Chartbook #5:

Health Care Expenses in the Community Population, 1996

By Steven R. Machlin, M.S., Joel W. Cohen, Ph.D., Samuel H. Zuvekas, Ph.D., Joshua Thorpe, M.P.H., Christopher T. Lee, M.P.H.

Contents

The estimates in this report are based on the most recent data available from MEPS at the time the report was written. However, selected elements of MEPS data may be revised on the basis of additional analyses, which could result in slightly different estimates from those shown here. Please check the MEPS Web site for the most current file releases—www.meps.ahrq.gov

Executive Summary

In 1996, the average expense per person in the U.S. civilian noninstitutionalized population (including people with no expenses) was $2,038. The average for people with an expense (about 85 percent of the population) was $2,389.

About half of all people had expenses of less than $395 (the median value), while the median for people with expenses was $566. Median expenses were substantially lower than average expenses because a small percentage of people incurred a disproportionately large share of medical expenses.

Hospital inpatient stays made up the largest share of national health care expenses (38 percent) in 1996, followed by ambulatory services from both physician and nonphysician providers (33 percent).

The vast majority of medical expenses were paid for by third-party payers (82 percent in total), while 18 percent were paid out of pocket by individuals and families. Private insurance was the largest third-party payer, covering 45 percent of total expenses.

Medical expenses varied substantially by age in 1996, with average expenses per person by far the highest among older people ($5,370 for the population age 65 and over). Average expenses for adults ages 18-64 were approximately double those for children but only about one-third as large as for the elderly.

Uninsured people under age 65 had substantially lower per capita expenses than their counterparts with private or public insurance coverage.

The percent of health expenses paid out of pocket was highest for children ages 6-17 years (28 percent) and lowest for children under 6 (9 percent). Among people under 65, the uninsured paid for a higher share of their total medical expenses out of pocket (43 percent) than people with private (20 percent) or public insurance (7 percent).

Return To Table Of Contents

Introduction

This chartbook presents data from the Medical Expenditure Panel Survey (MEPS) on spending in 1996 for medical services and supplies for the civilian noninstitutionalized (community) population. This kind of detailed information has not been available since the data from the 1987 National Medical Expenditure Survey were released in the early 1990s. Since that time, the health care system in the United States has undergone tremendous change, making the need for updated expense data critical.

Expenses refer to payments for health care services. More specifically, they are defined as the sum of direct payments for care provided during the year, including out-of-pocket payments and payments by private insurance, Medicaid, Medicare, and other sources. Payments for over-the-counter drugs, alternative care services, and phone contacts with medical providers are not included. Indirect payments not related to specific medical events, such as Medicaid Disproportionate Share and Medicare Direct Medical Education subsidies, also are not included.

The report is organized into four sections. Section 1 shows national expenses by amount, type of service, and source of payment. Sections 2-4 illustrate variation in different aspects of health care spending by selected population characteristics (age, race/ethnicity, income, insurance status, and health status). Section 2 shows per capita expenses, Section 3 shows the distribution of expenses by type of service, and Section 4 shows out-of-pocket expenses. See the section "Definitions of Terms" for information on the categories used for type of service, source of payment, and population characteristics.

This chartbook and other MEPS publications are available electronically on the MEPS Web site at http://www.meps.ahrq.gov

Return To Table Of Contents

Sources of Data for This Report

The estimates presented in this chartbook are

drawn from the 1996 Medical Expenditure Panel Survey (MEPS) Household

Component. MEPS is the third in a series of medical expenditure surveys

conducted by the Agency for Healthcare Research and Quality (formerly

the Agency for Health Care Policy and Research). The MEPS Household

Component is a nationally representative survey that collects detailed

information on health status, health care use and expenses, and health

insurance coverage of individuals and families in the U.S. civilian

noninstitutionalized (community) population.

In some cases, totals may not add precisely to 100 percent as a consequence of rounding. Because of small sample sizes, people identified as American Indians, Aleuts, Eskimos, or other races are not included in comparisons by race/ethnicity, although they are included in the other charts. Only differences that are statistically significant at the 0.05 level are discussed in the text.

The numbers shown in this chartbook are primarily drawn from MEPS public use file HC-012, updated with public use file HC-012S1. (See the MEPS Web site http://www.meps.ahrq.gov.)

Additional and more detailed information on 1996 expenditures can be found in MEPS Research Findings No. 12, "Health Care Expenses in the United States, 1996." The estimates presented here differ slightly from corresponding estimates in MEPS Research Findings No. 12 because of revisions made to the estimates for prescribed medicines.

