Chartbook #25: MEPS Insurance Component 2020 Chartbook

Agency for Healthcare Research and Quality

5600 Fishers Lane

Rockville, MD 20857

www.ahrq.gov

Acknowledgments

This chartbook was prepared by G. Edward Miller, Patricia Keenan, Thomas A. Hegland and

Asako S. Moriya of the Division of Research and Modeling, Center for Financing, Access, and

Cost Trends (CFACT) in the Agency for Healthcare Research and Quality (AHRQ).

The authors appreciate the efforts of Alon Evron, Jillian Botkin, Lauren Kestner, Sara Bernate Angulo, and Andy Elkins of IMPAQ, Karen Turner of the University of Minnesota, Abigail Smith and Damon Harris of Insignia, and Embrey Young of Visual Connections in creating the exhibits in the chartbook, compiling the chartbook, and preparing the chartbook for production; the data production work of Brandon Flanders of the U.S. Census Bureau; and the production assistance of Doreen Bonnett and Nicole Shulman, AHRQ.

Reviewers of this publication were Joel W. Cohen, Director of CFACT, and Steven C. Hill

(Senior Economist), Julie Hudson (Senior Economist), Salam Abdus (Senior Economist), Paul

D. Jacobs (Senior Service Fellow), and Samuel H. Zuvekas (Senior Research Adviser) of the

Division of Research and Modeling in CFACT.

Introduction

Background

Data Presentation

References

Executive Summary

Section 1: Health Insurance Offer Rates

Section 2: Employee Eligibility and Enrollment

Section 3: Health Insurance Premiums

Section 4: Employee and Employer Premium Contributions

Section 5: Employee Cost Sharing

The data used in this report are from the Insurance Component of the Medical Expenditure Panel Survey. Information about this survey, including sample design, data collection, sample sizes, and response rates, can be found at

https://meps.ahrq.gov/survey_comp/Insurance.jsp.

This product is in the public domain and may be used and reprinted without permission in the United States for noncommercial purposes, unless materials are clearly noted as copyrighted in the document. No one may reproduce copyrighted materials without the permission of the copyright holders. Users outside the United States must get permission from AHRQ to reprint or translate this product. Anyone wanting to reproduce this product for sale must contact AHRQ for permission.

Suggested Citation

Medical Expenditure Panel Survey Insurance Component 2020 Chartbook.

Rockville, MD: Agency for Healthcare Research and Quality;

December 2021. AHRQ Publication No. 22-0002.

https://meps.ahrq.gov/mepsweb/data_files/publications/cb25/cb25.shtml.

The Medical Expenditure Panel Survey Insurance Component (MEPS-IC) is an annual survey of

private employers and State and local governments. The MEPS-IC produces national and Statelevel estimates of employer-sponsored insurance, including offered plans, costs, employee

eligibility, and number of enrollees. The MEPS-IC is sponsored by the Agency for Healthcare

Research and Quality and is fielded by the U.S. Census Bureau.

This chartbook provides both single-year and multiyear trend analyses using private-sector

MEPS-IC data from 2008 to 2020. To best convey key information from the MEPS-IC, the

report is presented in five sections: Health Insurance Offer Rates; Employee Eligibility and

Enrollment; Health Insurance Premiums; Employee and Employer Premium Contributions; and

Employee Cost Sharing. Each section provides charts and discussion with links to MEPS-IC data

tables that contain the estimates and standard errors for each exhibit.

Many of the estimates in this publication are categorized by firm sizes that are relevant to

national healthcare policy. The firm-size categories used in the charts and tables are based on

actual employment counts rather than full-time equivalent (FTE) counts, because the MEPS-IC

does not collect FTE employment figures.

Each section discusses the estimates to highlight trends and differences by employer and

workforce characteristics. If a comparison of estimates is presented in the discussion, any

differences are statistically significant at the 0.05 level. In some cases, differences noted in the

text, in estimates as well as statistical significance of comparisons, may vary slightly from

calculations performed using data in the exhibits, MEPS-IC data available on the MEPS website,

or MEPS-IC Statistical Briefs due to rounding. All dollar estimates are nominal (not adjusted for

inflation).

Return to Table of Contents

The IC is one of three annual component surveys that make up MEPS. The other two

components are the Household Component (HC) and the Medical Provider Component (MPC).

The HC is a nationally representative survey of the U.S. civilian noninstitutionalized population

that collects data at both the person and household levels. The MPC collects information from a

sample of physicians, hospitals, home health agencies, and pharmacies that provided services to

HC respondents.

