Research

Findings #15: HMO Enrollment in the United States: Estimates Based

on Household Reports, 1996

by Jessica S. Banthin, Ph.D., and Amy K. Taylor,

Ph.D., Agency for Healthcare Research and Quality

Abstract

This report from the 1996 Medical Expenditure Panel Survey (MEPS)

presents estimates of the total number of people enrolled in HMO (health

maintenance organization) plans for the first half of 1996. The

estimates are based on MEPS household survey data, which rely on

household members' understanding and reporting of HMO status. According

to MEPS household data, 91.6 million people—41.9 percent of the total

insured population—were enrolled in HMOs in the first half of 1996. HMO

enrollment rates were higher among the privately insured than the

publicly insured, higher among children and younger adults than older

adults, and higher for Hispanics and blacks than for the group of whites

and people of other races. In addition, middle- and high-income people

were more likely than those with lower incomes to be enrolled in HMOs.

HMO enrollment was higher in the West and in urban areas. There were

some health status differences in HMO enrollment for publicly insured

people. Among people on Medicare or Medicaid, those who needed help with

daily activities or were limited in their ability to work or do

housework were less likely than others to be in an HMO.

Introduction

The number of people enrolled in managed care

plans has grown rapidly in the last decade. As health care costs

continue to rise, employers increasingly have switched from traditional

indemnity plans to managed care plans in the hope of controlling

the costs of offering health insurance coverage to their employees.

While managed care can take many forms, one of the oldest types

of managed care plans is the health maintenance organization (HMO).

In more recent years, public payers such as Medicare and State

Medicaid programs also have begun to contract with HMOs. An HMO

is a prepaid health plan in which the cost of medical care typically

is covered in full or with a small copayment.

This report presents estimates of the total

number of people enrolled in HMO plans for the first half of 1996.

The estimates are based on data from Round 1 of the 1996 Medical

Expenditure Panel Survey (MEPS) Household Component, which is nationally

representative of the U.S. civilian noninstitutionalized population.

Because household survey data are used, the accuracy of the HMO

enrollment estimates presented in this analysis depend on household

members' understanding and reporting of HMO status. From a consumer's

point of view, the main characteristics of HMOs and other types

of managed care plans, compared with traditional indemnity plans,

are the limited choice of health care providers and smaller out-of-pocket

payments. The Technical Appendix at

the end of this report shows the exact questions used to identify

HMO enrollees in the MEPS Household Component.

This report focuses on HMO enrollment, excluding

from the analyses enrollment in other types of managed care plans.

HMOs are one of the oldest types of managed care health plans,

first becoming common as a result of the 1973 Health Maintenance

Organization Act. This Federal law defined HMO plans, emphasizing

their coverage of preventive care services. The law also mandated

that employers offer an HMO as an insurance choice to their employees

if there is an HMO in the area and if the employer offers a choice

of plans. HMOs are federally qualified if they meet the requirements

spelled out in the 1973 HMO Act and in subsequent modifications.

Whereas older HMOs tend to be nonprofit staff and group models,

many current HMOs include for-profit plans that contract with a

network of individual providers as well as groups.

Some of the estimates

of total HMO enrollees presented in the discussion below cannot

be derived exactly from

the accompanying tables because of rounding error. Whenever the

number presented in the text is at slight variance with the number

generated from the corresponding table, it will be noted.

^top

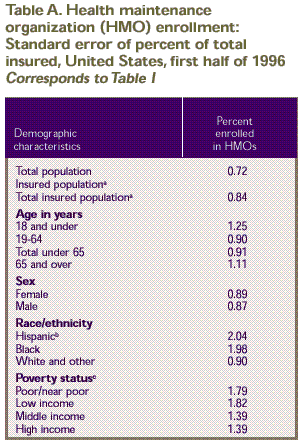

Total HMO Enrollment

In the first half of 1996, a total of 91.6

million people were enrolled in HMOs. Multiplying the numbers in Table

1 (the percent enrolled in an HMO times the total population)

yields an estimate slightly higher than 91.6 million because of

rounding error. HMO enrollees made up 34.8 percent of the total

U.S. civilian noninstitutionalized population and 41.9 percent

of the population with health insurance (Table

1). The rate of HMO enrollment was significantly higher in

the non-elderly population than in the elderly population (45.6

vs. 20.1 percent). HMO enrollment was also higher among Hispanics

of any race (51.6 percent) and blacks (47.2 percent) than for the

group of whites and others (40.1 percent). (People of other races,

including Asians, Pacific Islanders, American Indians, and Alaska

Natives, are grouped with whites for this report.) In addition,

insured people living in middle- and high-income families were

more likely to be enrolled in an HMO (43.4 percent and 45.6 percent,

respectively) than were people living in poor or near-poor (32.7

percent) and low-income families (37.0 percent). See the Technical

Appendix for definitions of the terms used in this report.

HMO enrollment varied significantly when the

total insured population was broken out into three mutually exclusive

subgroups: people under 65 with any private insurance, publicly

insured people under 65 with no private coverage, and people age

65 and over with Medicare coverage.

HMO enrollment was highest in the privately

insured non-elderly population (Tables

2–4). About 47.6 percent of the privately insured population

under 65, or 75.8 million people, were HMO enrollees. The 1987

National Medical Expenditure Survey showed 28.0 million HMO enrollees

(17.1 percent) in the privately insured population under 65 (Taylor,

Beauregard, and Vistnes, 1995). According to data from these two

national surveys, HMO enrollment grew by a factor of 2.8 from 1987

to 1996.

The rate of HMO enrollment was lower among

the publicly insured non-elderly population than among the privately

insured non-elderly population. In the first half of 1996, 36.5

percent of the publicly insured population under 65, or 9.5 million

people, were HMO enrollees (Table 3).

This total number is at variance with the estimate generated from

the first row of Table 3 because

of rounding error.

The lowest enrollment rates were found among

Medicare beneficiaries age 65 and over. In this group, 20.0 percent,

or 6.2 million people, were enrolled in an HMO in the first half

of 1996, either through their Medicare coverage or through private

insurance (Table 4).

^top

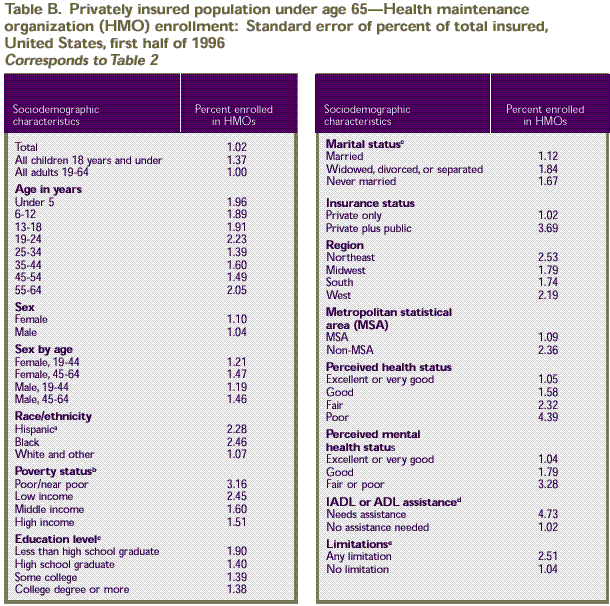

Privately Insured Non-Elderly

Table 2 shows

the percent of the privately insured population under age 65 who

were enrolled in HMOs in 1996 by various characteristics. HMO enrollment

varied by demographic and health-related characteristics, including

age, race/ethnicity, and place of residence.