Return To Table Of Contents

Section 1: Overall Expenses

The United States spends a larger share of its Gross Domestic Product on health care than any other major industrialized country. To understand health care spending in the United States, it is necessary to examine how payments are distributed across types of services, payment sources, and different segments of the population. This section presents summary statistics on the amount, type, and sources health care spending for the U.S. community population in 1996.

What proportion of the community population had medical expenses and how much was paid?

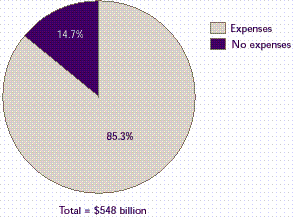

- In 1996, 85 percent of the U.S. civilian noninstitutionalized population, about 229 million people, had some type of medical expense. The total payments made for health care services and supplies for this population were about $548 billion.

- Of the 15 percent of the population with no expenses, a small proportion (approximately 5 percent of this group) received some care for which no payments were made.

Return To Table Of Contents

How does the MEPS estimate of medical expenses compare with the National Health Accounts?

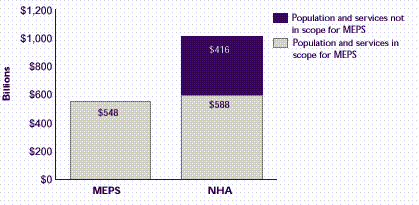

- The MEPS estimate of national medical expenses for 1996 is substantially lower than the estimate from the National Health Accounts (NHA) of the Health Care Financing Administration (HCFA). However, the NHA are more expansive than MEPS in the scope of expenses included. The NHA also include expenses for people who are not part of the civilian noninstitutionalized population.

- AHRQ and HCFA staff have estimated that over 90 percent of the difference in expense estimates between MEPS and the NHA (about $416 billion) is attributable to the more extensive range of items and broader population included in the NHA. The remaining difference probably stems from irreconcilable definition and measurement differences between the two sources and statistical sampling error associated with the estimates.

Return To Table Of Contents

What are the average annual medical expenses per person?

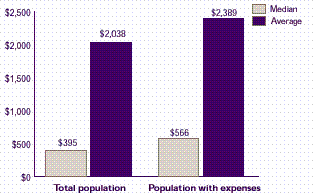

- The average expense per person in the U.S. community population (including people with no expenses) was about $2,038. The average for people with an expense (about 85 percent of the population) was $2,389.

- About half of all people had expenses of less than $395 (the median value). The median for people with expenses was $566.

- Median expenses were substantially lower than average expenses because a small percentage of people incurred a disproportionately large share of medical expenses.

Return To Table Of Contents

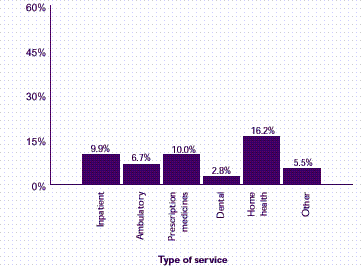

How are medical expenses distributed by type of service?

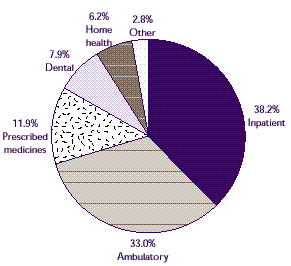

- Hospital inpatient stays have declined substantially as a proportion of total expenses over the last two decades. However, they still made up the largest share of national health care expenses (38 percent) in 1996, followed by ambulatory services from both physician and nonphysician providers (33 percent).

- Purchases of prescription medicines accounted for 12 percent of expenses in 1996, about double the proportion in 1987.

- Dental visits, home health care, and other medical services accounted for the smallest portions of national medical expenses.

Return To Table Of Contents

How do average payments vary by medical service?

- Hospital inpatient stays are by far the most expensive type of medical service. The average expense per stay in 1996, including payments for hospital facility services and physician care while in the hospital, was $8,330. However, expenses for about half of all stays were less than $4,332 (the median value).

- Median expenses were $64 per dental visit, $50 per ambulatory visit to medical providers (including both physicians and other providers), and $23 per prescribed medicine.

| |

Average |

Median |

| Inpatient (per stay) |

$8,330 |

$4,332 |

| Ambulatory (per visit) |

$127 |

$50 |

| Medicines (per prescription) |

$35 |

$23 |

| Dental (per visit) |

$146 |

$64 |

Return To Table Of Contents

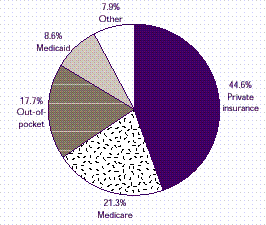

How are medical expenses distributed by source of payment?