The MEPS-IC uses two independent samples: the private sector and the public sector. The

private-sector sample is composed of approximately 42,000 business establishments from more

than 7 million establishments found on the Business Register at the U.S. Census Bureau, with 4.2

percent of the sample determined during the data collection process to be out of scope. In 2020,

the response rate for the private sector was 56.1 percent of the remaining in-scope sample units.

An establishment is a single business entity or location. Firms (also often referred to as companies) can include one or more establishments. An example of a multi-establishment firm is a chain of grocery stores, where the establishments of the firm are the sites of the individual grocery stores. The charts and tables in this publication report characteristics within firm-based size categories.

The public-sector sample of the MEPS-IC selects almost 3,000 State and local government agencies. However, this report focuses only on the private sector.

Additional information on MEPS-IC sampling can be found in Sample Design of the 2020 Medical Expenditure Panel Survey Insurance Component (Davis, 2021; PDF).

The unprecedented pandemic and economic disruption in 2020 have caused uncertainty in some

of the private-sector employment estimates, particularly with respect to the distribution of

employment across firm sizes.

The issue is a concern because offers of health insurance are strongly correlated with firm size.

Consequently, changes in employment may have affected differences in the estimated

percentages of employees offered, and covered by, employer-sponsored health insurance

between 2019 and 2020. They also affect estimates of totals by firm size (e.g., totals of

establishments and employees). However, our initial investigations suggest that the vast majority

of means and proportions estimated in the MEPS-IC data are not affected by this issue.

AHRQ is currently investigating several factors that may have influenced the 2020 MEPS-IC

data. These factors include: (1) when firms of different sizes respond to the survey; (2) openings

and closures of establishments during the survey period; and (3) the role of openings and

closures in multi-establishment firms.

For purposes of the analyses presented in this chartbook, the District of Columbia is treated as a State. In addition, exhibits are organized by category (e.g., premium type, firm size), so references to exhibits in the text may not be in numeric order (e.g., Exhibits 3.1, 3.3, and 3.5 instead of 3.1, 3.2, and 3.3).

Return to Table of Contents

Davis K. Sample Design of the 2020 Medical Expenditure Panel Survey Insurance Component.

Methodology Report #34. Rockville, MD: Agency for Healthcare Research and Quality; August

2021. https://meps.ahrq.gov/data_files/publications/mr34/mr34.shtml.

Accessed September 29, 2021.

Kearney A, Sommers J. Switching from retrospective to current-year data collection in

the Medical Expenditure Panel Survey - Insurance Component. ICES-III: Third

International Conference on Establishment Surveys, Conference Proceedings, Montréal, Québec, Canada; June 2007.

Return to Table of Contents

Overview

Employer-sponsored insurance (ESI) is the primary source of health insurance coverage for

individuals under age 65. This chartbook uses data for private-sector establishments in the

Medical Expenditure Panel Survey-Insurance Component (MEPS-IC) to describe trends in

employer coverage, premiums, and benefits from 2008 to 2020.

The MEPS-IC is an annual survey of private employers and State and local governments and is

designed to be representative of all 50 States and the District of Columbia. The large sample size

(about 42,000 private-sector establishments), combined with a response rate of 56.1 percent in

2020, permits analyses of variations in ESI by firm size and across States that are not readily

available from other sources.

Examining trends by firm size and across States is important due to variation in insurance

markets along these dimensions. Historically, insurance markets have differed by firm size due

to smaller firms' more limited ability to pool risk and their higher administrative costs compared

with larger firms. State variation in ESI markets may reflect differences in employment patterns,

healthcare prices, and utilization, as well as differences in State approaches to regulating private

insurance and administering Medicaid.

This chartbook describes trends and patterns in ESI overall, by firm size, and by State from 2008

to 2020. All differences noted are at the 0.05 significance level. All dollar estimates are nominal

(not adjusted for inflation).