The rate of enrollment

for all children under age 18 was not significantly different

from that of all adults

under age 65. However, privately insured people ages 55–64

were considerably less likely than those under 55 to be enrolled

in an HMO. Only 36.9 percent of this older age group were enrolled

in HMOs, compared to 46.2–51.7 percent of the younger age

groups.

There were no significant differences in HMO

enrollment by sex for all ages combined, but Table

2 shows some sex differences in HMO enrollment rates for age-sex

groups. Women of childbearing age (19–44 years) were more

likely than men that age to be enrolled in an HMO (51.0 percent

vs. 47.0 percent).

Among the non-elderly privately insured population,

a higher percentage of blacks and Hispanics than people in the

white and other group were HMO members. Only 45.1 percent of privately

insured whites and others were enrolled in an HMO, compared to

57.6 percent of blacks and 62.0 percent of Hispanics.

While HMO enrollment did not differ significantly

by marital status, education level, or insurance status, it varied

by poverty status. Nearly half (48.6 percent) of high-income people

under age 65 were enrolled in HMOs, compared to 41.8 percent of

people this age in poor or near-poor families.

Region of the country and degree of urbanization

were associated with differences in the likelihood of HMO enrollment.

Among privately insured Americans under age 65, people living in

the Midwest were less likely than others to be enrolled in an HMO

(37.8 percent) and people living in the West were more likely to

be an HMO enrollee (59.9 percent). Those living in metropolitan

statistical areas (MSAs) were much more likely to be HMO enrollees

(51.6 percent) than those living outside of MSAs (29.3 percent).

Table

2 also

shows that there were no significant differences in HMO enrollment

among the non-elderly privately insured population by several health

status measures. This finding is important, since many have speculated

that HMOs are able to control costs by enrolling healthier people

than those remaining in traditional indemnity plans. This finding

that there is no difference in HMO enrollment by several health

status measures supports other recent evidence of the lack of selection

in HMO enrollment among the privately insured population under

age 65 (Reschovsky, 1999/2000; Taylor, Beauregard, and Vistnes,

1995). ^top

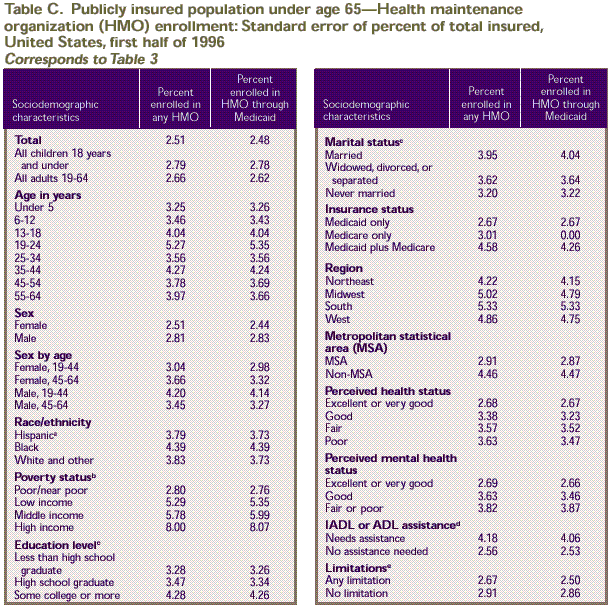

Publicly Insured Non-Elderly

Table 3 presents

enrollment in HMOs among the non-elderly population covered by

public insurance only. It includes people enrolled in an HMO through

Medicaid, Medicare, or other public programs that provide hospital

and medical coverage but not people covered by CHAMPUS (Armed-Forces-related

coverage). The table also shows data separately for those enrolled

through Medicaid. Among publicly insured Americans, a higher percent

of children (40.0 percent) than adults ages 19–64 (30.1 percent)

were enrolled in an HMO through Medicaid. Breaking this down further,

adults over age 44 were much less likely than younger adults to

be HMO members, while younger adults had an HMO enrollment rate

similar to that of children.

Although there were

no significant differences in HMO membership for publicly insured

non-elderly Americans by

sex, differences can be seen for age-sex groups. Among the publicly

insured population ages 19–44, women were much more likely

than men to be enrolled in any HMO (42.4 percent compared to 28.2

percent).

Race/ethnicity, poverty status, and marital

status did not significantly affect the rates of participation

in HMOs among the publicly insured population. There were, however,

differences by education level and type of public coverage. People

who had not graduated from high school were less likely to be enrolled

in an HMO than those with a high school education (28.0 percent

vs. 37.9 percent). In terms of insurance status, people with Medicaid

only were much more likely to be enrolled in an HMO (39.0 percent)

than either those with Medicare only (11.7 percent) or those with

Medicare plus Medicaid (20.8 percent).

Among non-elderly Americans, regional patterns

in HMO enrollment among the publicly insured were similar to patterns

among the privately insured, with those living in the West more

likely to be HMO members (49.2 percent) than those in the South

(27.3 percent) or the Northeast (34.7 percent). Overall, publicly

insured people living in metropolitan areas were much more likely

than those living elsewhere to be enrolled in an HMO (40.4 percent

vs. 24.0 percent), and this pattern also held for Medicaid recipients

considered separately.

One of the important differences in HMO enrollment

patterns between the privately insured and publicly insured non-elderly

population is in health status. The privately insured population

showed no differences in HMO enrollment by health status, but the

publicly insured non-elderly population showed significant differences

by several health status measures. HMO enrollment was higher for

people in excellent or very good health (40.0 percent) and good

health (38.6 percent) than for people in fair health (26.3 percent)

or poor health (26.9 percent). Similarly, people with excellent

or very good mental health were more likely than people with fair

or poor mental health to be enrolled in an HMO (39.6 percent vs.

26.5 percent). Publicly insured people who did not need assistance

with activities of daily living (ADLs) or instrumental activities

of daily living (IADLs) were more likely to be enrolled in an HMO

than those who did need such assistance ( 37.5 percent vs. 24.7

percent). People who did not have any health limitations that affected

work, housework, or school were more likely than those with limitations

to be enrolled in an HMO ( 38.4 percent vs. 24.8 percent).