- The vast majority of medical expenses were paid for by third-party payers (82 percent in total), while 18 percent were paid out of pocket by individuals and families.

- Private insurance was the largest third-party payer, covering 45 percent of total expenses.

- Medicare and Medicaid, the largest government-sponsored health insurance programs, accounted for about 30 percent of national medical expenses (21 percent and 9 percent, respectively).

Return To Table Of Contents

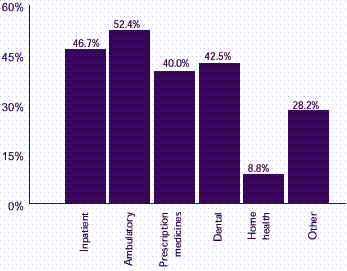

What portion of expenses does private health insurance pay for different medical services?

- About half (52 percent) of all ambulatory care expenses in 1996 were paid by private health insurance. The proportion for inpatient care was slightly lower (47 percent).

- Private health insurance paid for only 9 percent of home health care, a substantially smaller portion than for any other service category.

- Private health insurance paid for a relatively small portion of other medical expenses (28 percent). About half of all expenses in this category were for glasses and other visual aids, items that often are not covered by private insurance.

Return To Table Of Contents

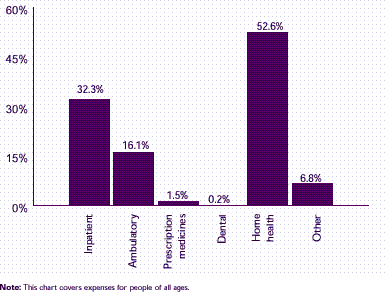

What portion of expenses does Medicare pay for different medical services?

- In 1996, over half of medical expenses for home health care were covered by Medicare. Medicare also paid for substantial portions of inpatient care (32 percent) and ambulatory care (16 percent).

- The portion of prescription medicine and dental expenses paid by Medicare was negligible since Medicare typically does not cover these services.

Return To Table Of Contents

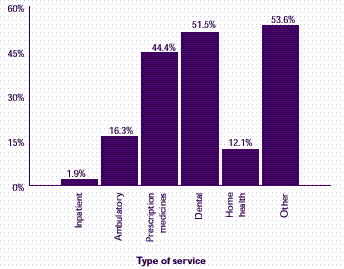

What portion of expenses is paid out of pocket for different medical services?

- About half of the "other" medical expense category, half of dental expenses, and nearly half of expenses for prescribed medicines were paid out of pocket. The portion paid out of pocket was substantially lower for the remaining service categories.

- Out-of-pocket payments comprised a negligible portion of payments for inpatient care (2 percent) because private insurance and Medicare covered the vast majority of these expenses.

Return To Table Of Contents

What portion of expenses does Medicaid pay for different medical services?

- Among the civilian noninstitutionalized population, Medicaid paid proportionately more of the expenses for home health care (16 percent) than for any other type of service.

- Medicaid covered expenses for inpatient care and prescription medicines in equal shares (about 10 percent each) and paid 7 percent or less of the expenses for the other medical service types.

Return To Table Of Contents

Section 2: Per Capita Expenses

Per capita expenses vary according to characteristics of the population such as age, race/ethnicity, income, health status, and type of insurance coverage—factors that are examined in this section. These characteristics are associated with factors affecting medical spending, including the need for care, the likelihood that people will seek care, access to care, and prices charged for services. For example, the need for care generally increases with age and access to care generally increases with the extent of insurance coverage. Average per capita estimates shown in this section include people who either used no services or used services for which no payment was made.

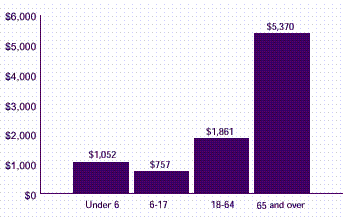

How do average medical expenses per person vary by age?

- In 1996, average medical expenses per person were by far the highest among the elderly ($5,370).

- Average expenses were somewhat higher for children under age 6 than for children ages 6-17. This difference mainly results from the lower proportion of older children with any medical expenses (83 percent, as opposed to 90 percent for children under 6).