Summary of Findings

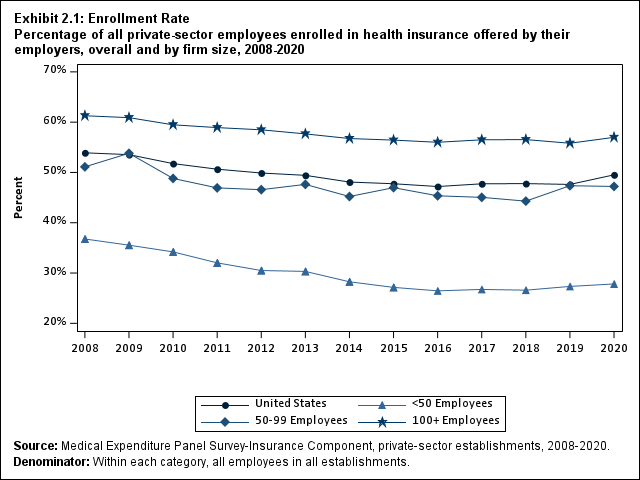

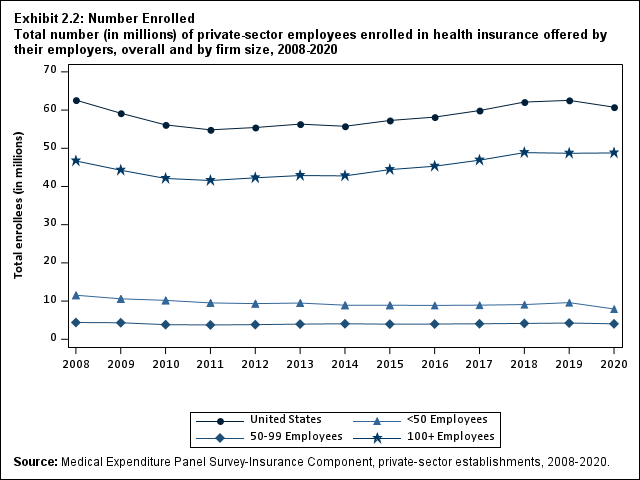

Employee Enrollment in Health Insurance

Between 2019 and 2020, there was a significant increase, from 47.6 percent to 49.5 percent, in

the overall percentage of private-sector employees covered by a health insurance plan offered by

their employers (the "enrollment rate"). There were no significant changes, however, in the

enrollment rate within any of the three firm size groups examined in this study.

Compared with 2019, the increase in the overall 2020 enrollment rate reflects a large reduction in

employment among small employers (fewer than 50 employees) and a subsequent increase in the

proportion of employees in medium (50 to 99 employees) and large firms (100 or more

employees). Since these firms have higher enrollment rates than small firms, the overall 2020

enrollment rate increased even though enrollment rates within firm sizes did not change.*

The enrollment rate reflects the combination of employers' decisions about offering health

insurance and employee eligibility for such coverage, as well as employees' decisions to take up

coverage if eligible. Offer rates, eligibility rates, and take-up rates, as well as coverage rates

among employees offered insurance, are described further below.