^top

Elderly Medicare Enrollees

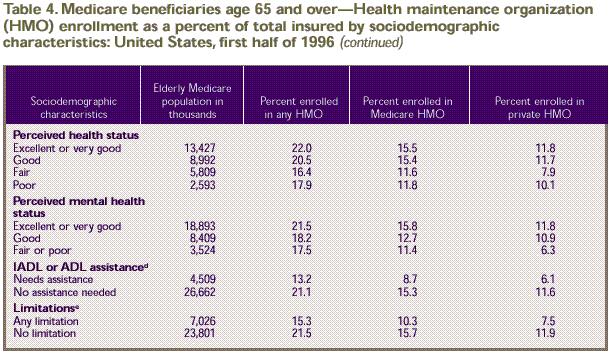

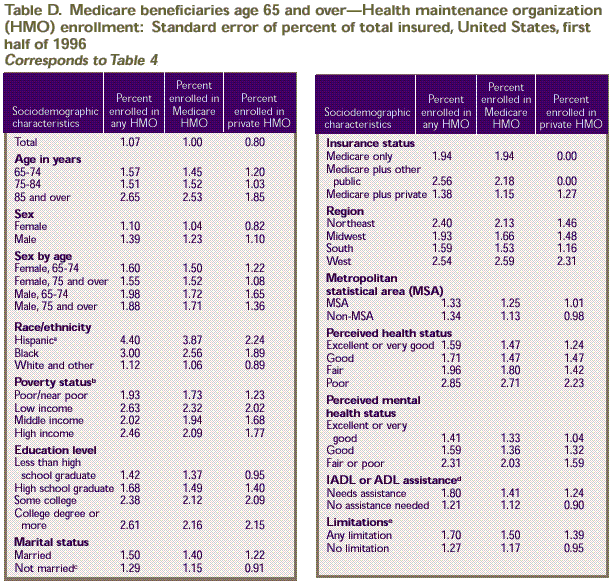

Table 4 presents

estimates of HMO enrollment for the Medicare-insured population

age 65 and over. Elderly people without Medicare coverage are not

included. The table presents separate statistics on HMO enrollment

through private insurance and HMO enrollment through Medicare.

A person can be enrolled in an HMO directly through Medicare as

part of the Medicare + Choice program. Another way a Medicare recipient

can be enrolled in an HMO is through a supplemental insurance policy,

sometimes called a Medigap plan, or through a retirement health

plan offered by a former employer. This is an important distinction

because about 61.5 percent of Medicare beneficiaries held private

coverage in addition to their Medicare coverage in 1996 (Vistnes

and Monheit, 1997). Twenty percent of all elderly noninstitutionalized

Medicare beneficiaries, or 6.2 million people, were enrolled in

an HMO through any source of insurance. About 14.3 percent of all

beneficiaries, or 4.5 million people, were enrolled in an HMO through

Medicare coverage.

HMO enrollment through Medicare and HMO enrollment

through private insurance have slightly different patterns by age

group. While there were no significant differences in Medicare

HMO enrollment by age group, Table 4 shows

that younger beneficiaries were more likely than older beneficiaries

to be enrolled in an HMO through private insurance (13.4 percent

of beneficiaries ages 65–74 vs. 7.4 percent for ages 75–84

and 6.8 percent for age 85 and over). Similarly, beneficiaries

ages 65–74 were more likely than those in older age groups

to be enrolled in an HMO through either source of insurance. There

are no significant differences by sex or age-sex groups.

Almost a third of Hispanics (32.3 percent)

were enrolled in any HMO (Medicare or private insurance enrollment).

This is significantly higher than overall HMO enrollment rates

among blacks (20.6 percent) and the white and other group (19.3

percent).

Low-income, middle-income, and high-income

elderly Medicare beneficiaries were more likely than poor and near-poor

beneficiaries to be enrolled in any HMO. Among poor or near-poor

beneficiaries, 15.5 percent were enrolled in an HMO, compared to

24.4 percent of low-income, 22.6 percent of middle-income, and

21.2 percent of high-income beneficiaries. Limiting the focus to

Medicare HMOs, a similar pattern existed. Only 11.7 percent of

poor and near-poor beneficiaries were enrolled in Medicare HMOs,

compared with 18.3 percent of low-income and 17.3 percent of middle-income

beneficiaries. There were no differences in HMO enrollment rates

by education level or marital status.

In 1996 enrolling in a Medicare HMO often meant

extra benefits, such as prescription drug coverage, which could

save beneficiaries the cost of a supplemental Medigap policy. Thus,

it is not surprising that the highest Medicare HMO enrollment rate

(20.6 percent) was among beneficiaries with Medicare only (no private

or public supplemental insurance). This rate was higher than the

HMO enrollment rates of 10.3 percent for beneficiaries with Medicare

and Medicaid and 12.2 percent for beneficiaries with Medicare and

private insurance.

Regional differences in HMO enrollment for

elderly Medicare beneficiaries followed patterns similar to those

of younger populations. HMO enrollment was most common in the West,

where 40.4 percent of Medicare beneficiaries were enrolled in an

HMO. Similarly, residents of metropolitan areas were more likely

to be enrolled in an HMO than those living in nonurban areas (24.0

vs. 6.8 percent).

Health status differences are of particular

concern for Medicare HMOs because the Health Care Financing Administration

did not adjust payments to HMOs for such differences in 1996. Among

all Medicare beneficiaries age 65 and over, there were no significant

differences in the rates of enrollment in Medicare HMOs by general

perceived health status or by mental health status. However, looking

at enrollment in private HMOs shows that Medicare beneficiaries

in fair health were less likely than those in very good and excellent

health to be enrolled. In addition, both Medicare and private HMO

enrollment rates show significant differences by need for ADL or

IADL assistance and by work or housework limitations. Beneficiaries

who required assistance with ADL or IADL activities were less likely

to be enrolled in an HMO through Medicare (8.7 percent) or through

private insurance (6.1 percent) than those who did not require

such assistance (15.3 and 11.6 percent, respectively). Similarly,

beneficiaries with limitations in the ability to do work or housework

were less likely to enroll in an HMO through Medicare (10.3 percent)

or through private insurance (7.5 percent) than those without such

limitations (15.7 and 11.9 percent, respectively).

^top

Conclusion

HMO enrollment grew

rapidly in the last decade, to the point that 91.6 million people

were enrolled in the first

half of 1996. This figure represents 41.9 percent of the total

insured population for that year. Although HMOs were commonplace

in 1996, there were significant differences in HMO enrollment by

insurance status, age group, race/ethnicity, poverty status, and

geographic area. Enrollment rates were higher among the privately

insured than the publicly insured and higher among children and

younger adults than older adults. Women of childbearing age were

more likely than men of the same age to be enrolled in an HMO.

Hispanics and blacks were more likely than whites and persons of

other races to be enrolled in an HMO. In addition, middle- and

high-income people were more likely than poor, near-poor, or low-income

people to be enrolled in an HMO. Within the publicly insured population,

there were some health status differences in HMO enrollment. Among

the population with Medicaid or Medicare, people who needed assistance

with ADL or IADL activities or who were limited in their ability

to work were less likely than other Medicaid or Medicare enrollees

to be enrolled in an HMO. Across all insurance groups, HMO enrollment

was higher in the West and in urban areas than in other locations. ^top

References

American Association of Health Plans. Managed

care facts. Washington (DC); 1998.

Cohen J. Design

and methods of the Medical Expenditure Panel Survey Household

Component. Rockville (MD): Agency

for Health Care Policy and Research; 1997. MEPS Methodology Report

No. 1. AHCPR Pub. No. 97–0026.

Cohen JW, Monheit

AC, Beauregard KM, et al. The Medical Expenditure Panel Survey:

a national health information

resource. Inquiry 1996;33:373–89.

Cohen S. Sample

design of the 1996 Medical Expenditure Panel Survey Household

Component. Rockville (MD): Agency

for Health Care Policy and Research; 1997. MEPS Methodology Report

No. 2. AHCPR Pub. No. 97–0027.

Eppig F. Personal communication from Franklin

Eppig, Health Care Financing Administration, to Jessica Banthin,

Agency for Healthcare Research and Quality; 1998 Mar 10.

