Chartbook #4:

State Differences in Job-Related Health Insurance, 1996

By Chris L. Peterson, Jessica P. Vistnes

Contents

Definitions of Terms Used in This Chartbook

Establishment—A particular workplace or location.

Firm—A company or business. A firm can have many establishments or only one.

Small firm—A firm with fewer than 50 employees.

Large firm—A firm with 50 or more employees.

Single coverage—Insurance that covers the employee only.

Family coverage—Insurance that covers the employee and the employee's family. If a plan offers more than one arrangement for family coverage, premium information for a family of four is used.

Total premium—Total amount paid for insurance, consisting of contributions by both the employer and employee.

Conventional indemnity plan—Insurance plan in which enrollees can go to the physicians of their choice on a fee-for-service basis. The plan does not have any providers associated with it.

Managed care plan—Insurance plan in which enrollees are restricted in their choice of providers or have a financial incentive to go to a preferred provider. Includes both exclusive provider plans and preferred provider plans.

Exclusive provider plan—Managed care plan, such as a health maintenance organization, in which enrollees must go to providers associated with the plan, except in an emergency.

Preferred provider plan—Managed care plan, such as a preferred provider organization or point-of-service plan, in which enrollees can go to a set of preferred providers associated with the plan or to other providers. If they go to a non-preferred provider, they face higher costs.

Level of significance—The maps show statistical

significance at the 1% and 5% levels. The test for differences at the

1% level is stricter than the test at the 5% level. This means that differences

at the 1% level are more likely to be differences that did not occur by

chance.

Return To Table Of Contents

Return To Table Of Contents

Executive Summary

This report presents estimates of workers' access to job-related health insurance, the cost of that insurance, and the choice of plans available to workers in 1996. Key findings include:

Access

Establishments were most likely to offer job-related insurance to at least some of their employees in Hawaii, where State law mandates that employers offer health insurance and pay for at least half of the premiums for most workers.

See Note 1.

Establishments in Mississippi, Arkansas, Oklahoma, and Nebraska were the least likely to offer insurance to their employees.

In every State, establishments in large firms were more likely to offer insurance than those in small firms.

Cost

The national average premium for single coverage was $1,997.The national average for family coverage was $4,953.

For both single and family coverage, the total premiums were most in the northeastern States of Connecticut, New Jersey, Massachusetts, and New York. Premiums were lowest in South Carolina, New Mexico, and Arkansas.

Workers contributed less than one-quarter of the total premiums for family coverage in Michigan, Ohio, Wisconsin, Connecticut, Illinois, New York, and

Utah. The national average was 29.1%.

Choice

Approximately 78% of establishments in the Nation offered workers only one plan.

In Wisconsin, Mississippi, Alabama, Minnesota, and West Virginia, more than 85% of the establishments that offered insurance had only one plan.

Conventional indemnity plans were more common in the eastern United States.

In every State but West Virginia and Maine, establishments were more likely to offer a managed care plan than a conventional indemnity plan.

Return To Table Of Contents

Introduction

In recent years, States have been increasingly active in crafting policies for their residents who lack health insurance coverage. In the early 1990s, most States established reforms to encourage more small firms to offer insurance to their workers. At the same time, States expanded Medicaid's eligibility thresholds. In 1997, Congress enacted the State Children's Health Insurance Program (SCHIP), which gave States the funds and flexibility to extend public insurance coverage to more uninsured children. (The enactment of SCHIP occurred after 1996, the time period covered in this report.)

In spite of increasing enrollment in public health insurance programs and decreasing private coverage from 1987 to 1996, job-related coverage remains the primary source of health insurance for most Americans. However, employer-sponsored coverage varies significantly across States. This report focuses on three key aspects of State differences in employer-sponsored health insurance. The first section looks at workers' access to job-related health insurance. The cost of insurance, which may be a factor in whether employers offer coverage and whether workers accept it, is examined in the second section. Finally, the report presents data on the choice of plans offered to employees.