- Average expenses for adults ages 18-64 were approximately double those for children but only about one-third as large as for the elderly.

Return To Table Of Contents

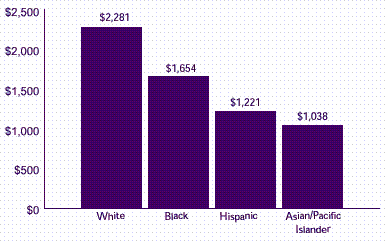

How do average medical expenses per person vary by race/ethnicity?

- Average medical expenses per person were substantially higher for whites than for any other racial/ethnic group. Blacks had the second highest per capita expenses.

- Per capita expenses were lowest for Hispanics and Asian/Pacific Islanders.

Return To Table Of Contents

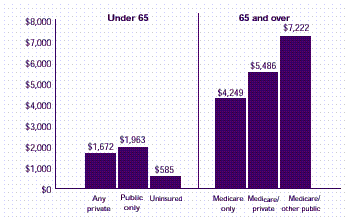

How do average medical expenses per person vary by insurance status?

- People under age 65 who were uninsured throughout 1996 had substantially lower per capita expenses than their counterparts with private or public insurance coverage.

- Among the elderly, those with Medicare but no supplemental insurance coverage had the lowest average expenses. Those with Medicare and supplemental public insurance coverage, the elderly group in the poorest health, had the highest per capita expense

Return To Table Of Contents

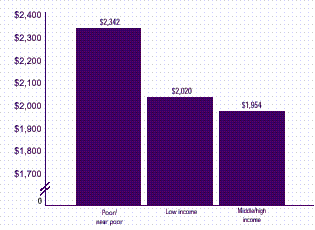

How do average medical expenses per person vary by poverty status?

- Average expenses per person were about 20 percent higher for people in poor or near-poor families than for others.

- The average expenses for people in low-income families were similar to those for people in families with middle to high income (about $2,000).

Return To Table Of Contents

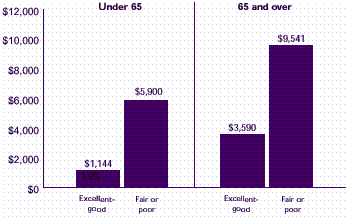

How do average medical expenses per person vary by perceived health status?

- For both the elderly and non-elderly, average medical expenses per person were substantially higher for people in fair or poor health than for those in better health.

- Among people under 65 years of age, average expenses were about five times higher for those in fair or poor health ($5,900, compared with $1,144 for those in better health). Among the elderly, average expenses were only about 2 1 /2 times greater for those in fair or poor health ($9,541 vs. $3,590).

Return To Table Of Contents

Section 3: Expenses by Type of Service

The mix of services is an important determinant of the total cost of medical care in the United States. For example, the proportion of expenses accounted for by inpatient hospital care (the most expensive type) has fallen over the last decade as insurers have encouraged the substitution of ambulatory for inpatient care. Furthermore, expenses for prescription medicines have increased dramatically with the rapid diffusion of new drugs in recent years. In this section, variations in the distribution of expenses by type of service are examined by age, race/ethnicity, income, insurance status, and health status.

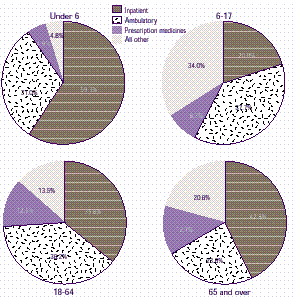

How does the distribution of expenses vary by age?

- Children under 6 had the highest proportion of medical expenses for inpatient hospital care (59 percent), followed by elderly people (43 percent). High inpatient expenses for some infants and 1-year-olds account for the high proportion of inpatient expenses for young children.

- The elderly had the smallest proportion of expenses for ambulatory care—only about 1 in 4 dollars spent (24 percent), compared to 31 percent or more in the other age groups.

- About 13 percent of medical expenses for adults, but less than 9 percent of expenses for children, were for prescribed medicines.

Return To Table Of Contents

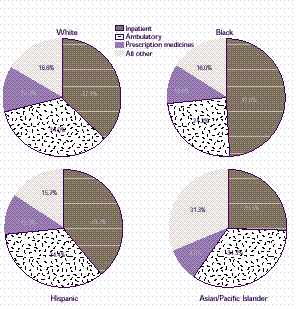

How does the distribution of expenses vary by race/ethnicity?

- About half of expenses for blacks, compared to only about one-fourth of expenses for Asian/Pacific Islanders, were for inpatient care.

