Research

Findings #8: Health Insurance Status of the Civilian Noninstitutionalized

Population, 1997

Jessica P. Vistnes, Ph.D., and Samuel H. Zuvekas,

Ph.D., Agency for Health Care Policy and Research.

Abstract This report from the 1997 Medical Expenditure Panel Survey (MEPS) provides preliminary estimates of the health insurance status of the civilian noninstitutionalized U.S. population during the first half of 1997, including the size and characteristics of the population with private health insurance, with public insurance, and without any health care coverage. During this period, 83.2 percent of all Americans were covered by private or public health insurance, leaving 16.8 percent of the population, some 44.6 million persons, uninsured. Among the non-elderly population, 81.1 percent of Americans had either private or public coverage and 18.9 percent of the population (44.2 million persons) lacked health care coverage. The probability that an individual would be uninsured during this period was especially high for young adults aged 19-24 and members of racial and ethnic minorities (especially Hispanic males). Public health insurance continues to play an important role in ensuring that children, black Americans, and Hispanic Americans obtain health care coverage.

^top

Introduction This report is the second in a series of yearly

reports on the health insurance status of the U.S. population.

The first report (Vistnes and Monheit, 1997) presented health insurance

estimates for the first half of 1996.

The health insurance status of the U.S. population,

especially the size and composition of the uninsured population,

has become an issue of perennial public policy concern for several

reasons.

First,

health insurance is viewed as essential to ensure that individuals

obtain timely access to medical care and protection against the

risk of expensive and unanticipated medical events. Compared to

people without health care coverage, insured individuals are more

likely to have a usual source of medical care, to spend less out

of pocket on health services, and to experience different treatment

patterns, quality, and continuity in their health care (Lefkowitz

and Monheit, 1991; U.S. Congress, Office of Technology Assessment,

1992).

Second, concern over

the population’s health

insurance status reflects a variety of equity and efficiency considerations.

These include the magnitude and appropriate mix of private and

public sector responsibility for financing health care, the impact

of health insurance on the efficient use of health care, and the

manner in which health insurance affects the distribution of health

care among the general population and across groups of specific

policy interest.

Third, timely and

reliable estimates of the population’s

health insurance status are essential to evaluate the costs and

expected impact of public policy interventions to expand coverage

or to alter the manner in which private and public insurance is

financed. Identification of how individual and household demographic

characteristics, health status, and economic circumstances are

associated with the population’s health insurance status is

of critical importance in developing efficient and targeted policy

interventions. This is especially relevant given the current emphasis

on incremental health care reform that is focused on particular

health care markets and population groups.

Finally, comparisons

of the characteristics of insured and uninsured populations over

time provide information

on whether greater equity has been achieved in the ability of specific

population groups to obtain health insurance or whether serious

gaps remain. In this regard, estimates of the population’s

health insurance status from the Medical Expenditure Panel Survey

(MEPS), which is conducted annually, provide critical data for

evaluating the health insurance implications of recent legislative

initiatives: the 1996 Health Insurance Portability and Accountability

Act (HIPAA), Public Law 104-191; welfare reform under the 1996

Personal Responsibility and Work Opportunity Reconciliation Act,

Public Law 104-193; and the 1997 State Children’s Health Insurance

Program (CHIP). A primary goal of HIPAA is to reduce the impact

of preexisting health conditions on the continuity of health insurance

during employment transitions. Under welfare reform, mandated work

requirements and time limitations governing the receipt of public

assistance may have consequences for a recipient’s health

insurance status. The goal of the CHIP program is to provide health

insurance coverage to low-income children who are not eligible

for Medicaid.

This report presents

preliminary estimates of the number and characteristics of people

with private and public

health insurance at any time during the first half of 1997, on

average. Particular emphasis is directed toward estimating the

size of the population that was uninsured throughout the first

half of 1997 and identifying groups especially at risk of lacking

health insurance.

