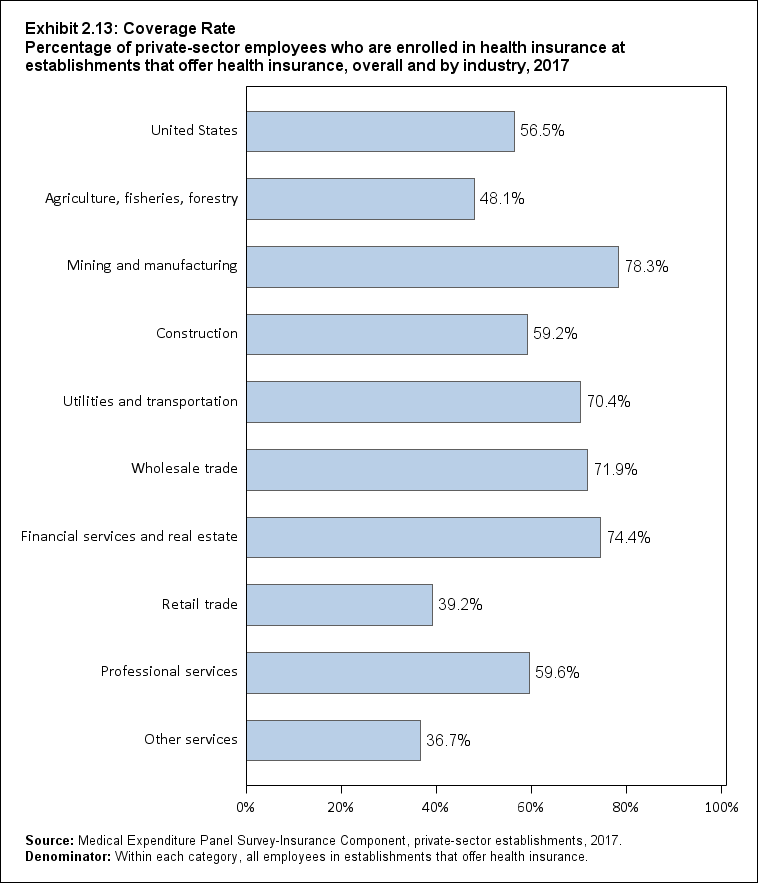

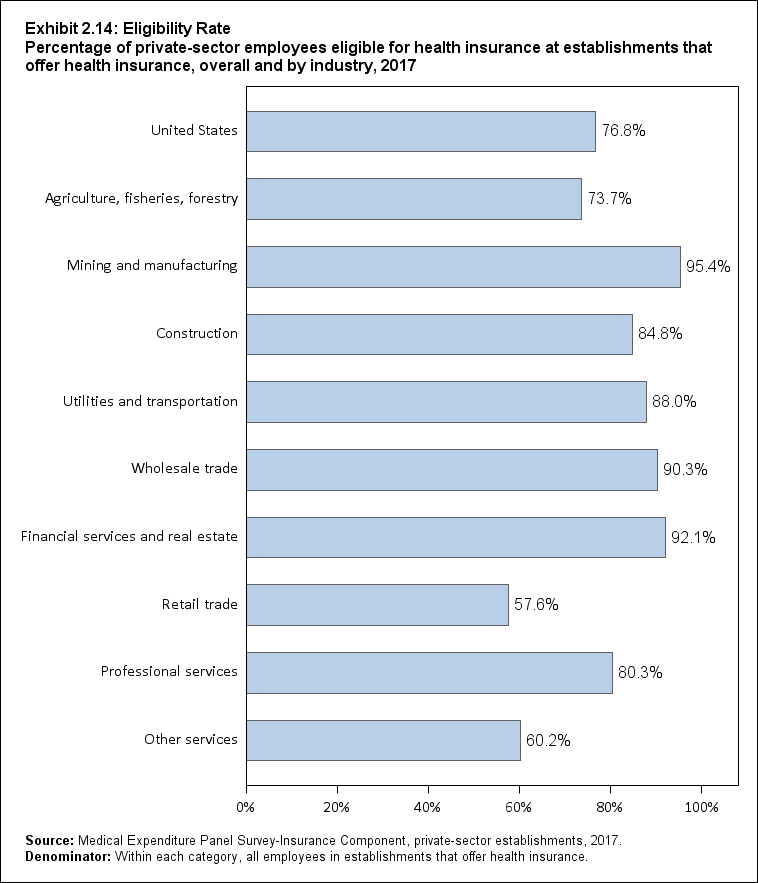

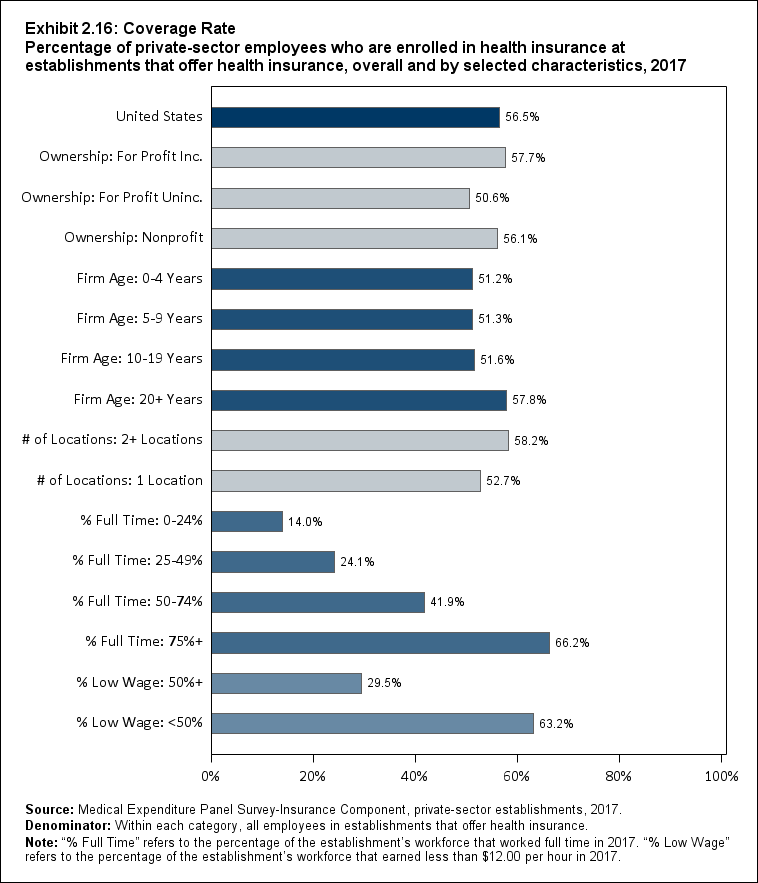

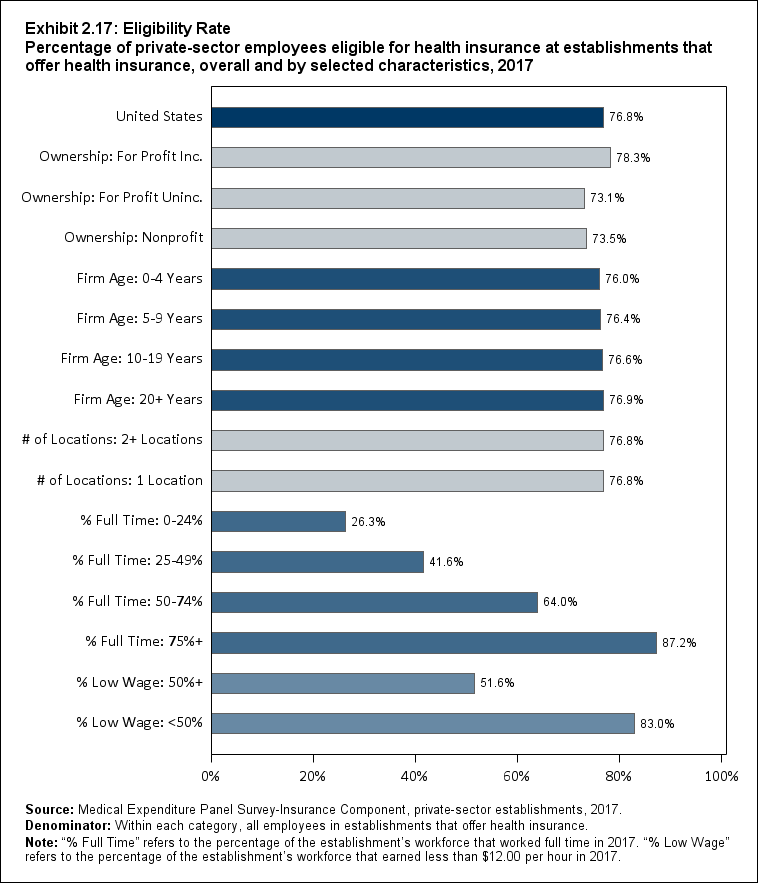

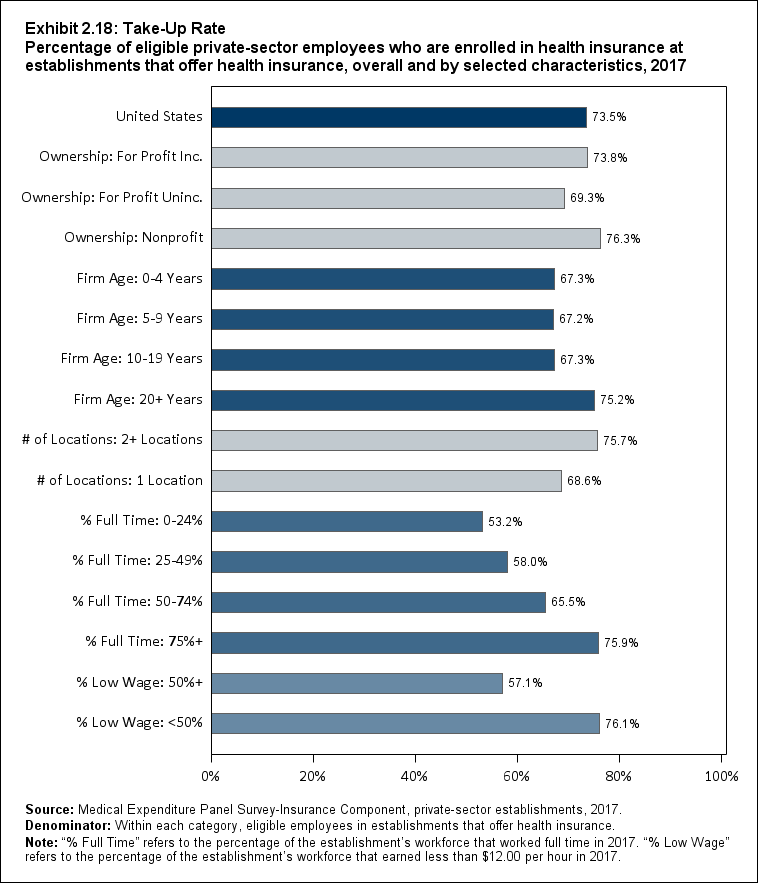

Among establishments that offered insurance, 56.5 percent of

employees were enrolled in coverage through their employer (the "coverage

rate") and 76.8 percent were eligible for health insurance (the "eligibility

rate"). Among eligible employees, 73.5 percent were enrolled in their

employer's health insurance (the "take-up rate") (Exhibit ES.3, Exhibit ES.4, Exhibit

ES.5).

Exhibit ES.3: Coverage Rate Percentage (standard error) of private-sector employees who are enrolled in health insurance at establishments that offer health insurance, overall and by firm size, 2004-2017

| Number of Employees |

2004 |

2005 |

2006 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

| U.S. |

62.6% |

62.5% |

60.7% |

61.4% |

61.1% |

59.8% |

59.4% |

58.9% |

58.2% |

57.8% |

57.0% |

56.0% |

56.5% |

| (Standard Error) |

(0.5%) |

(0.4%) |

(0.3%) |

(0.4%) |

(0.4%) |

(0.5%) |

(0.2%) |

(0.4%) |

(0.3%) |

(0.4%) |

(0.4%) |

(0.4%) |

(0.4%) |

| <50 |

61.9% |

60.1% |

60.1% |

59.7% |

59.6% |

59.2% |

58.6% |

57.7% |

57.1% |

56.8% |

57.0% |

55.5% |

55.4% |

| (Standard Error) |

(0.5%) |

(0.5%) |

(0.6%) |

(0.2%) |

(0.4%) |

(0.6%) |

(0.5%) |

(0.5%) |

(0.5%) |

(0.6%) |

(0.6%) |

(0.6%) |

(0.6%) |

| 50-99 |

58.3% |

57.4% |

55.6% |

56.3% |

60.1% |

55.9% |

54.9% |

55.4% |

54.7% |

54.5% |

55.8% |

51.2% |

52.2% |

| (Standard Error) |

(1.7%) |

(1.5%) |

(1.6%) |

(1.0%) |

(1.0%) |

(0.8%) |

(1.0%) |

(1.2%) |

(0.8%) |

(1.3%) |

(1.2%) |

(1.2%) |

(1.2%) |

| 100+ |

63.2% |

63.6% |

61.4% |

62.4% |

61.6% |

60.4% |

60.0% |

59.5% |

58.8% |

58.3% |

57.1% |

56.6% |

57.1% |

| (Standard Error) |

(0.7%) |

(0.6%) |

(0.5%) |

(0.5%) |

(0.6%) |

(0.6%) |

(0.3%) |

(0.4%) |

(0.3%) |

(0.5%) |

(0.5%) |

(0.5%) |

(0.5%) |

|

Source: Medical Expenditure Panel Survey-Insurance Component, private-sector establishments, 2004-2017.

Denominator: Within each category, all employees in establishments that offer health insurance.

Note: Medical Expenditure Panel Survey-Insurance Component estimates are not available for 2007.

|

Return to Table of Contents

Exhibit ES.4: Eligibility Rate Percentage (standard error) of private-sector employees eligible for health insurance at establishments that offer health insurance, overall and by firm size, 2004-2017

| Number of Employees |

2004 |

2005 |

2006 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

| U.S. |

78.4% |

78.5% |

77.5% |

78.1% |

79.5% |

78.2% |

78.0% |

77.8% |

77.8% |

75.4% |

76.0% |

76.5% |

76.8% |

| (Standard Error) |

(0.4%) |

(0.5%) |

(0.4%) |

(0.4%) |

(0.3%) |

(0.5%) |

(0.4%) |

(0.3%) |

(0.2%) |

(0.4%) |

(0.4%) |

(0.4%) |

(0.4%) |

| <50 |

78.8% |

78.0% |

77.7% |

78.5% |

79.3% |

78.6% |

78.7% |

77.9% |

78.0% |

77.7% |

79.1% |

78.7% |

78.3% |

| (Standard Error) |

(0.6%) |

(0.7%) |

(0.6%) |

(0.4%) |

(0.5%) |

(0.5%) |

(0.6%) |

(0.5%) |

(0.4%) |

(0.6%) |

(0.6%) |

(0.6%) |

(0.6%) |

| 50-99 |

74.1% |

76.6% |

72.3% |

75.3% |

79.2% |

74.5% |

73.6% |

76.4% |

76.2% |

74.1% |

77.8% |

76.2% |

75.5% |

| (Standard Error) |

(1.5%) |

(1.4%) |

(1.5%) |

(1.3%) |

(0.8%) |

(0.6%) |

(1.0%) |

(1.2%) |

(0.8%) |

(1.4%) |

(1.2%) |

(1.2%) |

(1.2%) |

| 100+ |

78.7% |

78.8% |

77.9% |

78.3% |

79.6% |

78.5% |

78.3% |

77.9% |

77.9% |

75.0% |

75.2% |

76.0% |

76.6% |

| (Standard Error) |

(0.6%) |

(0.6%) |

(0.6%) |

(0.4%) |

(0.5%) |

(0.6%) |

(0.4%) |

(0.3%) |

(0.3%) |

(0.5%) |

(0.5%) |

(0.4%) |

(0.5%) |

|

Source: Medical Expenditure Panel Survey-Insurance Component, private-sector establishments, 2004-2017.

Denominator: Within each category, all employees in establishments that offer health insurance.

Note: Medical Expenditure Panel Survey-Insurance Component estimates are not available for 2007.

|

Return to Table of Contents

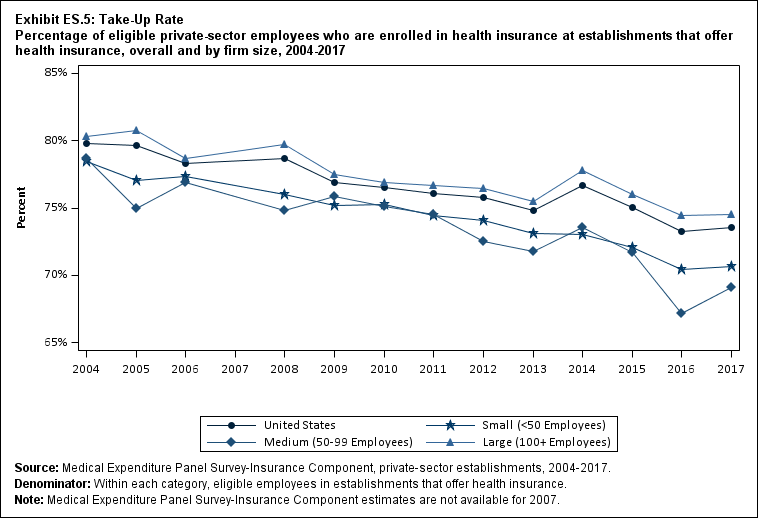

Exhibit ES.5: Take-Up Rate Percentage (standard error) of eligible private-sector employees who are enrolled in health insurance at establishments that offer health insurance, overall and by firm size, 2004-2017

| Number of Employees |

2004 |

2005 |

2006 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

| U.S. |

79.8% |

79.6% |

78.3% |

78.7% |

76.9% |

76.5% |

76.1% |

75.8% |

74.8% |

76.7% |

75.0% |

73.3% |

73.5% |

| (Standard Error) |

(0.3%) |

(0.3%) |

(0.3%) |

(0.3%) |

(0.3%) |

(0.2%) |

(0.3%) |

(0.3%) |

(0.2%) |

(0.3%) |

(0.3%) |

(0.3%) |

(0.3%) |

| <50 |

78.5% |

77.0% |

77.4% |

76.0% |

75.2% |

75.3% |

74.4% |

74.1% |

73.1% |

73.0% |

72.1% |

70.4% |

70.7% |

| (Standard Error) |

(0.5%) |

(0.6%) |

(0.7%) |

(0.3%) |

(0.3%) |

(0.6%) |

(0.4%) |

(0.4%) |

(0.6%) |

(0.5%) |

(0.5%) |

(0.5%) |

(0.6%) |

| 50-99 |

78.7% |

74.9% |

76.9% |

74.9% |

75.9% |

75.1% |

74.5% |

72.5% |

71.8% |

73.5% |

71.7% |

67.2% |

69.1% |

| (Standard Error) |

(1.2%) |

(1.2%) |

(1.3%) |

(0.5%) |

(0.9%) |

(0.7%) |

(0.6%) |

(0.8%) |

(1.0%) |

(1.0%) |

(1.1%) |

(1.2%) |

(1.1%) |

| 100+ |

80.3% |

80.7% |

78.7% |

79.7% |

77.5% |

76.9% |

76.7% |

76.4% |

75.5% |

77.8% |

76.0% |

74.4% |

74.5% |

| (Standard Error) |

(0.4%) |

(0.5%) |

(0.4%) |

(0.4%) |

(0.5%) |

(0.3%) |

(0.3%) |

(0.4%) |

(0.3%) |

(0.3%) |

(0.3%) |

(0.4%) |

(0.4%) |

|

Source: Medical Expenditure Panel Survey-Insurance Component, private-sector establishments, 2004-2017.

Denominator: Within each category, eligible employees in establishments that offer health insurance.

Note: Medical Expenditure Panel Survey-Insurance Component estimates are not available for 2007.

|

Return to Table of Contents

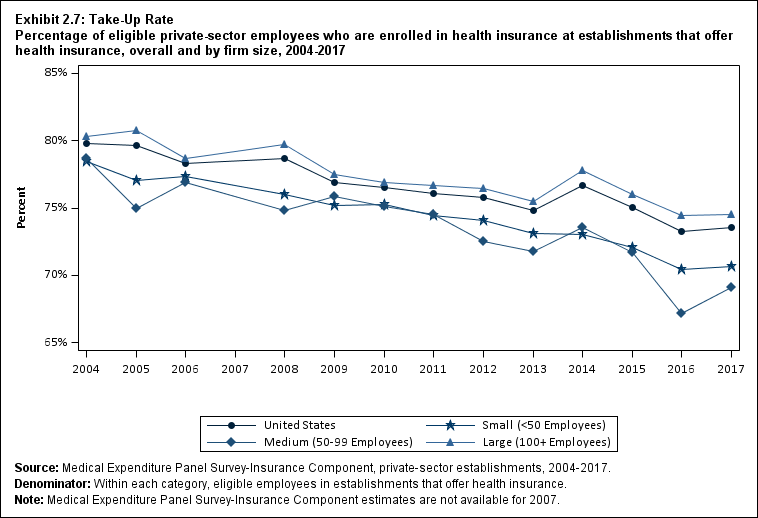

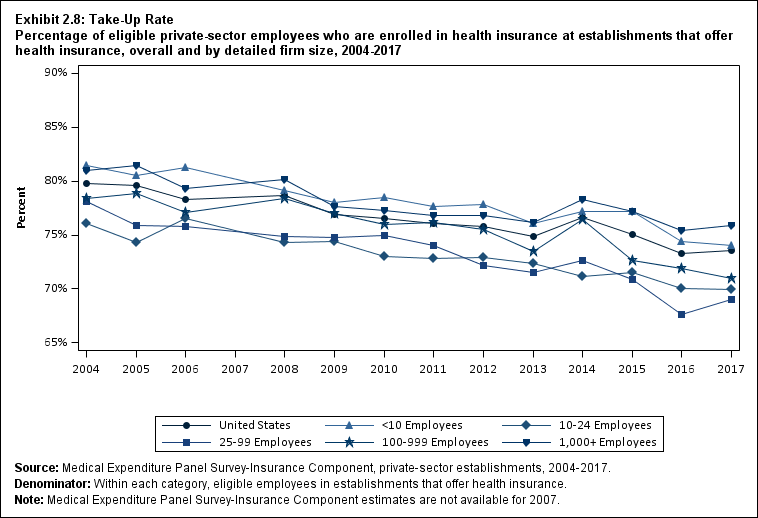

There were no significant changes in coverage, eligibility,

or take-up rates between 2016 and 2017. However, coverage, eligibility, and

take-up rates in 2017 were lower than earlier in the 2004 to 2017 period. Specifically,

coverage rates were significantly lower in 2017 than in all years from 2004 to

2014 and eligibility rates were significantly lower than in all years from 2004

to 2013 except 2006. Take-up rates were significantly lower in 2017 than in all

years from 2004 to 2015.

Choice of Plans

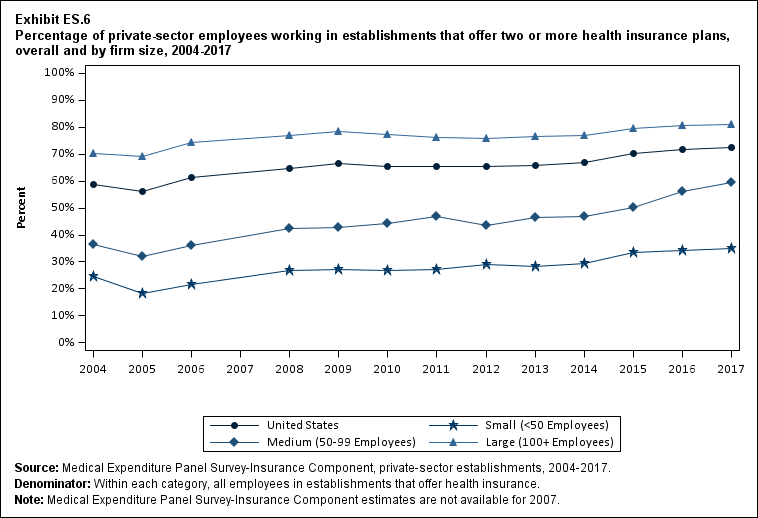

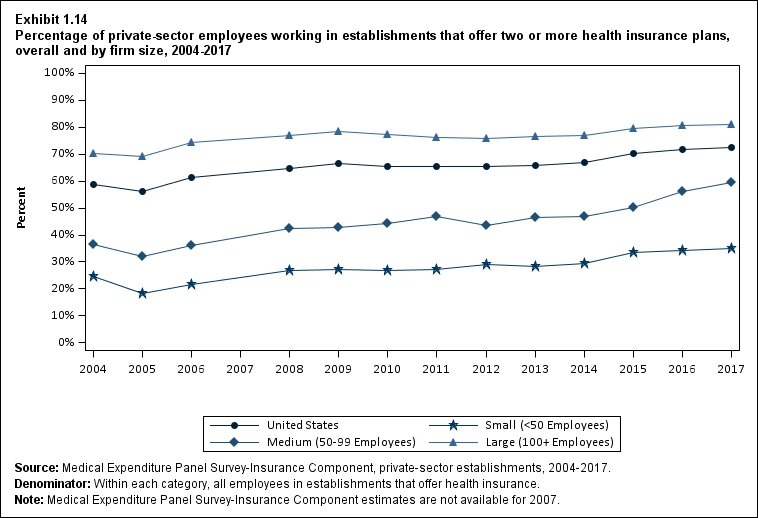

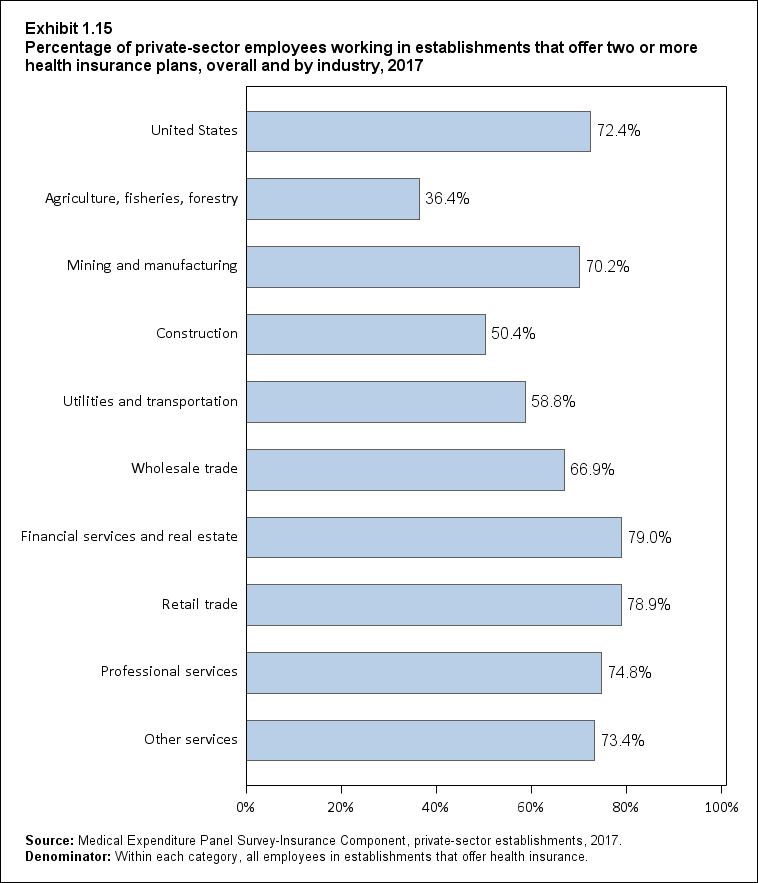

There was no significant change in the percentage of

employees with a choice of plans between 2016 and 2017 (71.7 percent in 2016

and 72.4 percent in 2017). This followed a period where these rates increased

by 3.2 percentage points from 2014 to 2015 and by 1.5 percentage points from

2015 to 2016 (p <0.10). The availability of plan choice was significantly

higher in 2017 than in 2004 for small employers (34.9 percent vs. 24.7

percent), medium employers (59.3 percent vs. 36.7 percent), and large employers

(81.0 percent vs. 70.2 percent) (Exhibit ES.6).

