Highlights

#8: Uninsured Workers - Job Characteristics, 1996

Estimates for U.S. Civilian

Noninstitutionalized Workers Ages 16-64

Introduction

For most Americans, health insurance obtained through the workplace

is the primary source of private coverage. Data from the 1996

Medical Expenditure Panel Survey (MEPS), conducted by the Agency

for Health Care Research and Quality (AHRQ), indicate that nearly

two-thirds of Americans under 65 years of age obtained job-related

health insurance during the first half of 1996 (data not shown).

However, employment does not necessarily lead to health insurance

coverage for many working Americans. Nearly a fifth (18.4 percent)

of working Americans ages 16-64 (approximately 23 million people)

were uninsured during the first half of 1996. These workers represented

half (51 percent) of the total uninsured population. MEPS data

also indicate that certain job characteristics such as self-employment

or wage earning, size of business, hourly wage, and weekly hours

of work have significant effects on workers' health insurance

status.

^top

Briefly Stated

- Workers with the following job characteristics were most likely to be uninsured: the self-employed, those working in small businesses, those earning low wages, and part-time workers.

- Workers who were self-employed were almost twice as likely as wage earners to be uninsured.

- The risk of being uninsured was related to size of business. Wage earners were more likely to be uninsured if they worked for establishments with less than 25 employees.

- Workers earning less than $10.00 per hour were at substantially greater risk of lacking health insurance than those earning $10.00 or more per hour.

- Over three-fourths of full-time workers had job-related insurance.

^top

Findings

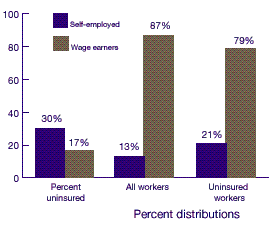

Self-employed people were

nearly twice as likely as wage earners to be uninsured during

the first half of 1996. About 30 percent lacked any type of health

insurance, compared to 17 percent of wage earners (Figure

1).

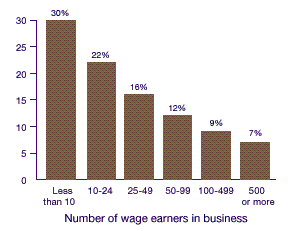

MEPS data also indicate that size of business

is a factor in whether or not a worker has health insurance,

regardless of whether the worker is self-employed or a wage earner.

The self-employed with small businesses of fewer than 10 workers

were more than twice as likely to be uninsured as those with

businesses of 10 or more workers (31 percent and 15 percent,

respectively; data not shown). For wage earners, the contrast

is even more striking (Figure 2).

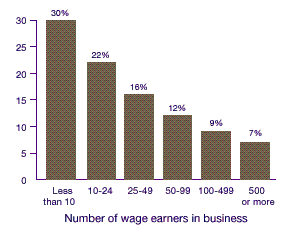

Thirty percent of wage earners in businesses with fewer than

10 workers were uninsured, but only 7 percent of those in large

establishments (more than 500 workers) were uninsured. Wage earners

in businesses with fewer than 10 employees represented 15 percent

of all working Americans but accounted for 25 percent of the

working uninsured (Figure 3).

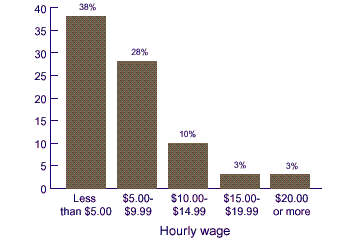

Workers who earned low hourly wages also were

at greater risk of being uninsured. Less than half (43 percent)

of workers earning less than $5.00 per hour and only two-thirds

(64 percent) of workers earning $5.00-$9.99 per hour obtained

job-related coverage, in contrast to 95 percent of workers earning

$15.00 or more per hour (data not shown). About 38 percent of

workers earning less than $5.00 per hour and 28 percent of workers

earning $5.00-$9.99 per hour were uninsured, compared to only

3 percent of workers earning $15.00 or more per hour (Figure

4).