^top

Overview

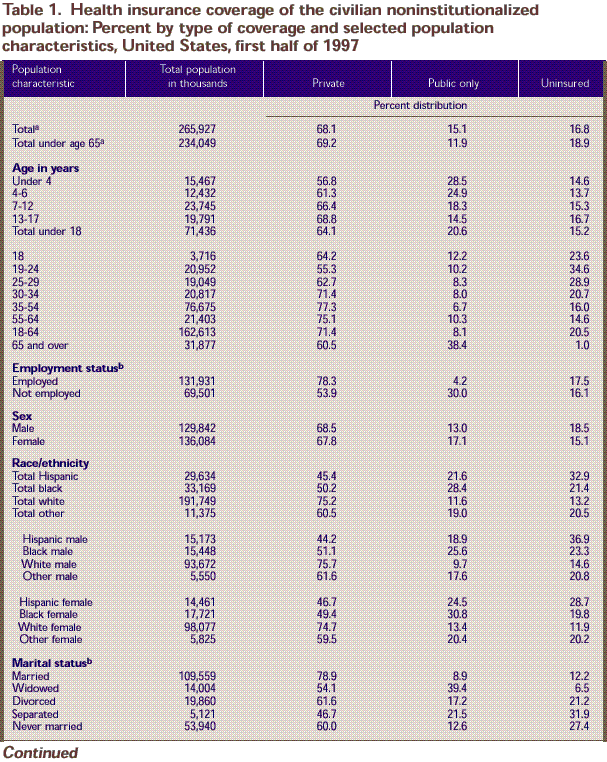

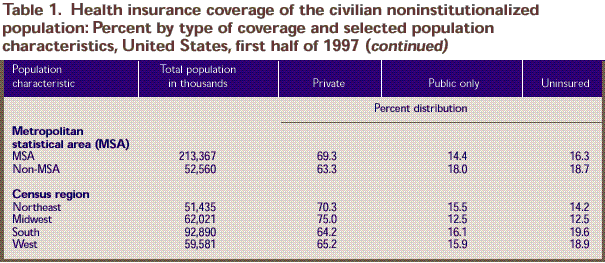

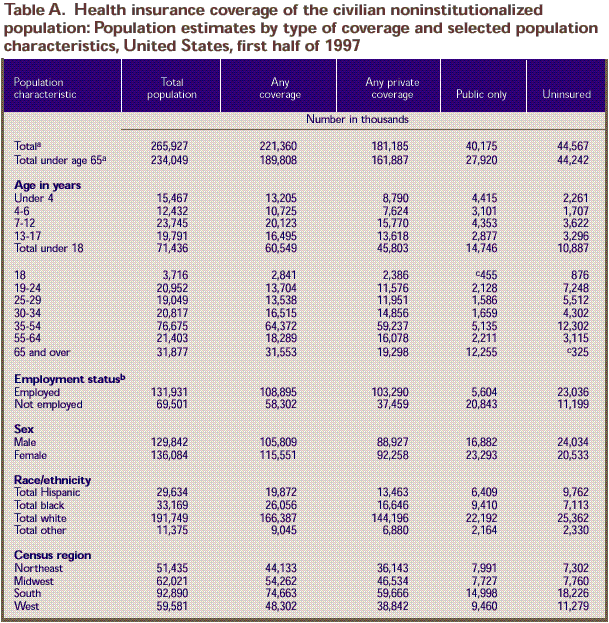

During the first half of

1997, on average, 83.2 percent of all Americans in the civilian

noninstitutionalized population

had some type of private or public health insurance coverage (Table

1). Roughly 68 percent of Americans obtained health insurance

from private sources.Another 15.1 percent obtained public sources

of coverage, primarily from the Medicare and Medicaid programs.

The remaining 16.8 percent of Americans, 44.6 million people, were

without health insurance throughout the first half of 1997. Among

the non-elderly population, 69.2 percent were covered by private

insurance and 11.9 percent by public insurance. Almost a fifth

of the non-elderly population (18.9 percent), an estimated 44.2

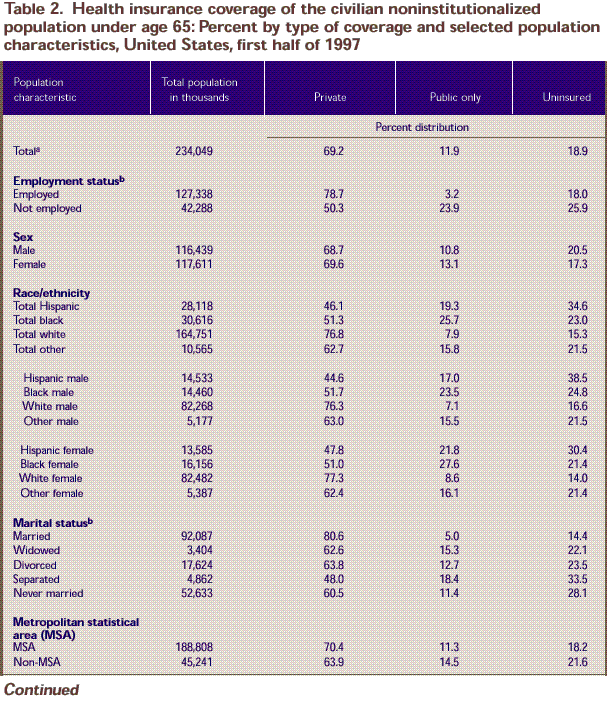

million people, were uninsured. Table 2 gives

more detailed information on the health insurance status of the

non-elderly population. Overall, these health insurance estimates

do not differ significantly from the 1996 MEPS figures reported

in Vistnes and Monheit, 1997.

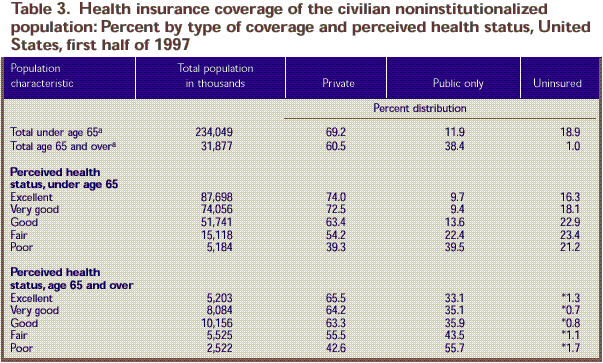

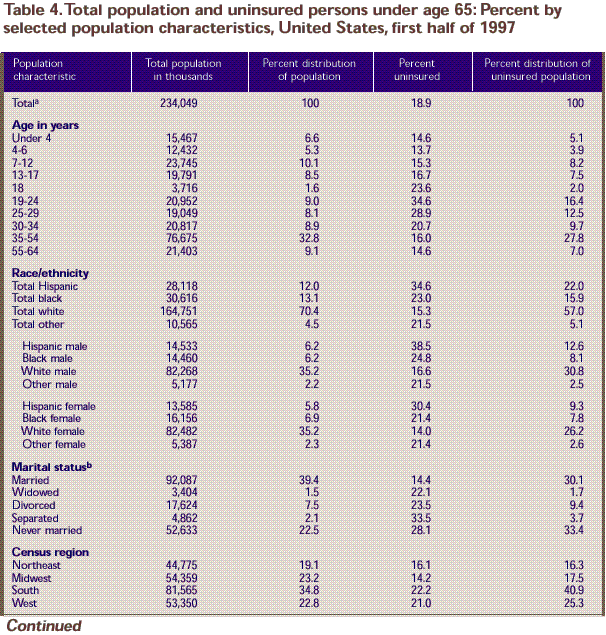

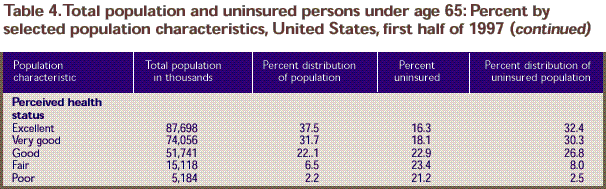

The data in Tables 1-3 provide

estimates of the population’s health insurance status according

to selected demographic characteristics, perceived health status,

employment status, and residential location. Table

4 provides estimates of the distribution of the uninsured population

by selected characteristics. Table A in the Technical Appendix

provides estimates of the number of people by health insurance

status. Some of the key findings and relationships revealed by

these data are discussed below.