Exhibit ES.6 Percentage (standard error) of private-sector employees working in establishments that offer two or more health insurance plans, overall and by firm size, 2004-2017

| Number of Employees |

2004 |

2005 |

2006 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

| U.S. |

58.6% |

56.3% |

61.4% |

64.8% |

66.5% |

65.6% |

65.5% |

65.3% |

66.0% |

67.0% |

70.2% |

71.7% |

72.4% |

| (Standard Error) |

(0.8%) |

(0.8%) |

(0.7%) |

(0.6%) |

(0.7%) |

(0.8%) |

(0.5%) |

(0.7%) |

(0.6%) |

(0.6%) |

(0.5%) |

(0.5%) |

(0.5%) |

| <50 |

24.7% |

18.2% |

21.5% |

26.8% |

27.3% |

26.7% |

27.2% |

29.3% |

28.4% |

29.6% |

33.6% |

34.2% |

34.9% |

| (Standard Error) |

(0.9%) |

(1.1%) |

(1.1%) |

(0.7%) |

(0.9%) |

(0.8%) |

(0.9%) |

(0.8%) |

(1.0%) |

(0.9%) |

(1.1%) |

(1.0%) |

(1.0%) |

| 50-99 |

36.7% |

32.1% |

36.0% |

42.5% |

42.8% |

44.1% |

46.8% |

43.7% |

46.6% |

46.8% |

50.2% |

56.2% |

59.3% |

| (Standard Error) |

(2.5%) |

(2.5%) |

(2.4%) |

(1.7%) |

(2.0%) |

(1.9%) |

(2.2%) |

(1.7%) |

(2.2%) |

(2.1%) |

(2.2%) |

(2.0%) |

(1.9%) |

| 100+ |

70.2% |

69.0% |

74.3% |

76.9% |

78.5% |

77.3% |

76.3% |

75.7% |

76.5% |

77.0% |

79.7% |

80.7% |

81.0% |

| (Standard Error) |

(0.9%) |

(0.9%) |

(0.6%) |

(0.7%) |

(0.7%) |

(1.0%) |

(0.7%) |

(0.7%) |

(0.7%) |

(0.6%) |

(0.6%) |

(0.6%) |

(0.6%) |

|

Source: Medical Expenditure Panel Survey-Insurance Component, private-sector establishments, 2004-2017.

Denominator: Within each category, all employees in establishments that offer health insurance.

Note: Medical Expenditure Panel Survey-Insurance Component estimates are not available for 2007.

|

Return to Table of Contents

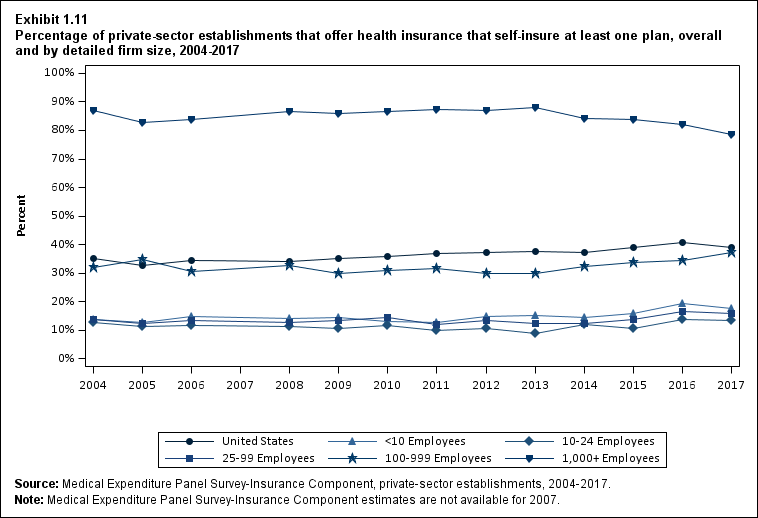

Self-Insured Plans

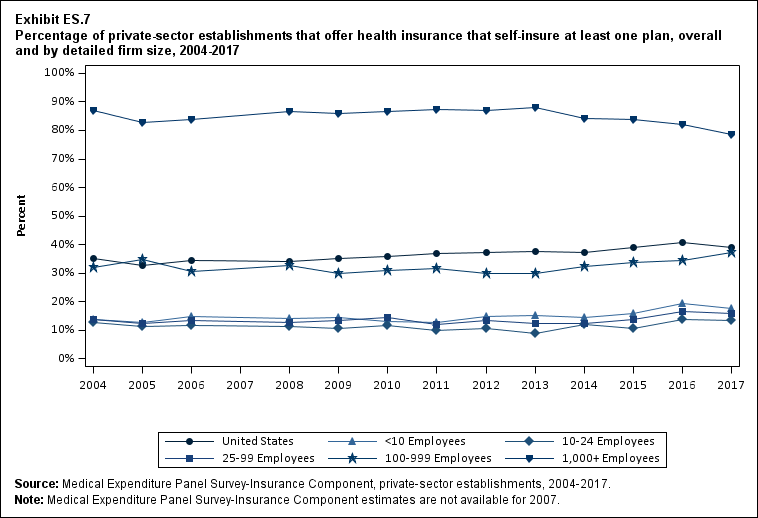

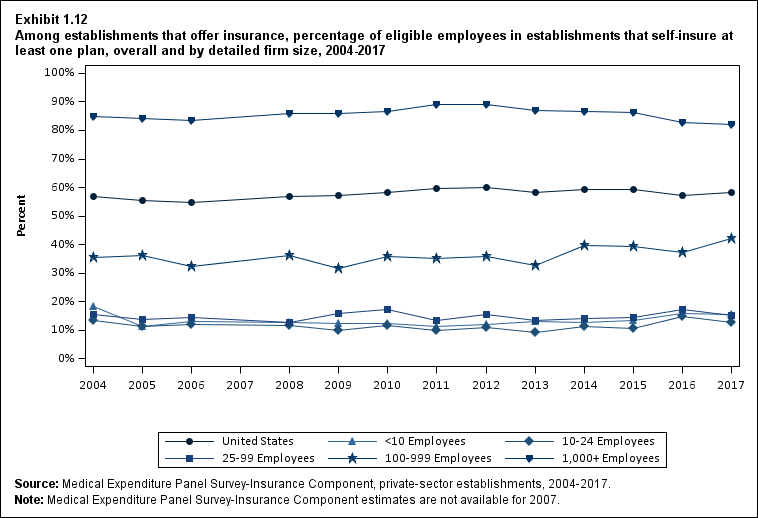

Between 2015 and 2017, the percentage of offering

establishments that self-insured at least one plan first rose and then fell

back to its 2015 level in 2017 (39.0 percent in 2015, 40.7 percent in 2016,

39.2 percent in 2017; p <0.10 for the 2016 to 2017 decline) (Exhibit ES.7). The

largest firms were the only firm size category to experience a significant

change in the percentage of establishments that self-insured at least one plan

from 2016 to 2017, falling from 81.9 percent to 78.6 percent. This decline

brought the 2017 level for the largest firms to its lowest level in the 2004 to

2017 period.

Among employers that offered

insurance, 13.3 percent to 17.7 percent of establishments in the three firm-size

categories with fewer than 100 workers self-insured at least one plan in 2017.

By contrast, 37.2 percent and 78.6 percent of offering establishments in firms

with 100 to 999 and 1,000 or more employees, respectively, self-insured at

least one plan. There were similar differences by firm size in the percentage

of eligible employees who worked for an employer that self-insured at least one

plan (Section 1, Exhibit 1.12).

Exhibit ES.7 Percentage (standard error) of private-sector establishments that offer health insurance that self-insure at least one plan, overall and by detailed firm size, 2004-2017

| Number of Employees |

2004 |

2005 |

2006 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

| U.S. |

35.0% |

32.7% |

34.4% |

34.2% |

35.1% |

35.8% |

36.9% |

37.2% |

37.6% |

37.2% |

39.0% |

40.7% |

39.2% |

| (Standard Error) |

(0.7%) |

(0.5%) |

(0.5%) |

(0.4%) |

(0.4%) |

(0.5%) |

(0.5%) |

(0.5%) |

(0.5%) |

(0.5%) |

(0.5%) |

(0.6%) |

(0.6%) |

| <10 |

13.7% |

12.7% |

14.9% |

14.0% |

14.6% |

13.1% |

12.6% |

14.9% |

15.2% |

14.4% |

15.8% |

19.3% |

17.7% |

| (Standard Error) |

(0.6%) |

(0.8%) |

(0.9%) |

(0.8%) |

(0.7%) |

(0.5%) |

(0.8%) |

(0.9%) |

(0.4%) |

(0.8%) |

(1.0%) |

(1.4%) |

(1.4%) |

| 10-24 |

12.7% |

11.2% |

11.6% |

11.1% |

10.4% |

11.6% |

9.9% |

10.7% |

9.0% |

12.0% |

10.6% |

13.6% |

13.3% |

| (Standard Error) |

(0.7%) |

(0.5%) |

(0.6%) |

(0.9%) |

(0.4%) |

(0.8%) |

(0.7%) |

(0.7%) |

(0.7%) |

(1.0%) |

(1.0%) |

(1.1%) |

(1.2%) |

| 25-99 |

13.9% |

12.2% |

13.5% |

12.6% |

13.4% |

14.3% |

12.2% |

13.5% |

12.4% |

12.2% |

13.7% |

16.6% |

16.0% |

| (Standard Error) |

(0.9%) |

(0.9%) |

(0.7%) |

(0.8%) |

(0.7%) |

(0.7%) |

(0.7%) |

(0.7%) |

(0.7%) |

(0.8%) |

(0.9%) |

(0.9%) |

(0.9%) |

| 100-999 |

31.8% |

34.9% |

30.6% |

32.7% |

29.9% |

30.9% |

31.7% |

30.1% |

30.1% |

32.5% |

33.7% |

34.4% |

37.2% |

| (Standard Error) |

(1.3%) |

(1.4%) |

(0.9%) |

(1.3%) |

(0.7%) |

(0.9%) |

(1.1%) |

(0.8%) |

(1.0%) |

(1.2%) |

(1.2%) |

(1.2%) |

(1.3%) |

| 1,000+ |

87.0% |

82.7% |

83.8% |

86.5% |

85.8% |

86.6% |

87.5% |

87.1% |

88.0% |

84.2% |

83.8% |

81.9% |

78.6% |

| (Standard Error) |

(0.6%) |

(0.5%) |

(0.7%) |

(0.5%) |

(0.4%) |

(0.6%) |

(0.5%) |

(0.7%) |

(0.5%) |

(0.8%) |

(0.8%) |

(0.8%) |

(0.8%) |

|

Source: Medical Expenditure Panel Survey-Insurance Component, private-sector establishments, 2004-2017.

Note: Medical Expenditure Panel Survey-Insurance Component estimates are not available for 2007.

|

Return to Table of Contents

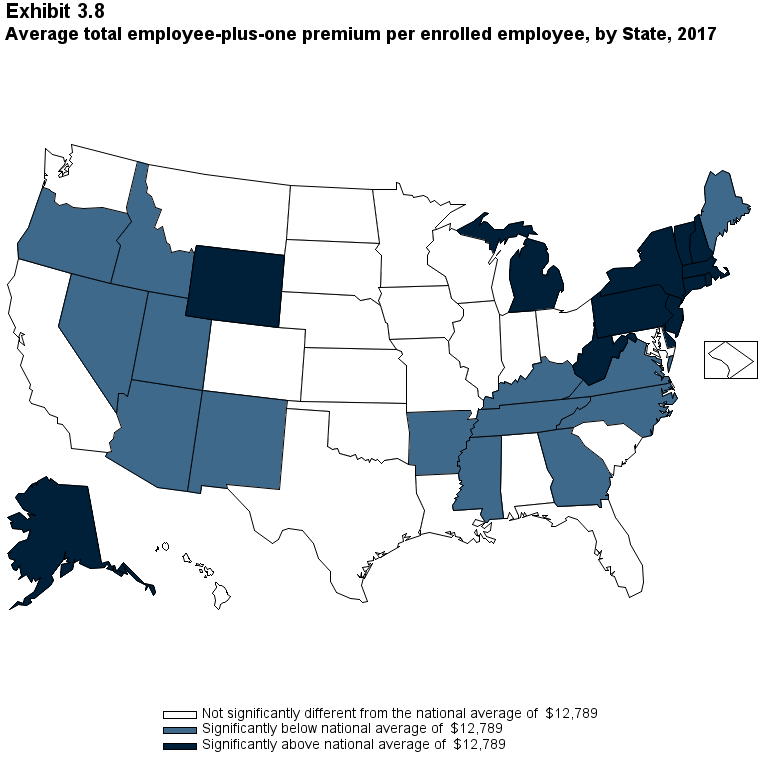

Premiums

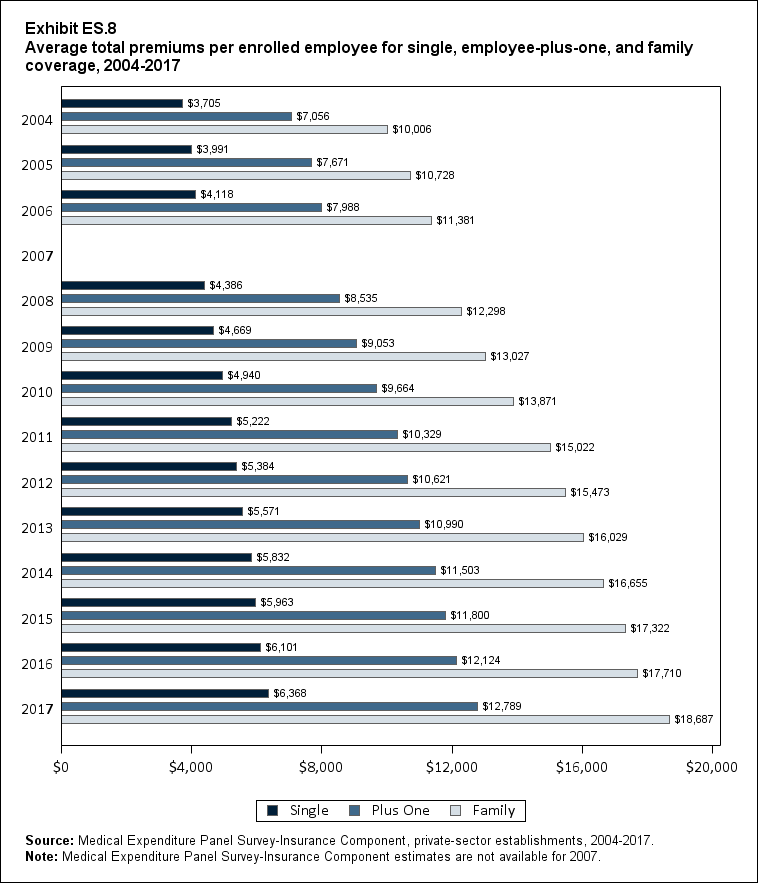

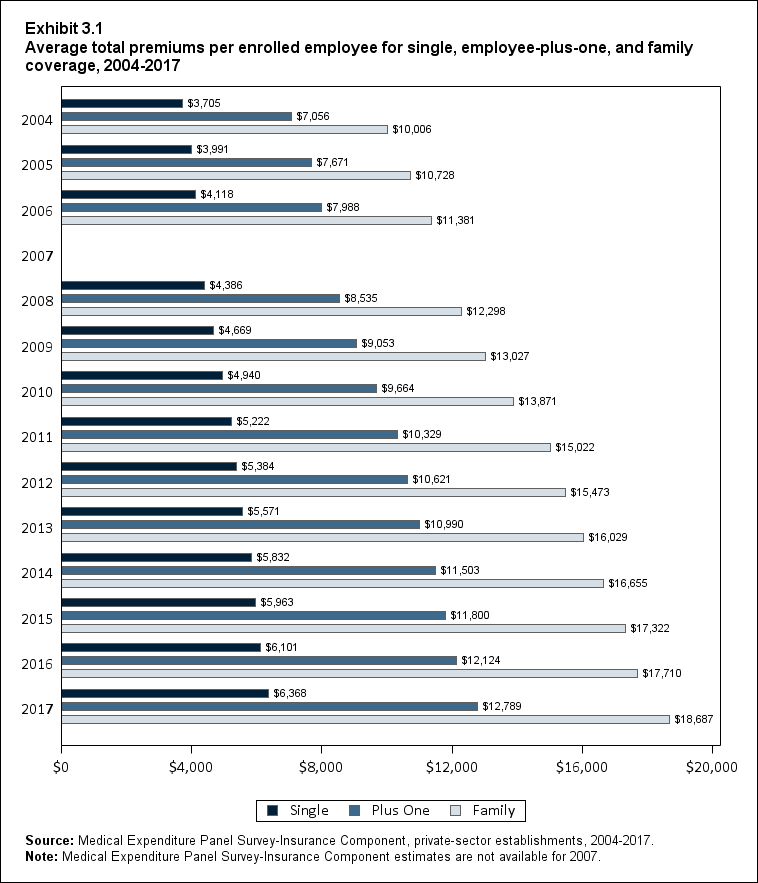

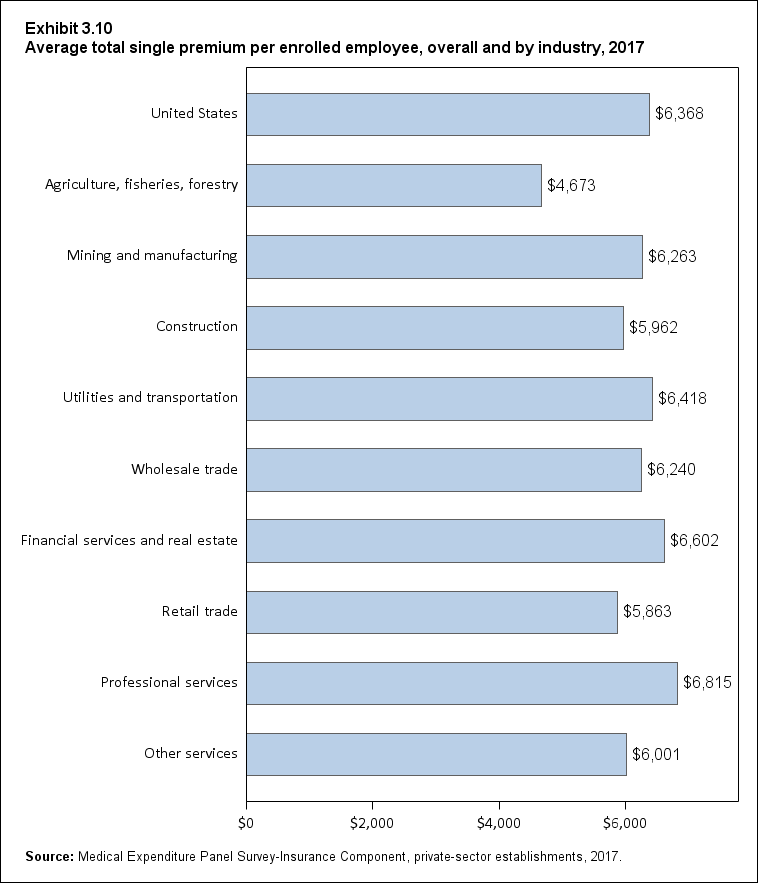

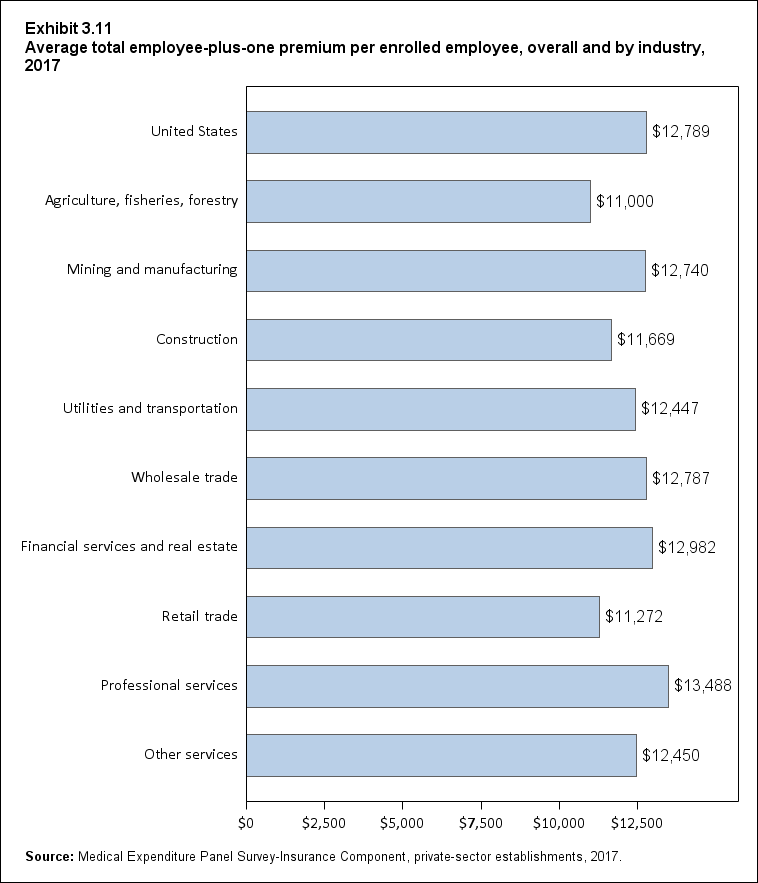

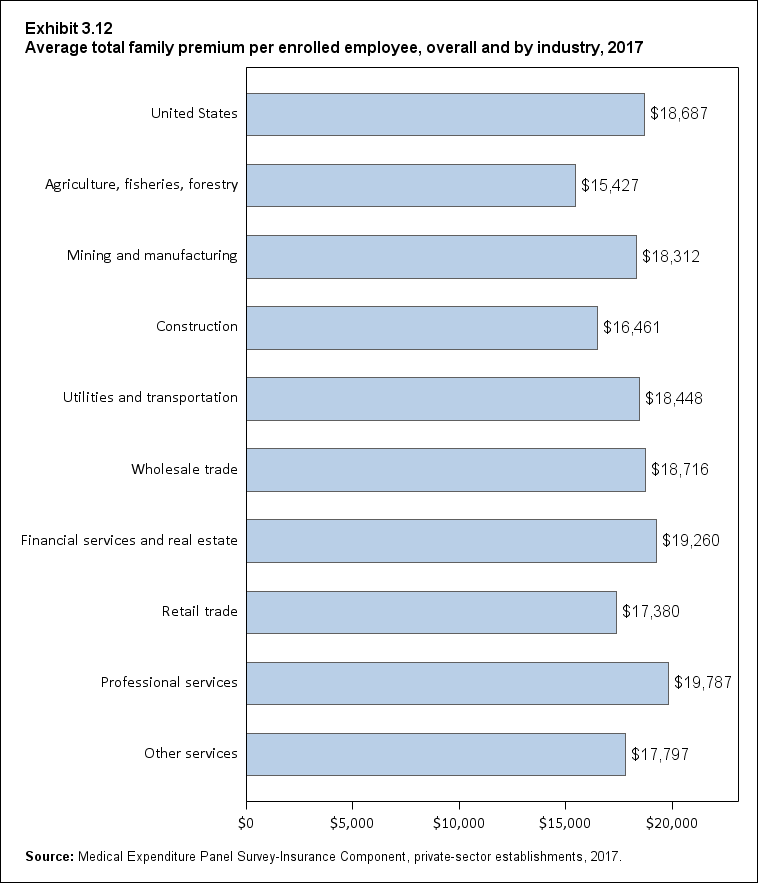

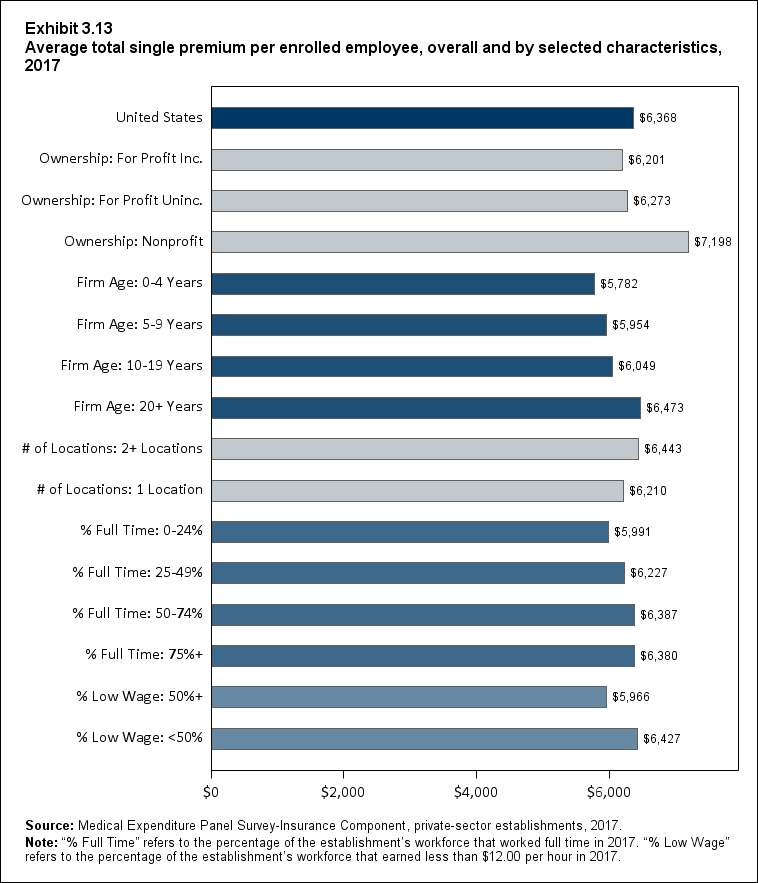

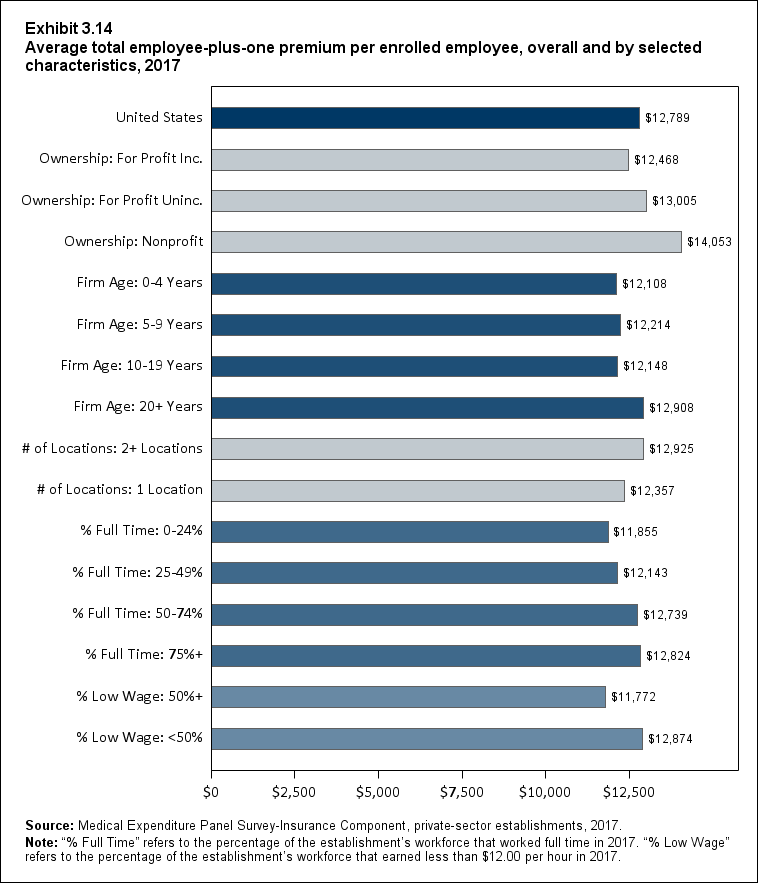

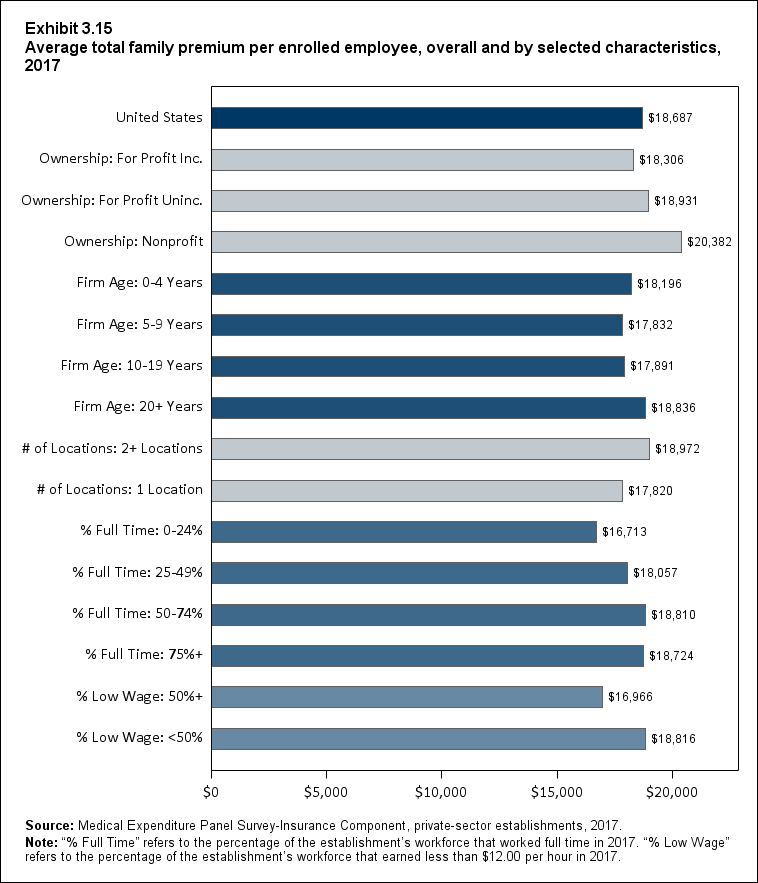

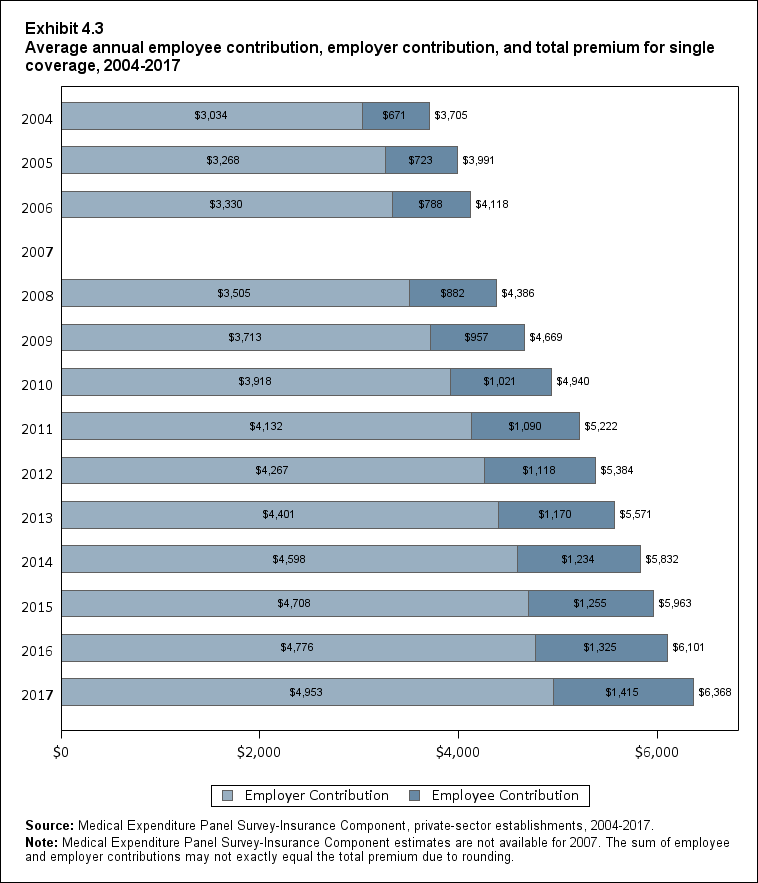

In 2017, average annual health insurance premiums per

enrolled employee with private-sector employer coverage were $6,368 for single

coverage, $12,789 for employee-plus-one coverage, and $18,687 for family

coverage. These amounts represent increases of 4.4 percent for single coverage

and 5.5 percent for both employee-plus-one and family coverage over 2016 levels

(Exhibit ES.8).