Kerwin, J, Cantor

D, Sheridan S. Results of Rounds 3 and 4 of managed care cognitive

interviews for the household

portion of NMES. Westat Deliverable #1.4.3. March 6, 1995.

The Centers for Medicare and Medicaid Services.

Medicaid information page [cited 1999 Mar 4]. Available from: URL: http://www.cms.hhs.gov/medicaid/default.asp

Interstudy. HMO

industry report 8.2 press release [cited 1998 Nov 12].

Reschovsky JD. Do

HMOs make a difference? Data and methods. Inquiry 1999/2000;36(4):378–89.

Taylor AK, Beauregard

KM, Vistnes JP. Who belongs to HMOs: a comparison of fee-for-service

versus HMO enrollees.

Medical Care Research and Review 1995;22(3):389–408.

Vistnes JP, Monheit

AC. Health insurance status of the civilian noninstitutionalized

population: 1996. Rockville

(MD): Agency for Health Care Policy and Research; 1997. MEPS Research

Findings No. 1. AHCPR Pub. No. 97–0030.

^top

Tables

Table 1. Health maintenance organization (HMO) enrollment as a percent of total insured: United States, first half of 1996

Demographic Characteristics |

Number in thousands |

Percent enrolled in HMOs |

| Total population |

263,516 |

34.8 |

|

Insured population a |

| Total insured population a |

218,760 |

41.9 |

| Age in years |

|

|

| 18 and under |

62,912 |

46.8 |

| 19-64 |

124,279 |

45.0 |

| Total under 65 |

187,191 |

45.6 |

| 65 and over |

31,568 |

20.1 |

| Sex |

|

|

| Female |

114,319 |

42.1 |

| Male |

104,440 |

41.7 |

| Race/ethnicity |

|

|

| Hispanic b |

18,886 |

51.6 |

| Black |

25,407 |

47.2 |

| White and other |

174,466 |

40.1 |

| Poverty Status c |

|

|

| Poor/near poor |

34,762 |

32.7 |

| Low income |

28,570 |

37.0 |

| Middle income |

74,561 |

43.4 |

| High income |

80,867 |

45.6 |

a Includes

all persons covered by private insurance, Medicaid, Medicare,

CHAMPUS /CHAMPVA (Armed-Forces-related coverage), and other public

hospital/physician coverage.

b Includes

Hispanics of all races; the other race/ethnicity categories exclude

Hispanics.

c Limited to persons insured in Round 1 who reported

annual family income. Poor indicates family income is less

than 100 percent of the poverty line, near poor indicates

family income is 100 to less than 125 percent of poverty,

low income

indicates family income is 125 to less than 200 percent of

poverty, middle income indicates family income is 200 to

less than 400 percent of poverty, and high income indicates

family

income is 400 percent or more of poverty.

Source: Center

for Financing, Access, and Cost Trends, Agency for Healthcare

Research and Quality: Medical Expenditure Panel Survey Household

Component, 1996 (Round 1).

Table

2. Privately insured population under age 65—Health maintenance organization (HMO) enrollment as a percent of total insured, by sociodemographic characteristics: United States, first half of 1996

Sociodemographic Characteristics

|

Privately insured population in thousands |

Percent enrolled in HMOs |

| Total |

159,235 |

47.6 |

| All children 18 years and under |

47,730 |

49.5 |

| All adults 19-64 years |

111,504 |

46.8 |

| Age in years |

|

|

| Under 5 |

14,834 |

51.7 |

| 6-12 |

18,054 |

50.3 |

| 13-18 |

14,843 |

46.5 |

| 19-24 |

11,563 |

46.5 |

| 25-34 |

27,698 |

50.0 |

| 35-44 |

32,049 |

49.2 |

| 45-54 |

24,785 |

46.2 |

| 55-64 |

15,410 |

36.9 |

| Sex |

|

|

| Female |

80,646 |

48.6 |

| Male |

78,589 |

46.6 |

| Sex by Age |

|

|

| Female, 19-44 |

36,608 |

51.0 |

| Female, 45-64 |

20,678 |

42.9 |

| Male, 19-44 |

34,702 |

47.0 |

| Male, 45-64 |

19,517 |

42.3 |

| Race/ethnicity |

|

|

| Hispanic a |

11,998 |

62.0 |

| Black |

15,124 |

57.6 |

| White |

132,112 |

45.1 |

| Poverty Status b |

|

|

| Poor/near poor |

10,295 |

41.8 |

| Low income |

17,101 |

43.4 |

| Middle income |

60,874 |

47.6 |

| High income |

|

|

| Education Level c |

|

|

| Less than high school grad |

10,266 |

45.1 |

| High school grad |

36,876 |

44.7 |

| Some college |

29,535 |

49.6 |

| College degree or more |

34,452 |

47.0 |

| Marital Status |

|

|

| Marriedc |

73,748 |

45.7 |

| Widowed, divorced, or separated |

14,199 |

50.1 |

| Never married |

23,455 |

48.0 |

| Insurance status |

|

|

| Private only |

154,106 |

47.7 |

| Private plus public |

5,128 |

43.6 |

| Region |

|

|

| Northeast |

32,113 |

51.2 |

| Midwest |

40,163 |

37.8 |

| South |

53,029 |

44.9 |

| West |

33,929 |

59.9 |

| Metropolitan statistical area (MSA) |

|

|

| MSA |

130,693 |

51.6 |

| Non-MSA |

28,542 |

29.3 |

| Perceived health status |

|

|

| Excellent or very good |

118,375 |

47.3 |

| Good |

30,868 |

48.5 |

| Fair |

7,709 |

48.1 |

| Poor |

2,168 |

46.8 |

| Perceived mental health status |

|

|

| Excellent or very good |

131,730 |

47.5 |

| Good |

23,081 |

47.6 |

| Fair or poor |

4,276 |

51.9 |

| IADL or ADL assistance d |

|

|

| Needs assistance |

1,769 |

40.3 |

| No assistance needed |

157,466 |

47.7 |

| Limitationse |

|

|

| Any limitation |

5,129 |

43.3 |

| No limitation |

141,856 |

47.4 |

a Includes

Hispanics of all races; the other race/ethnicity categories exclude

Hispanics.

b Limited to persons insured in Round 1 who reported

annual family income. Poor indicates family income is less than

100 percent of the poverty line, near poor indicates family income

is 100 to less than 125 percent of poverty, low income indicates

family income is 125 to less than 200 percent of poverty, middle

income indicates family income is 200 to less than 400 percent

of poverty, and high income indicates family income is 400 percent

or more of poverty.

c Age 19 and over.

d Needs help in one or more instrumental activities

of daily living (such as shopping) or activities of daily living

(such as bathing).

e Includes limitations in work, school, and housework

for persons age 5 and over.

Source: Center

for Financing, Access, and Cost Trends, Agency for Healthcare

Research and Quality: Medical Expenditure Panel Survey Household

Component, 1996 (Round 1).