- Only one-fourth of health care expenses for blacks, as opposed to one-third of expenses for other racial/ethnic groups, were for ambulatory services. This lower proportion for blacks reflects their larger proportion of expenses for inpatient care.

- About 31 percent of expenses for Asian/Pacific Islanders were in the "all other" category of medical expenses (largely dental and home health services). This proportion is about twice as high as for the other racial/ethnic groups.

Return To Table Of Contents

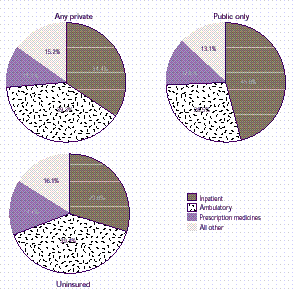

How does the distribution of expenses for people under 65 vary by type of insurance coverage?

- The share of spending that went for inpatient care was higher for people under 65 with public health insurance coverage (primarily Medicaid) than for their privately insured or uninsured counterparts. This may be attributable to the fact that people with public insurance were more likely than people with private insurance or no coverage to be in poor health.

- The proportion of total expenses accounted for by prescribed medicines for the non-elderly did not vary significantly by insurance status.

Return To Table Of Contents

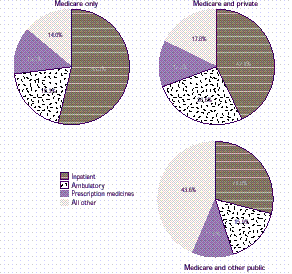

How does the distribution of expenses for the elderly vary by type of insurance coverage?

- The elderly who had public insurance (primarily Medicaid) in addition to Medicare differed from elderly people in the other insurance categories in two main ways:

- — A much smaller proportion of their expenses went for inpatient care: only 29 percent, compared with 54 percent for those with Medicare only and 43 percent for those with Medicare and private insurance.

- — A larger share of their expenses (44 percent) were in the "all other" category. The vast majority of these expenses were for home health care.

Return To Table Of Contents

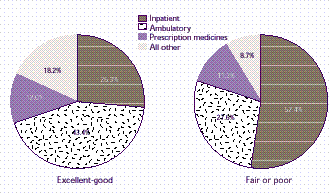

How does the distribution of expenses for people under 65 vary by perceived health status?

- About half of expenses for non-elderly people in fair or poor health were for inpatient care, compared to only about one-quarter of expenses for their healthier counterparts.

- The portion of expenses for people under 65 that went for prescription drugs was similar regardless of health status.

- The share of expenses for the non-elderly in excellent or good health that went for "all other" services was about twice as large as it was for their counterparts fair or poor health.

- For people under age 65, most of the expenses in the "all other" category for those in better health were for dental care. In contrast, only about one-quarter of these expenses for people in poorer health were for dental care and about half were for home health care.

Return To Table Of Contents

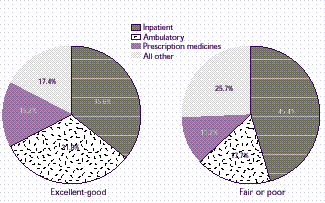

How does the distribution of expenses for the elderly vary by perceived health status?

- The distribution of expenses for the elderly varied substantially by health status. For example, elderly people in excellent to good health had higher proportions of expenses for ambulatory care (32 percent, compared to 18 percent for those in fair or poor health) and for prescribed medicines (15 percent vs. 11 percent)

- The elderly in fair or poor health had a higher proportion of expenses for inpatient care than those in better health (45 vs. 36 percent). However, this differential by health status is substantially smaller for the elderly than for the non-elderly. (See previous chart.)

- The share of expenses that went for "all other" services was higher for elderly people in fair or poor health than for their counterparts in better health (26 vs. 17 percent). For the elderly in fair or poor health, most expenses in the "all other" category were for home health services; only about half of expenses in this category for the elderly in excellent to good health were for home health.

Return To Table Of Contents

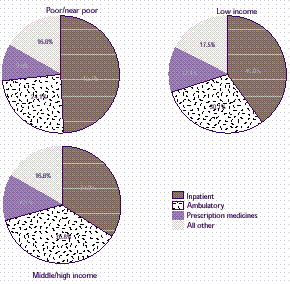

How does the distribution of expenses vary by poverty status?

In 1996, the share of expenses for inpatient care was highest for people in the poorest families. Only about one-third of medical expenses for people in families with middle to high income were for inpatient care, compared to about half of all expenses for people in poor or near-poor families. People in middle- to high-income families had the highest proportion of expenses for ambulatory services.