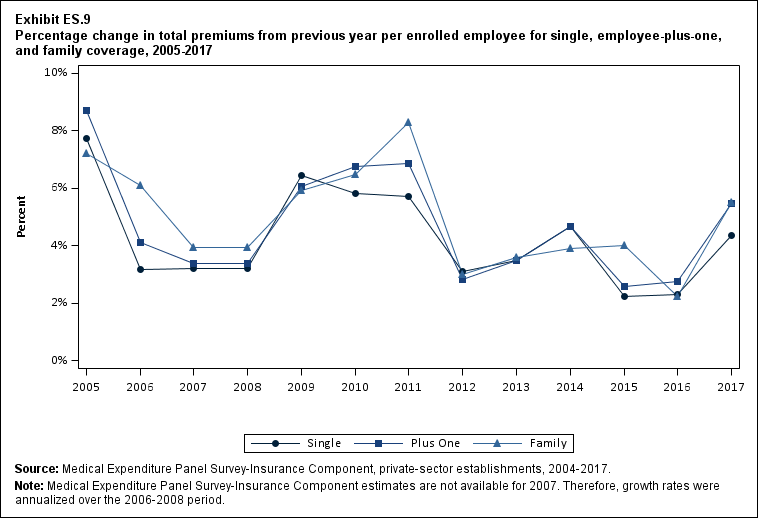

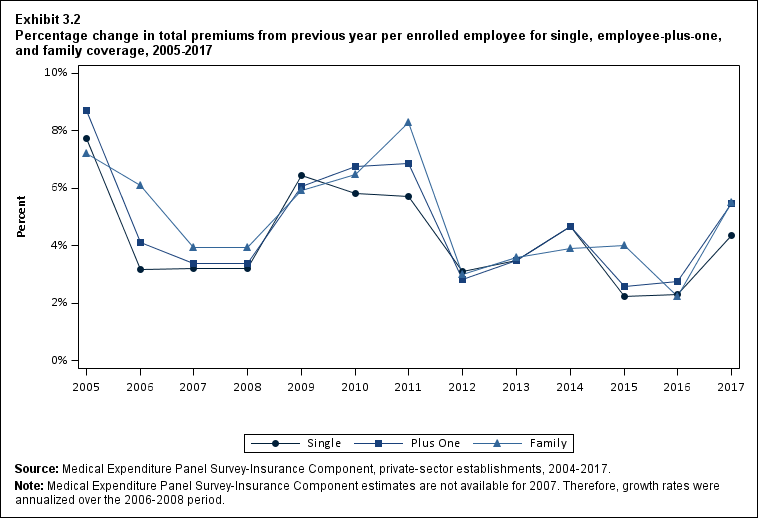

The 2016 to 2017 growth rates for single premiums and

employee-plus-one premiums (4.4 percent and 5.5 percent, respectively) were

higher than the growth rates for these types of coverage from 2014 to 2015 and

2015 to 2016, which ranged from 2.2 percent to 2.7 percent. The 2016 to 2017

growth rate for family premiums (5.5 percent) was higher than the growth rate

for 2015 to 2016 (2.2 percent). Between 2004 and 2017, premiums for the three

types of coverage grew by between 71.9 percent and 86.8 percent (average annual

growth rates of between 4.3 percent and 4.9 percent, data not shown).

From 2016 to 2017, growth rates for all three types of premiums

were close to smoothed longer term growth rates (data not shown). Specifically,

there were no significant differences between the 2016 to 2017 growth rates and

the average annual growth rate from 2004 to 2017 for single coverage (4.4

percent vs. 4.3 percent), employee-plus-one coverage (5.5 percent vs. 4.7

percent), or family coverage (5.5 percent vs. 4.9 percent) (Exhibit ES.9).

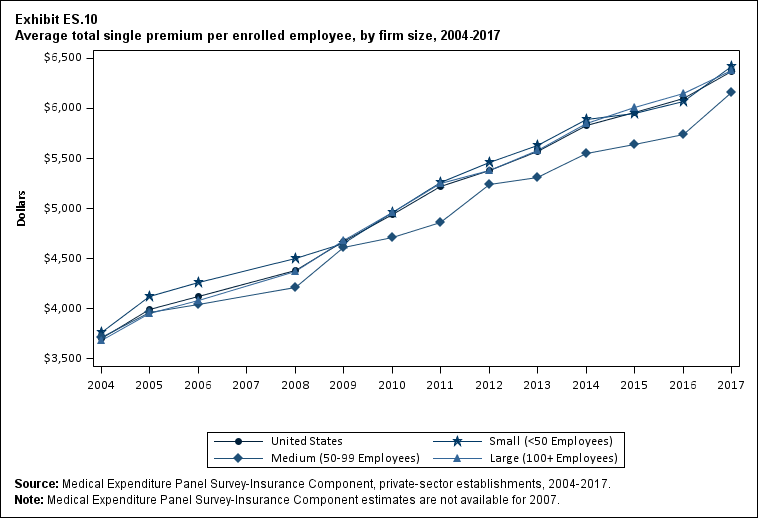

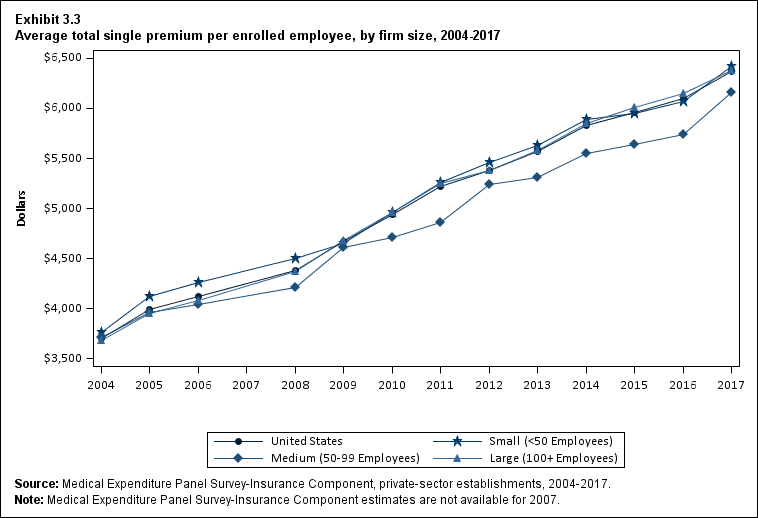

From 2010 through 2017, average single premiums were lower

in medium firms (50 to 99 employees) than in small (fewer than 50 employees) or

large firms (100 or more employees) (p <0.10 for the differences in 2017)

(Exhibit ES.10). From 2004 to 2017, there were no significant differences by

firm size in the growth of single premiums, as single premiums grew by 70.6

percent ($3,763 to $6,421) in small firms, 66.1 percent ($3,711 to $6,163) in

medium firms, and 73.1 percent ($3,684 to $6,377) in large firms (Exhibit ES.10).

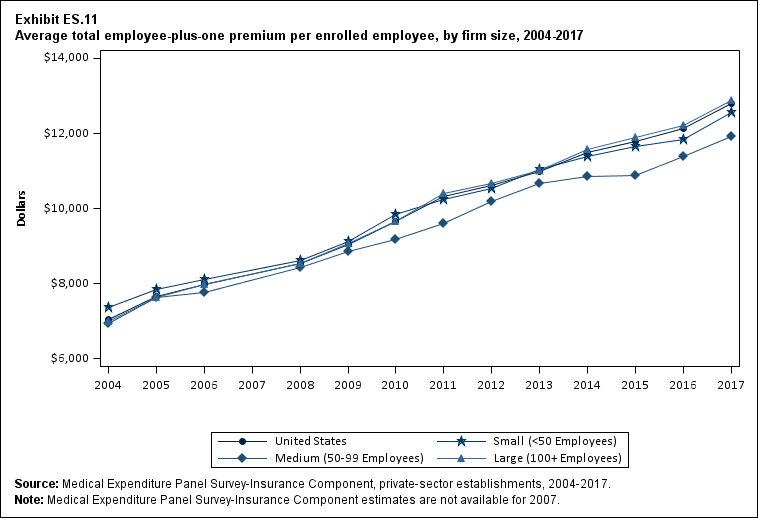

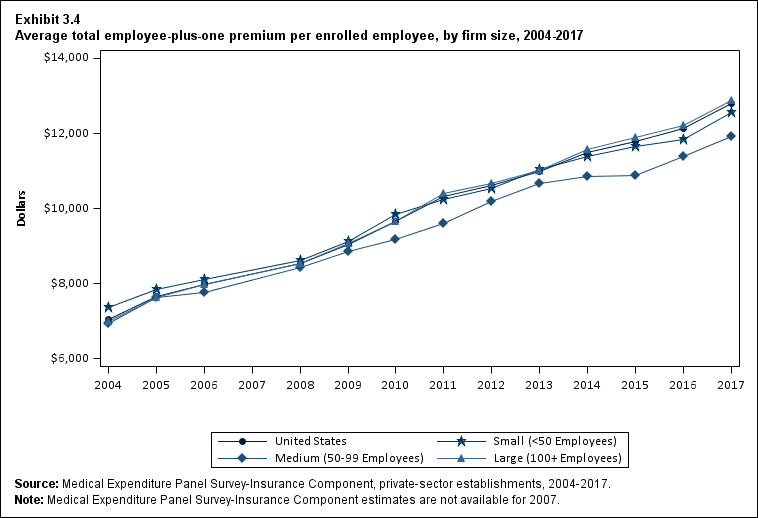

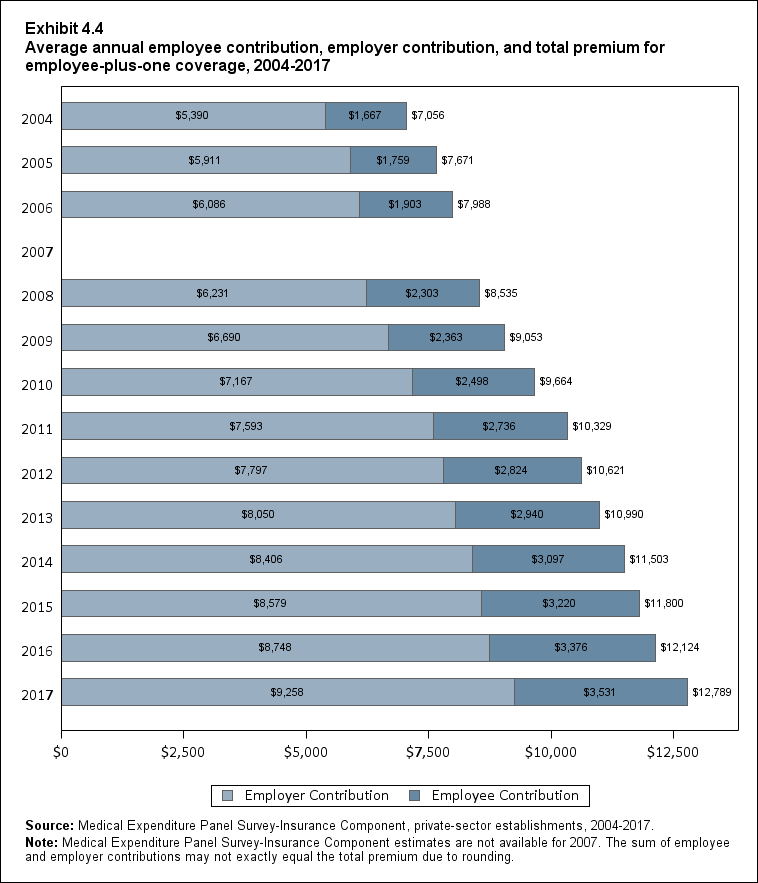

In 2004, employee-plus-one premiums were higher in small

firms ($7,373) than in medium firms ($6,945) or large firms ($7,002). From 2004

to 2017, however, employee-plus-one premiums grew more rapidly in large firms

(83.9 percent) than in medium firms (71.8 percent) and small firms (70.3

percent). By 2017, average employee-plus-one premiums in large firms ($12,878)

were higher than in medium firms ($11,931) and small firms ($12,558) (p

<0.10) (Exhibit ES.11).

Exhibit ES.8 Average total premiums (standard error) per enrolled employee for single, employee-plus-one and family coverage, 2004-2017

| Coverage |

2004 |

2005 |

2006 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

| Single |

$3,705 |

$3,991 |

$4,118 |

$4,386 |

$4,669 |

$4,940 |

$5,222 |

$5,384 |

$5,571 |

$5,832 |

$5,963 |

$6,101 |

$6,368 |

| (Standard Error) |

($16) |

($24) |

($25) |

($15) |

($21) |

($22) |

($26) |

($28) |

($23) |

($25) |

($26) |

($27) |

($28) |

| Plus One |

$7,056 |

$7,671 |

$7,988 |

$8,535 |

$9,053 |

$9,664 |

$10,329 |

$10,621 |

$10,990 |

$11,503 |

$11,800 |

$12,124 |

$12,789 |

| (Standard Error) |

($39) |

($44) |

($48) |

($43) |

($34) |

($60) |

($105) |

($56) |

($54) |

($60) |

($58) |

($60) |

($70) |

| Family |

$10,006 |

$10,728 |

$11,381 |

$12,298 |

$13,027 |

$13,871 |

$15,022 |

$15,473 |

$16,029 |

$16,655 |

$17,322 |

$17,710 |

$18,687 |

| (Standard Error) |

($28) |

($41) |

($32) |

($81) |

($25) |

($75) |

($98) |

($95) |

($61) |

($79) |

($95) |

($84) |

($105) |

|

Source: Medical Expenditure Panel Survey-Insurance Component, private-sector establishments, 2004-2017.

Note: Medical Expenditure Panel Survey-Insurance Component estimates are not available for 2007.

|

Return to Table of Contents

Exhibit ES.9 Percentage change (standard error) in total premiums from previous year per enrolled employee for single, employee-plus-one, and family coverage, 2005-2017

| Year |

Single |

Employee-Plus-One |

Family |

| 2005 |

7.7% |

8.7% |

7.2% |

| (Standard Error) |

(0.8%) |

(0.9%) |

(0.5%) |

| 2006 |

3.2% |

4.1% |

6.1% |

| (Standard Error) |

(0.9%) |

(0.9%) |

(0.5%) |

| 2007 |

3.2% |

3.4% |

4.0% |

| (Standard Error) |

(0.8%) |

(0.8%) |

(0.8%) |

| 2008 |

3.2% |

3.4% |

4.0% |

| (Standard Error) |

(0.8%) |

(0.8%) |

(0.8%) |

| 2009 |

6.5% |

6.1% |

5.9% |

| (Standard Error) |

(0.6%) |

(0.7%) |

(0.7%) |

| 2010 |

5.8% |

6.7% |

6.5% |

| (Standard Error) |

(0.7%) |

(0.8%) |

(0.6%) |

| 2011 |

5.7% |

6.9% |

8.3% |

| (Standard Error) |

(0.7%) |

(1.3%) |

(0.9%) |

| 2012 |

3.1% |

2.8% |

3.0% |

| (Standard Error) |

(0.7%) |

(1.2%) |

(0.9%) |

| 2013 |

3.5% |

3.5% |

3.6% |

| (Standard Error) |

(0.7%) |

(0.7%) |

(0.7%) |

| 2014 |

4.7% |

4.7% |

3.9% |

| (Standard Error) |

(0.6%) |

(0.7%) |

(0.6%) |

| 2015 |

2.2% |

2.6% |

4.0% |

| (Standard Error) |

(0.6%) |

(0.7%) |

(0.8%) |

| 2016 |

2.3% |

2.7% |

2.2% |

| (Standard Error) |

(0.6%) |

(0.7%) |

(0.7%) |

| 2017 |

4.4% |

5.5% |

5.5% |

| (Standard Error) |

(0.7%) |

(0.8%) |

(0.8%) |

|

Source: Medical Expenditure Panel Survey-Insurance Component, private-sector establishments, 2004-2017.

Note: Medical Expenditure Panel Survey-Insurance Component estimates are not available for 2007.

Therefore, growth rates were annualized over the 2006-2008 period.

|

Return to Table of Contents

Exhibit ES.10 Average total single premium (standard error) per enrolled employee, by firm size, 2004-2017

| Number of Employees |

2004 |

2005 |

2006 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

| U.S. |

$3,705 |

$3,991 |

$4,118 |

$4,386 |

$4,669 |

$4,940 |

$5,222 |

$5,384 |

$5,571 |

$5,832 |

$5,963 |

$6,101 |

$6,368 |

| (Standard Error) |

($16) |

($24) |

($25) |

($15) |

($21) |

($22) |

($26) |

($28) |

($23) |

($25) |

($26) |

($27) |

($28) |

| <50 |

$3,763 |

$4,121 |

$4,260 |

$4,501 |

$4,652 |

$4,956 |

$5,258 |

$5,460 |

$5,628 |

$5,886 |

$5,947 |

$6,070 |

$6,421 |

| (Standard Error) |

($44) |

($45) |

($34) |

($31) |

($31) |

($34) |

($39) |

($60) |

($39) |

($55) |

($55) |

($53) |

($61) |

| 50-99 |

$3,711 |

$3,962 |

$4,045 |

$4,215 |

$4,614 |

$4,713 |

$4,861 |

$5,246 |

$5,314 |

$5,549 |

$5,642 |

$5,743 |

$6,163 |

| (Standard Error) |

($90) |

($70) |

($66) |

($37) |

($82) |

($52) |

($75) |

($39) |

($73) |

($82) |

($104) |

($96) |

($121) |

| 100+ |

$3,684 |

$3,950 |

$4,080 |

$4,370 |

$4,681 |

$4,959 |

$5,252 |

$5,378 |

$5,584 |

$5,851 |

$6,006 |

$6,146 |

$6,377 |

| (Standard Error) |

($25) |

($32) |

($32) |

($26) |

($38) |

($23) |

($31) |

($28) |

($29) |

($30) |

($31) |

($32) |

($33) |

|

Source: Medical Expenditure Panel Survey-Insurance Component, private-sector establishments, 2004-2017.

Note: Medical Expenditure Panel Survey-Insurance Component estimates are not available for 2007.

|

Return to Table of Contents

Exhibit ES.11 Average total employee-plus-one premium (standard error) per enrolled employee, by firm size, 2004-2017

| Number of Employees |

2004 |

2005 |

2006 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

| U.S. |

$7,056 |

$7,671 |

$7,988 |

$8,535 |

$9,053 |

$9,664 |

$10,329 |

$10,621 |

$10,990 |

$11,503 |

$11,800 |

$12,124 |

$12,789 |

| (Standard Error) |

($39) |

($44) |

($48) |

($43) |

($34) |

($60) |

($105) |

($56) |

($54) |

($60) |

($58) |

($60) |

($70) |

| <50 |

$7,373 |

$7,841 |

$8,105 |

$8,631 |

$9,124 |

$9,850 |

$10,253 |

$10,524 |

$11,050 |

$11,386 |

$11,666 |

$11,833 |

$12,558 |

| (Standard Error) |

($125) |

($115) |

($113) |

($110) |

($119) |

($80) |

($104) |

($121) |

($92) |

($163) |

($158) |

($156) |

($170) |

| 50-99 |

$6,945 |

$7,645 |

$7,774 |

$8,421 |

$8,852 |

$9,166 |

$9,615 |

$10,178 |

$10,673 |

$10,845 |

$10,885 |

$11,389 |

$11,931 |

| (Standard Error) |

($165) |

($138) |

($167) |

($88) |

($148) |

($124) |

($192) |

($185) |

($330) |

($187) |

($198) |

($227) |

($232) |

| 100+ |

$7,002 |

$7,640 |

$7,981 |

$8,527 |

$9,058 |

$9,669 |

$10,394 |

$10,672 |

$11,006 |

$11,571 |

$11,892 |

$12,225 |

$12,878 |

| (Standard Error) |

($40) |

($60) |

($61) |

($60) |

($34) |

($62) |

($113) |

($70) |

($59) |

($68) |

($66) |

($68) |

($79) |

|

Source: Medical Expenditure Panel Survey-Insurance Component, private-sector establishments, 2004-2017.

Note: Medical Expenditure Panel Survey-Insurance Component estimates are not available for 2007.

|

Return to Table of Contents

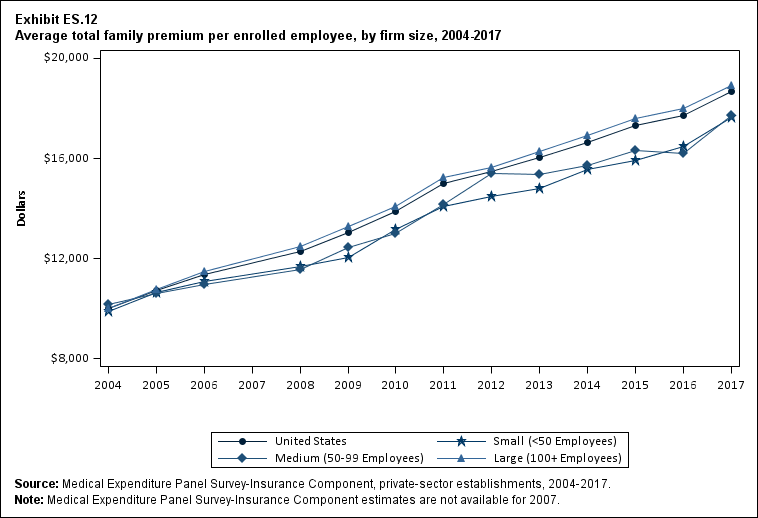

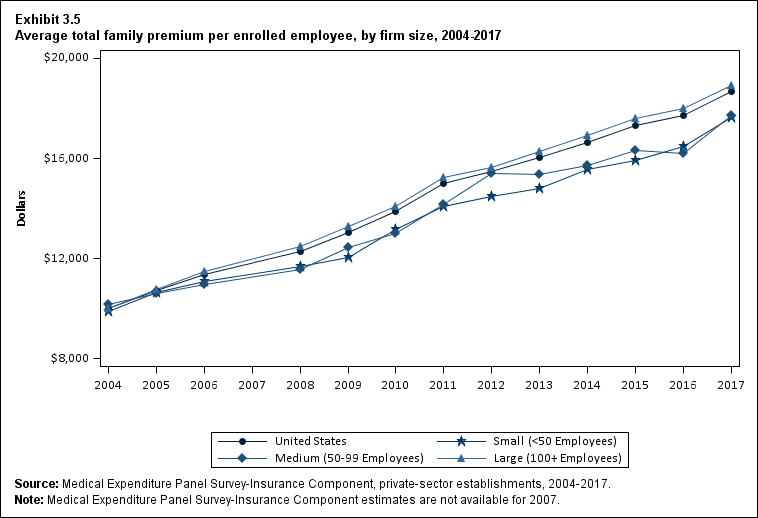

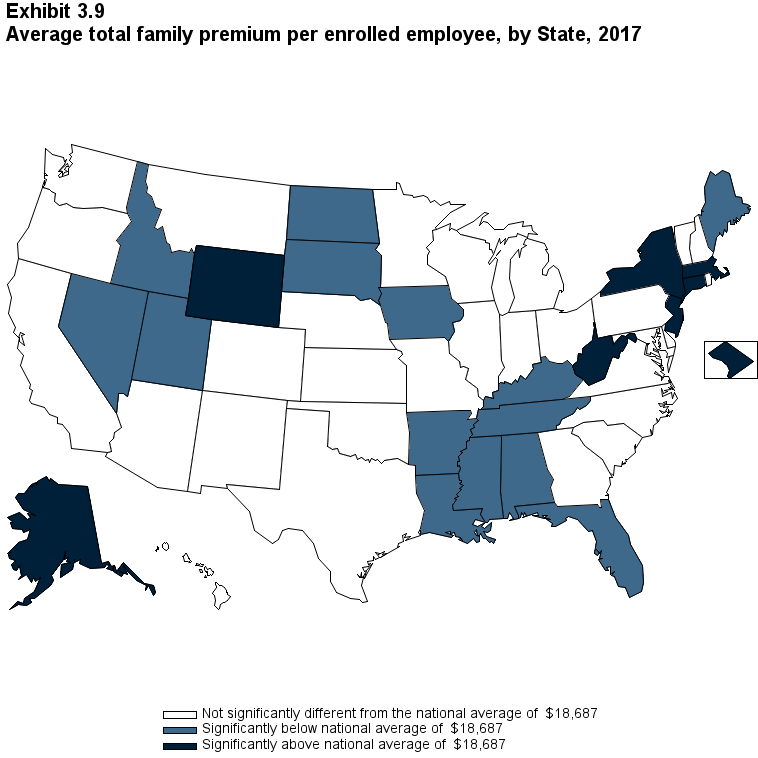

In 2004, there were no statistically significant differences

in average family premiums by firm size. However, from 2004 to 2017, family

premiums grew faster at large firms than at smaller firms (88.8 percent in

firms with 100 or more employees vs. 74.3 percent in firms with 50 to 99

employees and 78.3 percent in firms with fewer than 50 employees). Thus, by

2017, family premiums in the largest firms ($18,911) were about 7 percent

higher than in firms with 50 to 99 employees ($17,735) and firms with fewer

than 50 employees ($17,649) (Exhibit ES.12).

Exhibit ES.12 Average total family premium (standard error) per enrolled employee, by firm size, 2004-2017

| Number of Employees |

2004 |

2005 |

2006 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

| U.S. |

$10,006 |

$10,728 |

$11,381 |

$12,298 |

$13,027 |

$13,871 |

$15,022 |

$15,473 |

$16,029 |

$16,655 |

$17,322 |

$17,710 |

$18,687 |

| (Standard Error) |

($28) |

($41) |

($32) |

($81) |

($25) |

($75) |

($98) |

($95) |

($61) |

($79) |

($95) |

($84) |

($105) |

| <50 |

$9,898 |

$10,632 |

$11,095 |

$11,679 |

$12,041 |

$13,170 |

$14,086 |

$14,496 |

$14,787 |

$15,575 |

$15,919 |

$16,471 |

$17,649 |

| (Standard Error) |

($106) |

($106) |

($116) |

($182) |

($129) |

($111) |

($145) |

($181) |

($89) |

($177) |

($212) |

($207) |

($192) |

| 50-99 |

$10,172 |

$10,619 |

$10,954 |

$11,578 |

$12,431 |

$13,019 |

$14,151 |

$15,421 |

$15,376 |

$15,732 |

$16,336 |

$16,214 |

$17,735 |

| (Standard Error) |

($190) |

($208) |

($301) |

($128) |

($229) |

($153) |

($168) |

($273) |

($268) |

($274) |

($335) |

($348) |

($327) |

| 100+ |

$10,019 |

$10,754 |

$11,471 |

$12,468 |

$13,271 |

$14,074 |

$15,245 |

$15,641 |

$16,284 |

$16,903 |

$17,612 |

$18,000 |

$18,911 |

| (Standard Error) |

($50) |

($55) |

($51) |

($95) |

($33) |

($85) |

($117) |

($114) |

($82) |

($91) |

($110) |

($95) |

($122) |

|

Source: Medical Expenditure Panel Survey-Insurance Component, private-sector establishments, 2004-2017.