Return To Table Of Contents

Data in This Report

The data in this report come from the private-sector sample of the Medical Expenditure Panel Survey Insurance Component (MEPS IC), conducted by the Agency for Healthcare Research and Quality. The MEPS IC is an annual survey of more than 25,000 responding private-sector establishments and governments. It provides estimates of job-related insurance both at the national level and at the State level for 40 States in a given year. The data shown in this chartbook refer exclusively to the 23,000 responding private-sector establishments and are drawn from tables that appear on the MEPS Web site:

http://www.meps.ahrq.gov

Specific sources for additional information presented in the discussion are listed in the references section.

Besides the Insurance Component, MEPS includes components

on households, medical providers, and nursing homes. With all of its components,

MEPS is a nationally representative survey that collects detailed information

on health status, health care use and expenses, and health insurance coverage

of individuals and families in the United States.

Unless otherwise noted, only differences that are statistically significant at least at the 0.05 level are discussed in the text. States whose rates differ from the national average at the 0.05 or 0.01 significance levels are identified on the maps. Note that estimates for certain States do not meet a standard of reliability or precision. Such estimates are indicated on the appropriate map. In such cases, the standard error of the estimate exceeds 30% of the estimate itself.

When the text states that findings are significant "in every State," this refers to the 40 States for which MEPS is able to make State-specific estimates. The District of Columbia and 10 States—Alaska, Delaware, Idaho, Montana, New Hampshire, North Dakota, Rhode Island, South Dakota, Vermont, and Wyoming—are excluded from individual analysis because of limited sample size. In the future, sufficient sample sizes for obtaining State-specific estimates will be gathered from these States on a rotating basis.

On each map, the 40 States for which estimates have been made are grouped into thirds of about 13 or 14 States based on their rankings and are shaded accordingly. In a few cases, the number of States in the groups were varied to make the grouping more valuable for comparisons. For example, if the rate in more than 14 States was significantly below the national average, the "bottom third" included all of them.

When a State is described as having the highest or lowest

rate, this means that it is significantly different from the national

average, but not that it is significantly different from all other States.

For example, Maine had the highest percentage of workers who were eligible

for the insurance offered by their employer (88.5%). While this rate is

statistically different from the national average, it is not statistically

different from the rates in Ohio (87.4%) or South Carolina (87.2%). The

text, however, may mention that workers in Maine were the most likely

to be eligible for the insurance offered by their employer.

In this report, "establishment" refers to a particular workplace or location. "Firm" refers to a company or business. A firm can have many establishments or only one. "Single coverage" refers to insurance that covers only the employee. "Family coverage" is for the employee and the employee's family. If a plan offers more than one arrangement for family coverage, the survey asks for premium information for a family of four.

The premium data in MEPS do not assume a standardized package of benefits for all health insurance plans. Because plans offer various benefits, higher premiums in a State may indicate that the plans in that State offer more generous benefits. The variations in premiums by State also reflect differences in medical costs, enrollment patterns, State regulations, and plan types.

Return To Table Of Contents

Section 1: Access

Job-related insurance plays a critical role in covering American workers and their families. Yet many workers may not receive needed medical care and are exposed to catastrophic financial risk because they do not have access to such coverage. In fact, among working-age Americans who are uninsured, more than two-thirds are employed (Vistnes and Monheit, 1997). In which States are establishments most likely to offer health insurance to their workers?

Select to access Map.

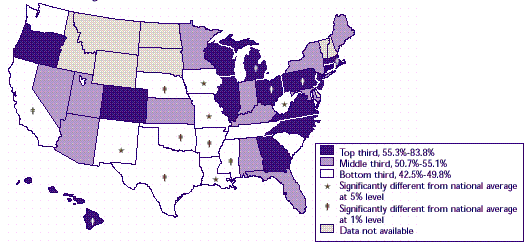

- Establishments were most likely to offer insurance to at least some of their employees in Hawaii (83.8%), where employers are mandated by State law to offer coverage to most workers. The other States where establishments were most likely to offer health insurance were Ohio (61.4%), Massachusetts (60.1%), Pennsylvania (60.0%), and Michigan (58.6%).