Table 3. Publicly insured population under age 65—Health maintenance organization (HMO) enrollment as a percent of total insured, by sociodemographic characteristics: United States, first half of 1996

Sociodemographic Characteristics

|

Publicly insured population in thousands |

Percent enrolled in any HMOs |

Percent Enrolled in HMO through Medicaid |

| Total |

26,131 |

36.5 |

35.6 |

| All children 18 years and under |

14,460 |

40.1 |

40.0 |

| All adults 19-64 years |

11,671 |

32.2 |

30.1 |

| Age in years |

|

|

|

| Under 5 |

5,854 |

40.3 |

40.2 |

| 6-12 |

5,630 |

42.3 |

42.1 |

| 13-18 |

2,976 |

65.4 |

35.4 |

| 19-24 |

1,743 |

41.7 |

40.7 |

| 25-34 |

3,068 |

34.0 |

33.5 |

| 35-44 |

2,946 |

38.6 |

38.0 |

| 45-54 |

1,998 |

22.9 |

18.3 |

| 55-64 |

1,917 |

20.4 |

15.4 |

| Sex |

|

|

|

| Female |

14,262 |

36.9 |

35.9 |

| Male |

11,869 |

36.0 |

35.2 |

| Sex by Age |

|

|

|

| Female, 19-44 |

5,069 |

42.4 |

41.6 |

| Female, 45-64 |

2,177 |

22.9 |

18.2 |

| Male, 19-44 |

2,687 |

28.2 |

27.7 |

| Male, 45-64 |

1,737 |

20.2 |

15.3 |

| Race/ethnicity |

|

|

|

| Hispanic a |

5,300 |

35.0 |

34.4 |

| Black |

7,427 |

36.8 |

36.7 |

| White |

13,404 |

37.0 |

35.4 |

| Poverty Status b |

|

|

|

| Poor/near poor |

18,352 |

34.1 |

33.5 |

| Low income |

4,168 |

34.9 |

33.3 |

| Middle income |

2,376 |

38.5 |

36.5 |

| High income |

1,217 |

44.4 |

42.2 |

| Education Level c |

|

|

|

| Less than high school graduate |

5,010 |

28.0 |

26.3 |

| High school grad |

4,224 |

37.9 |

35.5 |

| Some college or more |

2,281 |

31.2 |

29.5 |

| Marital Status |

|

|

|

| Marriedc |

3,883 |

34.9 |

31.8 |

| Widowed, divorced, or separated |

3.636 |

32.9 |

30.6 |

| Never married |

4,153 |

29.0 |

28.1 |

| Insurance status |

|

|

|

| Medicaid only |

23,328 |

39.0 |

39.0 |

| Medicare only |

1,586 |

11.7 |

0.0 |

| Medicaid plus Meidcare |

1,217 |

20.8 |

15.2 |

| Region |

|

|

|

| Northeast |

5,312 |

34.7 |

33.7 |

| Midwest |

5,207 |

36.3 |

34.9 |

| South |

8,526 |

27.3 |

26.6 |

| West |

7,085 |

49.2 |

48.2 |

| Metropolitan statistical area (MSA) |

|

|

|

| MSA |

19,976 |

40.4 |

39.3 |

| Non-MSA |

6,154 |

24.0 |

23.6 |

| Perceived health status |

|

|

|

| Excellent or very good |

13,097 |

40.0 |

39.6 |

| Good |

7,065 |

38.6 |

38.1 |

| Fair |

3,693 |

26.3 |

24.8 |

| Poor |

2,187 |

26.9 |

21.6 |

| Perceived mental health status |

|

|

|

| Excellent or very good |

15,901 |

39.6 |

38.9 |

| Good |

6,634 |

34.5 |

33.1 |

| Fair or poor |

3,507 |

26.5 |

25.4 |

| IADL or ADL assistance d |

|

|

|

| Needs assistance |

1,983 |

24.7 |

21.0 |

| No assistance needed |

24,148 |

37.5 |

36.8 |

| Limitationse |

|

|

|

| Any limitation |

4,450 |

24.8 |

20.6 |

| No limitation |

16,723 |

38.4 |

38.0 |

a Includes

Hispanics of all races; the other race/ethnicity categories exclude

Hispanics.

b Limited to persons insured in Round 1 who reported

annual family income. Poor indicates family income is less than

100 percent of the poverty line, near poor indicates family income

is 100 to less than 125 percent of poverty, low income indicates

family income is 125 to less than 200 percent of poverty, middle

income indicates family income is 200 to less than 400 percent

of poverty, and high income indicates family income is 400 percent

or more of poverty.

c Age 19 and over.

d Needs help in one or more instrumental activities

of daily living (such as shopping) or activities of daily living

(such as bathing).

e Includes limitations in work, school, and housework

for persons age 5 and over.

Source: Center

for Financing, Access, and Cost Trends, Agency for Healthcare

Research and Quality: Medical Expenditure Panel Survey Household

Component, 1996 (Round 1).

Table 4. Medicare beneficiaries age 65 and older—Health maintenance organization (HMO) enrollment as a percent of total insured by sociodemographic characteristics: United States, first half of 1996

Sociodemographic Characteristics

|

Elderly Medicare population in thousands |

Percent enrolled in any HMO |

Percent enrolled in Medicare HMO |

Percent enrolled in private HMO |

| Total |

31,171 |

20.0 |

14.3 |

10.8 |

| Age in years |

|

|

|

|

| 65-74 |

17,709 |

23.2 |

15.7 |

13.4 |

| 75-84 |

10,931 |

16.2 |

12.8 |

7.4 |

| 85 and older |

2,531 |

13.8 |

11.0 |

6.8 |

| Sex |

|

|

|

|

| Female |

18,210 |

19.7 |

14.2 |

9.9 |

| Male |

12,961 |

20.3 |

14.6 |

12.1 |

| Sex by Age |

|

|

|

|

| Female, 65-74 |

9,830 |

22.9 |

15.5 |

11.8 |

| Female, 75 and over |

8,379 |

16.0 |

12.6 |

7.6 |

| Male, 65-74 |

7,878 |

23.5 |

16.0 |

15.5 |

| Male, 75 and over |

5,083 |

15.4 |

12.4 |

6.8 |

| Race/ethnicity |

|

|

|

|

| Hispanic a |

1,419 |

32.3 |

23.0 |

7.8 |

| Black |

2,613 |

20.6 |

13.4 |

8.7 |

| White and other |

27,139 |

19.3 |

14.0 |

11.1 |

| Poverty Status b |

|

|

|

|

| Poor/near poor |

6,232 |

15.5 |

11.7 |

5.4 |

| Low income |

6,945 |

24.4 |

18.3 |

14.0 |

| Middle income |

10,406 |

22.6 |

17.3 |

13.5 |

| High income |

7,588 |

21.2 |

14.3 |

12.2 |

| Education Level |

|

|

|

|

| Less than high school graduate |

11,976 |

18.9 |

14.0 |

8.4 |

| High school graduate |

10,137 |

20.5 |

14.8 |

12.1 |

| Some college |

4,147 |

23.3 |

17.3 |

14.8 |

| College degree or more |

4,276 |

19.4 |

12.0 |

11.0 |

| Marital Status |

|

|

|

|

| Married |

17,383 |

20.4 |

14.4 |

12.1 |

| Not marriedc |

13,756 |

19.5 |

14.3 |

9.2 |

| Insurance status |

|

|

|

|

| Medicare only |

8,744 |

20.6 |

20.6 |

0.0 |

| Medicare plus other public |

3,223 |

15.8 |

10.3 |

0.0 |

| Medicare plus private |

19,204 |

20.4 |

12.2 |

17.5 |

| Region |

|

|

|

|

| Northeast |

6,723 |

17.1 |

11.9 |

8.1 |

| Midwest |

7,669 |

14.5 |

8.4 |

8.8 |

| South |

10,904 |

14.6 |

9.1 |

6.8 |

| West |

5,875 |

40.4 |

34.7 |

23.7 |

| Metropolitan statistical area (MSA) |

|

|

|

|

| MSA |

23,848 |

24.0 |

17.6 |

13.0 |

| Non-MSA |

7,322 |

6.8 |

3.8 |

3.7 |

a Includes

Hispanics of all races; the other race/ethnicity categories exclude

Hispanics.