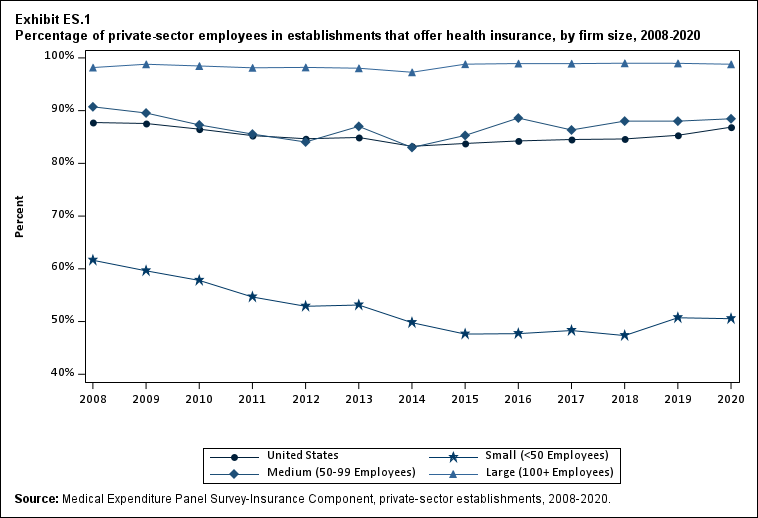

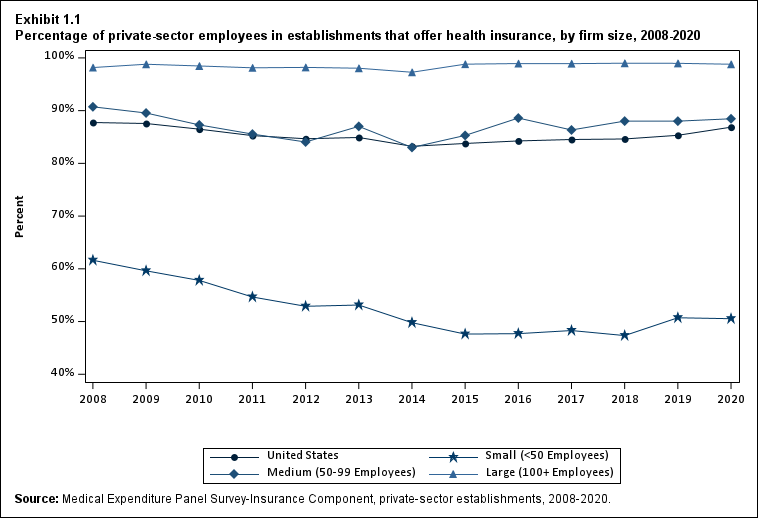

Availability of Coverage: Offer Rates

Overall, the percentage of private-sector employees working at establishments that offered

insurance ("the offer rate") increased from 85.3 percent in 2019 to 86.9 percent in 2020 (Exhibit

ES.1). Offer rates at small (50.5 percent), medium (88.5 percent), and large firms (98.8 percent)

were unchanged from their 2019 values.

The change in the overall offer rate was driven by the large decline in employment among small

employers. Compared with 2019, the increase in the overall 2020 offer rate reflects an increase

in the proportion of employees in medium and large firms. Since these firms have higher offer

rates than small firms, the overall 2020 offer rate increased even though offer rates within firm

sizes did not change.*

* These findings may be affected by measurement issues related to the 2020 MEPS-IC employment and related

estimates. For a discussion of these issues, see the MEPS IC 2020 user note.

Return to Table of Contents

| Number of Employees |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

| U.S. |

87.7% |

87.6% |

86.5%* |

85.3%* |

84.7% |

84.9% |

83.2%* |

83.8% |

84.3% |

84.5% |

84.6% |

85.3%* |

86.9%* |

| (Standard Error) |

(0.3%) |

(0.2%) |

(0.2%) |

(0.2%) |

(0.3%) |

(0.3%) |

(0.3%) |

(0.2%) |

(0.2%) |

(0.2%) |

(0.2%) |

(0.2%) |

(0.2%) |

| <50 |

61.6% |

59.6%* |

57.8%* |

54.7%* |

52.9%* |

53.1% |

49.8%* |

47.6%* |

47.7% |

48.3% |

47.3% |

50.7%* |

50.5%^ |

| (Standard Error) |

(0.5%) |

(0.5%) |

(0.5%) |

(0.4%) |

(0.6%) |

(0.7%) |

(0.6%) |

(0.6%) |

(0.6%) |

(0.6%) |

(0.6%) |

(0.7%) |

(0.7%) |

| 50-99 |

90.7% |

89.6% |

87.3% |

85.6% |

84.1% |

87.0% |

83.0%* |

85.3% |

88.6%* |

86.3% |

88.0% |

88.0% |

88.5%^ |

| (Standard Error) |

(0.9%) |

(1.3%) |

(0.9%) |

(1.0%) |

(1.4%) |

(1.0%) |

(1.3%) |

(1.2%) |

(1.0%) |

(1.2%) |

(1.1%) |

(1.1%) |

(1.2%) |

| 100+ |

98.2% |

98.8% |

98.5% |

98.1% |

98.2% |

98.0% |

97.3%* |

98.8%* |

98.9% |

98.9% |

99.0% |

99.0% |

98.8% |

| (Standard Error) |

(0.3%) |

(0.1%) |

(0.2%) |

(0.2%) |

(0.2%) |

(0.2%) |

(0.2%) |

(0.2%) |

(0.1%) |

(0.2%) |

(0.2%) |

(0.1%) |

(0.2%) |

Source: Medical Expenditure Panel Survey-Insurance Component, private-sector establishments, 2008-2020.