Age MEPS data reveal that, in general, children are

more likely than non-elderly adults to have health insurance coverage.

The main findings among age groups are described below.

Children There has been considerable

interest in the health insurance status of children. This interest

stems from the role

health care coverage plays in ensuring that children obtain the

medical care appropriate to their specific stage of development.

To help ensure such coverage, Congress passed the State Children’s

Health Insurance Program in 1997, allocating approximately $24

billion over 5 years to provide health insurance coverage to low-income

children who are not eligible for Medicaid. The CHIP program follows

on Medicaid expansions beginning in the late 1980s that focused

attention on the role of the public and private sectors in financing

health care for low-income children.MEPS data indicate that public health insurance

covered a substantial proportion of children in the first half

of 1997: Nearly 30 percent of children under age 4, one in four

children ages 4-6, and close to one in five children ages 7-12

had public coverage, primarily through Medicaid. As a result, children

under age 18 were less likely to be uninsured than were non-elderly

adults in general. Despite this finding, nearly 11 million children

lacked health care coverage.

Adults Young adults ages 19-24 were the age group most

likely to lack health insurance. Over a third of young adults (34.6

percent) were uninsured, twice the rate at which all Americans

lacked coverage. Young adults ages 19-24 also had the lowest rate

of private health insurance coverage among the non-elderly adult

population.On the other hand, 6 out

of 10 elderly Americans (60.5 percent) were covered by private

health insurance. Nearly

4 out of 10 elderly Americans (38.4 percent) held only public coverage

(Medicare alone or in conjunction with Medicaid).

Employment Status

Since most private health

insurance in the United States is provided through the workplace,

employment status is

an important indicator of access to private health insurance.

MEPS data reveal the following for the non-elderly population (Table

2):

- Over three-quarters

(78.7 percent) of workers were covered by private health insurance,

compared to half (50.3

percent) of individuals who were not employed.

- People who were not employed were more likely

than those who were employed to be covered by public insurance

(23.9 and 3.2 percent, respectively). Workers

were less likely than people who were not employed to be uninsured

(18.0 and 25.9 percent,

respectively).

Race/Ethnicity

MEPS data indicate that significant disparities

exist in the rate at which racial and ethnic minorities are covered

by private and public health insurance compared to white Americans (Table

1). For example:

- Less than half of all Hispanic Americans (45.4

percent) and half of black Americans (50.2 percent) were covered

by private health insurance, compared to three-quarters of whites

(75.2 percent). A third of Hispanics (32.9 percent) and over

a fifth of blacks (21.4 percent) were uninsured. In contrast,

13.2 percent of white Americans were uninsured.

- Among all racial/ethnic groups, Hispanic males

were the most likely to be uninsured; 36.9 percent lacked coverage.

Hispanic and black Americans were more likely

than white Americans to be covered by public health insurance (21.6

percent and 28.4 percent, respectively, compared to 11.6 percent).

Marital Status

Married individuals were more likely than others

to have private health insurance (Table 1).

Of those who were not married at the time of the survey:

- Widowed people were the least likely to be

uninsured (6.5 percent) because of their higher rate of coverage

from public programs (39.4 percent).

- More than one-quarter of Americans who never

married were uninsured (27.4 percent).

- Almost a third of Americans who were separated

were uninsured (31.9 percent).

- More than a fifth of all divorced persons

(21.2 percent) were uninsured.

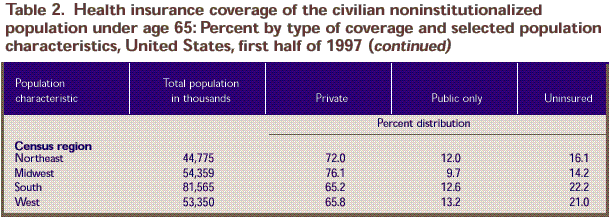

Residential Location

The type of health care coverage obtained by

Americans and the likelihood of being uninsured also varied by

region and whether they lived in a metropolitan statistical area

(MSA). MEPS data show that: People living

in the South and West were less likely than residents of other

regions to have private

health insurance (64.2 percent and 65.2 percent in the South

and West, respectively, compared to 70.3 percent and 75.0

percent of residents in the Northeast and Midwest). Nearly one

out of five persons in the South and West were uninsured (19.6

percent and 18.9 percent, respectively) compared to14.2

and 12.5 percent in the Northeast and Midwest, respectively.

- People living outside

MSAs were less likely than those living within MSAs to be covered

by private

health insurance (63.3 percent vs. 69.3 percent). They also were

more likely to be uninsured (18.7 percent vs. 16.3 percent).

Health Status

There is considerable

public policy interest in determining whether people with health

problems are able to

obtain health insurance and, if so, the source of such coverage.

MEPS respondents were asked to rate their health and family members’ health

as excellent, very good,good, fair, or poor. The data in Table

3 reveal the relationships described below between health status

and insurance coverage.

Non-Elderly Persons

More than one in five non-elderly Americans in

good health (22.9 percent), fair health (23.4 percent), or poor

health (21.2 percent) were uninsured throughout the first half

of 1997. Among the non-elderly:

- People in fair or poor health were less likely

than those in better health to have private health insurance.

Only 39.3 percent of those in poor health and 54.2 percent of

those in fair health had any private coverage.

- Public insurance helped to reduce the health-related

disparities in private coverage. Over 20 percent of people in

fair health and almost 40 percent of people in poor health had

public coverage.

Elderly Persons

Elderly Americans in fair or poor health were

less likely to have private coverage than those in better health.

As a result, those in fair or

poor health were more likely

to be covered by insurance from public sources only (43.5 and 55.7

percent,

respectively) than other elderly Americans. Medicare, either

alone or with Medicaid, was the main public source of coverage.