- In 14 States, less than half of the establishments offered health insurance. Offer rates were lowest in Mississippi (42.5%), Arkansas (45.3%), and Oklahoma (45.7%).

Return To Table Of Contents

Are large-firm establishments more likely to offer health insurance across the States?

Select to access Maps.

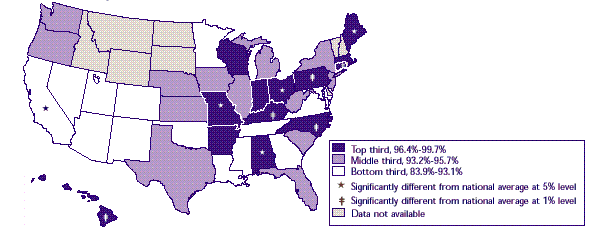

- In every State, establishments that were part of large firms (50 or more employees) were more likely than those in small firms to offer insurance.

- In Hawaii, nearly four out of five small-firm establishments offered health insurance (79.7%), compared to the next-highest rate in Massachusetts, where just over half of such establishments offered insurance (50.8%).

Return To Table Of Contents

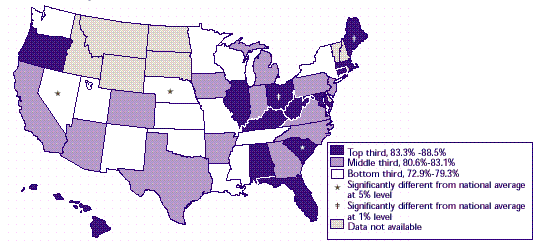

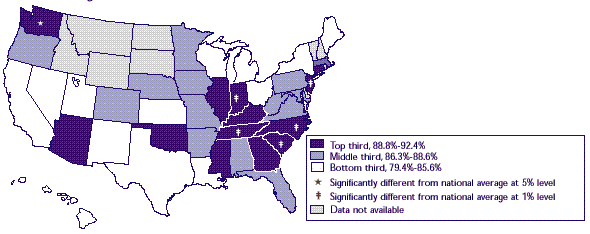

When health insurance is offered at the workplace, does the likelihood that workers will be eligible for coverage vary by State?

Select to access Map.

When an establishment offers insurance, not all of its workers may be eligible for coverage. Part-time employees may be ineligible. New employees may be excluded until they have completed a waiting period. Workers with pre-existing conditions also may not be eligible.

See Note 2.

- Employees in firms offering insurance were most likely to be eligible for coverage in Maine (88.5%), Ohio (87.4%), and South Carolina (87.2%).

- Eligibility was least likely for employees in Nevada (72.9%) and Nebraska (74.6%).

Return To Table Of Contents

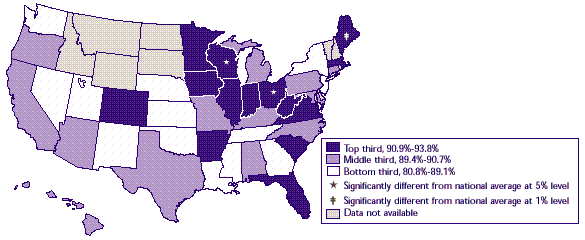

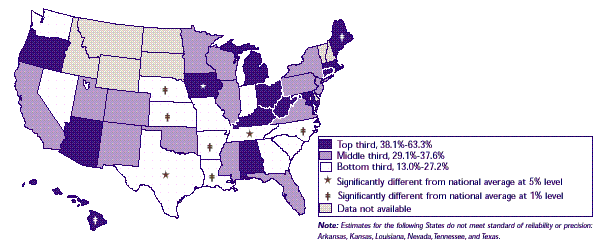

Are full-time employees more likely than part-time employees to be eligible for coverage across the States?