Note: * indicates the estimate is statistically different from the previous year at p < 0.05. ^ indicates that the estimates for firms with <50 and 50-99 employees are statistically different from the estimate for firms with 100+ employees at p < 0.05. This test is conducted for 2020 only. |

Return to Table of Contents

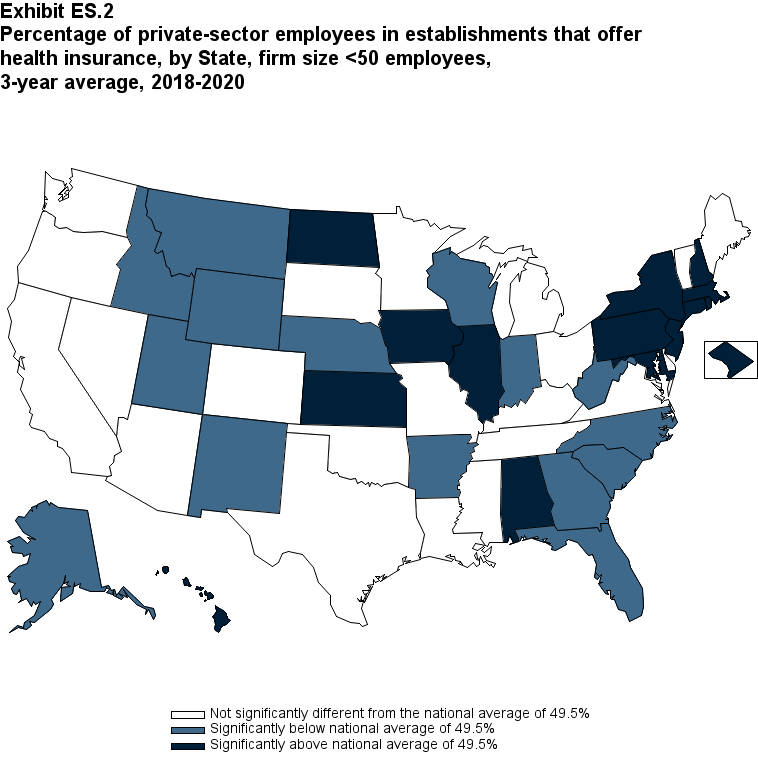

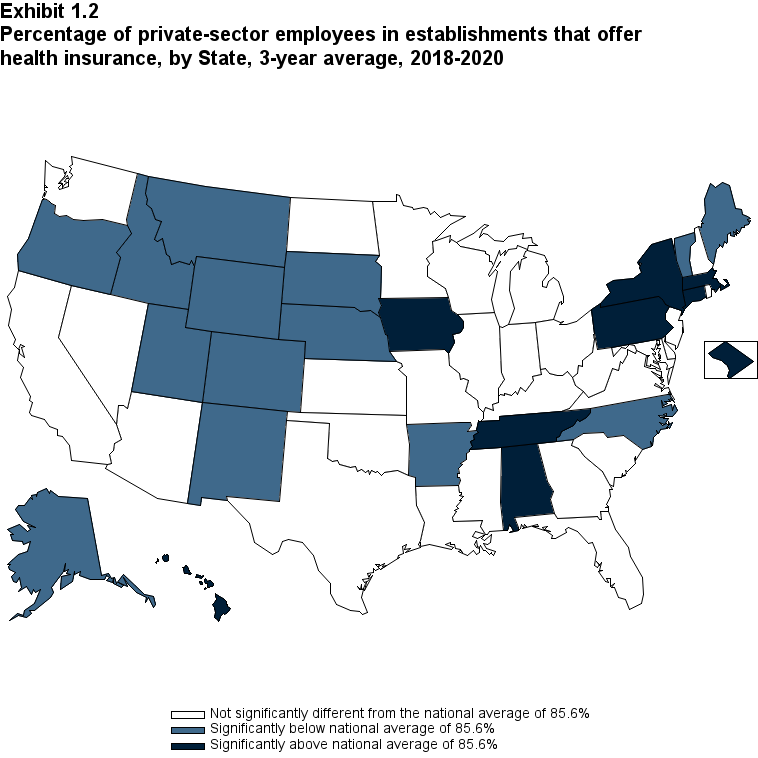

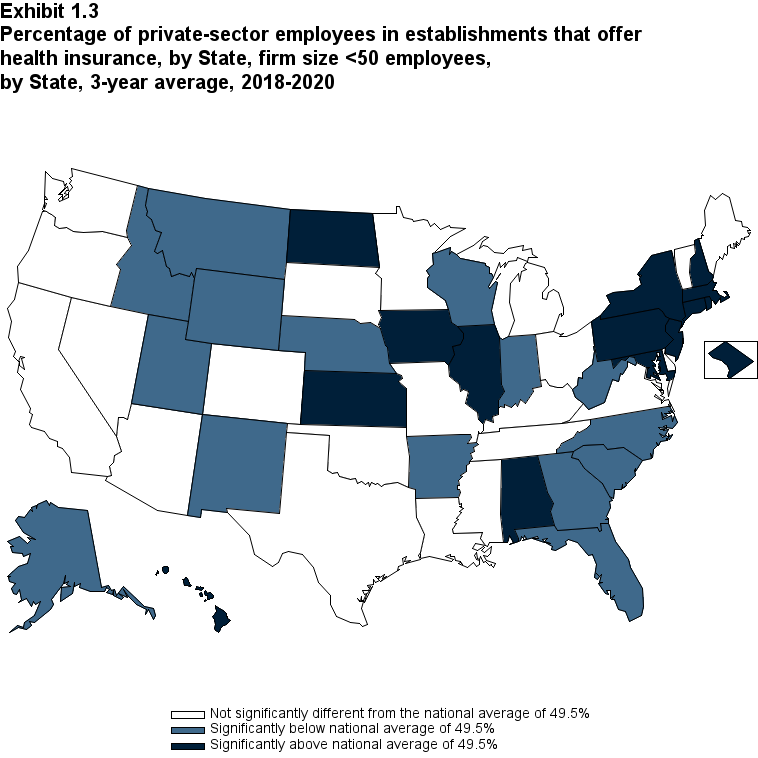

Since almost all large firms offer health insurance coverage, offer rates among small firms are an

important factor contributing to overall State ESI offer rates, along with the distribution of

employers by firm size in the State. Overall, the average annual offer rate for 2018-2020 was

49.5 percent for small firms, but there was substantial variation across the United States. Among

small firms, 15 States were significantly below the national average, with average annual offer

rates ranging from 35.5 to 44.4 percent. Another 15 States, with average annual offer rates

ranging from 53.7 to 90.2 percent, were significantly above the national average for small firms

(Exhibit ES.2).