Note: Medical Expenditure Panel Survey-Insurance Component estimates are not available for 2007.

|

Return to Table of Contents

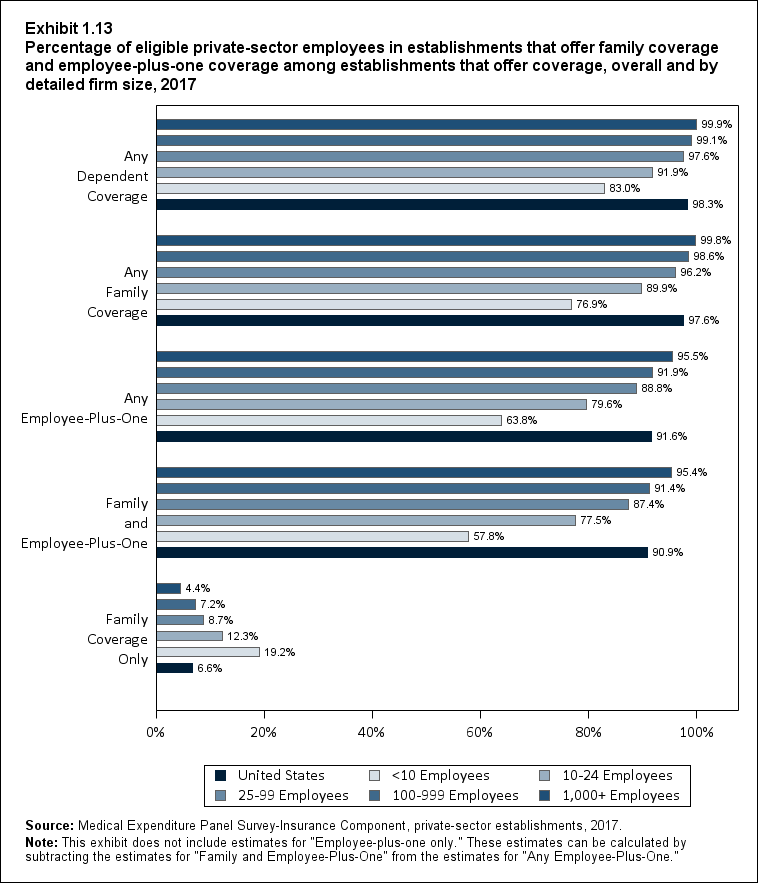

One factor that may partially explain higher family premiums

in larger firms is they are much more likely to offer employee-plus-one

coverage than smaller firms (e.g., 95.5 percent of employees in firms with

1,000 or more employees have offers of employee-plus-one coverage compared with

63.8 percent of employees in firms with fewer than 10 employees) (Section 1, Exhibit

1.13). Thus, at large firms, two-person families are less likely to be included

in the risk pool for family policies, and average family premiums would tend to

be higher than they would have been if two-person families were in the family policy

risk pool along with larger families. At many small firms, on the other hand,

workers seeking coverage for themselves and a single dependent may purchase a

family policy if no employee-plus-one coverage is offered, which would tend to

make the average family policy premium lower in those firms.

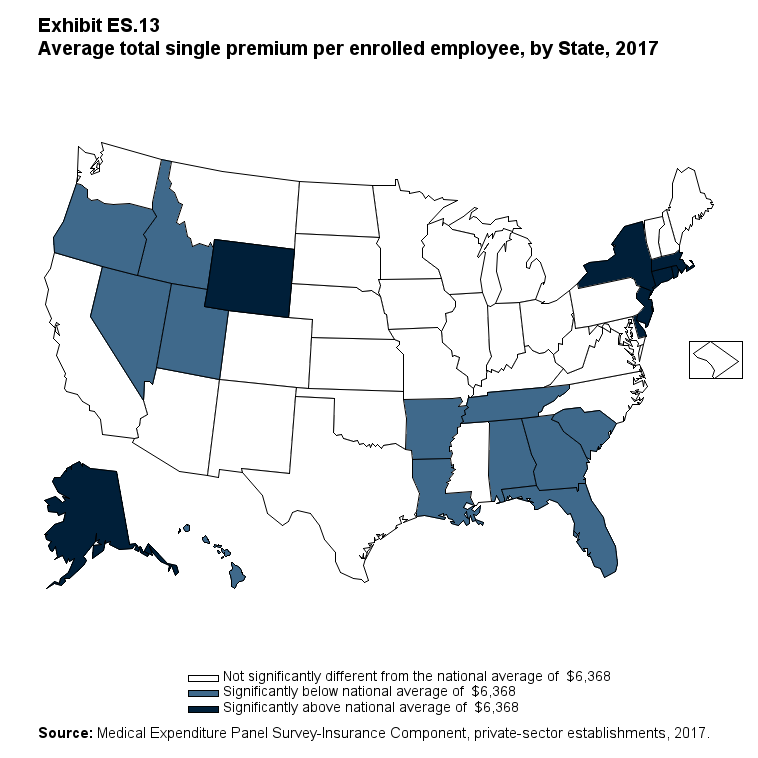

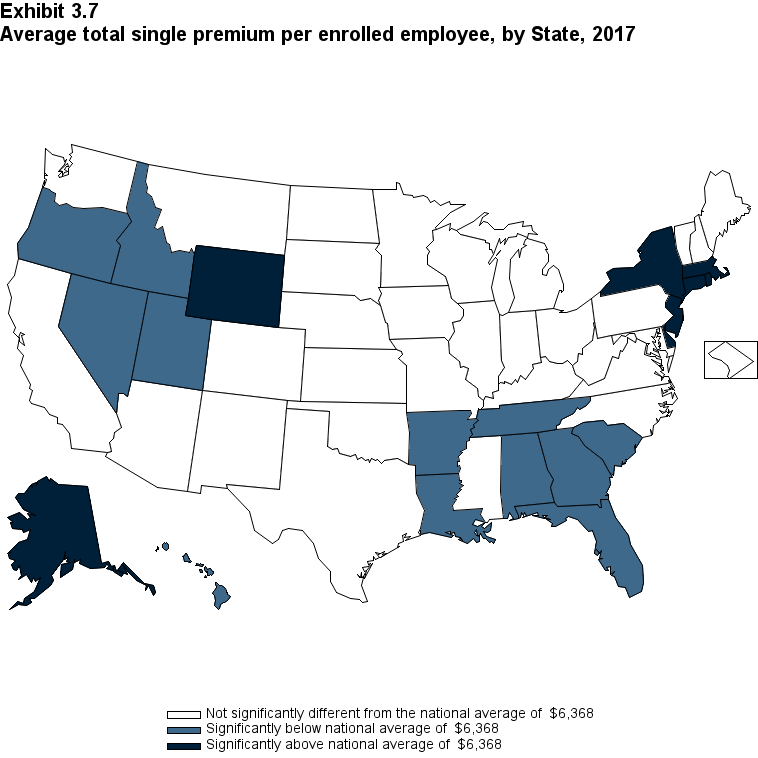

In total, 12 States had average annual premiums for single

coverage that were significantly lower than the national average of $6,368. These

States were Alabama, Arkansas, Florida, Georgia, Hawaii, Idaho, Louisiana,

Nevada, Oregon, South Carolina, Tennessee, and Utah. Another 8 States had

average annual single premiums that were significantly higher than the national

average. These States were Alaska, Connecticut, Delaware, Massachusetts, New

Jersey, New York, Rhode Island, and Wyoming (Exhibit ES.13).

Exhibit ES.13 Average total single premium (standard error) per enrolled employee, by State, 2017

| Alabama |

$6,075* |

Kentucky |

$6,101 |

North Dakota |

$6,341 |

| (Standard Error) |

($129) |

(Standard Error) |

($160) |

(Standard Error) |

($99) |

| Alaska |

$7,964* |

Louisiana |

$6,026* |

Ohio |

$6,247 |

| (Standard Error) |

($202) |

(Standard Error) |

($155) |

(Standard Error) |

($120) |

| Arizona |

$6,217 |

Maine |

$6,132 |

Oklahoma |

$6,236 |

| (Standard Error) |

($215) |

(Standard Error) |

($152) |

(Standard Error) |

($142) |

| Arkansas |

$5,722* |

Maryland |

$6,577 |

Oregon |

$6,081* |

| (Standard Error) |

($142) |

(Standard Error) |

($185) |

(Standard Error) |

($114) |

| California |

$6,295 |

Massachusetts |

$7,031* |

Pennsylvania |

$6,522 |

| (Standard Error) |

($116) |

(Standard Error) |

($131) |

(Standard Error) |

($107) |

| Colorado |

$6,456 |

Michigan |

$6,388 |

Rhode Island |

$7,048* |

| (Standard Error) |

($145) |

(Standard Error) |

($143) |

(Standard Error) |

($128) |

| Connecticut |

$7,012* |

Minnesota |

$6,268 |

South Carolina |

$6,079* |

| (Standard Error) |

($154) |

(Standard Error) |

($131) |

(Standard Error) |

($135) |

| Delaware |

$7,046* |

Mississippi |

$5,878 |

South Dakota |

$6,533 |

| (Standard Error) |

($214) |

(Standard Error) |

($257) |

(Standard Error) |

($136) |

| District of Columbia |

$6,704 |

Missouri |

$6,354 |

Tennessee |

$6,006* |

| (Standard Error) |

($195) |

(Standard Error) |

($172) |

(Standard Error) |

($138) |

| Florida |

$6,068* |

Montana |

$6,763 |

Texas |

$6,202 |

| (Standard Error) |

($117) |

(Standard Error) |

($228) |

(Standard Error) |

($108) |

| Georgia |

$5,849* |

Nebraska |

$6,305 |

Utah |

$5,568* |

| (Standard Error) |

($137) |

(Standard Error) |

($147) |

(Standard Error) |

($176) |

| Hawaii |

$6,039* |

Nevada |

$5,756* |

Vermont |

$6,551 |

| (Standard Error) |

($128) |

(Standard Error) |

($179) |

(Standard Error) |

($205) |

| Idaho |

$5,858* |

New Hampshire |

$6,670 |

Virginia |

$6,299 |

| (Standard Error) |

($155) |

(Standard Error) |

($184) |

(Standard Error) |

($124) |

| Illinois |

$6,493 |

New Jersey |

$7,074* |

Washington |

$6,495 |

| (Standard Error) |

($156) |

(Standard Error) |

($195) |

(Standard Error) |

($173) |

| Indiana |

$6,162 |

New Mexico |

$6,275 |

West Virginia |

$6,574 |

| (Standard Error) |

($138) |

(Standard Error) |

($160) |

(Standard Error) |

($200) |

| Iowa |

$6,128 |

New York |

$7,309* |

Wisconsin |

$6,437 |

| (Standard Error) |

($129) |

(Standard Error) |

($184) |

(Standard Error) |

($147) |

| Kansas |

$6,107 |

North Carolina |

$6,348 |

Wyoming |

$7,257* |

| (Standard Error) |

($131) |

(Standard Error) |

($125) |

(Standard Error) |

($190) |

|

Source: Medical Expenditure Panel Survey-Insurance Component, private-sector establishments, 2017.

Note: * Statistically different from national average of $6,368 at p < 0.05. Note that the standard error on the national estimate of $6,368 is $28.26.