Select to access Maps.

- The difference in eligibility between full- and part-time employees was significant in every State.

- The gap in the eligibility rates between full- and part-time employees was smallest in Hawaii (90.4% for full-time, 62.2% for part-time) and Maine (93.8% for full-time, 63.3% for part-time), although the difference was still significant.

- The difference was greatest in Arkansas, where 91.7% of full-time employees in establishments that offered insurance were eligible, compared to only 13.0% of part-time employees.

Return To Table Of Contents

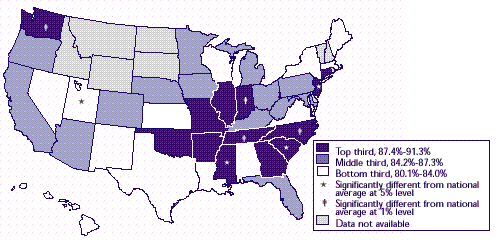

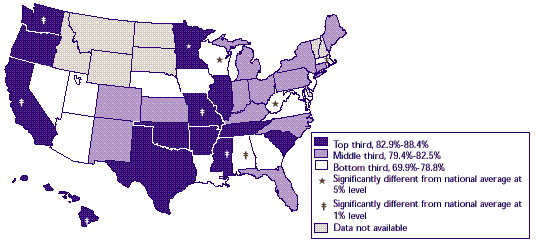

In which States are workers who are eligible for coverage most likely to enroll?

Select to access Map.

Even when workers are eligible for job-related insurance, they may choose not to enroll. They may already be covered through their spouse's employer, or they may think that the premiums are too expensive or that they do not need health insurance.

- Among workers eligible for coverage through their job, those in Utah were the least likely to enroll (81.5%).

- Enrollment rates were at least 90% in four States—Washington (91.3%), Mississippi (91.3%), Tennessee (90.4%), and Indiana (90.0%).

Across States, are employees in large firms more likely to enroll?

Select to access Maps.

- The disparity in enrollment rates between large and small firms was significant in 16 States.

- In no State were enrollment rates significantly higher in small firms than in large firms.

- Enrollment rates among workers in small firms were lowest in Massachusetts (69.9%).

Return To Table Of Contents

Section 2: Cost

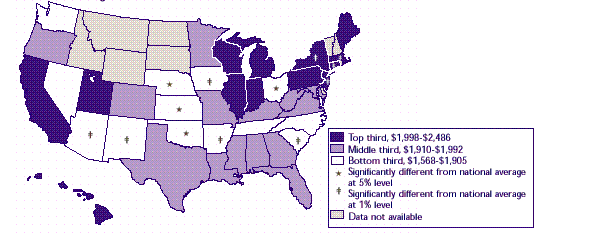

Many employers may not offer insurance because of the cost. Even when they do offer coverage, the portion of the premium that workers must pay may place such coverage out of reach for many Americans. Does the average total health insurance premium for single coverage vary across States?

Select to access Map.

The total health insurance premium for job-related coverage consists of contributions by both the employer and the employee. The variations by State reflect differences in medical costs, enrollment patterns, State regulations, and the generosity of health plan benefits and plan types.

- All of the States where the annual premium was higher than the national average were in the Northeast—Connecticut ($2,486), New Jersey ($2,380), Massachusetts ($2,316), and New York ($2,183).

- Premiums were below the national average in nine States, including five where the premiums were less than $1,800—South Carolina ($1,568), New Mexico ($1,714), Arkansas ($1,724), Oklahoma ($1,736), and Arizona ($1,780).

Return To Table Of Contents

Where do workers pay the most for single coverage?

Select to access Map.

- The employee contribution was highest in Massachusetts ($518), New Mexico ($513), and Alabama ($478).

- In eight States, the employee contribution was less than the national average of $338. The contribution in three of these States was less than $250—Hawaii ($198), Michigan ($205), and Oregon ($237).