| Alabama |

54.9%* |

Kentucky |

49.4% |

North Dakota |

56.3%* |

| (Standard Error) |

(2.3%) |

(Standard Error) |

(2.6%) |

(Standard Error) |

(2.1%) |

| Alaska |

35.5%* |

Louisiana |

50.2% |

Ohio |

50.0% |

| (Standard Error) |

(2.3%) |

(Standard Error) |

(2.5%) |

(Standard Error) |

(2.4%) |

| Arizona |

45.5% |

Maine |

45.0% |

Oklahoma |

50.2% |

| (Standard Error) |

(2.7%) |

(Standard Error) |

(2.4%) |

(Standard Error) |

(2.3%) |

| Arkansas |

40.4%* |

Maryland |

56.8%* |

Oregon |

48.2% |

| (Standard Error) |

(2.5%) |

(Standard Error) |

(2.4%) |

(Standard Error) |

(2.1%) |

| California |

50.2% |

Massachusetts |

62.5%* |

Pennsylvania |

55.6%* |

| (Standard Error) |

(1.4%) |

(Standard Error) |

(2.5%) |

(Standard Error) |

(1.9%) |

| Colorado |

46.1% |

Michigan |

50.5% |

Rhode Island |

56.1%* |

| (Standard Error) |

(2.4%) |

(Standard Error) |

(2.3%) |

(Standard Error) |

(2.5%) |

| Connecticut |

57.8%* |

Minnesota |

49.2% |

South Carolina |

40.8%* |

| (Standard Error) |

(2.3%) |

(Standard Error) |

(2.4%) |

(Standard Error) |

(2.4%) |

| Delaware |

50.5% |

Mississippi |

45.6% |

South Dakota |

50.1% |

| (Standard Error) |

(2.9%) |

(Standard Error) |

(2.6%) |

(Standard Error) |

(2.1%) |

| District of Columbia |

70.4%* |

Missouri |

49.2% |

Tennessee |

48.3% |

| (Standard Error) |

(2.6%) |

(Standard Error) |

(2.4%) |

(Standard Error) |

(2.5%) |

| Florida |

41.7%* |

Montana |

37.6%* |

Texas |

47.4% |

| (Standard Error) |

(2.1%) |

(Standard Error) |

(2.1%) |

(Standard Error) |

(1.7%) |

| Georgia |

41.1%* |

Nebraska |

41.2%* |

Utah |

38.1%* |

| (Standard Error) |

(2.5%) |

(Standard Error) |

(2.3%) |

(Standard Error) |

(2.5%) |

| Hawaii |

90.2%* |

Nevada |

51.3% |

Vermont |

46.1% |

| (Standard Error) |

(1.3%) |

(Standard Error) |

(2.9%) |

(Standard Error) |

(2.0%) |

| Idaho |

39.9%* |

New Hampshire |

55.3%* |

Virginia |

50.8% |

| (Standard Error) |

(2.3%) |

(Standard Error) |

(2.3%) |

(Standard Error) |

(2.3%) |

| Illinois |

53.7%* |

New Jersey |

57.1%* |

Washington |

50.1% |

| (Standard Error) |

(2.0%) |

(Standard Error) |

(2.3%) |

(Standard Error) |

(2.2%) |

| Indiana |

43.9%* |

New Mexico |

40.9%* |

West Virginia |

44.1%* |

| (Standard Error) |

(2.4%) |

(Standard Error) |

(2.3%) |

(Standard Error) |

(2.6%) |

| Iowa |

54.2%* |

New York |

55.7%* |

Wisconsin |

44.4%* |

| (Standard Error) |

(2.2%) |

(Standard Error) |

(1.6%) |

(Standard Error) |

(2.3%) |

| Kansas |

54.7%* |

North Carolina |

38.5%* |

Wyoming |

38.0%* |

| (Standard Error) |

(2.3%) |

(Standard Error) |

(2.2%) |

(Standard Error) |

(2.1%) |

Source: Medical Expenditure Panel Survey-Insurance Component, private-sector establishments, 2020.

Note: * Statistically different from the national average of 49.5 percent at p < 0.05. Note that the standard error on the national estimate of 49.5 percent is 0.4 percent. |