^top

Characteristics

of Uninsured Americans

Previous sections of this report have described

the health insurance status of Americans by focusing on demographic,

health status, and geographic characteristics associated with the

likelihood that particular groups obtained private or public health

insurance or were more at risk of being uninsured. To put this

discussion in perspective, data displayed in Table 4 characterize

the uninsured population by considering the representation of specific

groups in the general population of non-elderly Americans relative

to their representation among the uninsured population. In this

way, one can assess whether certain population groups are disproportionately

represented among the uninsured. Such information can be useful

in formulating targeted policy interventions on behalf of people

without health insurance.

Age

Young adults ages 19-24 composed 9.0 percent

of the non-elderly population but 16.4 percent of the uninsured

population. Among all age groups, young adults had the greatest

risk of being uninsured.

Race/Ethnicity

Racial and ethnic minorities were more at risk

of lacking health insurance than white Americans were. As a result,

minority representation among the uninsured exceeded their representation

among the general population. For example:

- Although Hispanics represented only 12.0 percent

of the non-elderly U.S. population, they accounted for 22.0 percent

of the uninsured population.

- Hispanic males represented only 6.2 percent

of all non-elderly Americans but were the racial/ethnic group

most likely to be uninsured, comprising 12.6 percent of the uninsured

population.

- Although 7 out of 10 non-elderly Americans

were white, whites accounted for less than 6 out of 10 uninsured

persons.

- When the uninsured are categorized by race/ethnicity

and sex, white males represent the largest proportion of the

uninsured population.

Other Factors

People with specific residential locations and

marital status were also disproportionately represented among the

uninsured:

- People living in the South represented about

a third (34.8 percent) of all non-elderly Americans but 40.9

percent of all uninsured Americans.

- People who never

married accounted for over a fifth of the non-elderly population

but over a third of the

uninsured population.

Finally, more than 1 out of 10 uninsured people

(10.5 percent of the uninsured population) were in fair or poor

health. These individuals are of particular policy concern because

of the importance of health insurance in assuring timely access

to needed health care services.

^top

Conclusions

Preliminary estimates from the 1997 MEPS reveal

that, during the first half of 1997, 68.1 percent of Americans

obtained health insurance from private sources, 15.1 percent obtained

coverage through public programs, and 16.8 percent of the population

(44.6 million people) lacked any health care coverage. Among the

non-elderly population, nearly one person in five was uninsured.

The tabulations presented in this report indicate

that the health insurance status of the U.S. population

is strongly associated with specific demographic characteristics,

health status, and employment status. Important disparities in

health care coverage exist for particular groups. Among the groups

especially at risk of lacking health care coverage are young adults

ages 19-24 and members of racial and ethnic minorities (especially

Hispanic males). Public health insurance continues to play an important

role in insuring children, black Americans, and Hispanic Americans.

Disparities in rates of insurance coverage also exist by health

status, with non-elderly people in good or fair health more likely

than people in better health to be uninsured.

^top

Tables

a Includes persons with

unknown employment status and marital status.

b For individuals age 16

and over.

Note: Percents

may not add to 100 because of rounding. Source: Center

for Financing, Access, and Cost Trends, Agency for Health Care

Policy and Research: Medical Expenditure Panel Survey Household

Component, 1997.

^top

a Includes persons with

unknown employment status and marital status.

b For individuals age 16

and over.

Note: Percents

may not add to 100 because of rounding.

Source: Center

for Financing, Access, and Cost Trends, Agency for Health Care

Policy and Research: Medical Expenditure Panel Survey Household

Component, 1997.

^top

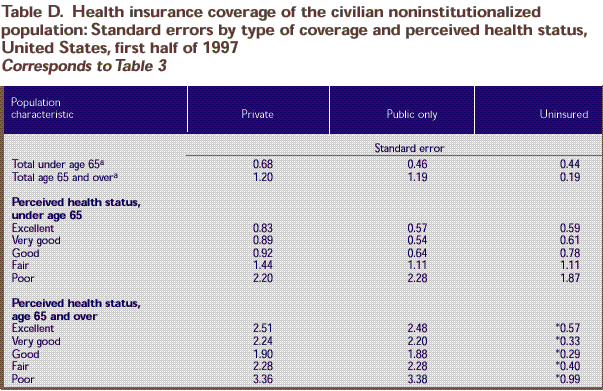

a Includes persons with

unknown perceived health status.

* Relative standard error

is greater than or equal to 30 percent.

Note: Percents

may not add to 100 because of rounding.

Source: Center

for Financing, Access, and Cost Trends, Agency for Health Care

Policy and Research: Medical Expenditure Panel Survey Household

Component, 1997.

^top

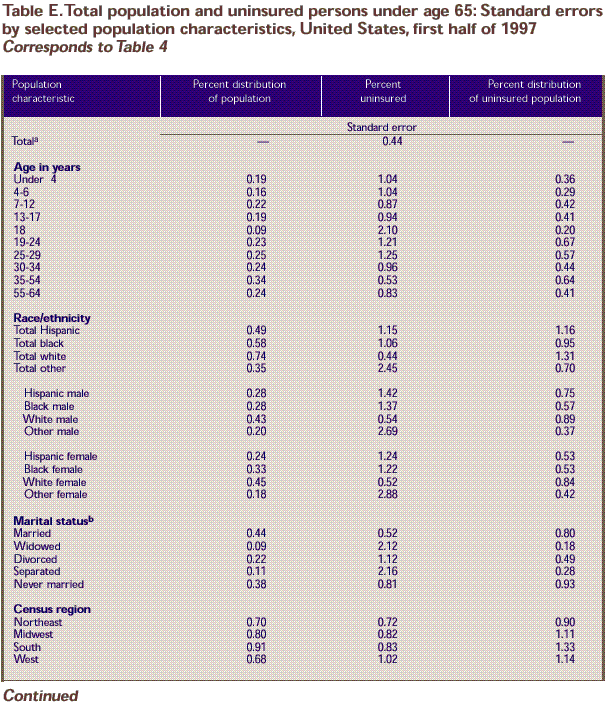

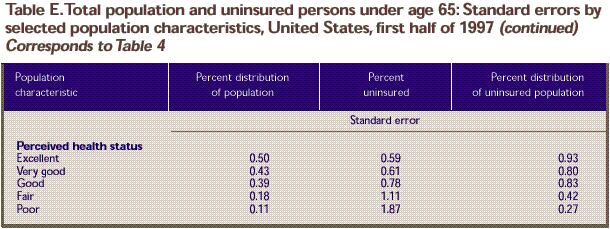

a Includes persons with

unknown marital status and perceived health status.

b For individuals age 16

and over. Excludes unknown marital status. As a result, percents

do not sum to 100.