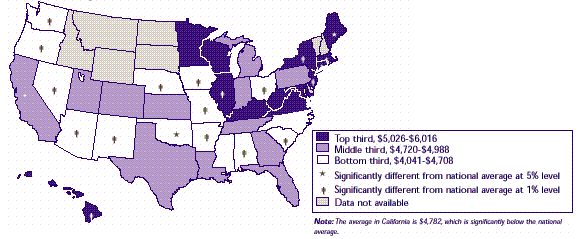

Does the average total health insurance premium for family coverage vary among States?

Select to access Map.

The total health insurance premium for job-related coverage consists of contributions by both the employer and the employee. The variations by State reflect differences in medical costs, enrollment patterns, State regulations, and the generosity of health plan benefits and plan types.

- The family premiums exceeded the national average in seven States—Massachusetts ($6,016), New Jersey ($5,870), Connecticut ($5,656), New York ($5,360), Hawaii ($5,350), Illinois ($5,338), and Maine ($5,142).

- The family premiums were below the national average in 14 States, including 6 where the premiums were less than $4,500—South Carolina ($4,041), New Mexico ($4,142), Arkansas ($4,197), Nevada ($4,455), Oregon ($4,462), and Washington ($4,468).

Return To Table Of Contents

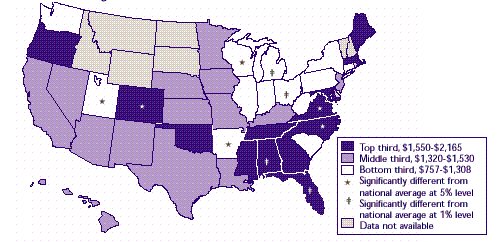

Do workers in different States pay the same for family coverage?

Select to access Map.

- The average employee contribution was above the national average in Florida ($2,165), Alabama ($1,920), Colorado ($1,703), North Carolina ($1,695), and Virginia ($1,656).

- It was below the national average in Michigan ($757), Ohio ($920), Utah ($1,178), Wisconsin ($1,180), and Arkansas ($1,197).

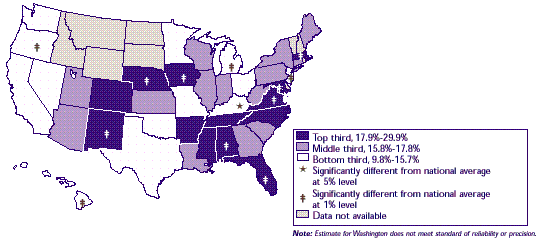

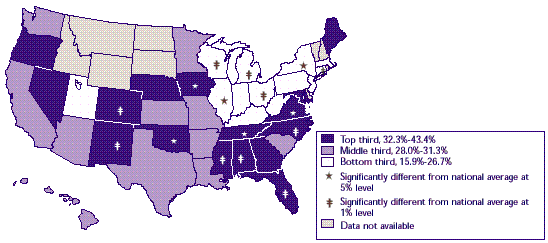

What percent of the premium for single and family coverage do employees pay across States?

Select to access Maps.

- The average employee contribution for single coverage ranged from less than 10% of the total premium (Hawaii) to nearly 30% (New Mexico).

- For family coverage, employees contributed anywhere from 15.9% (Michigan) to 43.4% (Florida).

- The employee contribution rate was higher for family coverage than for single coverage in all but four States (Massachusetts, New Mexico, West Virginia, and Pennsylvania).

- The difference between the employee contribution rate for family coverage and single coverage was greatest in Oregon (23.9 percentage points) and Oklahoma (20.6 percentage points).

- Workers contributed less than one-quarter of the total premiums for family coverage in Michigan, Ohio, Wisconsin, Connecticut, Illinois, New York, and Utah.