|

Return to Table of Contents

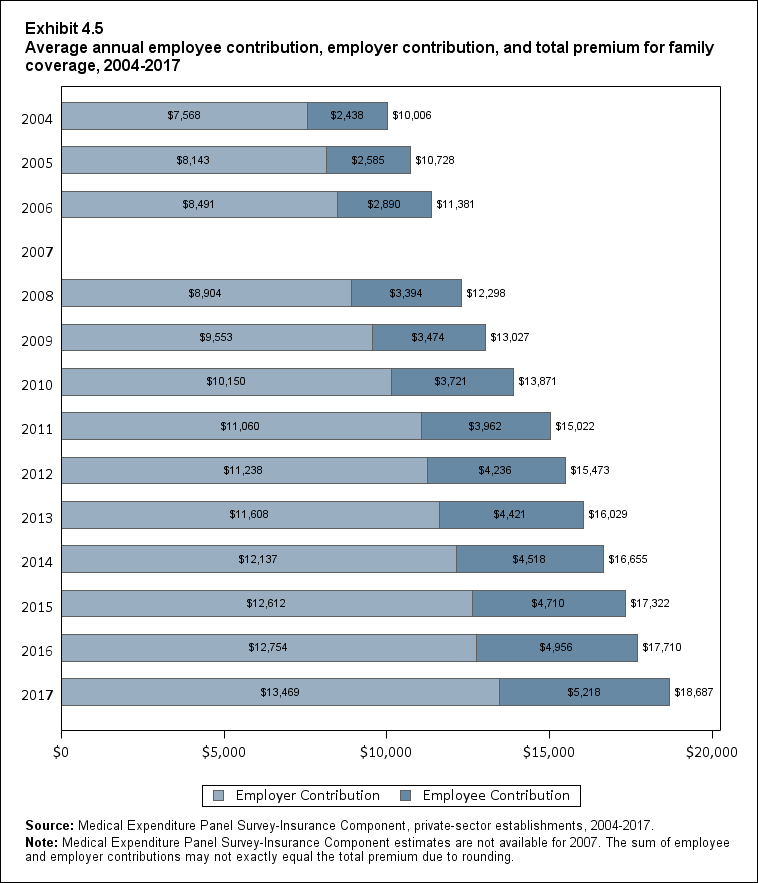

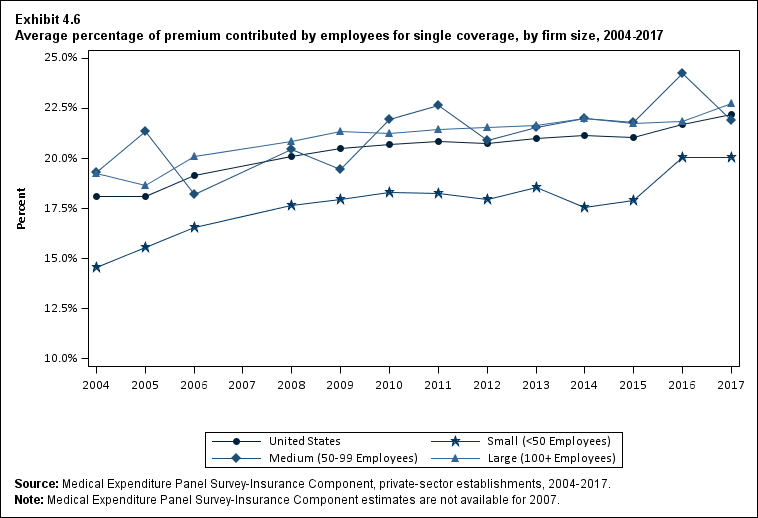

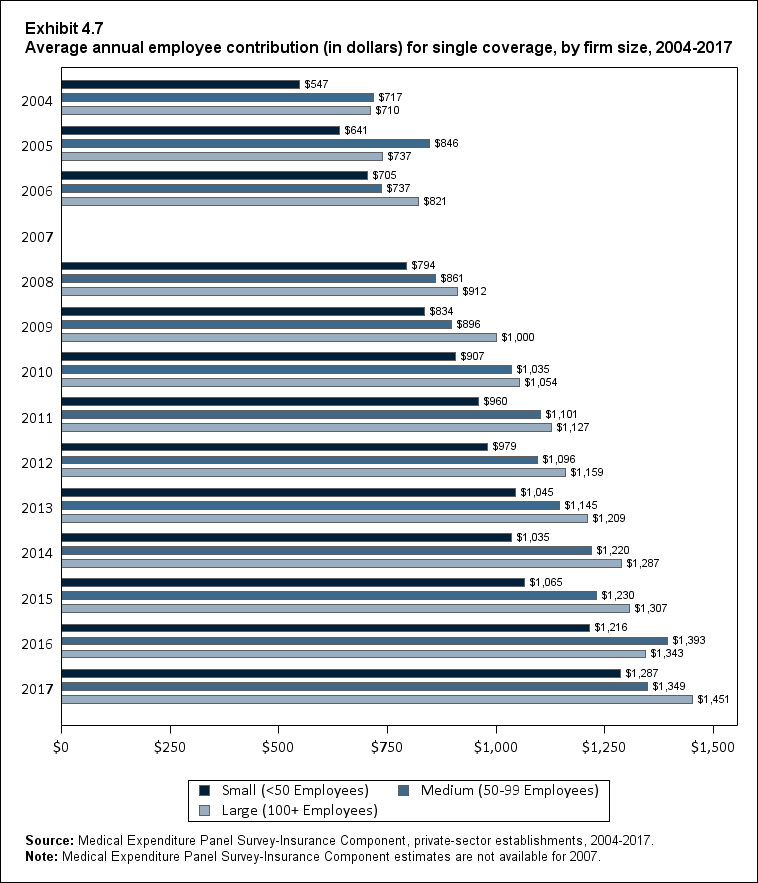

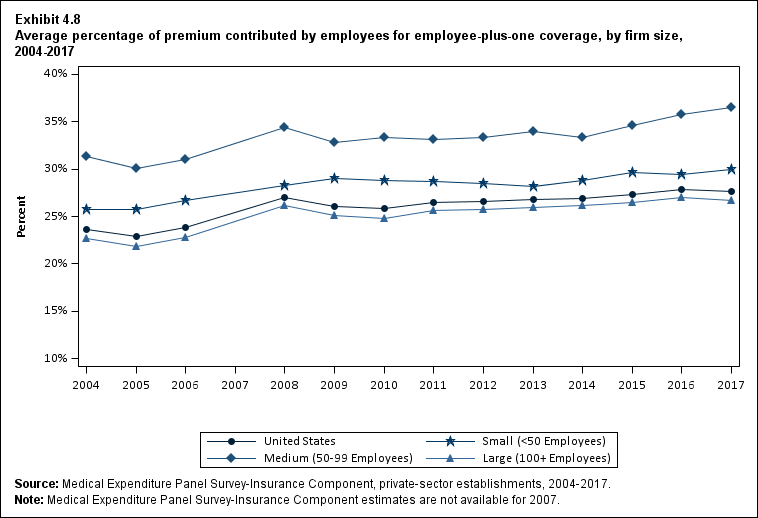

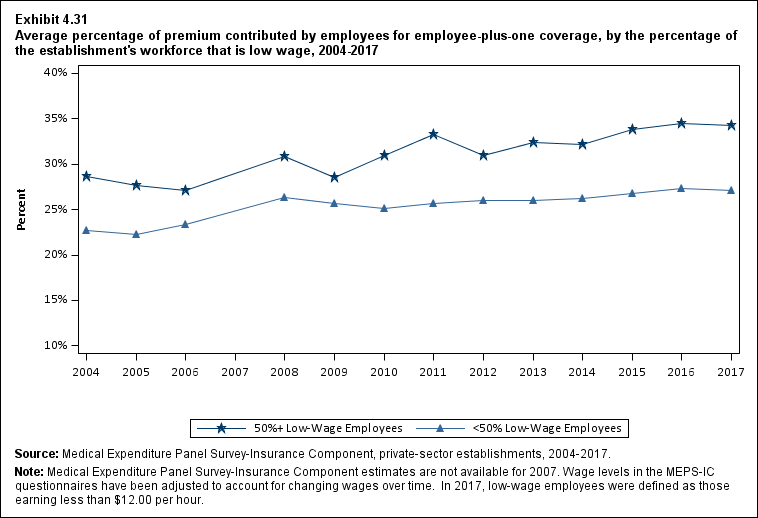

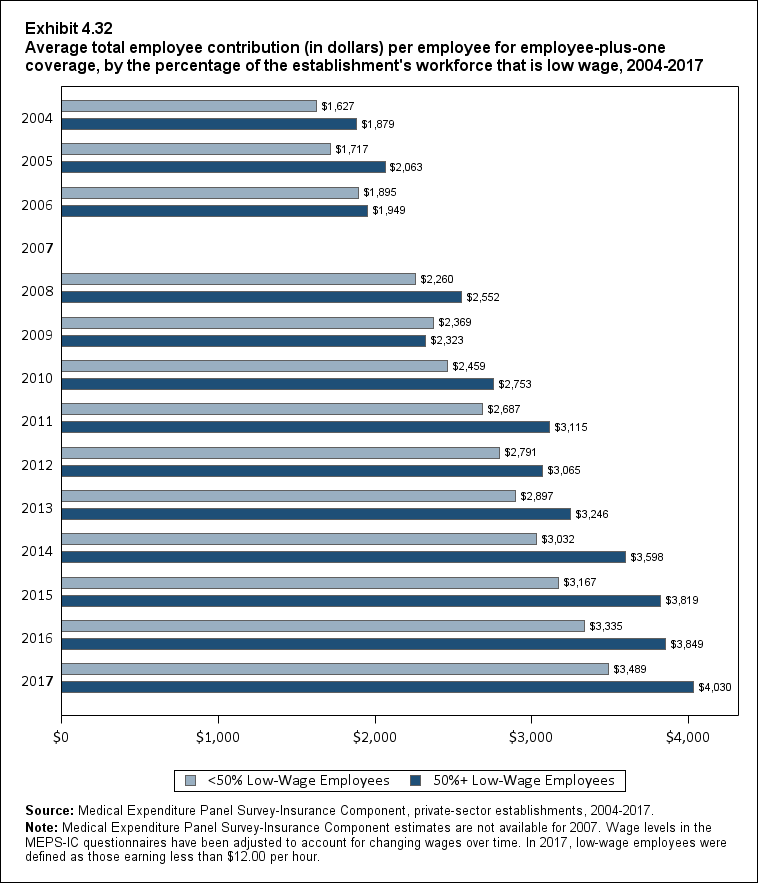

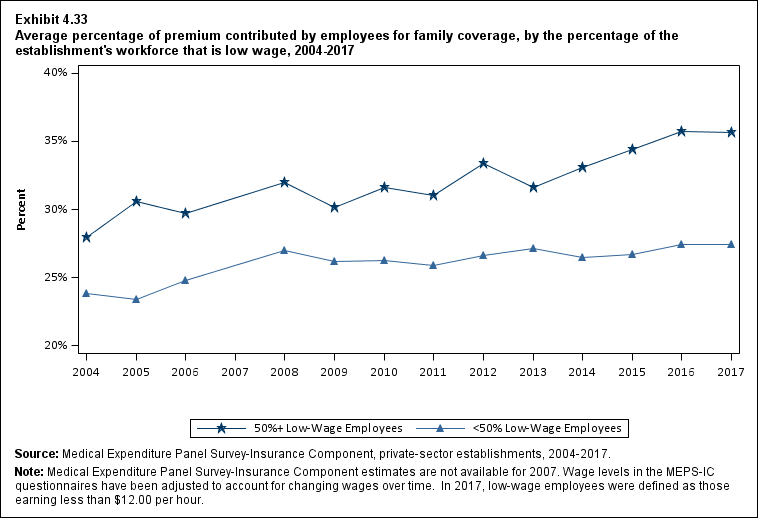

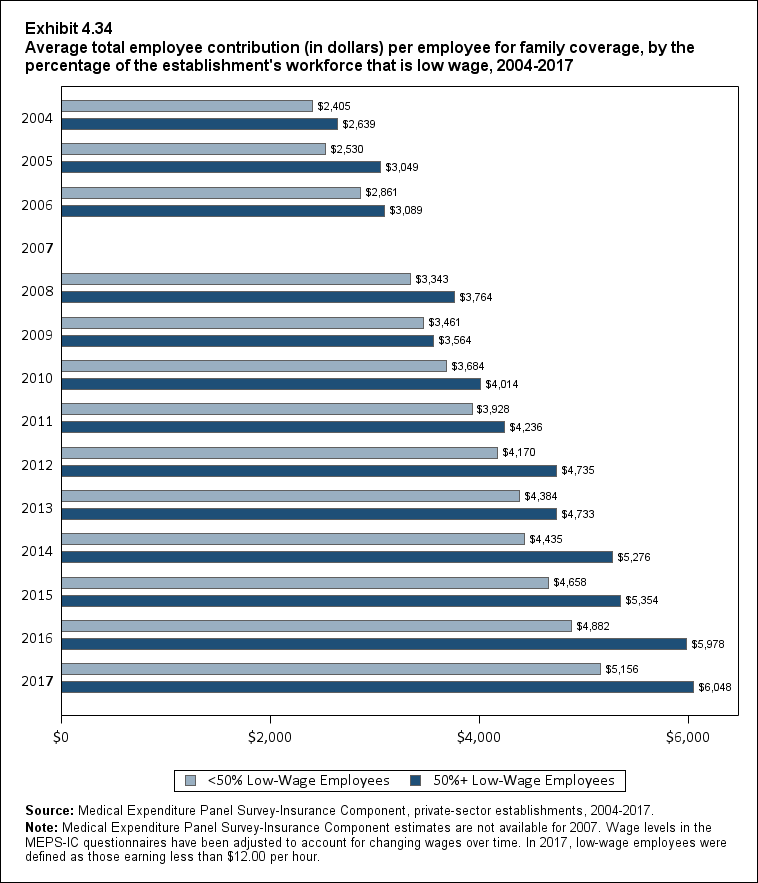

Employee Premium Contributions

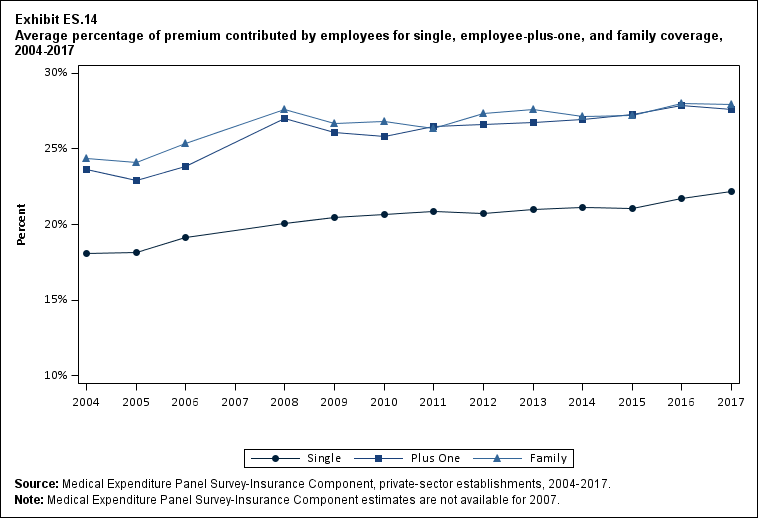

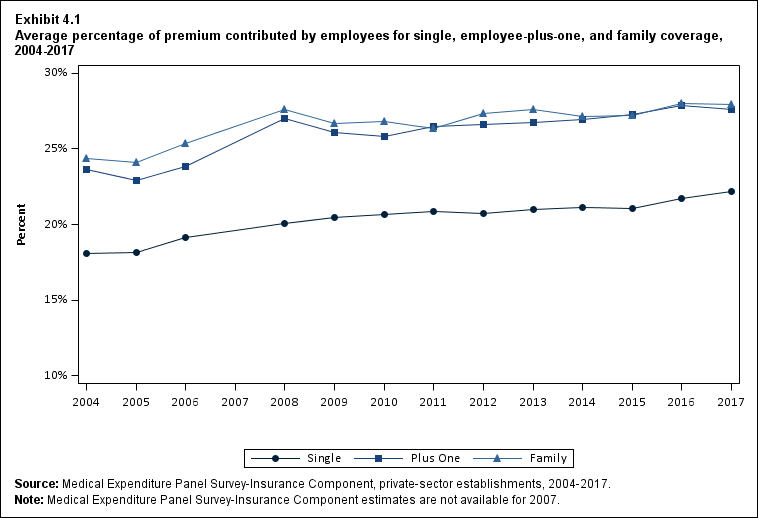

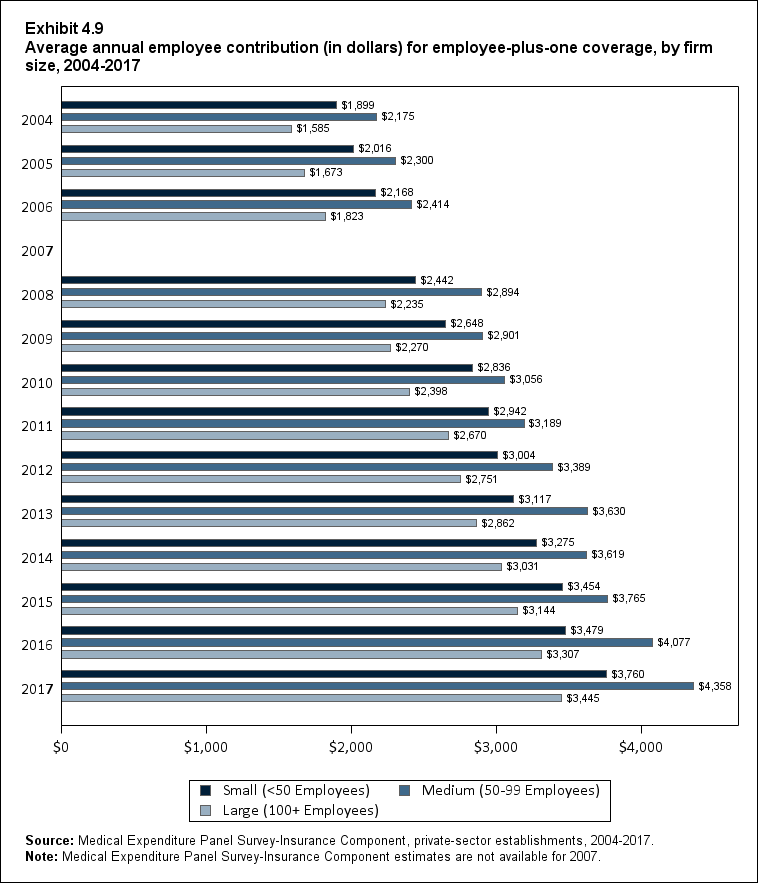

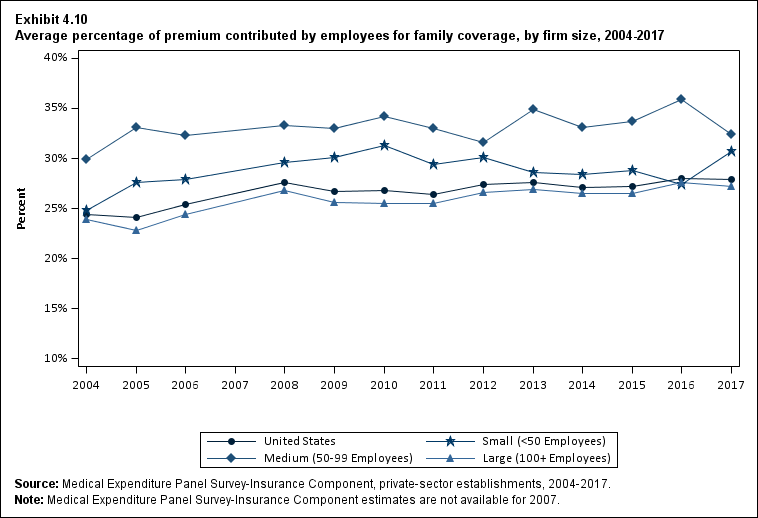

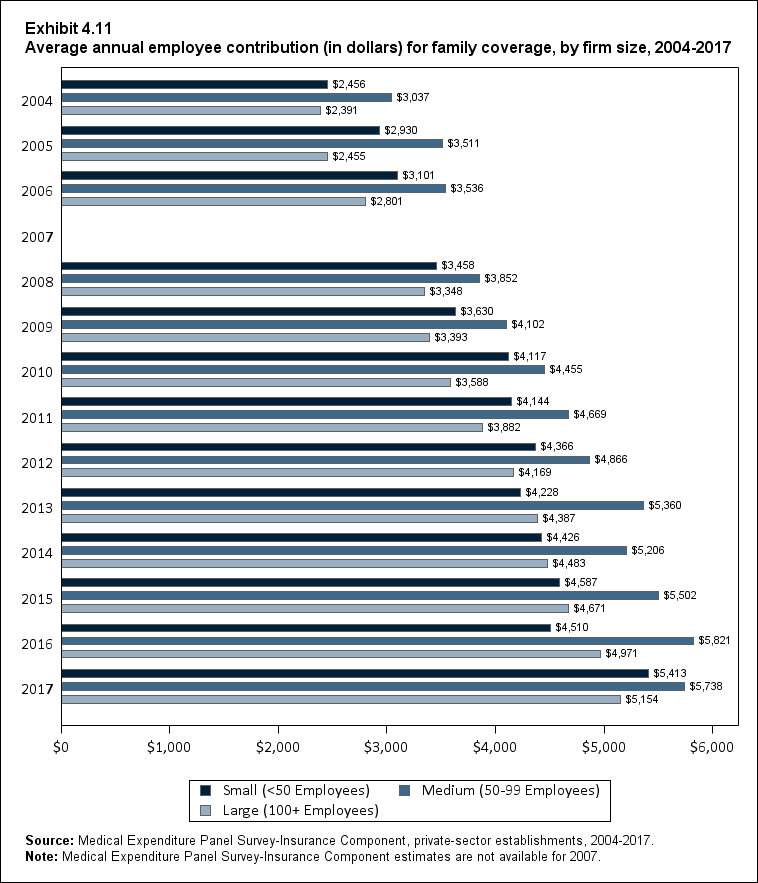

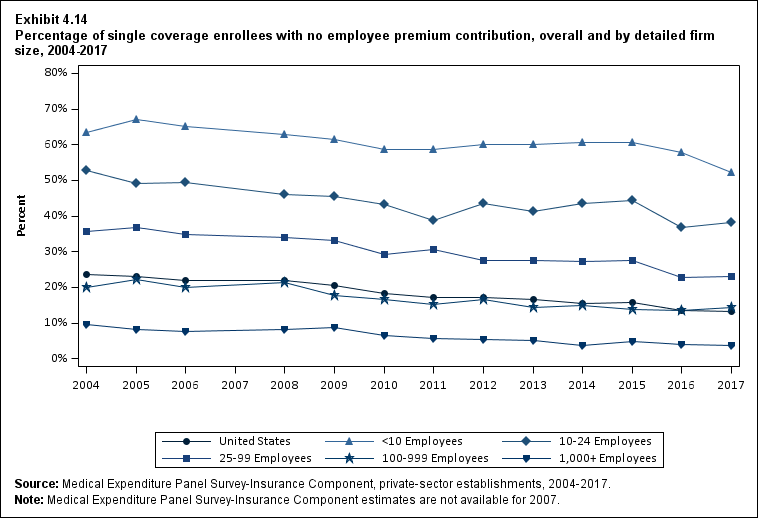

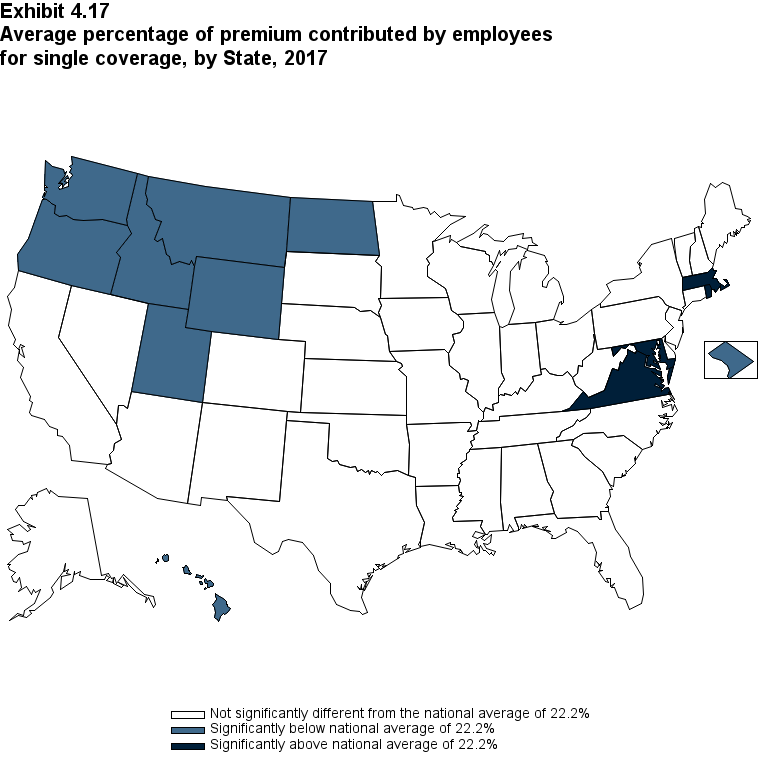

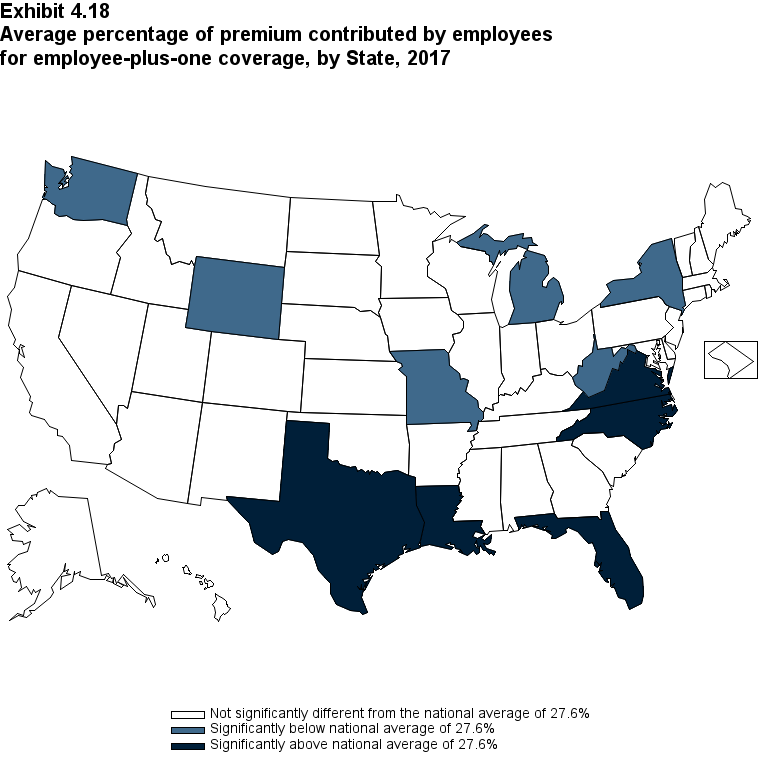

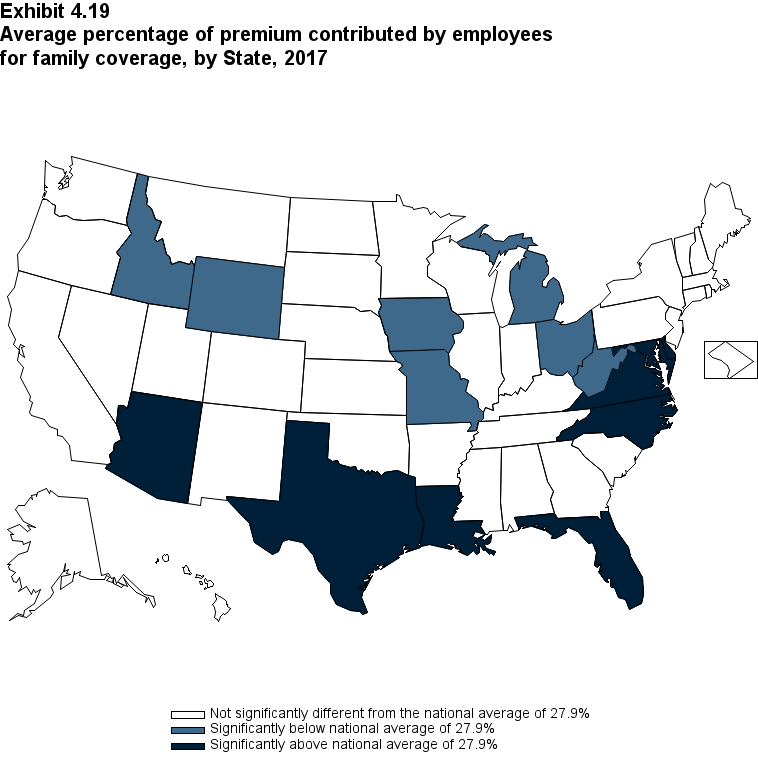

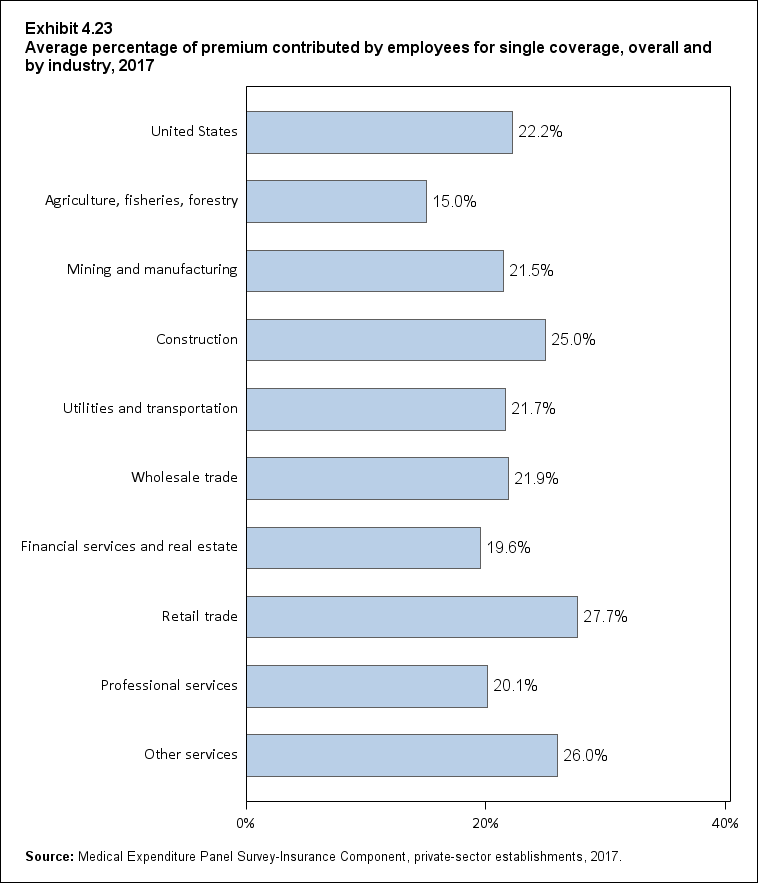

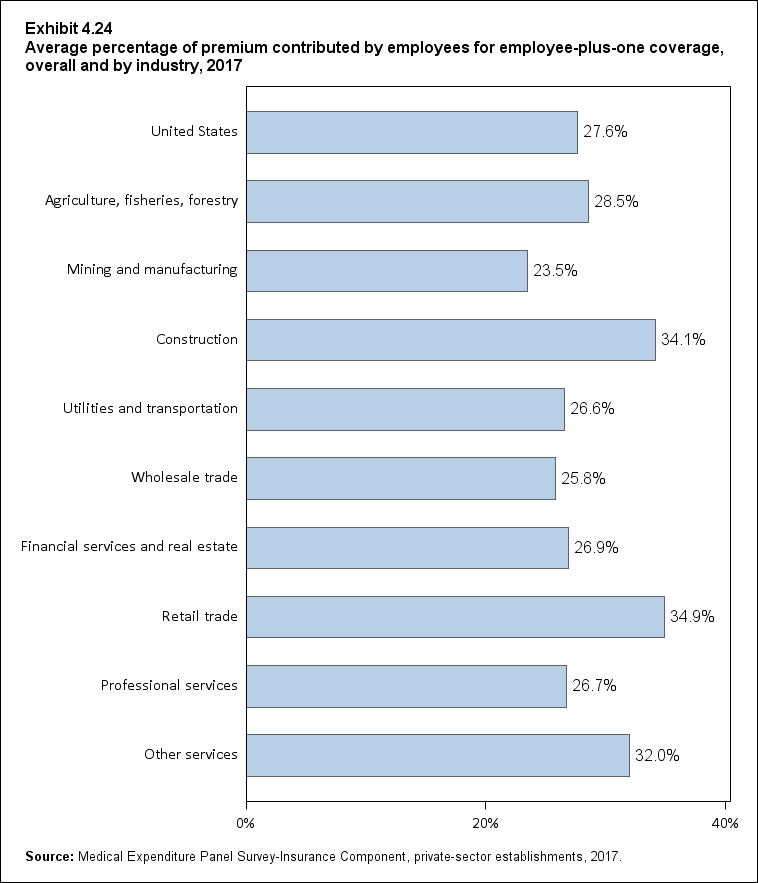

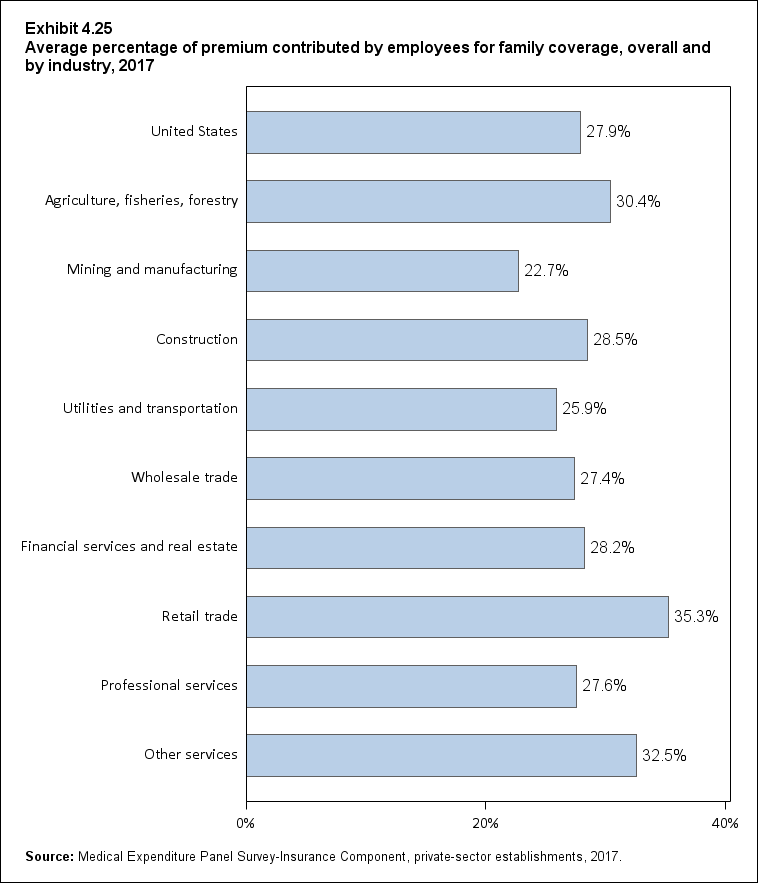

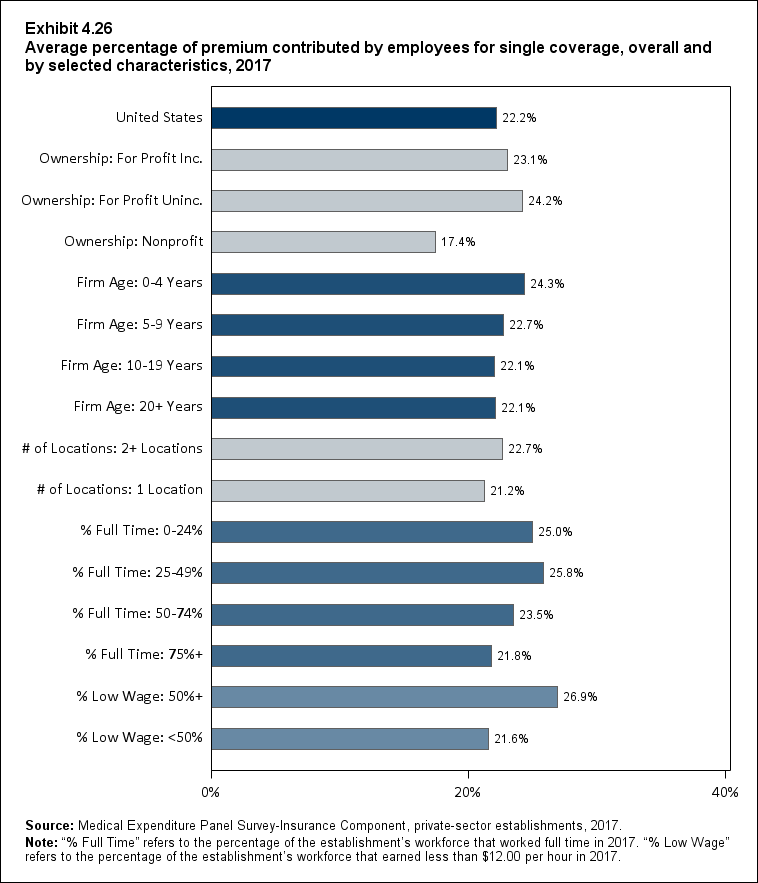

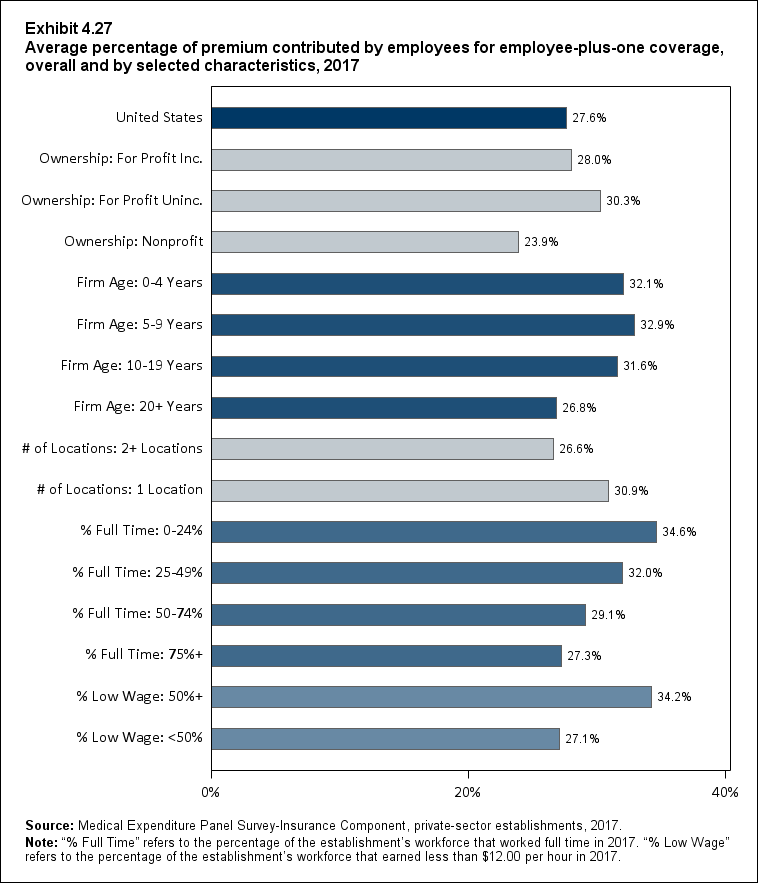

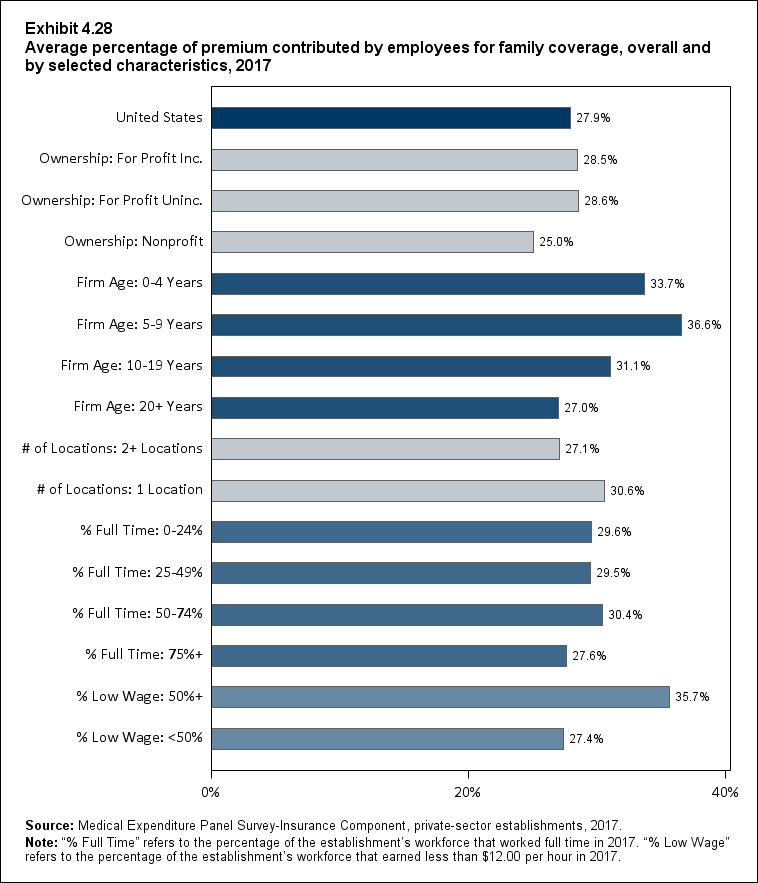

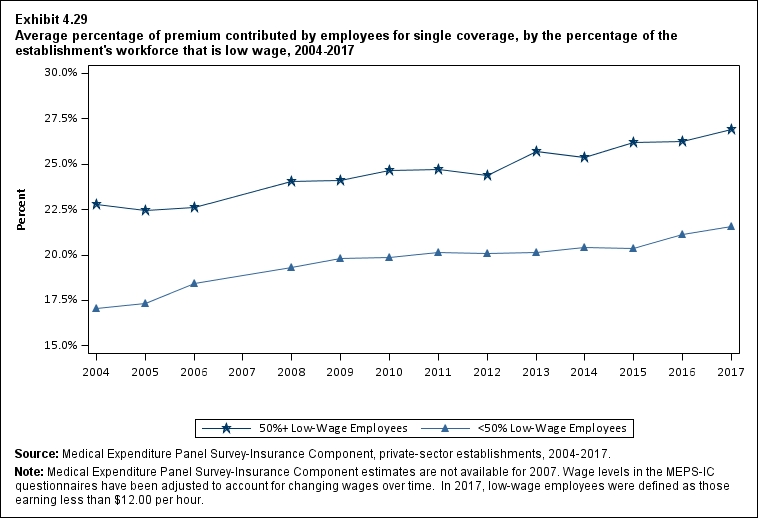

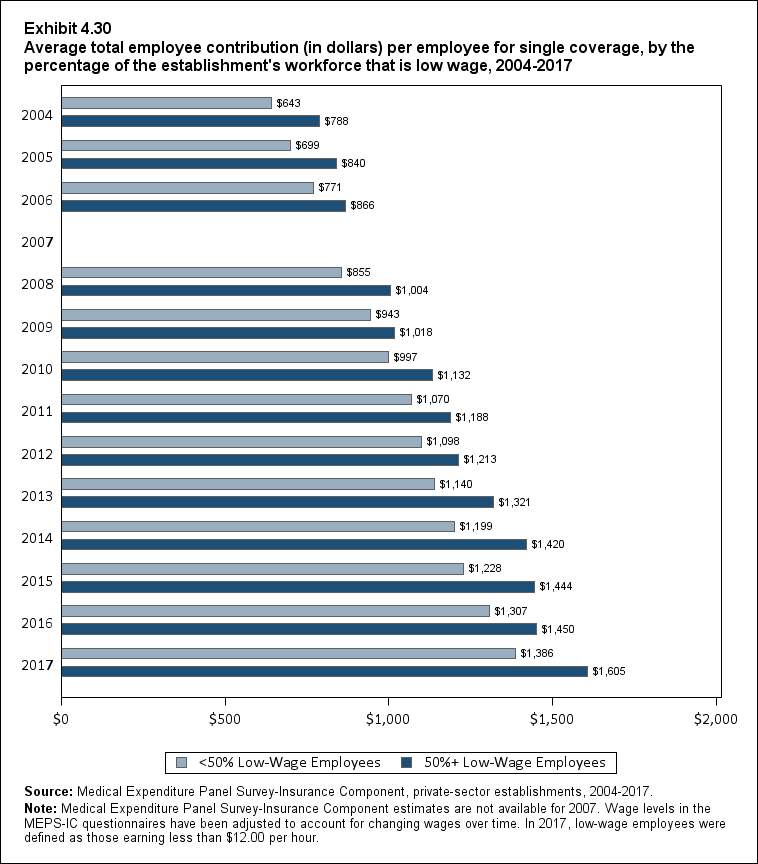

In 2017, enrolled employees paid 22.2 percent of total

premiums for single coverage, 27.6 percent for employee-plus-one coverage, and

27.9 percent for family coverage (Exhibit ES.14). The percentages of premiums

paid by enrolled employees in 2017 for these three coverage types were not

significantly different from their 2016 levels.