Note: Percent

distributions may not add to 100 because of rounding.

Source: Center

for Financing, Access, and Cost Trends, Agency for Health Care

Policy and Research: Medical Expenditure Panel Survey Household

Component, 1997.

^top

References

Cohen JW, Monheit AC, Beauregard KM, et al. The

Medical Expenditure Panel Survey: a national health information

resource. Inquiry 1996;33:373-89.

Cohen S. Sample design of the 1996 Medical Expenditure

Panel Survey Household Component. Rockville (MD): Agency for Health

Care Policy and Research; 1997. MEPS Methodology Report No. 2.

AHCPR Pub. No. 97-0027.

Lefkowitz D, Monheit AC. Health insurance, use

of health services, and health care expenditures. Rockville (MD):

Agency for Health Care Policy and Research; 1991. National Medical

Expenditure Survey Research Findings 14. AHCPR Pub. No. 92-0017.

U.S. Congress, Office of Technology Assessment.

Does health insurance make a difference? Background paper. Washington:

U.S. Government Printing Office; 1992. Report No. OTA-BP-H-99.

Vistnes, JP, Monheit, AC. Health insurance status

of the civilian noninstitutionalized population: 1996. Rockville

(MD): Agency for Health Care Policy and Research; 1997. MEPS Research

Findings No. 1. AHCPR Pub. No. 97-0030.

^top

Technical Appendix

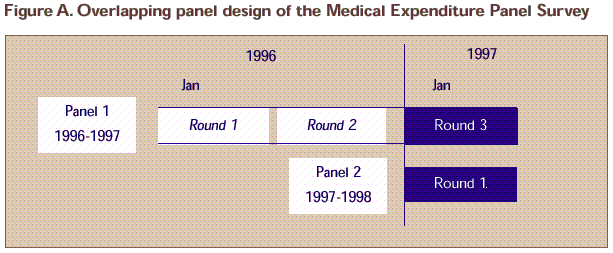

The data in this report were obtained in the

third round of interviews for the Household Component (HC) of the

1996 Medical Expenditure Panel Survey (MEPS) and the first round

of interviews from the 1997 MEPS HC. MEPS is cosponsored by the

Agency for Health Care Policy and Research (AHCPR) and the National

Center for Health Statistics (NCHS). The MEPS HC is a nationally

representative survey of the U.S. civilian noninstitutionalized

population that collects medical expenditure data at both the person

and household levels. The focus of the MEPS HC is to collect detailed

data on demographic characteristics, health conditions, health

status, use of medical care services, charges and payments, access

to care, satisfaction with care, health insurance coverage, income,

and employment. In other components of MEPS, data are collected

on the use, charges, and payments reported by providers; residents

of licensed or certified nursing homes; and the supply side of

the health insurance market.

The sample for the MEPS HC was selected from

respondents to the National Health Interview Survey (NHIS), which

was conducted by NCHS. NHIS provides a nationally representative

sample of the U.S. civilian noninstitutionalized population and

reflects an oversampling of Hispanics and blacks. The MEPS HC collects

data through an overlapping panel design. In this design, data

are collected through a precontact interview that is followed by

a series of five rounds of interviews over 21¼2 years.

Two calendar years of medical expenditure and utilization data

are collected from each household and captured using computer-assisted

personal interviewing (CAPI). This series of data collection rounds

is launched again each subsequent year on a new sample of households

to provide overlapping panels of survey data which, when combined

with other ongoing panels, will provide continuous and current

estimates of health care expenditures. The reference period for

Round 3 of the 1996 MEPS HC (Panel 1) was from the Round 2 interview

date to the Round 3 interview date. The reference period for Round

1 of the 1997 MEPS HC (Panel 2) was from January 1, 1997, to the

date of the Round 1 interview. Interviews for Panel 1 (Round 3)

and Panel 2 (Round 1) were conducted from March to July 1997.

Derivation

of Insurance Status Information

The household respondent

was asked if during the interview period anyone in the family

was covered by any of

the sources of public and private health insurance coverage discussed

in the following paragraphs. For respondents in their third MEPS

interview (Panel 1), previously reported insurance was reviewed

to determine whether it was still in effect and when changes in

insurance status had occurred. Although Panel 1 survey respondents

were asked about their insurance information for part of 1996 as

well as 1997, the insurance information in this report refers to

coverage only in 1997. Medicare and CHAMPUS/CHAMPVA coverage were

measured at the time of the interview. (CHAMPUS and CHAMPVA are

the Civilian Health and Medical Programs for the Uniformed Services

and Veterans’ Affairs.) All other sources of insurance were

measured for any time between January 1997 and the interview. Persons

counted as uninsured were uninsured throughout this time period.

Public Coverage

For this report, individuals were considered

to have public coverage only if they met both of the following

criteria:

- They were not covered by private insurance.

- They were covered by one of the public programs

discussed below.

Medicare

Medicare is a federally financed health insurance

plan for the elderly, persons receiving Social Security disability

payments, and most persons with end-stage renal disease. Medicare

Part A, which provides hospital insurance, is automatically given

to those who are eligible for Social Security. Medicare Part B

provides supplementary medical insurance that pays for medical

expenses and can be purchased for a monthly premium.