Return To Table Of Contents

Section 4: Out-Of-Pocket Expenses

Although insurance covers much of the cost of medical care in the United States, individuals and families also contribute toward payment of their medical bills. These out-of-pocket payments are often used as an indicator of the burden of health expenses on individuals and families. For example, out-of-pocket expenses as a proportion of income are a reflection of the adequacy of health insurance coverage. This section describes variations in out-of-pocket expenses for medical care and services (not including health insurance premiums) by age, race/ethnicity, income, insurance status, and health status.

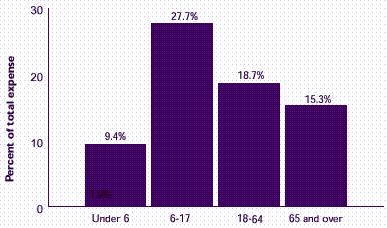

How does out-of-pocket spending for medical care vary by age?

- The percent paid out of pocket was highest for children ages 6- 17 (28 percent) and lowest for children under age 6 (9 percent). The high proportion of out-of-pocket expenses for children ages 6-17 can be attributed to large expenses for orthodontia, most of which is paid for out of pocket.

- The low percent paid out of pocket for young children relative to other age groups is associated with high inpatient expenses for some infants and 1- year-olds. (Out-of pocket spending is generally less for inpatient care than for other types of services.)

- The share of expenses paid for out of pocket was slightly higher for adults ages 18-64 years (19 percent) than for the elderly (15 percent).

Return To Table Of Contents

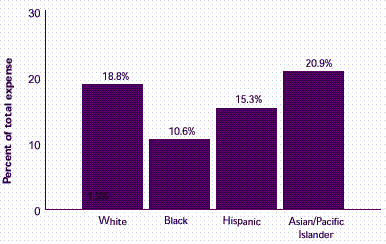

How does out-of-pocket spending for medical care vary by race/ethnicity?

- About 1 of every 5 dollars spent on health care for whites and Asian/Pacific Islanders in 1996 was paid out of pocket.

- Blacks paid a lower percentage of their medical expenses out of pocket (11 percent) compared to other racial/ethnic groups. This lower proportion for blacks reflects two factors:

- – Inpatient care (only a small share of which is paid out of pocket) accounted for a larger proportion of expenses for blacks than for people in the other racial/ethnic groups.

- – A relatively high proportion of blacks were covered by Medicaid, which requires less out-of-pocket payment than other types of insurance.

Return To Table Of Contents

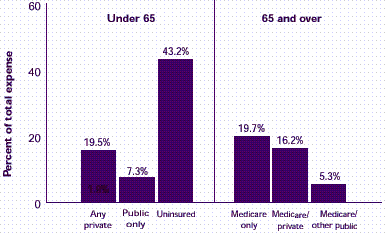

How does out-of-pocket spending for medical care vary by insurance status?

- Uninsured people under age 65 had lower per capita expenses than their insured counterparts. (See Section 2.) However, the uninsured paid for a higher share of their total medical expenses out of pocket (43 percent) than people with private insurance (20 percent) or public insurance (7 percent).

- Although the uninsured paid a high proportion of their expenses out of pocket, other sources— such as the Department of Veterans Affairs, public clinics, and other public and private sources—paid for over half (57 percent) of their medical expenses.

- Out-of-pocket spending was substantially lower for the elderly with Medicare and other public coverage (5 percent) than for those with Medicare only (20 percent) or Medicare and additional private coverage (16 percent).

Return To Table Of Contents

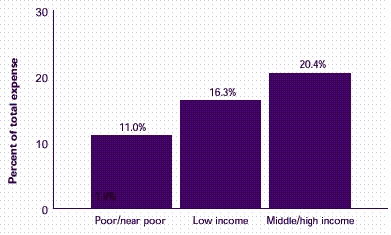

How does out-of-pocket spending for medical care vary by poverty status?

- The share of medical expenses in 1996 that was paid out of pocket rose as family income increased.

- About 1 out of every 5 dollars in medical expenses for people in middle- to high-income families was paid out of pocket, compared with only about 1 out of every 9 dollars spent for people in poor and near-poor families.

Return To Table Of Contents

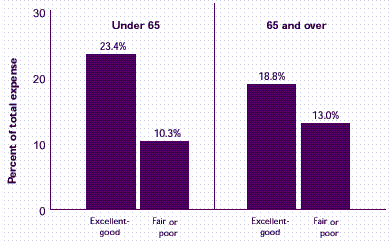

How does out-of-pocket spending for medical care vary by perceived health status?