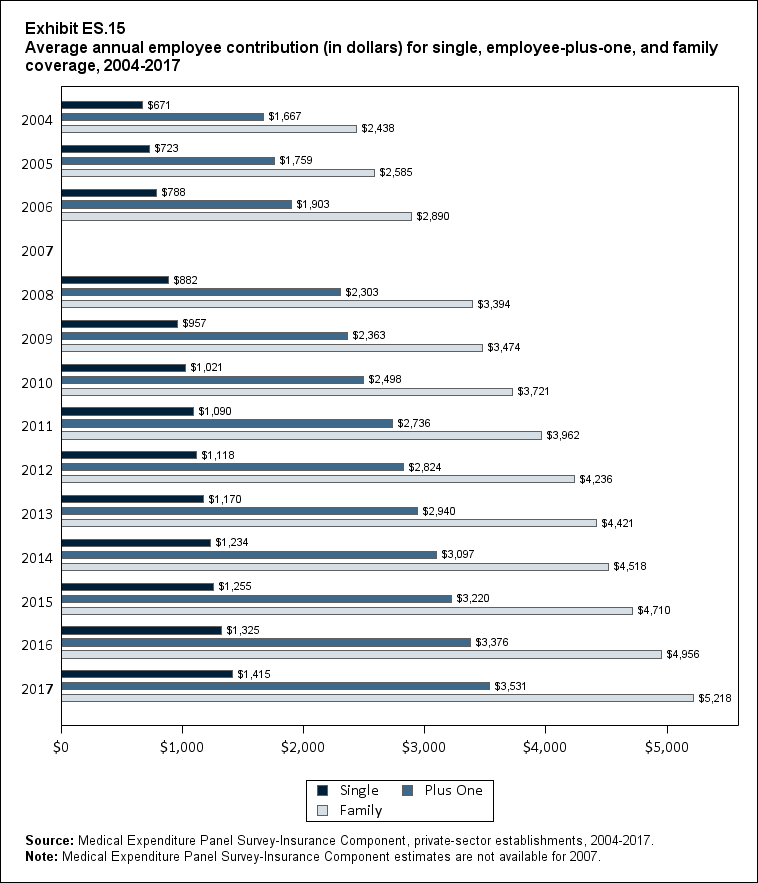

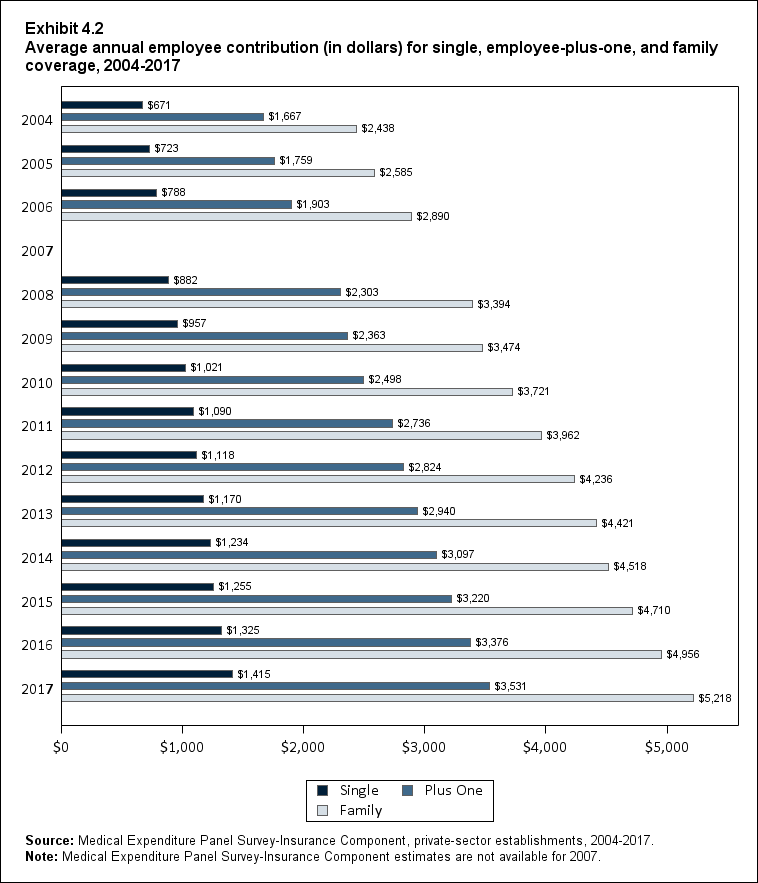

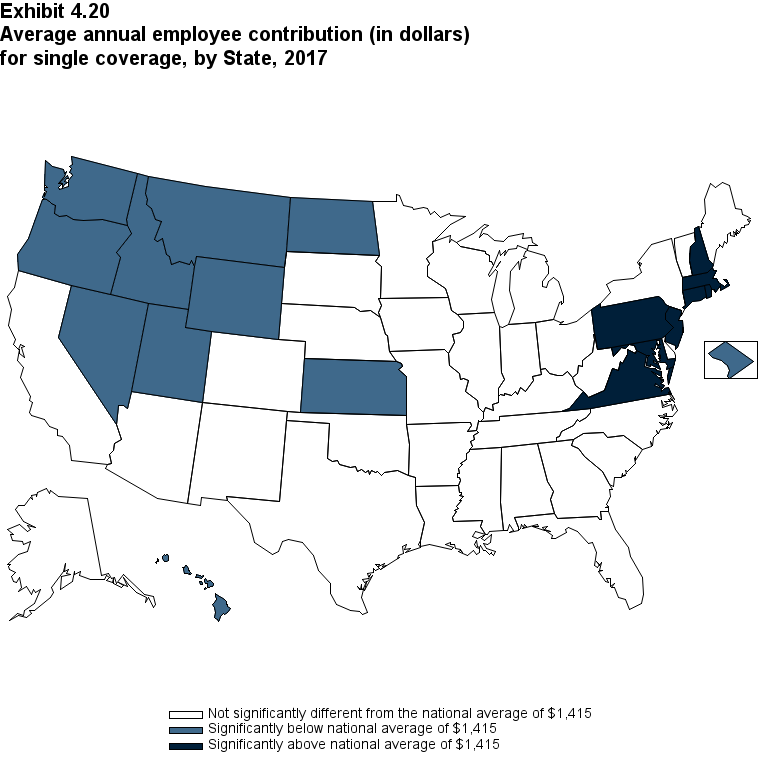

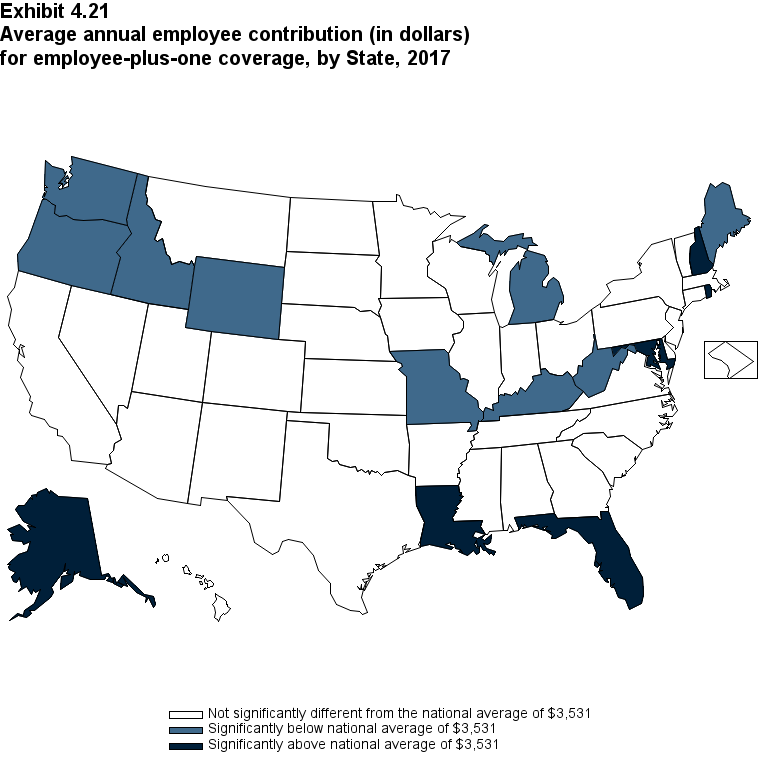

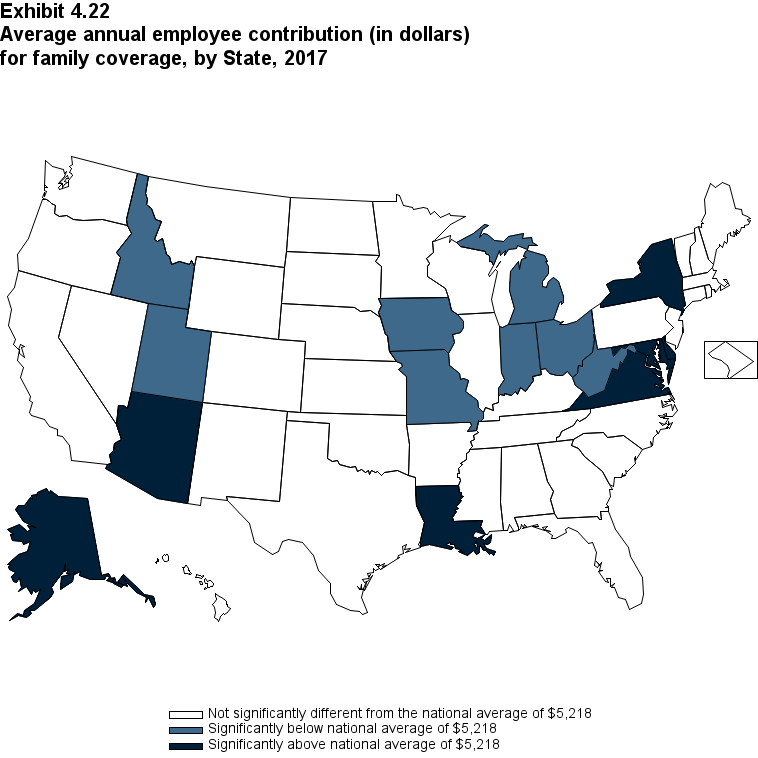

Average employee contributions in 2017 were $1,415 for

single coverage, $3,531 for employee-plus-one coverage, and $5,218 for family

coverage, representing increases of 6.8 percent, 4.6 percent, and 5.3 percent,

respectively, over 2016 levels. (Exhibit ES.15).

From 2004 to 2017, the percentage

of premiums contributed by employees increased by 4.1 percentage points, 4.0

percentage points, and 3.5 percentage points for single, employee-plus-one, and

family coverage, respectively (Exhibit ES.14). This was because employee

contributions increased more rapidly than employer contributions over the entire

period for each type of coverage (Section 4, Exhibits 4.1, 4.3, 4.4, and 4.5).

Exhibit ES.14 Average percentage (standard error) of premium contributed by employees for single, employee-plus-one, and family coverage, 2004-2017

| Coverage |

2004 |

2005 |

2006 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

| Single |

18.1% |

18.1% |

19.1% |

20.1% |

20.5% |

20.7% |

20.9% |

20.8% |

21.0% |

21.2% |

21.1% |

21.7% |

22.2% |

| (Standard Error) |

(0.2%) |

(0.4%) |

(0.4%) |

(0.2%) |

(0.3%) |

(0.2%) |

(0.2%) |

(0.3%) |

(0.3%) |

(0.2%) |

(0.2%) |

(0.2%) |

(0.2%) |

| Plus One |

23.6% |

22.9% |

23.8% |

27.0% |

26.1% |

25.8% |

26.5% |

26.6% |

26.7% |

26.9% |

27.3% |

27.8% |

27.6% |

| (Standard Error) |

(0.5%) |

(0.4%) |

(0.4%) |

(0.3%) |

(0.3%) |

(0.3%) |

(0.3%) |

(0.4%) |

(0.2%) |

(0.3%) |

(0.3%) |

(0.3%) |

(0.3%) |

| Family |

24.4% |

24.1% |

25.4% |

27.6% |

26.7% |

26.8% |

26.4% |

27.4% |

27.6% |

27.1% |

27.2% |

28.0% |

27.9% |

| (Standard Error) |

(0.4%) |

(0.4%) |

(0.3%) |

(0.4%) |

(0.3%) |

(0.4%) |

(0.3%) |

(0.4%) |

(0.3%) |

(0.3%) |

(0.3%) |

(0.3%) |

(0.4%) |

|

Source: Medical Expenditure Panel Survey-Insurance Component, private-sector establishments, 2004-2017.

Note: Medical Expenditure Panel Survey-Insurance Component estimates are not available for 2007.

|

Return to Table of Contents

Exhibit ES.15 Average annual employee contribution (in dollars) (standard error) for single, employee-plus-one, and family coverage, 2004-2017

| Coverage |

2004 |

2005 |

2006 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

| Single |

$671 |

$723 |

$788 |

$882 |

$957 |

$1,021 |

$1,090 |

$1,118 |

$1,170 |

$1,234 |

$1,255 |

$1,325 |

$1,415 |

| (Standard Error) |

($8) |

($14) |

($16) |

($6) |

($13) |

($14) |

($9) |

($14) |

($16) |

($13) |

($14) |

($13) |

($15) |

| Plus One |

$1,667 |

$1,759 |

$1,903 |

$2,303 |

$2,363 |

$2,498 |

$2,736 |

$2,824 |

$2,940 |

$3,097 |

$3,220 |

$3,376 |

$3,531 |

| (Standard Error) |

($40) |

($29) |

($24) |

($22) |

($27) |

($42) |

($36) |

($46) |

($23) |

($40) |

($35) |

($36) |

($39) |

| Family |

$2,438 |

$2,585 |

$2,890 |

$3,394 |

$3,474 |

$3,721 |

$3,962 |

$4,236 |

$4,421 |

$4,518 |

$4,710 |

$4,956 |

$5,218 |

| (Standard Error) |

($39) |

($38) |

($34) |

($54) |

($44) |

($53) |

($42) |

($69) |

($50) |

($48) |

($56) |

($56) |

($64) |

|

Source: Medical Expenditure Panel Survey-Insurance Component, private-sector establishments, 2004-2017.

Note: Medical Expenditure Panel Survey-Insurance Component estimates are not available for 2007.

|

Return to Table of Contents

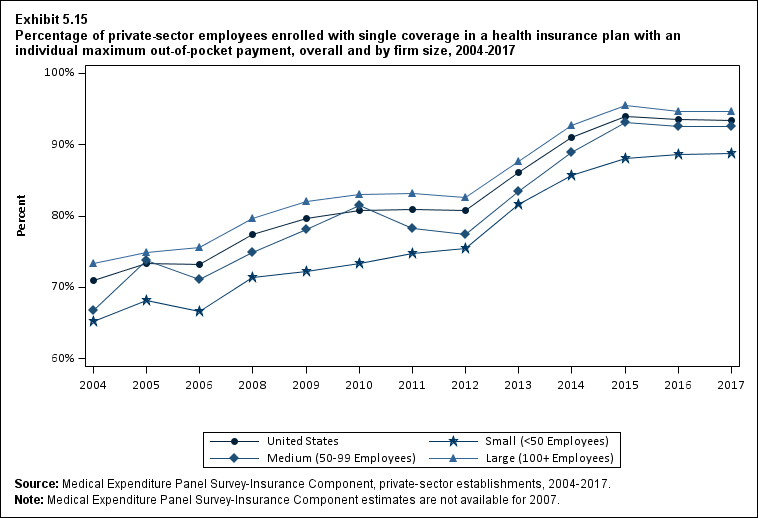

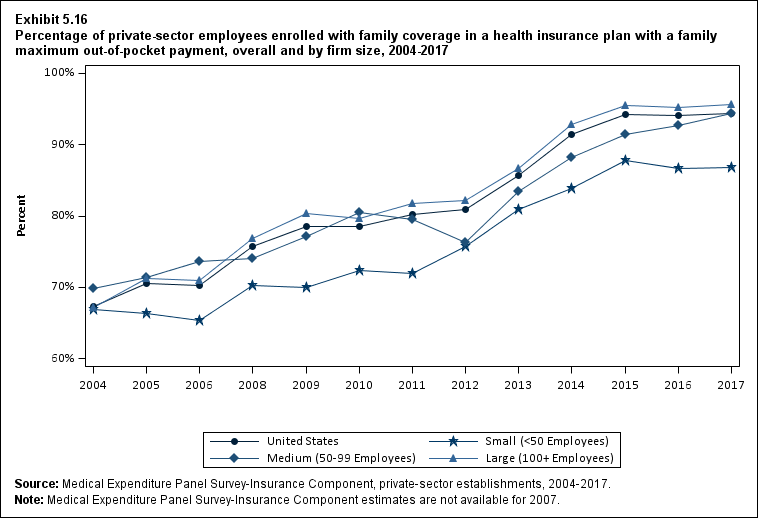

Plan Benefits: Deductibles

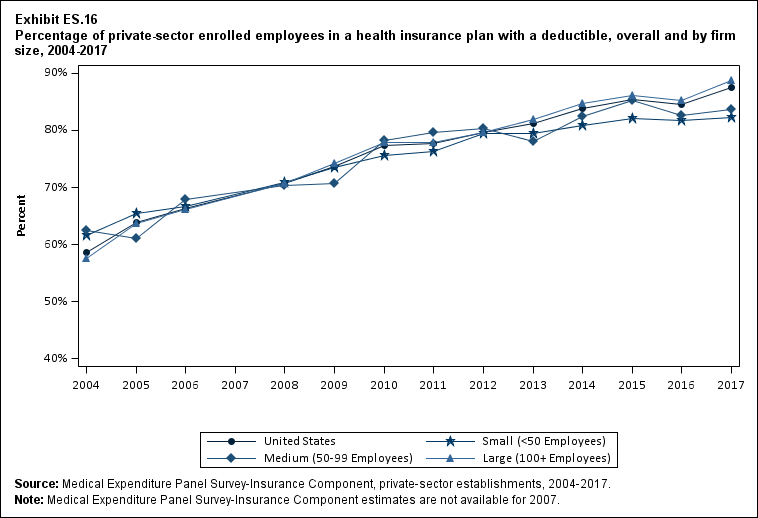

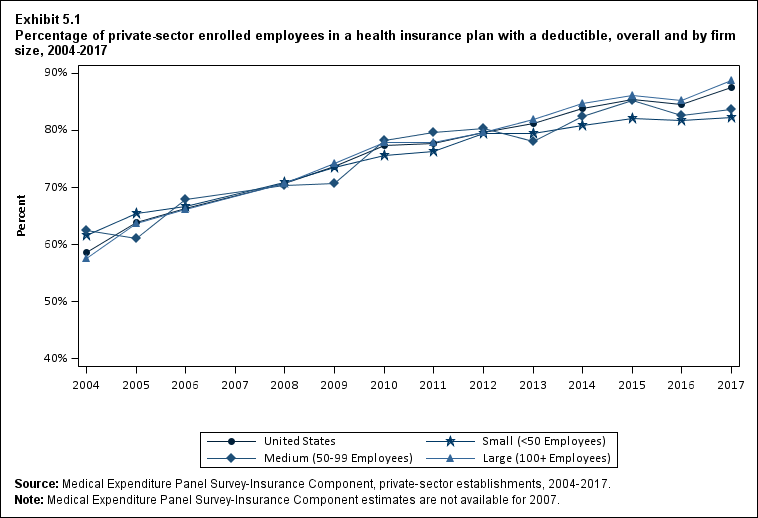

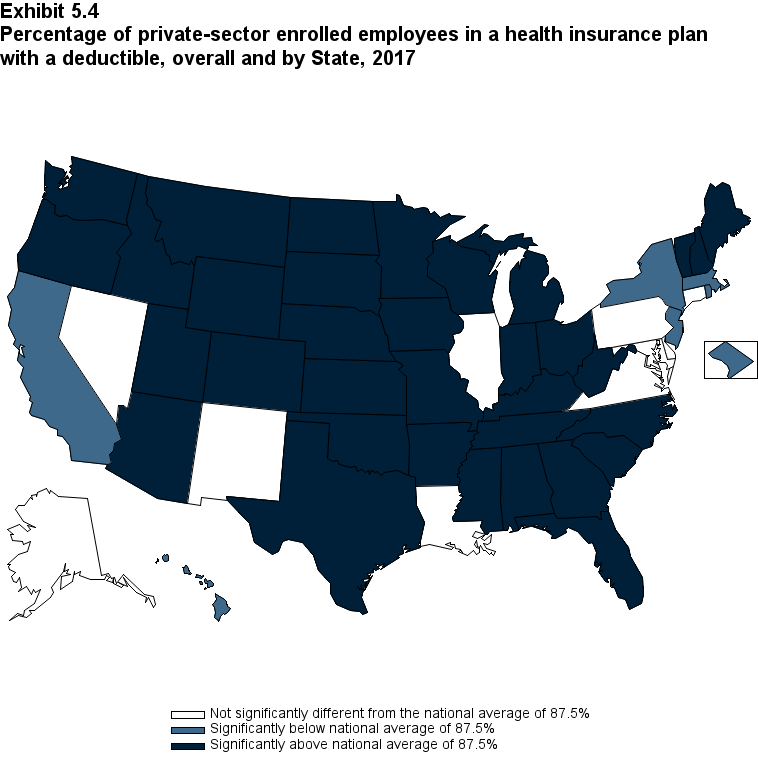

The percentage of enrolled employees in a health insurance

plan with a deductible increased from 2016 (84.5 percent) to 2017 (87.5

percent) (Exhibit ES.16). Except for

2011 and 2016, this percentage increased in every year from 2004 to 2017 (p

<0.10 in 2013). From 2004 to 2017, the percentage of enrollees in plans with

deductibles increased from 58.7 percent to 87.5

percent.

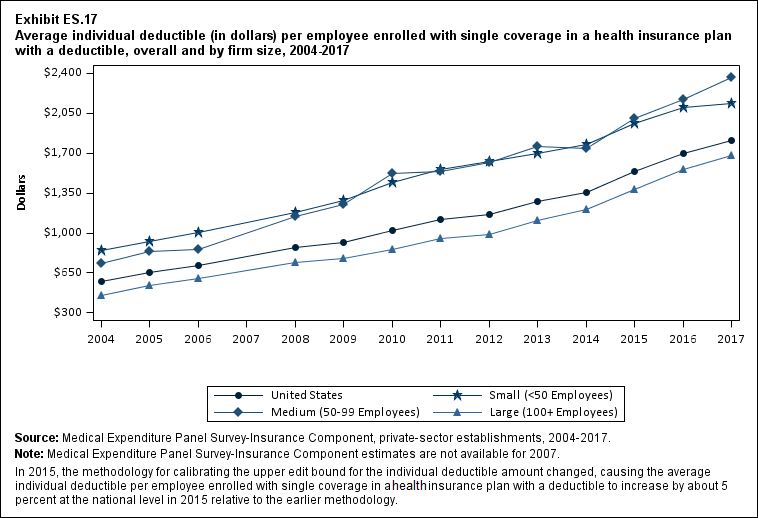

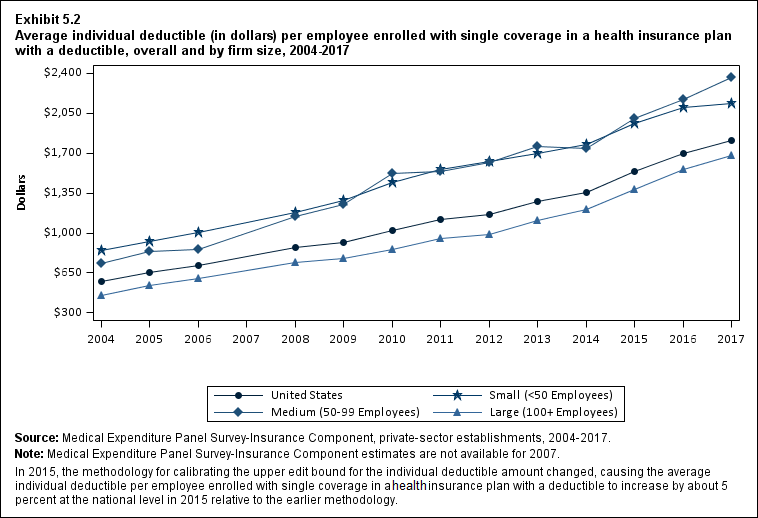

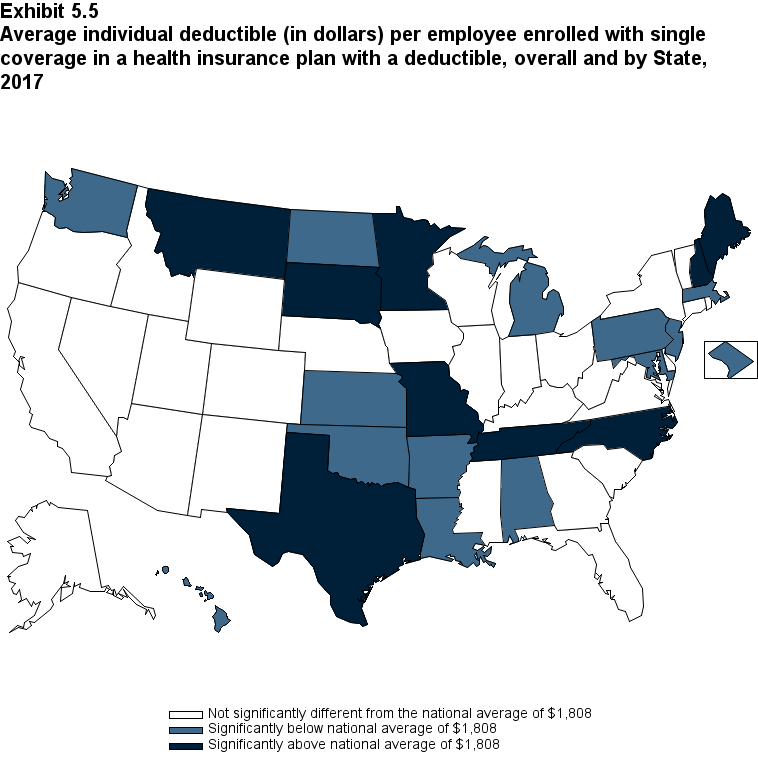

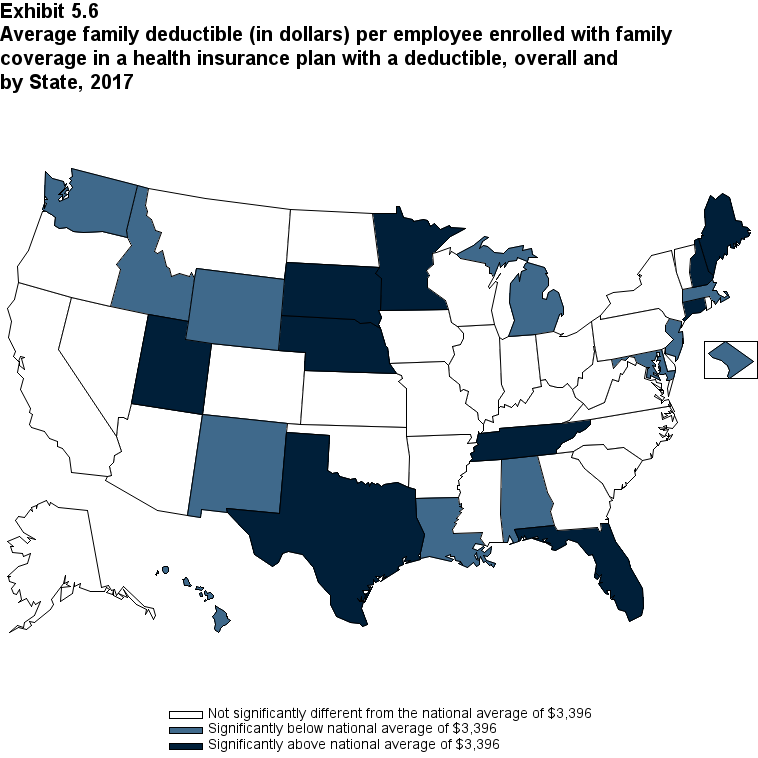

Among enrollees with deductibles, the average individual

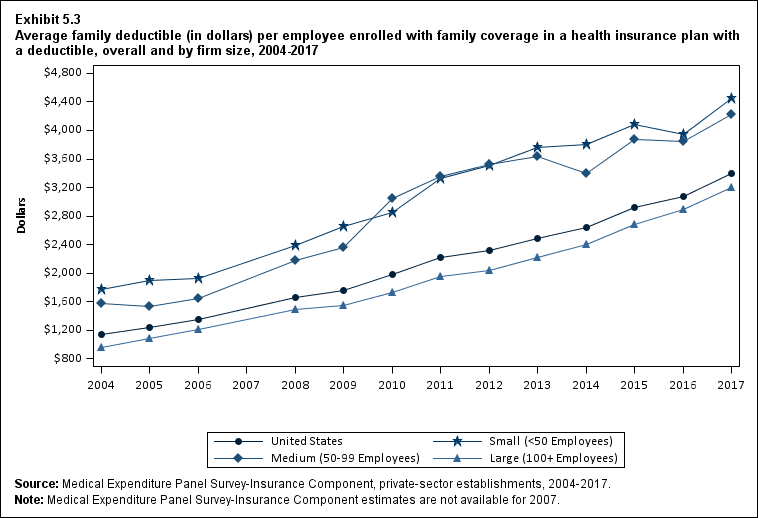

deductible increased from $1,696 in 2016 to $1,808 in 2017 (Figure ES.17). The average family deductible

increased from $3,069 in 2016 to $3,396 in 2017(Section 5, Exhibit 5.3).