Return to Table of Contents

Employee Coverage, Eligibility, and Take-Up Rates

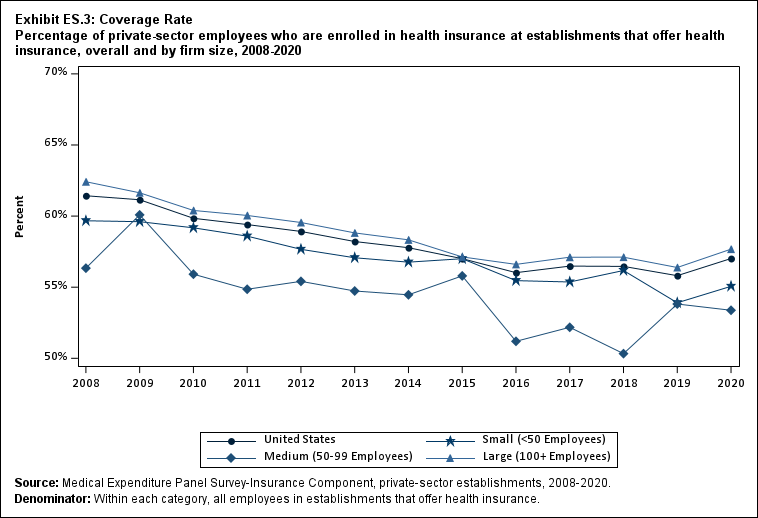