CHAMPUS/CHAMPVA

CHAMPUS covers retired members of the Uniformed

Services and the spouses and children of active-duty, retired,

and deceased members. Spouses and children of veterans who died

from a service-connected disability, or who are permanently disabled

and are not eligible for CHAMPUS or Medicare, are covered by CHAMPVA.

In this report, CHAMPUS or CHAMPVA coverage is considered to be

public coverage. When persons covered by CHAMPUS/CHAMPVA reach

age 65, their coverage generally ends and enrollees are eligible

for Medicare.

Medicaid

Medicaid is a means-tested government program

jointly financed by Federal and State funds that provides health

care to those who are eligible. Program eligibility criteria vary

significantly by State, but the program is designed to provide

health coverage to families and individuals who are unable to afford

necessary medical care.

Other Public Hospital/Physician Coverage

Respondents who did not report Medicaid coverage

were asked if they were covered by any other public hospital/physician

coverage. These questions were asked in an attempt to identify

Medicaid recipients who might not have recognized their coverage

as Medicaid. In this report, all coverage reported in this manner

is considered public coverage.

Private Health Insurance

Private health insurance was defined for this

report as insurance that provides coverage for hospital and physician

care (including Medigap coverage). Insurance that provides coverage

for a single service only, such as dental or vision coverage, was

not counted. Private health insurance could have been obtained

through an employer, union, self-employed business, directly from

an insurance company or a health maintenance organization (HMO),

through a group or association, or from someone outside the household.

Uninsured

The uninsured were defined as persons not covered

by Medicare, CHAMPUS/CHAMPVA, Medicaid, other public hospital/physician

programs, or private hospital/physician insurance (including Medigap

coverage) during the period from January 1997 through the time

of the interview. Individuals covered only by noncomprehensive

State-specific programs (e.g., Maryland Kidney Disease Program)

or private single-service plans (e.g., coverage for dental or vision

care only, coverage for accidents or specific diseases) were not

considered to be insured.

Health Insurance

Edits

For the Round 1 (Panel 2) sample, minimal editing

was performed on sources of public coverage and no edits were performed

on the private coverage variables. For Round 3 (Panel 1), most

of the insurance variables were logically edited to address issues

that arose during Rounds 2 and 3 when reviewing insurance reported

in earlier rounds. The health insurance data were edited as described

below.

Medicare

Medicare coverage was edited for persons age

65 and over but not for persons under age 65. Persons age 65 and

over were assigned Medicare coverage if they met one of the following

criteria:

- They answered “yes” to

a follow-up question on whether they had received Social Security

benefits.

- They were covered by Medicaid, other public

hospital/physician coverage, or Medigap coverage.

- Their spouse was age 65 or over and covered

by Medicare.

- They were covered by CHAMPUS/CHAMPVA.

Medicaid

A small number of cases reporting Aid to Families

with Dependent Children (AFDC) or Supplemental Security Income

(SSI) coverage (questions included in the MEPS health insurance

section for editing purposes) were assigned Medicaid coverage.

Since this report does not distinguish among sources of public

insurance, no further edits were performed using the other public

hospital/physician coverage variables. Other public hospital/physician

coverage was included, however, when considering whether an individual

was covered only by public insurance.

CHAMPUS/CHAMPVA

Respondents age 65 and over who reported CHAMPUS/CHAMPVA

coverage were instead classified as covered by Medicare.

Private Health Insurance

Private insurance coverage was unedited and unimputed

for Round 1 (Panel 2). For Round 3 (Panel 1), most of the insurance

variables were logically edited to address issues that arose during

Rounds 2 and 3 when reviewing insurance reported in earlier rounds.

One edit to the private insurance variables corrected for a problem

concerning covered benefits when respondents reported a change

in any of their health insurance plan names. Additional edits addressed

issues of missing data on the time period of coverage.

Individuals were considered to be covered by

private insurance if the insurance provided coverage for hospital/physician

care. Medigap plans were included. Individuals covered by single-service

plans only (e.g., dental, vision, or drug plans) were not considered

to be privately insured. Sources of insurance with missing information

regarding the type of coverage were assumed to contain hospital/physician

coverage.

It should be noted that these data were generally

reported by a single household respondent, who may not have been

the most knowledgeable source for other family members. The employers

and insurance companies of household respondents are being contacted

in a follow-up survey as part of the MEPS data collection effort

designed to verify and supplement the information provided by the

household respondents.

Population

Characteristics

Place of Residence

Individuals were identified

as residing either inside or outside a metropolitan statistical

area (MSA) as designated

by the U.S. Office of Management and Budget (OMB), which applied

1990 standards using population counts from the 1990 U.S. census.

An MSA is a large population nucleus combined with adjacent communities

that have a high degree of economic and social integration within

the nucleus. Each MSA has one or more central counties containing

the area’s main population concentration. In New England,

metropolitan areas consist of cities and towns rather than whole

counties. Regions of residence are in accordance with the U.S.

Bureau of the Census definition.

Race/Ethnicity

Classification by race and ethnicity was based

on information reported for each household member. Respondents

were asked if their race was best described as American Indian,

Alaska Native, Asian or Pacific Islander, black, white, or other.

They were also asked if their main national origin or ancestry

was Puerto Rican; Cuban; Mexican, Mexicano, Mexican American, or

Chicano; other Latin American; or other Spanish. All persons who

claimed main national origin or ancestry in one of these Hispanic

groups, regardless of racial background, were classified as Hispanic.

Since the Hispanic grouping can include black Hispanic, white Hispanic,

and other Hispanic, the race categories of black, white, and other

do not include Hispanic.

Employment Status

Persons were considered to be employed if they

were age 16 and over, and had a job for pay, owned a business,

or worked without pay in a family business at the time of the Round

1 or Round 3 interview.

Sample

Design and Accuracy of Estimates

MEPS is designed to produce estimates at the

national and regional level over time for the civilian noninstitutionalized

population of the United States and some subpopulations of interest.