b Limited to persons insured in Round 1 who reported

annual family income. Poor indicates family income is less than

100 percent of the poverty line, near poor indicates family income

is 100 to less than 125 percent of poverty, low income indicates

family income is 125 to less than 200 percent of poverty, middle

income indicates family income is 200 to less than 400 percent

of poverty, and high income indicates family income is 400 percent

or more of poverty.

c Includes widowed, divorced, separated, and never

married.

d Needs help in one or more instrumental activities

of daily living (such as shopping) or activities of daily living

(such as bathing).

e Includes limitations in work, school, and housework.

Note: A person

can be enrolled in an HMO directly through Medicare as part of

the Medicare + Choice program. Such people are said to be enrolled

in Medicare HMOs. Another way a Medicare recipient can be enrolled

in an HMO is through a supplemental insurance policy, sometimes

called a Medigap plan, or through a retirement health plan offered

by a former employer.

Source: Center

for Financing, Access, and Cost Trends, Agency for Healthcare

Research and Quality: Medical Expenditure Panel Survey Household

Component, 1996 (Round 1).

^top

Technical Appendix

The data in this report were obtained in the

first round of interviews for the Household Component (HC) of the

1996 Medical Expenditure Panel Survey (MEPS). MEPS is cosponsored

by the Agency for Healthcare Research and Quality (AHRQ) and the

National Center for Health Statistics (NCHS). The MEPS HC is a

nationally representative survey of the U.S. civilian noninstitutionalized

population that collects medical expenditure data at both the person

and household levels. The focus of the MEPS HC is to collect detailed

data on demographic characteristics, health conditions, health

status, use of medical care services, charges and payments, access

to care, satisfaction with care, health insurance coverage, income,

and employment. In other components of MEPS, data are collected

on residents of licensed or certified nursing homes and from the

supply side of the health insurance market.

Survey Design

The sample for the 1996 MEPS HC was selected

from respondents to the 1995 National Health Interview Survey (NHIS),

which was conducted by NCHS. NHIS provides a nationally representative

sample of the U.S. civilian noninstitutionalized population and

reflects an oversampling of Hispanics and blacks. The MEPS HC collects

data through an overlapping panel design. In this design, data

are collected through a precontact interview that is followed by

a series of five rounds of interviews over 2 1/2 years. Interviews

are conducted with one member of each family, who reports on the

health care experiences of the entire family. Two calendar years

of medical expenditure and utilization data are collected from

each household and captured using computer-assisted personal interviewing

(CAPI). This series of data collection rounds is launched again

each subsequent year on a new sample of households to provide overlapping

panels of survey data that will provide continuous and current

estimates of health care expenditures. The reference period for

Round 1 of the MEPS HC was from January 1, 1996, to the date of

the first interview, which occurred during the period from March

through July 1996.

Health Insurance Status

The household respondent was asked if, between

January 1, 1996, and the time of the Round 1 interview, anyone

in the family was covered by any of several sources of public and

private health insurance coverage. For this report, Medicare and

CHAMPUS/CHAMPVA coverage represent coverage as of the date of the

Round 1 interview. (CHAMPUS and CHAMPVA are the Civilian Health

and Medical Programs for the Uniformed Services and Veterans Affairs.)

All other sources of insurance represent coverage at any time during

the Round 1 reference period. For additional details on health

insurance status measures in MEPS, see Vistnes and Monheit (1997).

Public Coverage

For this report, individuals are considered

to have public coverage only if they met both of the following

criteria:

- They were not covered by private insurance.

- They were covered by one of the following

public programs: Medicare, Medicaid, or other public hospital/physician

coverage.

For this report, persons with CHAMPUS are not

included in this definition of public coverage because, due to

a skip pattern in the MEPS instrument, they were not asked specifically

about HMO coverage. Persons with CHAMPUS are not included in Tables

2, 3, or 4.

In order to present a complete picture of insured persons, however,

they are included in Table 1 along

with all other insured persons. The Defense Department confirmed

that for calendar year 1996 no one covered exclusively by CHAMPUS

was enrolled in an HMO.

Private Health Insurance

Private health insurance is defined for this

report as insurance that provides coverage for hospital and physician

care, including Medigap coverage. Insurance that provides coverage

for a single service only, such as dental or vision coverage, is

not counted.

Total Insured

The total insured population shown in Table

1 includes persons covered by Medicare, Medicaid, other public

hospital/physician programs, or private hospital/physician insurance

at any time during the Round 1 reference period. For this table

only, persons covered by CHAMPUS are also included. Individuals

covered only by noncomprehensive State-specific programs (e.g.,

Maryland Kidney Disease Program) or private single-service plans

(e.g., coverage for dental or vision care only, coverage for

accidents or specific diseases) are not considered to be insured.

HMO Enrollment Status

The Agency for Healthcare Research and Quality

used cognitive interviewing methods to develop a series of questions

for the MEPS HC on the managed care characteristics of health insurance

coverage. Open-ended semi-structured interviews were administered

to a total of approximately 100 respondents through four rounds

of question development and refinement. Respondents included privately

and publicly insured individuals with a variety of managed care

type plans. Answers concerning health plan type were validated

by obtaining the health plan information from employers or other

sources. Further details of the cognitive testing are described

in Kerwin, Cantor, and Sheridan (1995).

Cognitive pretesting

confirmed that household survey respondents were often unable

to identify their health plan's

type according to a standard descriptive name or acronym, such

as: PPO (preferred provider organization), POS (point-of-service

plan), EPO (exclusive provider organization), and IPA (independent

practice association). Only one acronym, "HMO," and its

definition as a health maintenance organization was reliably understood

by a majority of respondents included in the pretest sample. As

a result of the cognitive pretesting, the MEPS HC includes a series

of questions on HMO status and managed care characteristics of

health plans. These questions are administered to MEPS household

respondents during the first round of each panel (and whenever

there has been a change in insurance coverage), with separate questions

for private, Medicaid, and Medicare plans.

In this report HMO enrollees are distinguished

from all non-HMO enrollees. Distinctions between PPO, POS, and

other types of managed care plans are not made.

a Includes all persons

covered by private insurance, Medicaid, Medicare, CHAMPUS/CHAMPVA

(Armed-Forces-related coverage), and other public hospital/physician

coverage.

b Includes Hispanics of all races; the other race/ethnicity

categories exclude Hispanics.

c Limited to persons insured in Round 1 who reported

annual family income. Poor indicates family income is less than

100 percent of the poverty line, near poor indicates family income

is 100 to less than 125 percent of poverty, low income indicates

family income is 125 to less than 200 percent of poverty, middle

income indicates family income is 200 to less than 400 percent

of poverty, and high income indicates family income is 400 percent

or more of poverty.