Return To Table Of Contents

Section 3: Choice

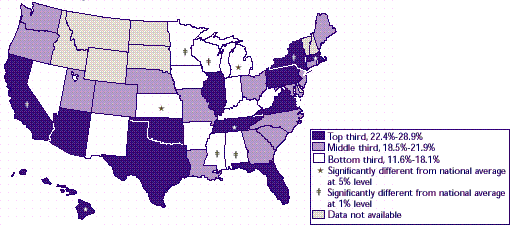

Health insurance plans differ in important ways. Some restrict enrollees' choice of providers, while others do not. Some plans require a higher fee for a doctor's visit than others do. With a choice of plans, workers can choose the plan that best meets their needs in terms of both benefits and cost. In which States are establishments most likely to offer a choice of health insurance plans?

Select to access Map.

- Establishments were most likely to offer a choice of plans in California (28.9%), Tennessee (28.6%), New York (27.9%), Hawaii (27.6%), and Massachusetts (27.0%).

- They were least likely to offer a choice of plans in the Midwest and South—Wisconsin (11.6%), Mississippi (11.7%), Alabama (12.9%), Minnesota (13.0%), Kansas (15.4%), and Michigan (17.7%).

Return To Table Of Contents

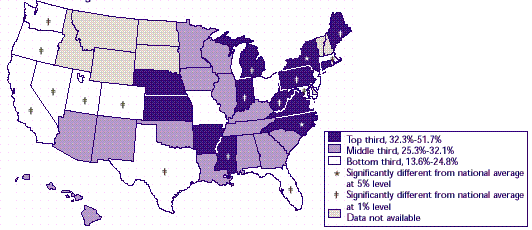

Where are establishments most likely to offer conventional indemnity plans?

Select to access Map.

A conventional indemnity plan is one in which enrollees can go to the physicians of their choice on a fee-for-service basis. The plan does not have any providers associated with it.

- Most of the States where establishments were more likely to offer indemnity plans were in the eastern part of the United States.

- Only in West Virginia (51.7%) and Maine (51.0%) did more than half of establishments offering insurance have an indemnity plan.

- Most of the States where indemnity plans were least likely to be offered were in the West.

- Less than one in seven establishments that offered insurance in California (13.6%) had indemnity plans.

Return To Table Of Contents

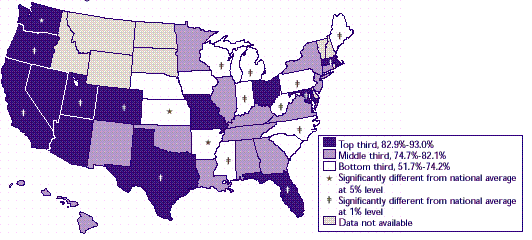

Where are establishments most likely to offer managed care plans?

Select to access Map.

In a managed care plan, enrollees are restricted in their choice of providers or have a financial incentive to go to a preferred provider. Managed care plans include both exclusive provider plans such as health maintenance organizations (HMOs) and preferred provider plans such as preferred provider organizations (PPOs) and point-of-service plans (POSs).

- Managed care plans were available in more than 9 out of 10 establishments in California (93.0%) and Massachusetts (92.7%) that offered insurance.

- They were least often available in West Virginia (51.7%) and Maine (57.9%). In fact, in every State besides these two, establishments were significantly more likely to offer a managed care plan than a conventional indemnity plan.

Return To Table Of Contents

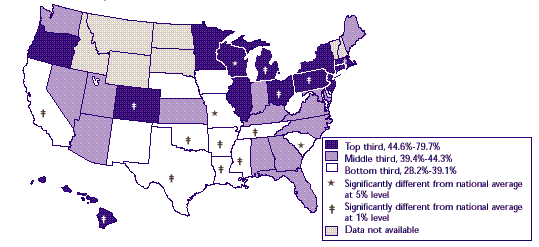

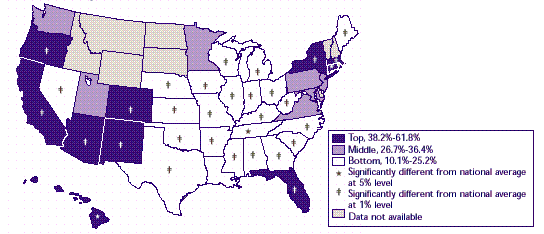

Where are establishments most likely to offer exclusive provider plans?