Average individual deductibles were higher in small ($2,136) and medium firms

($2,361) than in large firms ($1,681) in 2017. Family deductibles were also

higher in small ($4,447) and medium firms ($4,218) than in large firms ($3,195) in 2017.

Exhibit ES.16 Percentage (standard error) of private-sector enrolled employees in a health insurance plan with a deductible, overall and by firm size, 2004-2017

| Number of Employees |

2004 |

2005 |

2006 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

| U.S. |

58.7% |

63.9% |

66.4% |

70.7% |

73.8% |

77.5% |

77.8% |

79.6% |

81.3% |

83.9% |

85.4% |

84.5% |

87.5% |

| (Standard Error) |

(0.8%) |

(0.9%) |

(0.6%) |

(0.5%) |

(0.5%) |

(0.3%) |

(0.7%) |

(0.6%) |

(0.7%) |

(0.5%) |

(0.5%) |

(0.5%) |

(0.4%) |

| <50 |

61.6% |

65.5% |

66.6% |

70.9% |

73.5% |

75.7% |

76.3% |

79.5% |

79.5% |

80.8% |

82.1% |

81.7% |

82.3% |

| (Standard Error) |

(0.7%) |

(1.0%) |

(0.7%) |

(0.7%) |

(0.7%) |

(0.7%) |

(0.4%) |

(1.0%) |

(0.8%) |

(0.8%) |

(0.8%) |

(0.8%) |

(0.8%) |

| <50 |

62.5% |

61.1% |

67.9% |

70.3% |

70.6% |

78.2% |

79.6% |

80.3% |

78.0% |

82.4% |

85.3% |

82.5% |

83.7% |

| (Standard Error) |

(2.1%) |

(2.6%) |

(2.6%) |

(1.4%) |

(1.9%) |

(1.5%) |

(1.7%) |

(1.4%) |

(1.1%) |

(1.5%) |

(1.5%) |

(1.5%) |

(1.6%) |

| 100+ |

57.6% |

63.8% |

66.2% |

70.7% |

74.2% |

77.8% |

77.9% |

79.6% |

81.9% |

84.6% |

86.1% |

85.2% |

88.8% |

| (Standard Error) |

(1.0%) |

(1.0%) |

(0.8%) |

(0.6%) |

(0.6%) |

(0.3%) |

(1.0%) |

(0.7%) |

(0.7%) |

(0.6%) |

(0.6%) |

(0.6%) |

(0.4%) |

|

Source: Medical Expenditure Panel Survey-Insurance Component, private-sector establishments, 2004-2017.

Note: Medical Expenditure Panel Survey-Insurance Component estimates are not available for 2007.

|

Return to Table of Contents

Exhibit ES.17 Average individual deductible (in dollars) (standard error) per employee enrolled with single coverage in a health insurance plan with a deductible, overall and by firm size, 2004-2017

| Number of Employees |

2004 |

2005 |

2006 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

| U.S. |

$573 |

$652 |

$714 |

$869 |

$917 |

$1,025 |

$1,123 |

$1,167 |

$1,273 |

$1,353 |

$1,541 |

$1,696 |

$1,808 |

| (Standard Error) |

($10) |

($11) |

($9) |

($7) |

($9) |

($18) |

($12) |

($8) |

($20) |

($13) |

($16) |

($16) |

($17) |

| <50 |

$849 |

$929 |

$1,007 |

$1,177 |

$1,283 |

$1,447 |

$1,561 |

$1,628 |

$1,695 |

$1,777 |

$1,964 |

$2,105 |

$2,136 |

| (Standard Error) |

($21) |

($20) |

($20) |

($13) |

($24) |

($21) |

($26) |

($25) |

($24) |

($28) |

($35) |

($34) |

($35) |

| <50 |

$733 |

$836 |

$855 |

$1,149 |

$1,249 |

$1,522 |

$1,543 |

$1,622 |

$1,755 |

$1,744 |

$2,008 |

$2,173 |

$2,361 |

| (Standard Error) |

($50) |

($67) |

($71) |

($62) |

($46) |

($57) |

($49) |

($64) |

($49) |

($59) |

($62) |

($64) |

($85) |

| 100+ |

$457 |

$539 |

$605 |

$740 |

$774 |

$852 |

$951 |

$989 |

$1,106 |

$1,205 |

$1,383 |

$1,558 |

$1,681 |

| (Standard Error) |

($11) |

($9) |

($12) |

($8) |

($7) |

($20) |

($14) |

($10) |

($19) |

($14) |

($18) |

($18) |

($20) |

|

Source: Medical Expenditure Panel Survey-Insurance Component, private-sector establishments, 2004-2017.

Note: Medical Expenditure Panel Survey-Insurance Component estimates are not available for 2007.

In 2015, the methodology for calibrating the upper edit bound for the individual deductible amount changed,

causing the average individual deductible per employee enrolled with single coverage in a health insurance plan with a deductible to increase by about 5 percent at the national level in 2015 relative to the earlier methodology.

|

Conclusion

AHRQ hopes this chartbook helps to make MEPS-IC data more

readily usable by providing trends nationally and by firm size, by presenting

national and State-level estimates in one document, and by providing additional

firm-size cuts relevant to recent policy changes. More information is available

at www.meps.ahrq.gov.

AHRQ welcomes feedback on additional ways to make the data more usable to the

public.

Return to Table of Contents

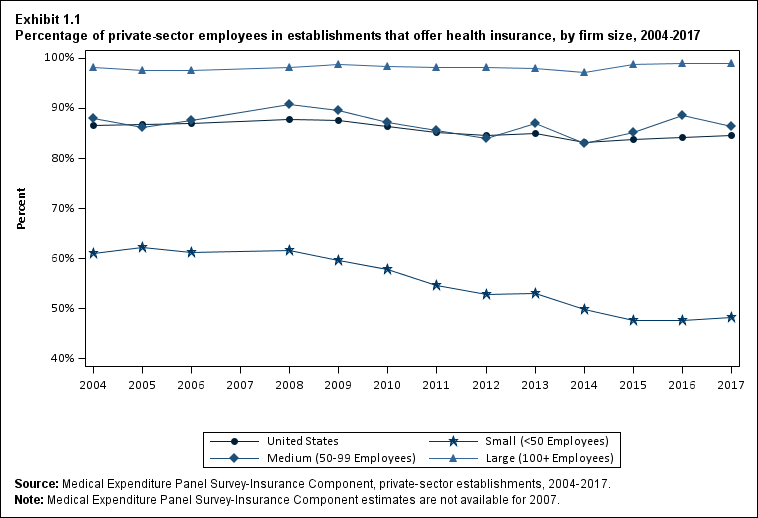

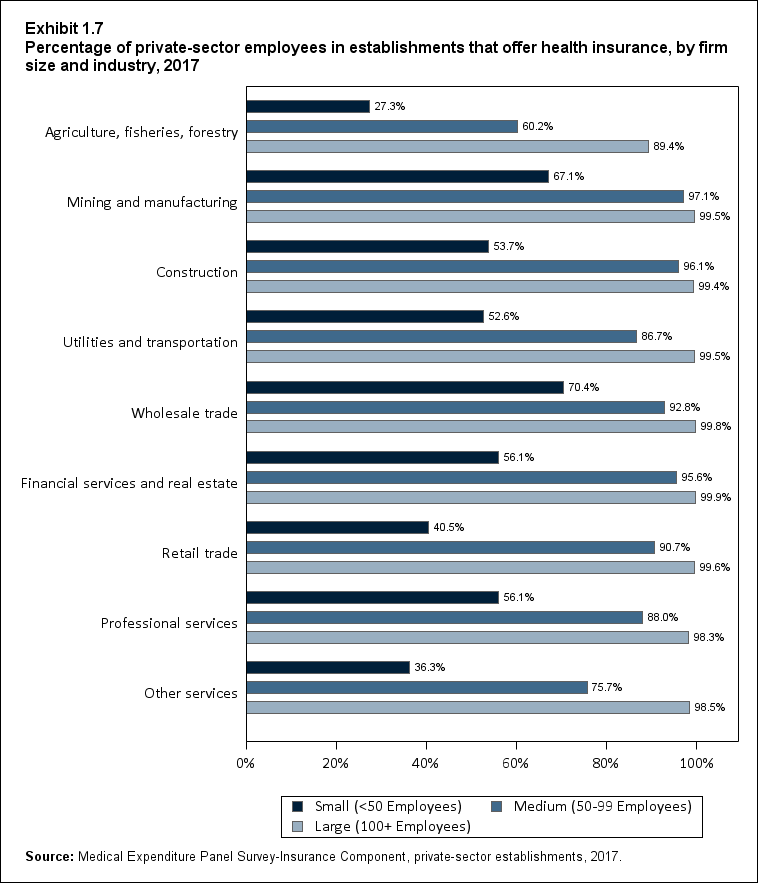

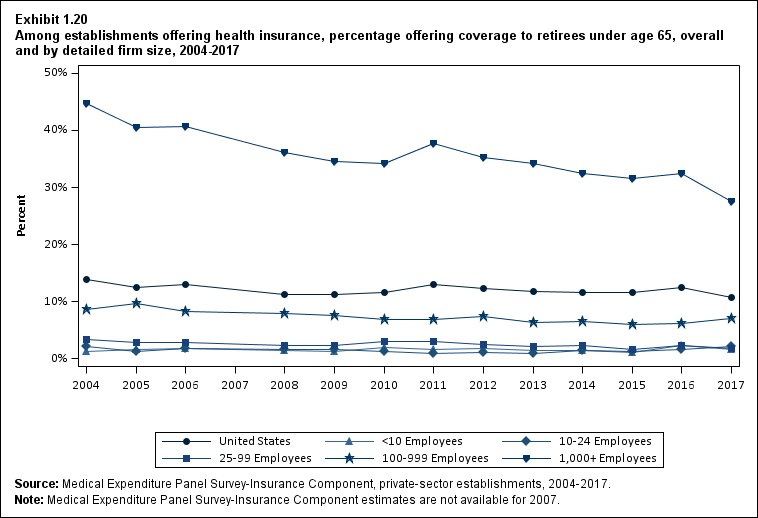

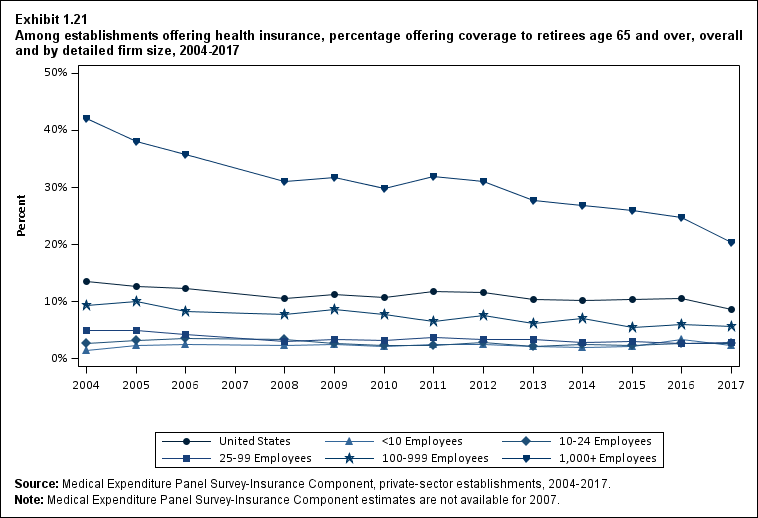

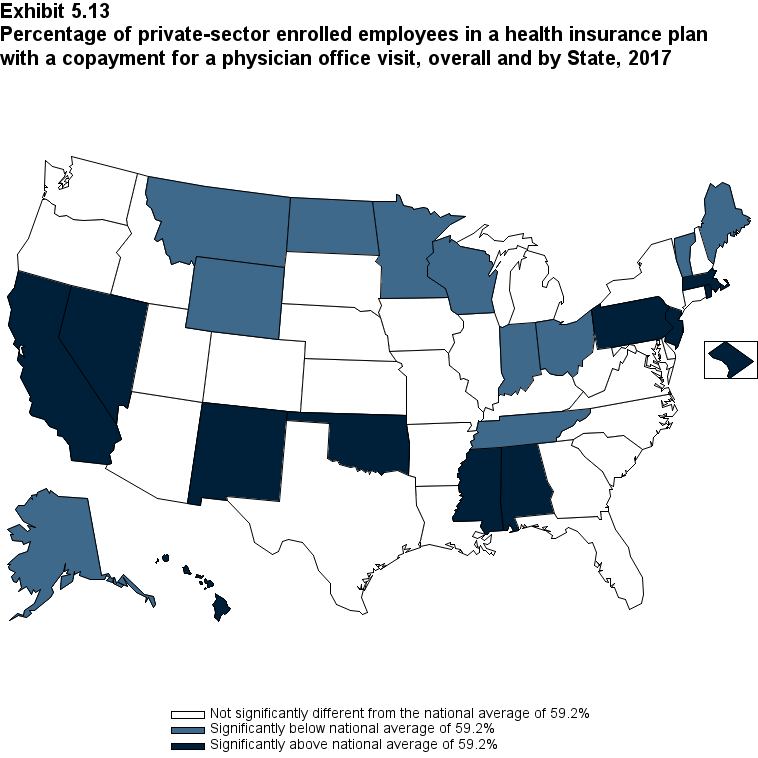

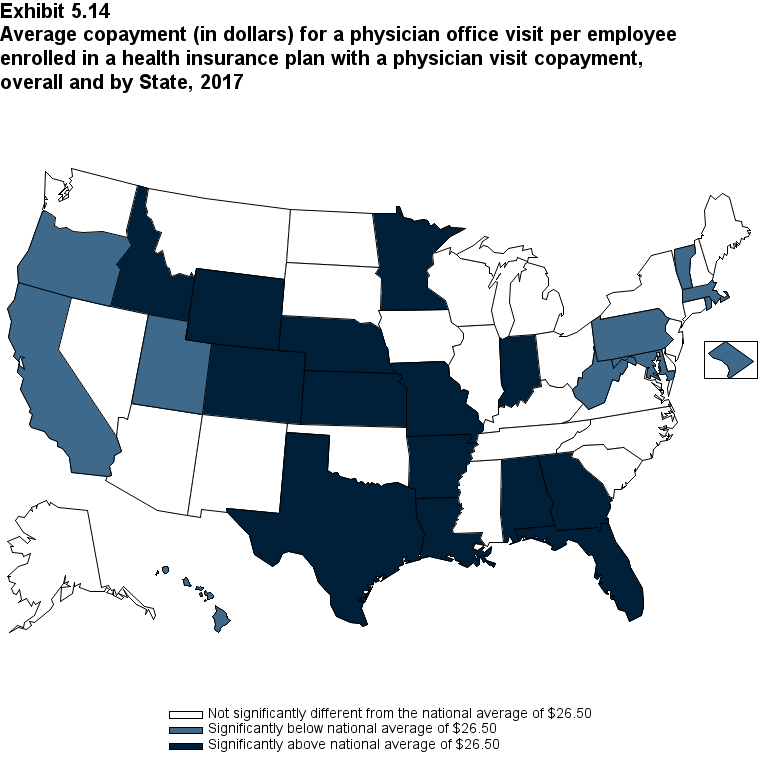

Availability of Coverage to Active Employees and Retirees

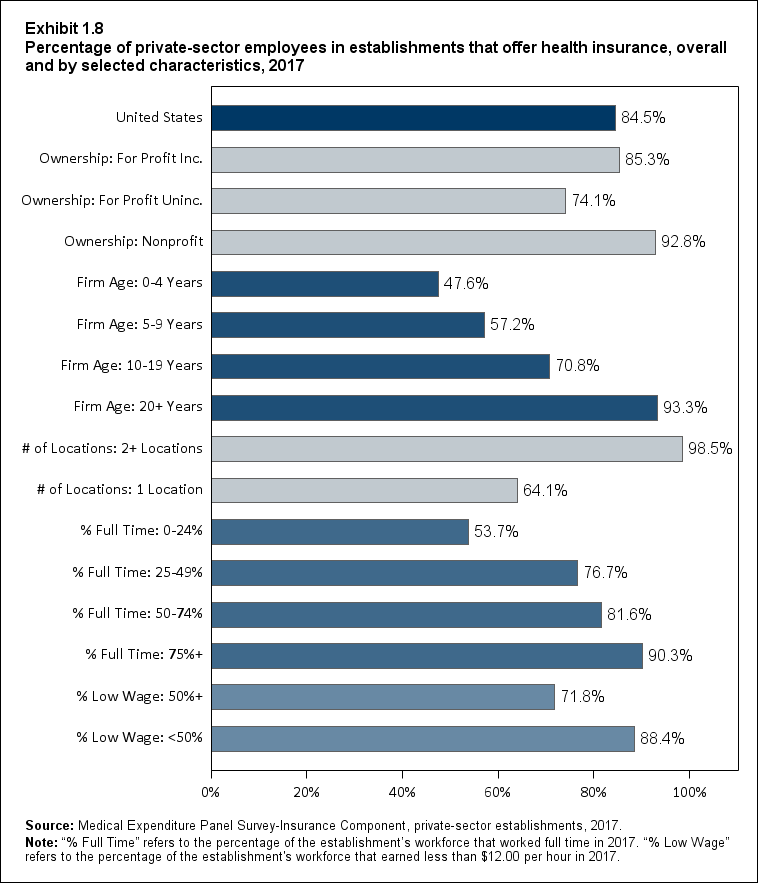

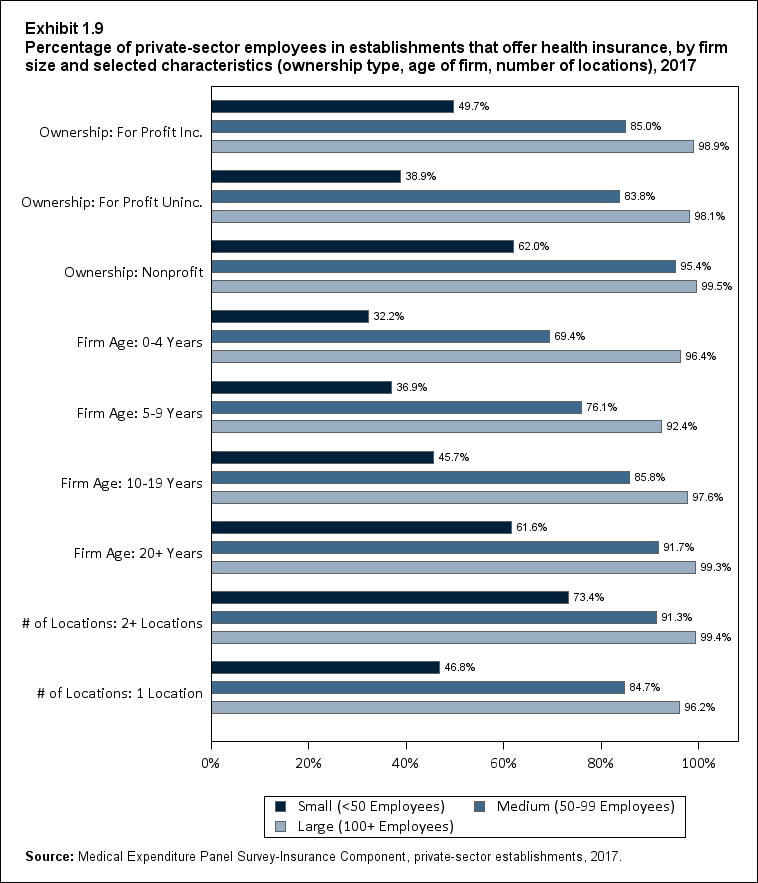

In 2017, almost all employees (98.9 percent) in firms with

100 or more employees worked at establishments that offered health insurance. In

comparison, about half (48.3 percent) of employees at firms with fewer than 50 employees

worked where health insurance was offered (Exhibit 1.1).

Historically, smaller employers have been less likely to offer coverage than larger employers for a number of reasons, including:

- Smaller risk pools, which result in higher premium costs (holding benefits constant),

- Higher administrative costs, and

- Lack of dedicated staff to select and administer health benefits.

Because of changes in national healthcare policy, employers began

facing new incentives regarding their employer-sponsored insurance decisions.

For example, starting in 2014 and throughout the 2014 through 2017 period, most

people were required to either obtain health insurance or make an individual

shared responsibility payment. Employer shared responsibility provisions began

to take effect for employers with 100 or more full-time-equivalent employees in

2015 and for employers with 50 or more employees in 2016.

This section presents estimates of the percentage of

employees who work where coverage is offered (the "offer rate"). It also provides

information on the characteristics of offered coverage, including the availability

of dependent coverage, choice of plans, and retiree coverage. In addition, this

section presents estimates of the percentage of offering establishments that

self-insure at least one plan.

Offer Rates Overall and by Firm Size, 2004 to 2017

All Employers

- There was no significant change in the overall percentage of employees working at establishments where insurance was offered

("the offer rate") between 2016 (84.3 percent) and 2017 (84.5 percent). In addition, there were no significant year-to-year changes between 2014 and 2016 (Exhibit 1.1).

- While there were no significant year-to-year changes between 2014 and 2017, offer rates increased from 83.2 percent in 2014 to 84.5 percent in 2017, after decreasing by 1.7 percentage points from 2013 to

2014. These changes resulted in no significant difference in offer rates between 2013 and 2017.

- Between 2004 and 2013, the overall percentage of

employees who worked for employers that offered health insurance declined from 86.7

percent to 84.9 percent, with almost all of the decline occurring between 2009

and 2012. During that time, offer rates declined in each year (p <0.10 for 2012).

Small Employers (Firms With Fewer Than 50 Employees)

- There were no significant changes in the offer

rates at small employers between 2016 (47.7 percent) and 2017 (48.3 percent) or

between 2015 and 2016. This period of relative stability followed a 7-year

period between 2008 and 2015 during which offer rates declined from 61.6

percent to 47.6 percent, with significant declines in every year except 2013 (Exhibit

1.1).

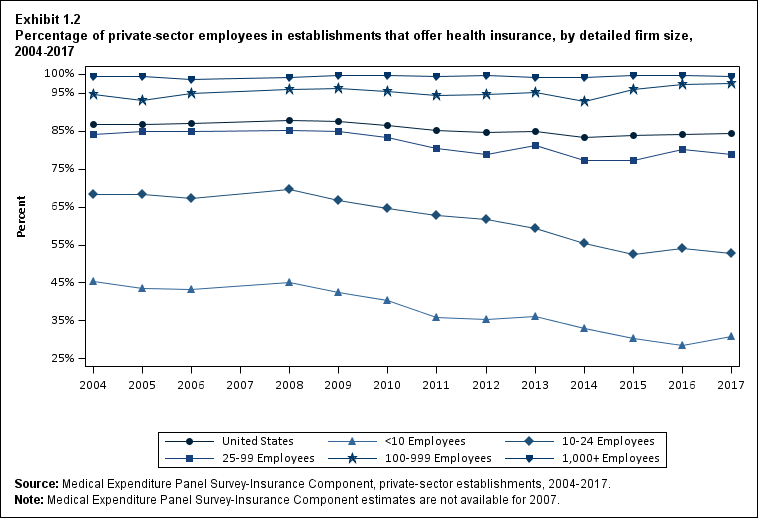

- From 2016 to 2017, offer rates in the smallest

firms (fewer than 10 workers) increased by 2.4 percentage points to 30.8

percent, the first significant year-to-year increase in offer rates at firms of

this size in the 2004 to 2017 period. This increase offset a 2.0 percentage point

decline from 2015 to 2016 (p <0.10). Between 2008 and 2015, offer rates at

the smallest firms declined each year (except 2012 and 2013), falling from 45.0

percent in 2008 to 30.4 percent in 2015 (Exhibit 1.2).

- There was no statistically significant change in

offer rates for employees in firms with 10 to 24 workers between 2016 (54.0

percent) and 2017 (52.8 percent) or between 2015 and 2016. However, between 2013

and 2015, offer rates at such firms declined by a total of 6.7 percentage

points, 3.8 percentage points from 2013 to 2014 and 2.9 percentage points from

2014 to 2015 (p <0.10). Offer rates for employers of this size were relatively

stable from 2004 to 2008 but declined by 10.2 percentage points between 2008

and 2013, from 69.5 percent in 2008 to 59.3 percent in 2013 (Exhibit 1.2).

Medium Employers (Firms With 50 to 99 Employees)

- There was no significant change in offer rates at medium employers (50 to 99 employees) from 2016 (88.6 percent) to 2017 (86.3

percent). In 2016, the first year that the federally mandated employer shared

responsibility provisions took effect for firms of this size, offer rates increased by 3.3 percentage points, from 85.3 percent in 2015 to 88.6 percent in 2016 (Exhibit 1.1).

- Offer rates in 2017 for medium employers were not significantly higher than in 2015, but they were higher than in 2014 (p <0.10) (Exhibit 1.1).

- From 2013 to 2014, offer rates for employers of this size declined by 4.0 percentage points, after increasing by 2.9 percentage

points from 2012 to 2013 (p <0.10), resulting in no significant difference in the 2012 and 2014 offer rates at medium employers (Exhibit 1.1).

- Between 2008 and 2012, offer rates at medium employers declined from 90.7 percent to 84.1 percent (Exhibit 1.1).

Large Employers (Firms With 100 or More Employees)

- The offer rate at large firms (100 or more employees) was unchanged in the 2-year period between 2015 (98.8 percent) and 2017 (98.9 percent) (Exhibit 1.1).

- Offer rates at firms with 100 to 999 employees were unchanged between 2016 and 2017, after increasing from 2015 to 2016 (p <0.10) (Exhibit 1.2).

- While there were no significant year-to-year changes in offer rates at firms with 1,000 or more employees in the 2015 to

2017 period, offer rates at the largest employers were slightly lower in 2017 (99.5 percent) than in 2015 (99.8 percent, p <0.10) (Exhibit 1.2).

- Offer rates at large employers (100 or more employees) increased from 97.3 percent in 2014 to 98.8 percent in 2015, the

first year that the federally mandated employer shared responsibility provisions took effect for firms of this size. This increase occurred after a 0.7

percentage point decline from 2013 to 2014 and raised the 2015 offer rate for large employers above that for 2013 (Exhibit 1.1).

- The 2014 to 2015 increase in offer rates for large employers occurred among employers with 100 to 999 employees and those

with 1,000 or more employees. Offer rates for employers with 100 to 999 employees increased from 92.7 percent in 2014 to 96.1 percent in 2015,

offsetting the decline that occurred from 2013 (95.2 percent) to 2014 (92.7 percent). Offer rates for the largest employers increased from 99.1 percent to

99.8 percent from 2014 to 2015 (Exhibit 1.2).