- For both the elderly and non-elderly, a smaller share of health care expenses was paid out of pocket for those in fair or poor health than for those in better health. This lower proportion for people in poorer health reflects:

- – A high share of expenses for inpatient care (only a small portion of which is usually paid out of pocket).

- – Higher proportions with Medicaid coverage, under which only minimal out-of-pocket payments are usually required.

Return To Table Of Contents

References

The MEPS data shown here are based on public use data file HC012, updated with HC012S1. (See the MEPS Web site <http://www.meps.ahrq.gov/>.) The following references were also used.

Cohen JW, Machlin SR, Zuvekas SH, et al. Health care expenses in the United States, 1996. Rockville (MD): Agency for Healthcare Research and Quality; 2000. MEPS Research Findings No. 12. AHRQ Pub. No. 01-0009.

Hahn B, Lefkowitz D. Annual expenses and sources of payment for health care services. Rockville (MD): Agency for Health Care Policy and Research; 1992. National Medical Expenditure Survey Research Findings 14. AHCPR Pub. No. 93-0007.

Selden TM, Levit KA, Cohen JW, et al. Reconciling medical expenditure estimates from the Medical Expenditure Panel Survey and the National Health Accounts, 1996. Unpublished report. Agency for Healthcare Research and Quality; 2001.

Return To Table Of Contents

Definitions of Terms

Type of Service

For the charts in Section 1, expenses by type of service are classified into six broad categories: hospital inpatient, ambulatory, prescribed medicines, dental, home health, and other. In Section 3, dental and home health expenses are combined with the "other" category, resulting in four categories.

Hospital inpatient services—This category includes room and board and all hospital diagnostic and laboratory expenses associated with the basic facility charge, payments for separately billed physician inpatient services, and some emergency room expenses incurred immediately prior to inpatient stays. It excludes expenses for hospital discharges that did not involve an overnight stay, which are included as ambulatory expenses.

Ambulatory services—This category includes expenses for visits to medical providers seen in office-based settings or clinics, hospital outpatient departments, emergency rooms (except some visits resulting in an overnight hospital stay), and clinics owned and operated by hospitals. It also includes expenses for events reported as hospital admissions without an overnight stay.

Prescribed medicines—This category includes expenses for all prescribed medications that were initially purchased or refilled during 1996, as well as expenses for diabetic supplies (some of which may have been purchased without a prescription).

Dental services—This category covers expenses from any type of dental care provider, including general dentists, dental hygienists, dental technicians, dental surgeons, orthodontists, endodontists, and periodontists.

Home health services—This category includes expenses for care provided by home health agencies and independent home health providers. Agency providers accounted for most (about 83 percent) of the expenses in this category.

Other—This category includes expenses for eyeglasses, contact lenses, ambulance services, orthopedic items, hearing devices, prostheses, bathroom aids, medical equipment, disposable supplies, and other miscellaneous items or services that were obtained, purchased, or rented during the year. About half the expenditures in this category were for vision items.

Return To Table Of Contents

Source of Payment

The estimates of sources of payment presented in this chartbook represent the percent of total expenses (summed across all persons) paid for by each payment source. Sources of payment are classified as follows.

Out-of-pocket by user or family.

Private insurance—This category includes payments made by insurance plans covering hospital and medical care (excluding payments from Medicare, Medicaid, and other public sources). Payments from Medigap plans or CHAMPUS and CHAMPVA (Armed-Forces-related coverage) are included. Payments from plans that provide coverage for a single service only, such as dental or vision coverage, are not included.

Medicare—Medicare is a federally financed health insurance plan for the elderly, persons receiving Social Security disability payments, and most persons with end-stage renal disease. Medicare Part A, which provides hospital insurance, is automatically given to those who are eligible for Social Security. Medicare Part B provides supplementary medical insurance that pays for medical expenses and can be purchased for a monthly premium.

Medicaid—Medicaid is a means-tested government program jointly financed by Federal and State funds that provides health care to those who are eligible. Program eligibility criteria vary significantly by State, but the program is designed to provide health coverage to families and individuals who are unable to afford necessary medical care.