Select to access Map.

Exclusive provider plans (for example, HMOs) require that enrollees go to providers associated with the plan except in an emergency. There is typically no cost or a small fixed cost for each physician visit.

- Establishments offering insurance in Massachusetts (61.8%) and California (60.5%) were nearly twice as likely as establishments nationwide to offer an exclusive provider plan.

- In general, those in the South and Midwest were much less likely to offer such plans to their workers.

- In Mississippi, exclusive provider plans were available in only a tenth of establishments that offered insurance.

Return To Table Of Contents

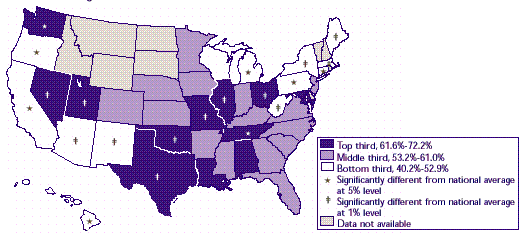

Where are establishments most likely to offer preferred provider plans?

Select to access Map.

In a preferred provider plan (for example, PPO or POS), enrollees can go to a set of "preferred" providers associated with the plan or to other providers of their choice. If they go to a nonpreferred provider, they face higher out-of-pocket costs.

- The four States in which establishments offering insurance are most likely to offer preferred provider plans are located in the central United States—Missouri (72.2%), Oklahoma (70.5%), Texas (68.9%), and Illinois (67.8%).

- Of the six States in which establishments are least likely to offer such plans, five are in the eastern United States—West Virginia (40.2%), Maine (41.4%), Massachusetts (42.4%), Pennsylvania (45.6%), and Connecticut (46.2%).

Return To Table Of Contents

Looking Ahead: Future MEPS Data on State Differences in Job-Related Health Insurance

These data provide a snapshot of State differences in job-related health insurance in 1996. Future MEPS data can be used to follow trends over time, as well as to provide additional insights into differences between States.

References

Branscome JM, Cooper PF, Sommers J, et al. Private employer-sponsored health insurance: new estimates from the 1996 MEPS-IC. Health Affairs 2000 Jan.-Feb.;19(1).

Cohen JW, Monheit AC, Beauregard KM, et al. The Medical Expenditure Panel Survey: a national health information resource. Inquiry 1996;33:373-89.

Cooper PF, Schone BS. More offers, fewer takers for employment-based health insurance: 1987 and 1996. Health Affairs 1997;16(6):142-9.

Sommers JP. List sample design of the 1996 Medical Expenditure Panel Survey Insurance Component. Rockville (MD): Agency for Health Care Policy and Research; 1999. MEPS Methodology Report No. 6. AHCPR Pub. No.99-0037.

State of Hawaii Department of Labor and Industrial Relations. Digest of Chapters 386, 392, and 393: Hawaii Workers' Compensation, Temporary Disability Insurance and Prepaid Health Care Laws. Form DC-1, revised Oct. 1992.

Vistnes JP, Monheit AC. Health insurance status of the civilian noninstitutionalized population: 1996. Rockville (MD): Agency for Health Care Policy and Research; 1997. MEPS Research Findings No. 1. AHCPR Pub. No.97-0030.