Source: Center for Financing, Access,

and Cost Trends, Agency for Healthcare Research and Quality: Medical

Expenditure Panel Survey Household Component, 1996 (Round 1).

a Includes Hispanics

of all races; the other race/ethnicity categories exclude Hispanics.

b Limited to persons insured in Round 1 who reported

annual family income. Poor indicates family income is less than

100 percent of the poverty line, near poor indicates family income

is 100 to less than 125 percent of poverty, low income indicates

family income is 125 to less than 200 percent of poverty, middle

income indicates family income is 200 to less than 400 percent

of poverty, and high income indicates family income is 400 percent

or more of poverty.

c Age 19 and over.

d Needs help in one or more instrumental activities

of daily living (such as shopping) or activities of daily living

(such as bathing).

e Includes limitations in work, school, and housework

for persons age 5 and over.

Source: Center for Financing, Access,

and Cost Trends, Agency for Healthcare Research and Quality: Medical

Expenditure Panel Survey Household Component, 1996 (Round 1).

a Includes Hispanics

of all races; the other race/ethnicity categories exclude Hispanics.

b Limited to persons insured in Round 1 who reported

annual family income. Poor indicates family income is less than

100 percent of the poverty line, near poor indicates family income

is 100 to less than 125 percent of poverty, low income indicates

family income is 125 to less than 200 percent of poverty, middle

income indicates family income is 200 to less than 400 percent

of poverty, and high income indicates family income is 400 percent

or more of poverty.

c Age 19 and over.

d Needs help in one or more instrumental activities

of daily living (such as shopping) or activities of daily living

(such as bathing).

e Includes limitations in work, school, and housework

for persons age 5 and over.

Source: Center

for Financing, Access, and Cost Trends, Agency for Healthcare

Research and Quality: Medical

Expenditure Panel Survey Household Component, 1996 (Round 1).

Private Insurance HMO Enrollment

A person covered by private insurance was classified

as being covered by an HMO if any of the three following conditions

were met:

- The person reported purchasing his/her insurance

directly through an HMO.

- A person reporting private insurance coverage

identified the type of insurance company as an HMO.

- The person answered yes to the following question:

Now I will ask you a few questions about how (POLICYHOLDER)'s health insurance

through (ESTABLISHMENT) works for non-emergency care.

We are interested in knowing if (POLICYHOLDER)'s (ESTABLISHMENT) plan is

an HMO, that is, a health maintenance organization. With an HMO, you must

generally receive care from HMO physicians. For other doctors, the expense

is not covered unless you were referred by the HMO or there was a medical

emergency. Is (POLICYHOLDER)'s (INSURER NAME) an HMO?

Public Insurance HMO Enrollment Excluding Medicare

A person covered by Medicaid or by some other

public program (other than Medicare) that provides hospital/physician

insurance coverage was classified as having HMO coverage if either

of the following conditions was met:

- The person picked his or her plan from a list

of Medicaid HMOs in the area.

- The person answered yes to the following question:

Under {{Medicaid/{STATE NAME FOR MEDICAID}}/the program sponsored by a State

or local government agency which provides hospital and physician benefits}

(are/is) (READ NAME(S) FROM BELOW) signed up with an HMO, that is, a health

maintenance organization?

[With an HMO, you must generally receive care from HMO physicians. If another

doctor is seen, the expense is not covered unless you were referred by the

HMO, or there was a medical emergency.]

Medicare HMO Enrollment

A person can be enrolled in an HMO directly

through Medicare as part of the Medicare + Choice program. Such

people are said to be enrolled in Medicare HMOs. Another way a

Medicare recipient could be enrolled in an HMO is through a supplemental

insurance policy, sometimes called a Medigap plan, or through a

retirement health plan offered by a former employer.

A person covered

by Medicare was classified as being covered by an HMO if either

of the following conditions

was met:

- The person identified his or her plan from

a list of Medicare HMOs in the area.

- The person answered yes to either of the following

questions:

- Now I will ask you a question about

how (PERSON)'s Medicare works for non-emergency care. (When

answering this question, please include only insurance

from Medicare, not any privately purchased insurance.)

(Are/is) (PERSON) signed up with an HMO, that is, a health maintenance

organization? With an HMO, you generally receive care from HMO physicians.

- Does Medicare require (PERSON) to sign

up with a certain primary care doctor, group of doctors,

or with a certain clinic which he or she must go to for

all routine care?

Medicare beneficiaries with additional private

insurance may be enrolled in an HMO through either Medicare or

the private insurance. They were administered the sets of managed

care questions for both private insurance and Medicare. It is possible

that Medicare beneficiaries with both private and Medicare coverage

may confuse the source of their HMO coverage. Population Characteristics

All population characteristics used in this

report come from the 1996 MEPS HC Round 1 data collection effort

except for poverty status, which comes from data collected in Round

3 as explained below.

Age

The respondent was asked to report the age

of each family member as of the date of the Round 1 interview.

Race/Ethnicity

Classification by

race and ethnicity is based on information reported for each

family member. Respondents were

asked if the race of the sample person was best described as American

Indian, Alaska Native, Asian or Pacific Islander, black, white,

or other. In this report, American Indian, Alaska Native, Asian,

and Pacific Islander are included together with white in the category

labeled "white and other."

Respondents also were asked if the sample person's

main national origin or ancestry was Puerto Rican; Cuban; Mexican,

Mexicano, Mexican American, or Chicano; other Latin American; or

other Spanish. All persons whose main national origin or ancestry

was reported in one of these Hispanic groups, regardless of racial

background, were classified as Hispanic. Since the Hispanic grouping

can include black Hispanic, white Hispanic, and other Hispanic,

the race categories of black, white, and other do not include Hispanic

persons.

Region and Place of Residence

Individuals were

identified as residing in one of four main regions—Northeast, Midwest, South, and West—in

accordance with the U.S. Bureau of the Census definition. Place

of residence either inside or outside a metropolitan statistical

area (MSA) was defined according to the U.S. Office of Management

and Budget designation, which applied 1990 standards using population

counts from the 1990 U.S. census. An MSA is a large population

nucleus combined with adjacent communities that have a high degree

of economic and social integration with the nucleus. Each MSA has

one or more central communities containing the area's main population

concentration. In New England, metropolitan areas consist of cities

and towns rather than whole counties.

Poverty Status

Unlike the other demographic characteristics

used in this study, which are drawn from the Round 1 interview,

poverty status comes from 1996 family income data collected in

Round 3. For sections of Tables 1–4 showing

HMO enrollment by poverty status, the sample was limited to persons

insured in Round 1 who also reported on sources of income in Round

3. Population estimates were further poststratified to MEPS population

estimates of the total insured population.

Family income was

constructed by summing person-level total income for all members

of the family. Person-level total

income comprises annual earnings from wages, salaries, bonuses,

tips, and commissions; business and farm gains and losses; unemployment

and worker's compensation; interest and dividends; alimony, child

support, and other private transfers; private pensions, IRA (individual

retirement account) withdrawals, social security, and veterans'

payments; Supplemental Security Income and cash welfare payments

from public assistance, Aid to Families with Dependent Children,

and Aid to Dependent Children; gains or losses from estates, trusts,

partnerships, S corporations, rent, and royalties; and a small

amount of "other" income. Logical editing or weighted,

sequential hot-deck imputation was used to impute income amounts

for missing values.