Other sources—This category includes payments from the Department of Veterans Affairs (excluding CHAMPVA); other Federal sources (Indian Health Service, military treatment facilities, and other care provided by the Federal Government); various State and local sources (community and neighborhood clinics, State and local health departments, and State programs other than Medicaid); Medicaid payments reported for people who were not enrolled in the Medicaid program at any time during the year; Worker’s Compensation; unclassified sources (automobile, homeowner’s, or liability insurance, and other miscellaneous or unknown sources); and any type of private insurance payments reported for people without private health insurance coverage during the year.

Return To Table Of Contents

Population Characteristics

In general, population characteristics are measured of December 31, 1996, or the last date that the sample person was part of the civilian noninstitutionalized population living in the United States prior to December 31, 1996.

Race/Ethnicity

Classification by race and ethnicity is based on information reported in MEPS for each family member. Respondents were asked if the race of the sample person was best described as American Indian, Alaska Native, Asian or Pacific Islander, black, white, or other. They also were asked if the sample person’s main national origin or ancestry was Puerto Rican; Cuban; Mexican, Mexicano, Mexican American, or Chicano; other Latin American; or other Spanish. All persons whose main national origin or ancestry was reported in one of these Hispanic groups, regardless of racial background, are classified as Hispanic. The other race categories do not include Hispanic persons.

Comparisons by race/ethnicity in this chartbook are based on the following four race/ethnicity groups: white, black, Hispanic, and Asian/Pacific Islander. Because of small sample sizes, persons identified as American Indians, Aleuts, Eskimos, or other races (who constitute about 1 percent of the population) are not included in charts showing race/ethnicity, although they are included in all other charts.

Health Insurance Status

Individuals under age 65 were classified into the following three insurance categories. Any private health insurance—Individuals with insurance that provides coverage for hospital and physician care at any time during the year, other than Medicare, Medicaid, or other public hospital/physician coverage, are classified as having private insurance. Persons with Armed-Forces-related coverage—CHAMPUS/CHAMPVA (currently called TRICARE)—are also included because the number of sample persons in this group is small and this type of coverage is similar to private insurance. Insurance that provides coverage for a single service only, such as dental or vision, is not included.

Public coverage only—Individuals are considered to have public coverage only if they met both of the following criteria:

- They were not covered by private insurance at any time during the year.

- They were covered by one of the following public programs at any point during the year: Medicare, Medicaid, or other public hospital/physician coverage.

Uninsured—The uninsured are defined as persons not covered by Medicare, CHAMPUS/CHAMPVA, Medicaid, other public hospital/physician programs, or private hospital/physician insurance at any time during 1996. Individuals covered only by noncomprehensive State-specific programs (e.g., Maryland Kidney Disease Program, Colorado Child Health Plan) or private single-service plans (e.g., coverage for dental or vision care only, coverage for accidents or specific diseases) are not considered to be insured.

Individuals age 65 and over were classified into the following three insurance categories:

- Medicare only.

- Medicare and private insurance.

- Medicare and other public insurance.

Poverty Status

Each person was classified according to the total 1996 income of his or her family. Within a household, all individuals related by blood, marriage, or adoption were considered to be a family. Personal income from all family members was summed to create family income. Possible sources of income included annual earnings from wages, salaries, bonuses, tips, and commissions; business and farm gains and losses; unemployment and Worker’s Compensation; interest and dividends; alimony, child support, and other private cash transfers; private pensions, IRA withdrawals, Social Security, and veterans’ payments; Supplemental Security Income and cash welfare payments from public assistance, Aid to Families with Dependent Children, and Aid to Dependent Children; gains or losses from estates, trusts, partnerships, S corporations, rent, and royalties; and a small amount of other income. Poverty status is the ratio of family income to the 1996 Federal poverty thresholds, which vary by family size and age of the head of the family. The categories are:

- Poor and near poor—This refers to persons in families with income less than or equal to 125 percent of the poverty line and includes those who reported negative income.

- Low income—This category includes persons in families with incomes over 125 percent through 200 percent of the poverty line.

- Middle and high income—This category includes persons in families with income over 200 percent of the poverty line.

Perceived Health Status

The MEPS respondent was asked to rate the health of each person in the family according to the following categories: excellent, very good, good, fair, and poor. For this report, the five health status categories were collapsed into the following two broad categories: excellent to good health and fair or poor health.

Return To Table Of Contents

| Suggested Citation: Chartbook #5: Health Care Expenses in the Community Population, 1996. May 2001. Agency for Healthcare Research and Quality, Rockville, MD. http://www.meps.ahrq.gov/data_files/publications/cb5/cb5.shtml |

|