Return To Table Of Contents

Notes

Note 1: Private employers in Hawaii are not required to offer health insurance to the following workers: Federal, State, and county workers; workers employed for less than 20 hours a week; agricultural seasonal workers; insurance and real estate salesmen paid solely by commission; individuals working for son, daughter, or spouse; children under age 21 working for father or mother; workers covered as dependents under a qualified health care plan; workers covered by State-governed medical assistance; or workers receiving public assistance. To be covered under the mandate, workers must have worked four consecutive weeks of 20 or more hours a week and earned monthly wages of at least 86.67 times the Hawaii minimum hourly wage, which is presently the Federal minimum wage of $5.25. Employers are required to pay at least half of the premium cost. Note 2:

The 1996 MEPS IC data were obtained prior to implementation of the Health Insurance Portability and Accountability Act (HIPAA), which requires that insurers not deny coverage to a worker on the basis of health status. Employers may refuse to cover a pre-existing condition for up to 12 months for new employees, but employees can reduce the length of that waiting period by the length of prior coverage.

Return To Table Of Contents

Percent of private-sector establishments offering health insurance, 1996

National average = 53.2%

Return To Table Of Contents

Percent of establishments offering health insurance, 1996

Large firms

National average = 93.8%

Return To Table Of Contents

Percent of establishments offering health insurance, 1996

Small firms

National average = 42.1%

Return To Table Of Contents

Percent of employees eligible for insurance in establishments offering health insurance, 1996

National average = 81.5%

Return To Table Of Contents

Percent of employees eligible for

insurance in establishments offering health insurance, 1996 Full

time

National average = 89.8%

Return To Table Of Contents

Percent of employees eligible for insurance in

establishments offering health insurance, 1996 Part time

National average = 33.7%

Return To Table Of Contents

Percent enrolled among employees

eligible for job-related insurance, 1996

National average = 85.4%

Return To Table Of Contents

Percent

enrolled among employees eligible for job-related single insurance

coverage, 1996 Large firms

National average = 86.5%

Return To Table Of Contents

Percent enrolled among employees eligible for

job-related single insurance coverage, 1996 Small firms

National average = 81.2%

Return To Table Of Contents

Average

total premium for job-related single insurance coverage, 1996

National average = $1,997

Return To Table Of Contents

Average

annual employee contribution for job-related single insurance coverage,

1996

National average = $338

Return To Table Of Contents

Average

total annual premium for job-related family insurance coverage, 1996

National average = $4,953

Return To Table Of Contents

Average annual employee contribution

for job-related family insurance coverage, 1996

National average = $1,439

Return To Table Of Contents

Percent

of total premium for job-related insurance paid by worker, 1996 Single

coverage

National average = 16.9%

Return To Table Of Contents

Percent of total premium for job-related

insurance paid by worker, 1996 Family coverage

National average = 29.1%

Return To Table Of Contents

Percent

that have two or more plans among establishments offering insurance, 1996

National average = 21.8%

Return To Table Of Contents

Percent that have at least one conventional indemnity plan among establishments offering insurance, 1996

National average = 28.1%

Return To Table Of Contents

Percent

that have at least one managed care plan among establishments offering

insurance, 1996

National average = 79.0%

Return To Table Of Contents

Percent that have at least one

exclusive provider plan among establishments offering insurance, 1996

National average = 32.7%

Return To Table Of Contents

Percent

that have at least one preferred provider plan among establishments

offering insurance, 1996

National average = 55.5%

Return To Table Of Contents

Order your free CD-ROM:

MEPS IC-001: 1996 Employer-Sponsored Health Insurance Data Tables by State and by Establishment Characteristics.

Write:

AHRQ Publications Clearinghouse

Attn: 99-DP07

P.O. Box 8547

Silver Spring, MD 20907

Or call:

1-800-358-9295 and ask for AHCPR 99-DP07.

For these and other data, visit the MEPS Web site at:

http://www.meps.ahrq.govReturn To Table Of Contents

| Suggested Citation: Chartbook #4: State Differences in Job-Related Health Insurance, 1996. February 2000. Agency for Healthcare Research and Quality, Rockville, MD.

http://www.meps.ahrq.gov/data_files/publications/cb4/cb4.shtml |

|