Each MEPS panel collects data covering a 2-year period, with the

first two MEPS panels spanning 1996-97 and 1997-98, respectively.

In this report, data from the 1997 portion of the third round of

data collection for the MEPS Panel 1 sample are pooled with data

from the first round of data collection for the MEPS Panel 2 sample

(shaded portion of Figure A).

The statistics presented in this report are affected

by both sampling error and sources of nonsampling error, which

include nonresponse bias, respondent reporting errors, interviewer

effects, and data processing misspecifications. For a detailed

description of the MEPS survey design, the adopted sample design,

and methods used to minimize sources of nonsampling error, see

Cohen (1997) and Cohen, Monheit, Beauregard, et al. (1996). The

MEPS person-level estimation

Source: Center for Financing, Access,

and Cost Trends, Agency for Health Care Policy and Research.

weights include nonresponse adjustments and poststratification

adjustments to population estimates derived from the March 1997

Current Population Survey (CPS) based on cross-classifications

by region, MSA status, age, race/ethnicity, and sex.

Tests of statistical significance were used to

determine whether the differences between populations exist at

specified levels of confidence or whether they occurred by chance.

Differences were tested using Z-scores having asymptotic normal

properties at the 0.05 level of significance. Unless otherwise

noted, only statistical differences between estimates are discussed

in the text.

Panel 1

At its beginning in 1996, MEPS Panel 1 consisted

of a sample of 10,639 households, a nationally representative subsample

of the households responding to the 1995 National Health Interview

Survey (NHIS). The 1995 NHIS sampled households with Hispanic members

and households with black members at approximately 2.0 and 1.5

times the rate of other households, respectively. These oversampling

rates are also reflected in the MEPS sample of households.

The overall MEPS Panel 1 response rate at the

end of Round 3 (which collects data for the first part of 1997)

was 70.2 percent. This overall rate reflects response to the 1995

NHIS interview and the MEPS interviews for Rounds 1-3.

Panel 2

At its beginning in 1997, MEPS Panel 2 consisted

of a sample of 6,281 households, a nationally representative subsample

of the households responding to the 1996 NHIS. Like Panel 1, the

Panel 2 sample reflects the oversampling

of Hispanic and black households in NHIS. However, the sample design

for Panel 2 differed from that for Panel 1 because the following

policy-relevant groups (classified based on 1996 NHIS data) were

also oversampled to produce more reliable estimates for these groups:

- Adults (age 18 and over) with functional impairments

(difficulty with one or more activities of daily living).

- Children (under age 18) with limitations in

activity.

- Individuals aged 18-64 expected to incur high

medical expenditures in 1997.

- Individuals predicted to reside in low-income

households (below 200 percent of poverty level).

- Adults (age 18 and over) with health limitations

other than functional impairments (difficulty with one or more

instrumental activities of daily living).

The overall MEPS Panel 2 response rate at the

end of Round 1 (when data were collected for the first part of

1997) was 77.9 percent. This overall rate reflects response to

both the 1996 NHIS interview and the MEPS Round 1 interview.

Combined Panel Response

Each panel was given approximately equal weight

in the development of sampling weights to produce national estimates.

Therefore, a pooled response rate for the survey respondents in

this data set can be obtained by taking an average of the panel-specific

response rates. This pooled response rate for the combined panels

is 74.1 percent.