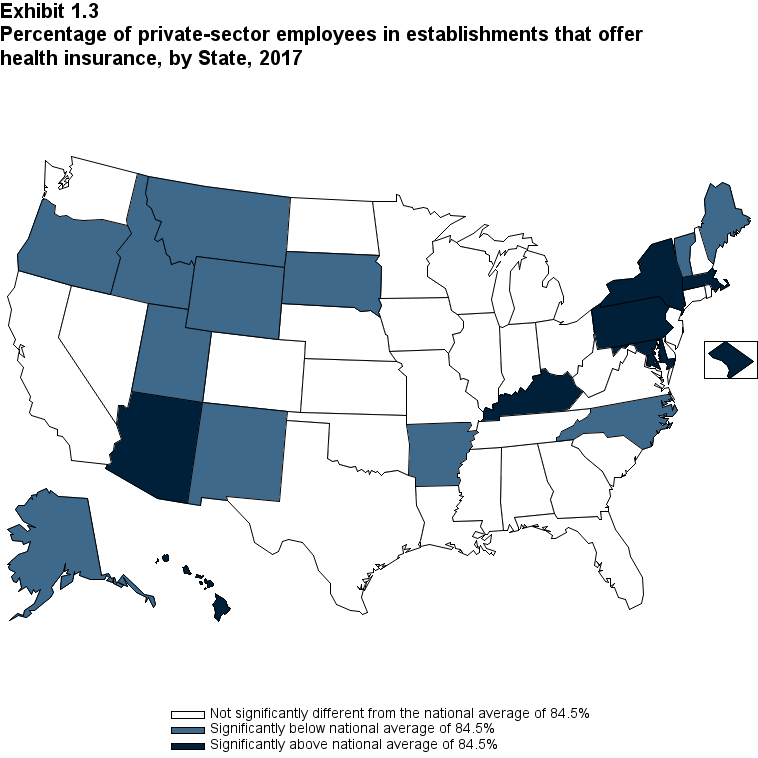

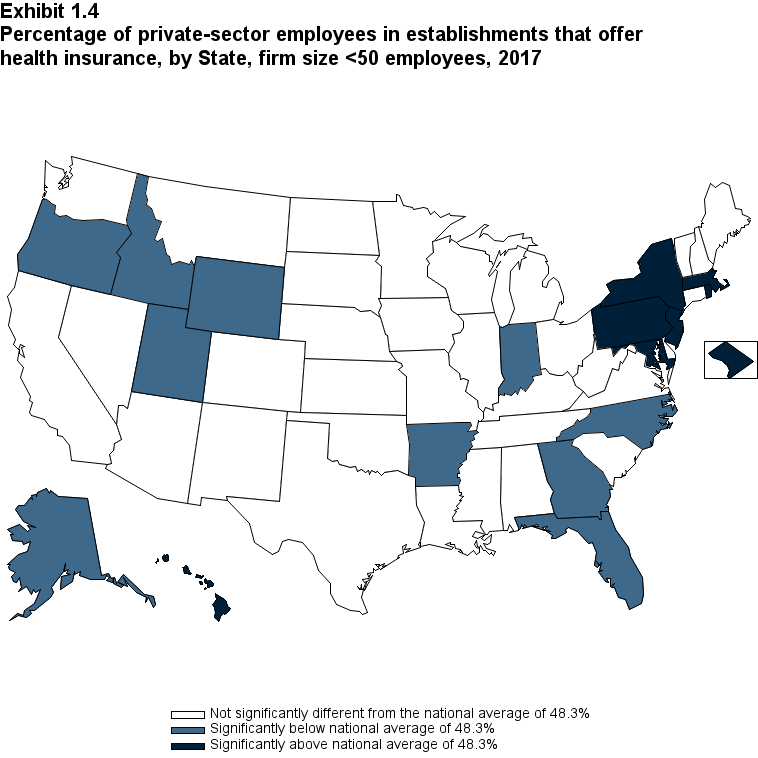

Offer Rates by State, 2017

- Nationwide, 84.5 percent of all private-sector employees

worked at establishments that offered insurance. The availability of workplace

coverage varied substantially across the country (Exhibit 1.3). This variation was

driven in part by differences in the distribution of workers by employer size across

States (data not shown) and by differences across States in offer rates at smaller employers (Exhibit 1.4).

- States with offer rates exceeding the national

average were Arizona, District of Columbia, Hawaii, Kentucky, Maryland, Massachusetts, New York, and Pennsylvania (Exhibit 1.3).

- States with offer rates below the national average in 2017 were Alaska, Arkansas, Idaho, Maine, Montana, New Mexico, North

Carolina, Oregon, South Dakota, Utah, Vermont, and Wyoming (Exhibit 1.3).

Offer Rates at Small Employers, by State, 2017

- Nationwide, a little less than half (48.3 percent) of employees of small firms (fewer than 50 employees) worked at

establishments that offered insurance. However, the availability of workplace coverage varied substantially across the country (Exhibit 1.4).

- States with small-employer offer rates exceeding the national average were the District of Columbia, Hawaii, Maryland, Massachusetts,

New Jersey, New York, Pennsylvania, and Rhode Island (Exhibit 1.4).

- States with small-employer offer rates below the national average were Alaska, Arkansas, Florida, Georgia, Idaho, Indiana, North

Carolina, Oregon, Utah, and Wyoming (Exhibit 1.4).

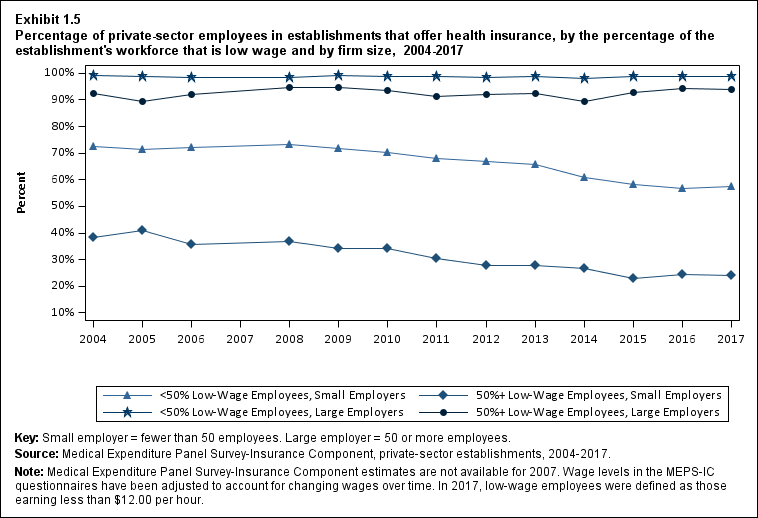

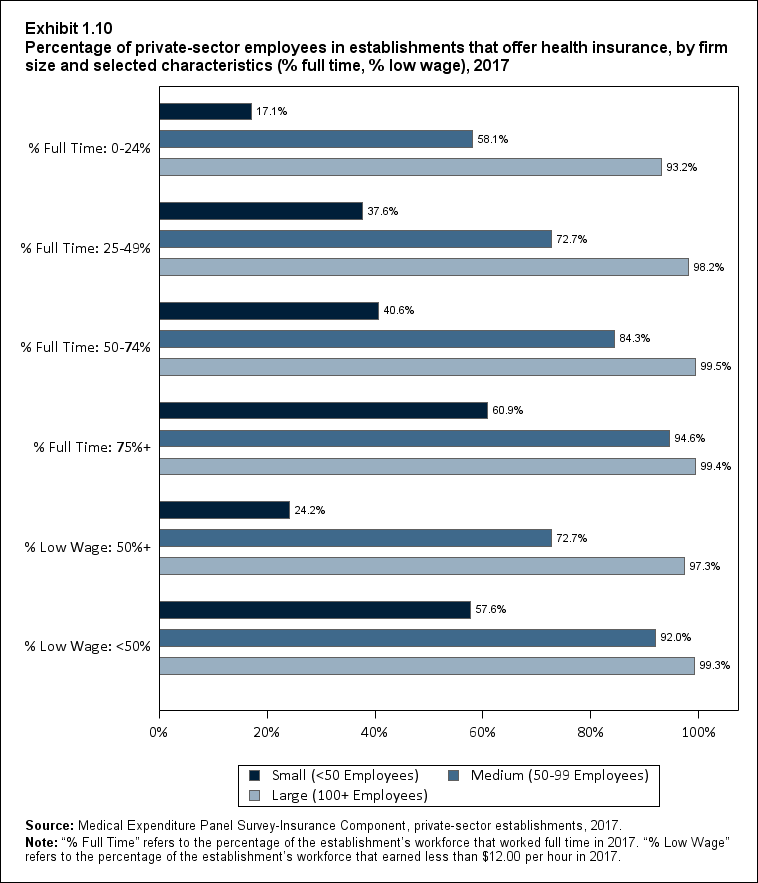

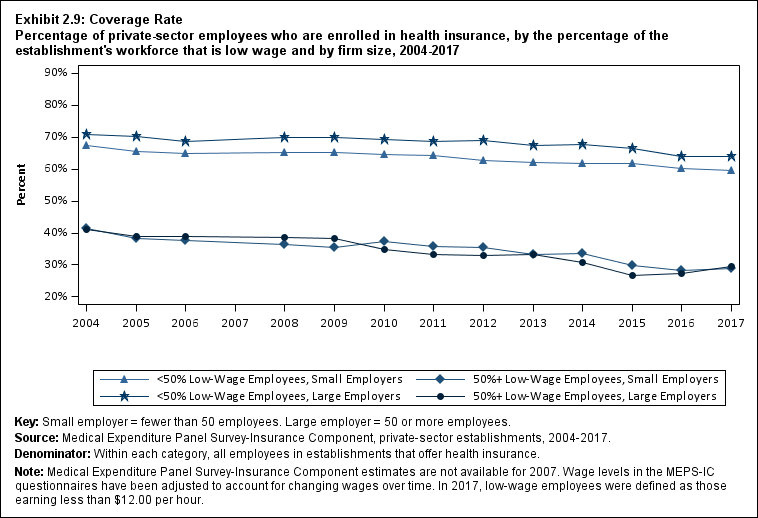

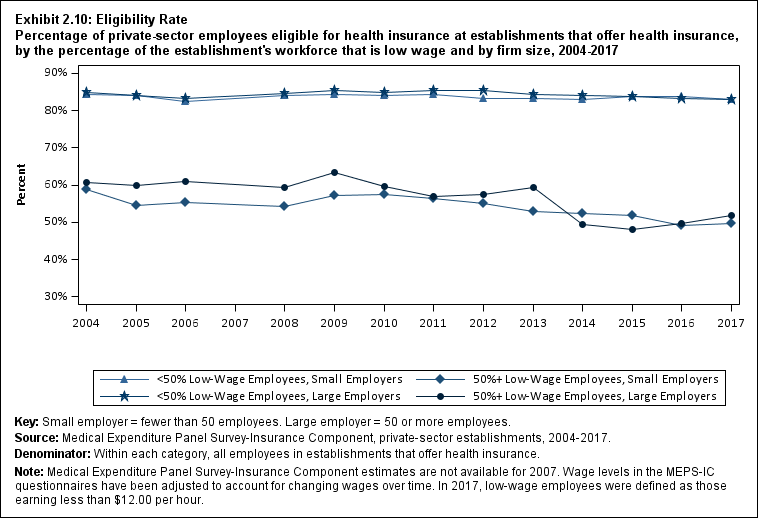

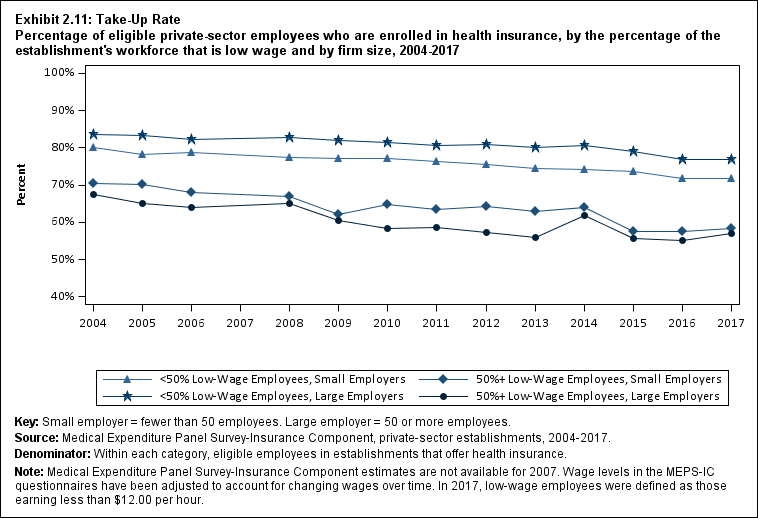

Offer Rates at Employers That Are Predominantly Low Wage vs. Higher Wage Establishments, by Firm Size, 2004 to 2017

- In 2017, workers at predominantly low-wage small employers (fewer than 50 employees) faced offer rates that were less than half the

rate at small employers with higher wages (24.2 percent vs. 57.6 percent)

(Exhibit 1.5). (Predominantly low-wage establishments are defined as those where 50 percent or more of an

establishment's workforce were low wage. Wage levels used in the question about

the wage distribution in the MEPS-IC questionnaire have been adjusted to account for changing wages over time. In 2017, low-wage employees were defined as those earning less than $12.00 per hour.)

- There were no significant changes in offer rates between 2016 and 2017 for any of the four subgroups of establishments jointly

defined by firm size and wage level (Exhibit 1.5).

- There were no significant changes in offer rates at small employers with higher wages (establishments that were not

predominantly low wage) between 2015 (58.4 percent) and 2017 (57.6 percent).

Between 2014 and 2015, offer rates at such employers declined by 2.6 percentage

points, which followed a 4.6 percentage point decline from 2013 to 2014. The total percentage point decline that

occurred from 2013 to 2015 (7.2 percentage points) is about the same as that from 2008 to 2013 (7.6 percentage points). Offer rates at higher wage small

employers in 2017 (57.6 percent) were 14.8 percentage points lower than in 2004 (72.4 percent) (Exhibit 1.5).

- There were no significant changes in offer rates at low-wage small employers between 2015 and 2017. Between 2014 and 2015, offer

rates at such employers declined from 26.6 percent to 23.1 percent. This decrease

followed a period of no significant change from 2012 to 2014. Offer rates at low-wage small employers declined by 10.5 percentage points between 2004 (38.5 percent)

and 2012 (28.0 percent). Most of the decline in offer rates at low-wage small employers in this period occurred after 2008 (Exhibit 1.5).

- Offer rates at large employers (50 or more employees) with a predominantly low-wage workforce remained at a relatively

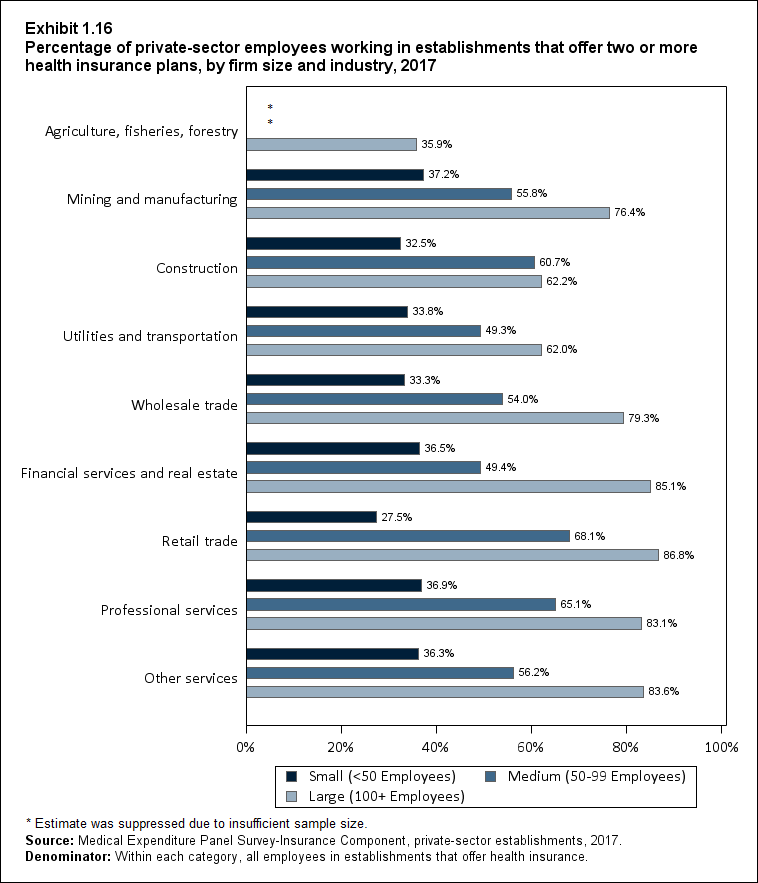

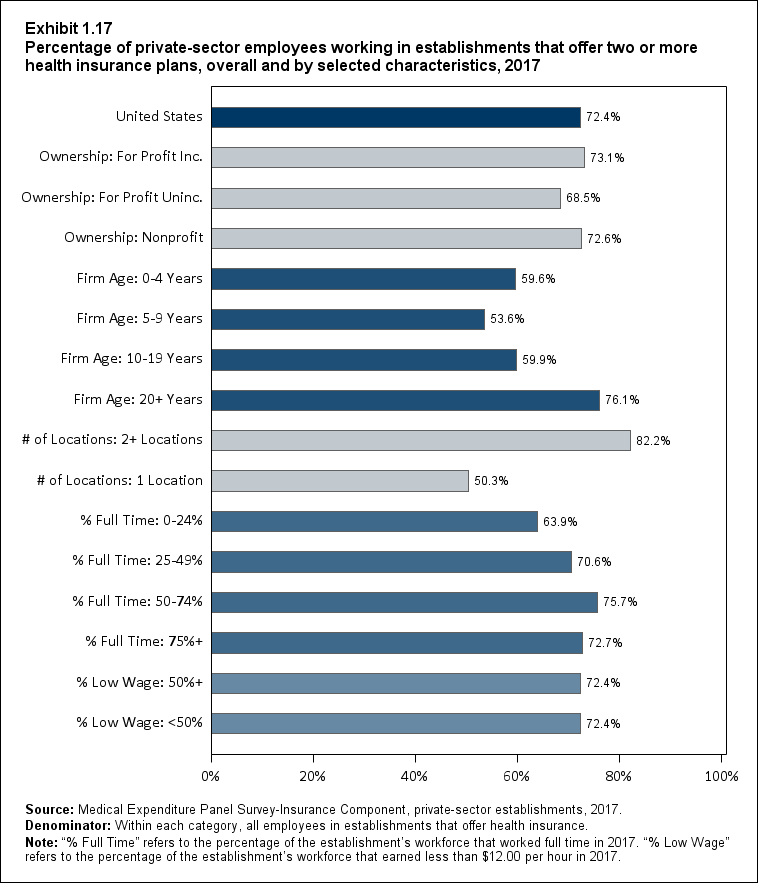

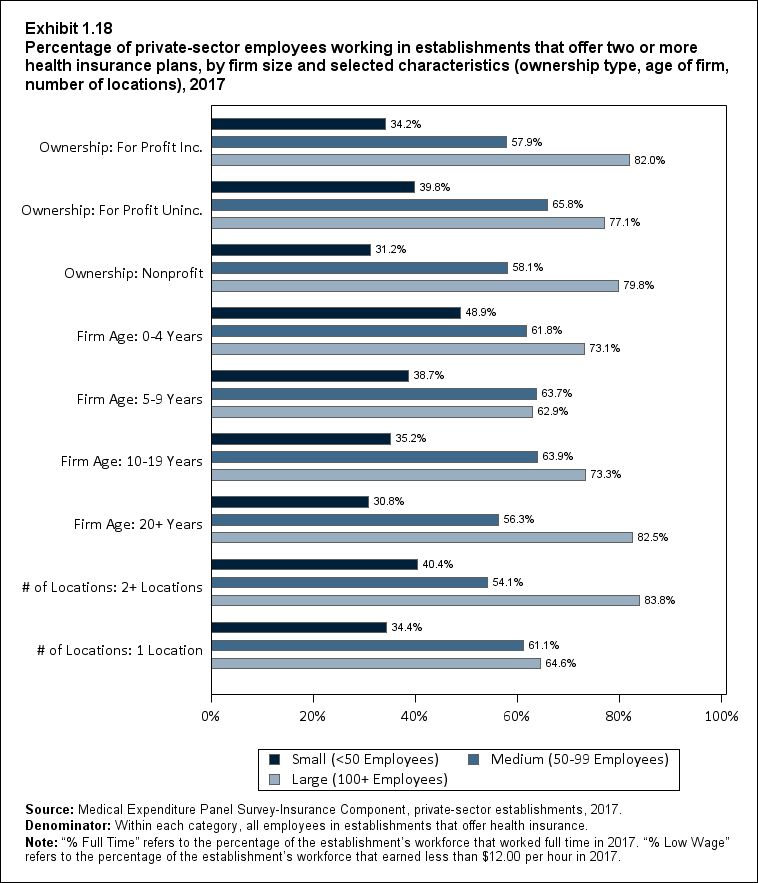

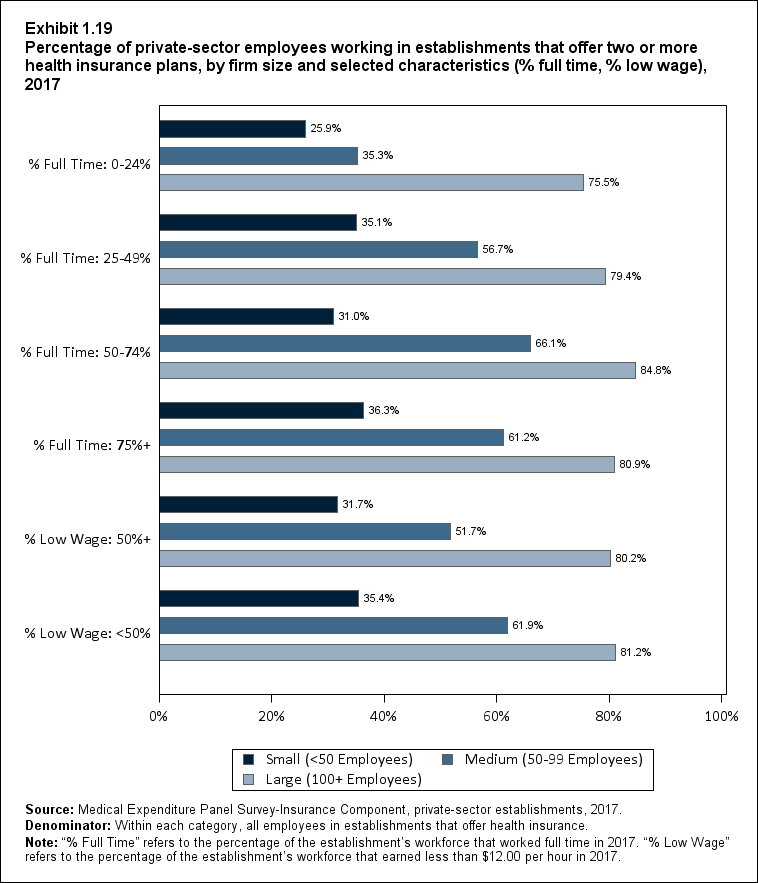

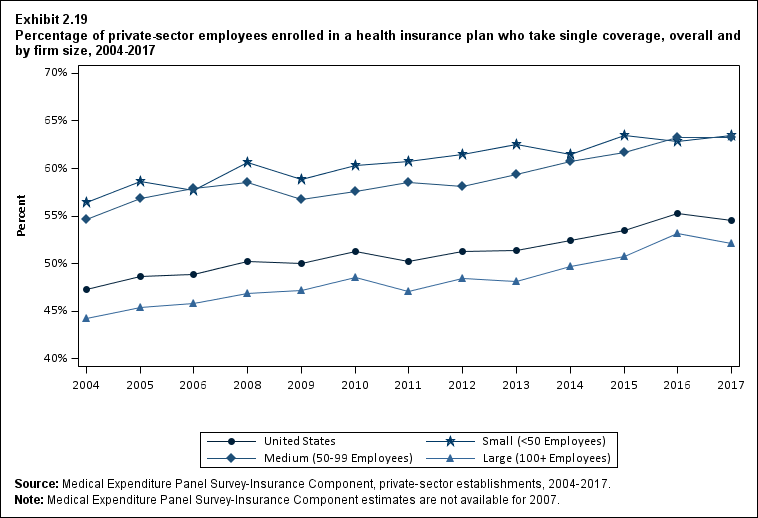

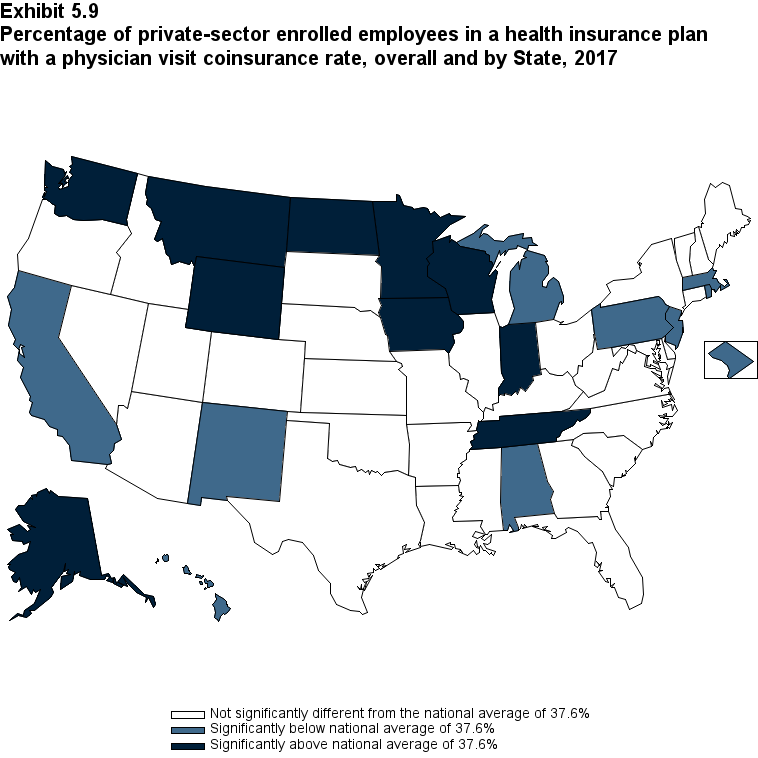

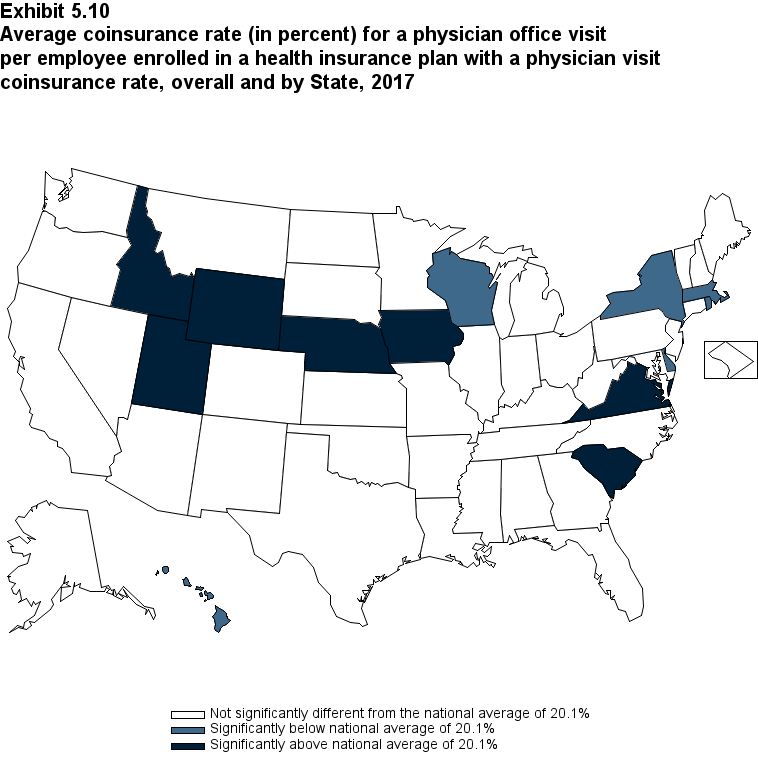

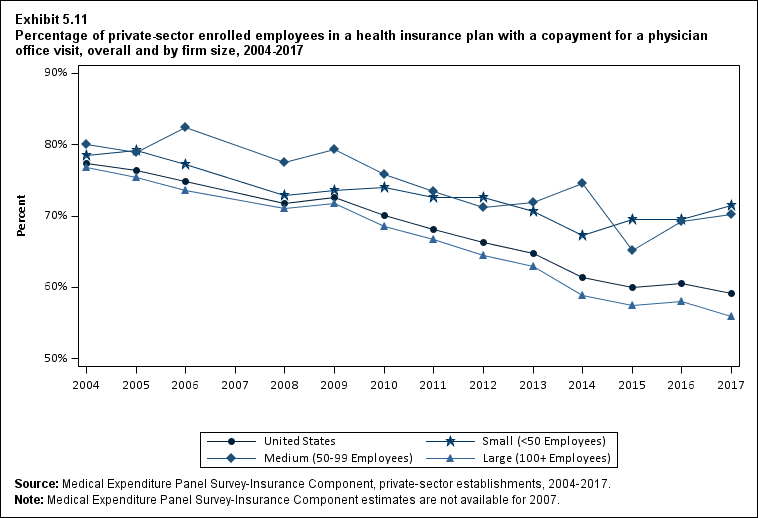

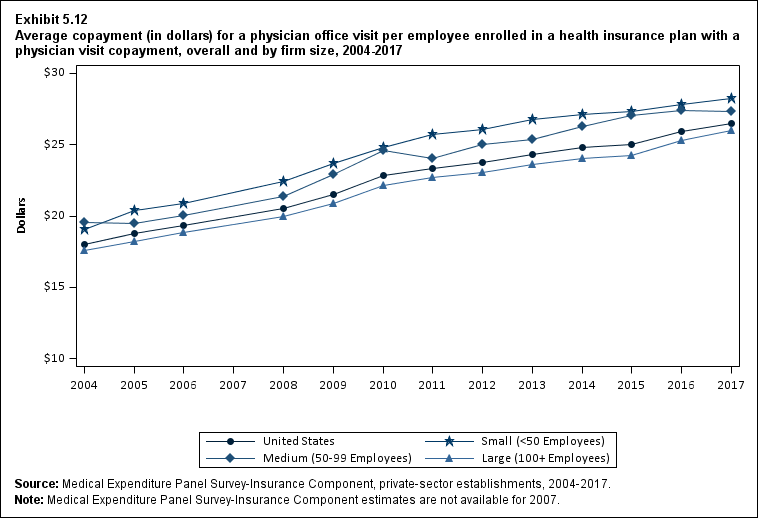

high level in 2017 (94.0 percent). In the 2-year period between 2014 and 2016, offer rates at such employers increased by a total of 4.9 percentage points, composed