Poverty status is determined by dividing family

income by the applicable poverty line (based on family size and

composition). The resulting percentages are grouped into five categories:

Poor indicates family income less than 100 percent of the poverty

line; near poor indicates family income from 100 to less than 125

percent of poverty; low income indicates family income from 125

to less than 200 percent of poverty; middle income indicates family

income from 200 to less than 400 percent of poverty; and high income

indicates family income 400 percent of poverty or more.

a Includes Hispanics

of all races; the other race/ethnicity categories exclude Hispanics.

b Limited to persons insured in Round 1 who reported

annual family income. Poor indicates family income is less than

100 percent of the poverty line, near poor indicates family income

is 100 to less than 125 percent of poverty, low income indicates

family income is 125 to less than 200 percent of poverty, middle

income indicates family income is 200 to less than 400 percent

of poverty, and high income indicates family income is 400 percent

or more of poverty.

c Includes widowed, divorced, separated, and never

married.

d Needs help in one or more instrumental activities

of daily living (such as shopping) or activities of daily living

(such as bathing).

e Includes

limitations in work, school, and housework.

Note: A person can be enrolled in an

HMO directly through Medicare as part of the Medicare + Choice

program. Such people are said to be enrolled in Medicare HMOs.

Another way a Medicare recipient can be enrolled in an HMO is through

a supplemental insurance policy, sometimes called a Medigap plan.

Source: Center

for Financing, Access, and Cost Trends, Agency for Healthcare

Research and Quality: Medical

Expenditure Panel Survey Household Component, 1996 (Round 1).

Health Status

Perceived Health Status

Health status measures

used in this report are from Round 1 of the 1996 MEPS HC. In

every round of MEPS, the

respondent is asked to rate the health of every member of the family.

The exact wording of the question is as follows: "In general,

compared to other people of (PERSON)'s age, would you say that

(PERSON)'s health is excellent, very good, good, fair, or poor?" A

similar question is asked about mental health status.

In order to generate the estimates presented

in Tables 2, 3, and 4, it

was assumed that nonrespondents to these questions were distributed

across health states following the distribution of respondents.

Assistance with ADLs and IADLs

Questions concerning

the need for assistance in activities of daily living (ADLs)

and in instrumental activities

of daily living (IADLs) are asked in every round of MEPS. Limitations

in the ability to perform IADLs are assessed by first asking the

respondent a screening question: "Does anyone in the family

receive help or supervision using the telephone, paying bills,

taking medications, preparing light meals, doing laundry, or going

shopping?" Limitations in the ability to perform ADLs are

assessed with the following question: "Does anyone in the

family receive help or supervision with personal care such as bathing,

dressing, or getting around the house?" Follow-up questions

are asked but are not used in this analysis. For this report, the

responses to the two screening questions are combined into a single

measure of need for any type of IADL or ADL assistance.

Limitations in Work/School/Housework

These limitations

include both paid work and unpaid housework, as well as limitations

in the ability to attend

school. The relevant question asks, "Is anyone in the family

limited in any way in the ability to work at a job, do housework,

or go to school because of an impairment or a physical or mental

health problem?" (emphasis in the question as indicated).

Sample Design and Accuracy of Estimates

The sample selected

for the 1996 MEPS, which was a subsample of the 1995 NHIS, was

designed to produce national

estimates that are representative of the civilian noninstitutionalized

population of the United States. Round 1 data were obtained for

approximately 9,400 households in MEPS—comprising 23,612 individuals—which

results in a survey response rate of 78 percent. This figure reflects

participation in both NHIS and MEPS.

The statistics presented in this report are

affected by both sampling error and sources of nonsampling error,

which include nonresponse bias, respondent reporting errors, and

interviewer effects. For a detailed description of the MEPS survey

design, the adopted sample design, and methods used to minimize

sources of nonsampling error, see J. Cohen (1997), S. Cohen (1997),

and Cohen, Monheit, Beauregard, et al. (1996). The MEPS person-level

estimation weights include nonresponse adjustments and poststratification

adjustments to population estimates derived from the March 1996

Current Population Survey based on cross-classifications by region,

age, race/ethnicity, and gender.

Tests of statistical

significance were used to determine whether the differences between

populations exist

at specified levels of confidence or whether they occurred by chance.

Differences were tested using Z-scores having asymptotic normal

properties at the 0.05 level of significance. Unless otherwise

noted, only statistically significant differences between estimates

are discussed in the text.

Rounding

Estimates presented

in the tables were rounded to the nearest 0.1 percent. Standard

errors, presented in Tables

A–D, were rounded to the nearest 0.01. Therefore, some

of the estimates for population totals of subgroups presented in

the tables will not add exactly to the overall estimated population

total. In addition, some of the estimates of total HMO enrollees

presented in the text of this report cannot be derived precisely

from the accompanying table because of the rounding of percents

in the tables.

HMO Enrollment: MEPS Estimates Compared With

Others

It is useful to compare MEPS estimates with

other estimates of HMO enrollment. The American Association of

Health Plans estimates that there were 67.5 million HMO enrollees

in 1996, representing about one-quarter of the population (American

Association of Health Plans, 1998). Estimates based on a census

of all HMO companies showed 58.7 million HMO enrollees as of January

1, 1996 (Interstudy, 1998). The MEPS estimate of 91.6 million persons,

or 34.8 percent of the total population, is higher than either

of these figures. As noted earlier, the MEPS data are based on

household respondents' understanding of HMO status, whereas both

of these other estimates are based on surveys of HMO companies.

It is possible that household respondents are over-reporting HMO

enrollment, perhaps describing their preferred provider organization

or other managed care plan as an HMO.

Administrative records of the number of Medicaid

HMO enrollees are not directly comparable to estimates published

in Table 3, which excludes the elderly

and Medicaid-covered persons in institutions. Nonetheless, figures

published by the Health Care Financing Administration (HCFA) provide

a useful benchmark since most Medicaid HMO enrollees are in the

community population. HCFA's administrative data show 8.6 million

Medicaid managed care enrollees as of June 1996, excluding persons

enrolled in Primary Care Case Management and carve-out plans that

do not provide a comprehensive set of benefits (Health Care Financing

Administration, 1999). The MEPS estimate of 9.5 million HMO enrollees

in Medicaid is 10 percent higher.

According to the 1995 Medicare Current Beneficiary

Survey, there were 4.38 million HMO enrollees among the Medicare

noninstitutionalized elderly population (Eppig, 1998), representing

13.9 percent of this population. These figures are directly comparable

to those shown here: 4.46 million HMO enrollees (derived from Table

4), or 14.3 percent of the noninstitutionalized Medicare population

age 65 and over (Table 4).

^top

Suggested

Citation:

Banthin, J. S. and Taylor,

A. K. Research Findings #15: HMO Enrollment in the United States: Estimates Based on Household Reports, 1996. January 2001. Agency

for Healthcare Research and Quality, Rockville,

MD.

http://www.meps.ahrq.gov/data_files/publications/rf15/rf15.shtml |

|