Rounding

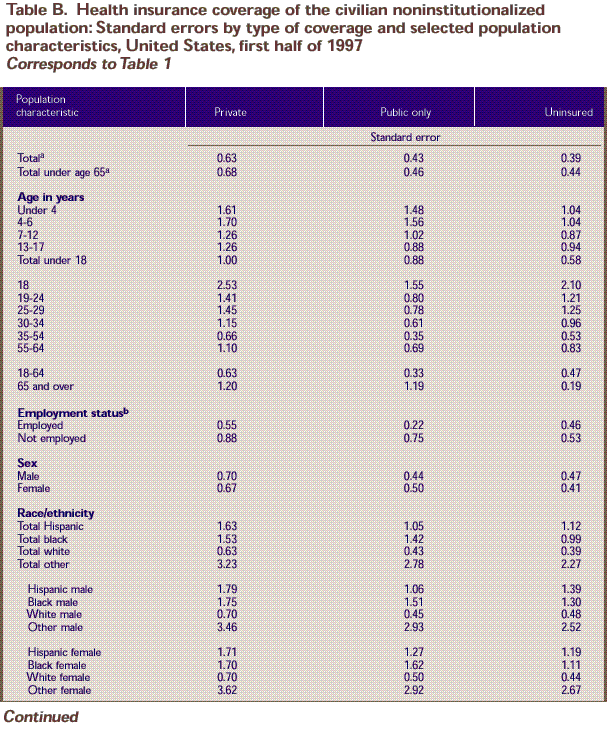

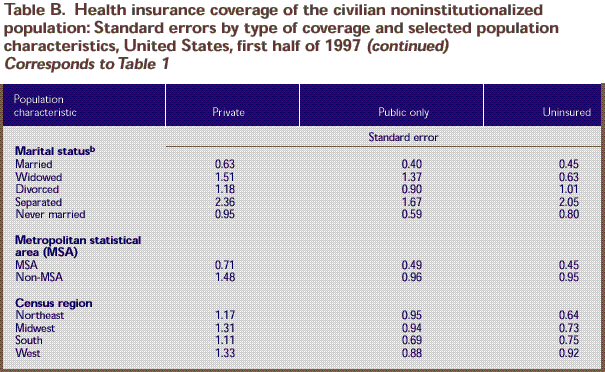

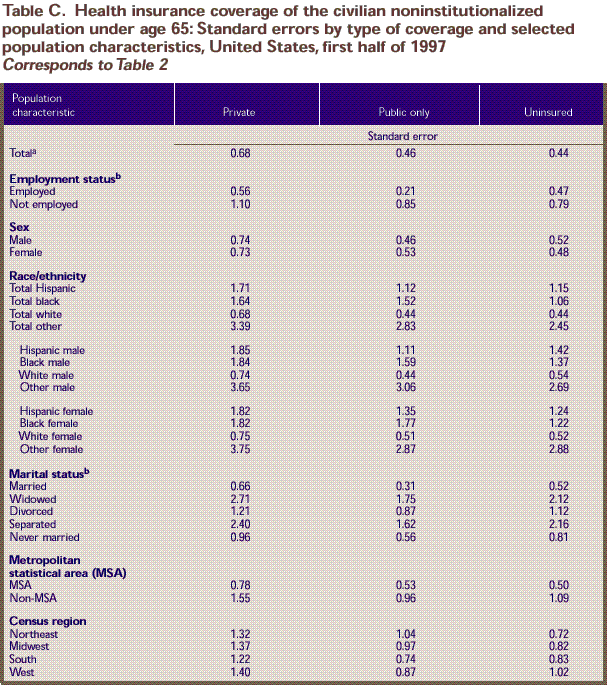

Estimates presented in the tables were rounded

to the nearest 0.1 percent. Standard errors, presented in Tables

B-F, were rounded to the nearest 0.01. Population estimates in

Tables 1-4 and Table A were rounded to the nearest thousand. Therefore,

some of the estimates presented in the tables for population totals

of subgroups will not add exactly to the overall estimated population

total.

Comparisons

with Other Data Sources

Other Surveys

Because of methodological differences, caution

should be used when comparing these data with data from other sources.

For example, CPS measures persons who are uninsured for a full

year; NHIS measures persons who lack insurance at a given point

in time--the month before the interview. The CPS interview that

contains information on the health insurance status of the population

is conducted annually, and NHIS collects insurance data on a continuous

basis each year. In addition, unlike MEPS, CPS counts as insured

military veterans whose source of health care is the Department

of Veterans Affairs. CPS also counts children of adults covered

by Medicaid as insured. For these preliminary estimates, MEPS did

not consider these children insured unless their families reported

them as such.

1996 MEPS Data

Users interested in comparing the 1996 and 1997

MEPS health insurance estimates should be aware that the standard

errors presented in the tables do not account for the fact that

the estimates are not independent. By design, the 1996 MEPS panel

respondents are present in both the 1996 and 1997 sample populations.

Users should also be aware of questionnaire wording differences

in the Rounds 1 and 3 MEPS interviews. The questionnaire for the

Round 3 interviews includes reviews of previously reported sources

of health insurance coverage. Note that the 1996 estimates presented

in MEPS Research Findings Number 1 (Vistnes and Monheit, 1997)

are based on data obtained during the 1996 MEPS Round 1 interview,

while the 1997 estimates are based on interviews conducted in Round

1 of the 1997 MEPS panel as well as Round 3 of the 1996 MEPS panel.

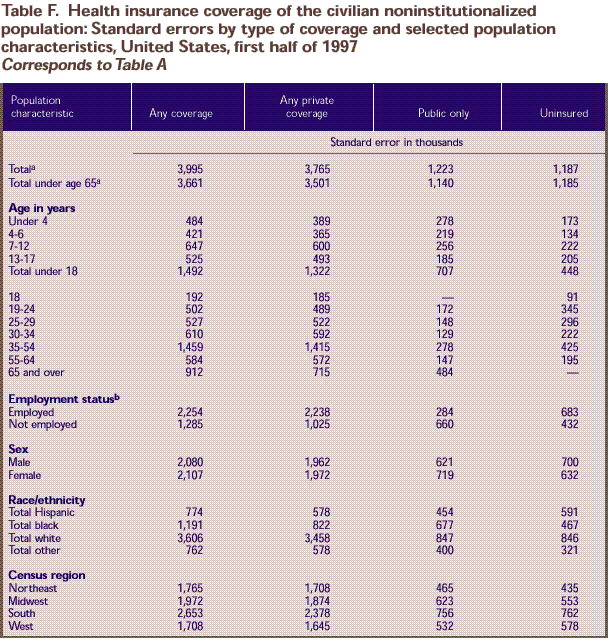

Population

and Standard Error Tables:

a Includes persons with unknown employment status.

b For individuals age 16 and over.

c Sample size too small to produce reliable estimates.

Source: Center

for Financing, Access, and Cost Trends, Agency for Health Care

Policy and Research: Medical Expenditure Panel Survey Household

Component, 1997.

^top

a Includes persons with unknown employment status

and marital status.

b For individuals age 16 and over. Source: Center

for Financing, Access, and Cost Trends, Agency for Health Care

Policy and Research: Medical Expenditure Panel Survey Household

Component, 1997.

^top

a Includes persons with unknown employment status

and marital status.

b For individuals age 16 and over. Source: Center

for Financing, Access, and Cost Trends, Agency for Health Care

Policy and Research: Medical Expenditure Panel Survey Household

Component, 1997.

^top

a Includes persons with unknown perceived health

status.

* Relative standard error is greater than or

equal to 30 percent. Source: Center

for Financing, Access, and Cost Trends, Agency for Health Care

Policy and Research: Medical Expenditure Panel Survey Household

Component, 1997.

^top

a Includes persons with unknown marital status

and perceived health status.

b For individuals age 16 and over.

Source: Center

for Financing, Access, and Cost Trends, Agency for Health Care

Policy and Research: Medical Expenditure Panel Survey Household

Component, 1997.

^top

a Includes persons with unknown employment status.

b For individuals age 16 and over.

– Sample size

too small to produce reliable estimates.

Source: Center

for Financing, Access, and Cost Trends, Agency for Health Care

Policy and Research: Medical Expenditure Panel Survey Household

Component, 1997.

^top

Suggested

Citation:

Vistnes, J. P. and Zuvekas,

S. H. Research Findings #8: Health Insurance Status of the Civilian Noninstitutionalized Population, 1997. July 1999. Agency

for Healthcare Research and Quality, Rockville,

MD.

http://www.meps.ahrq.gov/data_files/publications/rf8/rf8.shtml |

|