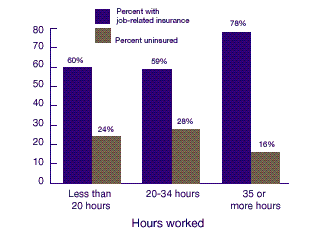

Part-time workers (those working less than

35 hours per week) were more likely than full-time workers to

be uninsured (Figure 5). Approximately

60 percent of part-time workers had job-related insurance, compared

to three-quarters (78 percent) of full-time workers.

^top

About MEPS

The Medical Expenditure Panel Survey (MEPS)

collects nationally representative data on health care use, expenditures,

source of payment, and insurance coverage for the U.S. civilian

noninstitutionalized population. MEPS is cosponsored by the Agency

for Health Care Research and Quality (AHRQ) and the National Center

for Health Statistics. This Highlights summarizes data concerning

the characteristics of the working uninsured population in the

United States during the first half of 1996, as derived from the

MEPS Household Component, Round 1. For more information about MEPS,

see the sources listed on the back page.

^top

Figures

Figure

1.

Percent uninsured for workers ages 16-64 and comparison of self-employed

workers and wage earners: First half of 1996

- Self-employed workers represented just

13 percent of all workers, but they composed 21 percent of all

uninsured workers.

DATA

SOURCE: 1996 Medical Expenditure Panel

Survey Household Component, Round 1.

^top

Figure 2. Percent

uninsured for wage earners ages 16-64 by size of business: First

half of 1996

- As the establishment size increased, the

percentage of uninsured workers declined.

DATA

SOURCE: 1996

Medical Expenditure Panel Survey Household Component, Round

1.

^top

Figure 3. Comparison

of size of business for all workers and uninsured workers

ages 16-64: First half of 1996

- Wage earners in businesses with less than

10 employees represented 15 percent of all workers but 25 percent

of uninsured workers.

DATA

SOURCE: 1996 Medical Expenditure Panel Survey

Household Component, Round 1.

^top

Figure 4. Percent

uninsured for wage earners ages 16-64 by hourly wage: First

half of 1996

- The likelihood that a worker was uninsured

during the first half of 1996 was directly related to level of

earnings.

DATA

SOURCE: 1996 Medical Expenditure Panel Survey

Household Component, Round 1.

^top

Figure 5. Insurance

comparison of workers ages 16-64 by number of hours worked

per week: First half of 1996

- Part-time workers were

less likely to have job-related insurance than full-time workers.

DATA

SOURCE: 1996 Medical Expenditure Panel Survey

Household Component, Round 1.

^top

References

For more information about MEPS, call the MEPS

information coordinator at AHRQ (301-594-1406) or visit the MEPS

section of the AHRQ Web site at: http://www.ahrq.gov/

For a detailed description of the MEPS survey

design, sample design, and methods used to minimize sources of

nonsampling error, see the following publications:

Cohen J. Design and methods of the Medical

Expenditure Panel Survey Household Component. Rockville (MD):

Agency for Health Care Policy and Research; 1997. MEPS Methodology

Report No. 1. AHRQ Pub. No. 97-0026.

Cohen S. Sample design of the 1996 Medical

Expenditure Panel Survey Household Component. Rockville (MD):

Agency for Health Care Policy and Research; 1997. MEPS Methodology

Report No. 2. AHRQ Pub. No. 97-0027.

The estimates in this Highlights are

based on the following, more detailed publication:

Monheit AC, Vistnes JP. Health insurance status

of workers and their families: 1996. Rockville (MD): Agency for

Health Care Policy and Research; 1997. MEPS Research Findings

No. 2. AHRQ Pub. No. 97-0065.

These publications are available from the

AHRQ Clearinghouse (800-358-9295) and on the AHRQ web site.

MEPS Highlights

No. 8, AHRQ Pub. No. 99-0008, December 1998.

^top

Suggested Citation:

Highlights #8: Uninsured Workers - Job Characteristics, 1996. December 1998. Agency for Healthcare Research and Quality, Rockville, MD.

http://www.meps.ahrq.gov

/data_files/publications/hl8/hl8.shtml

|

|