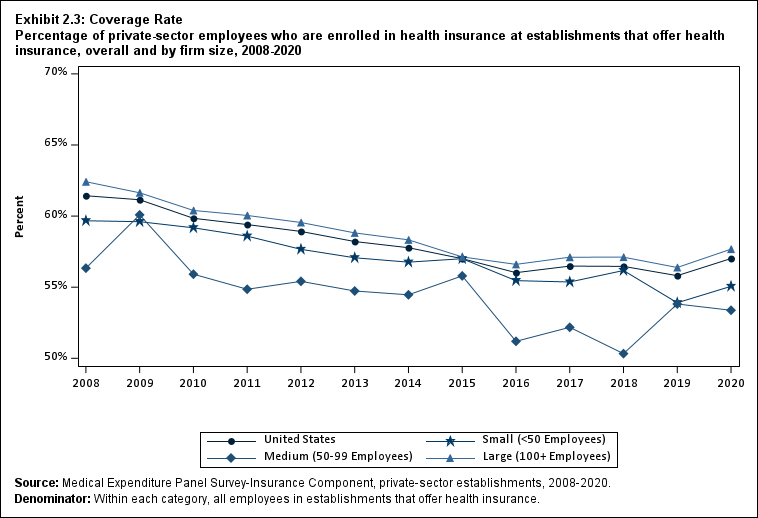

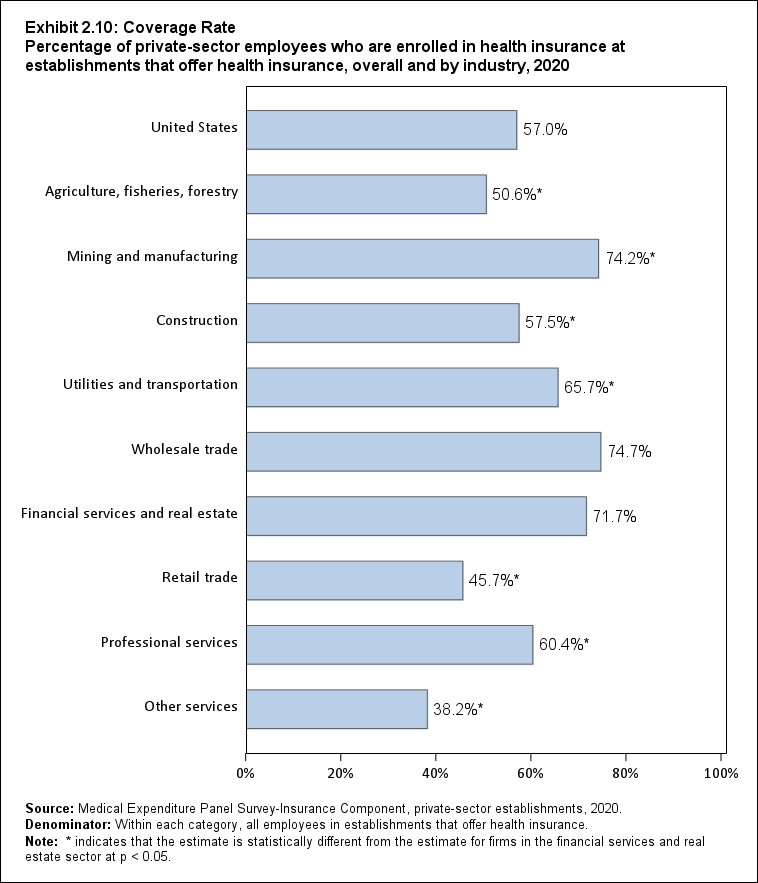

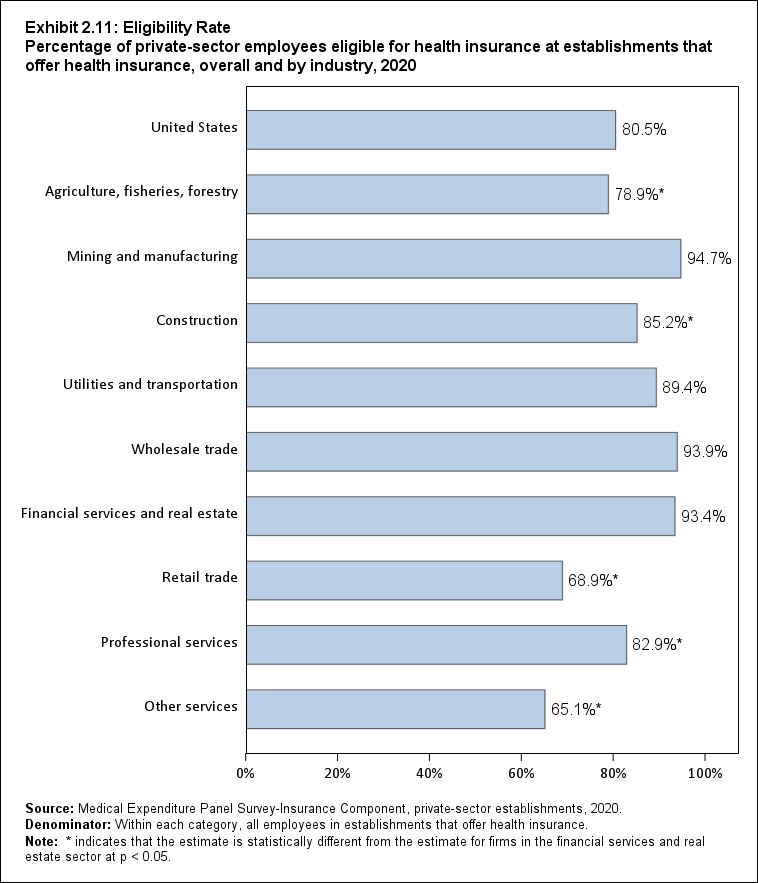

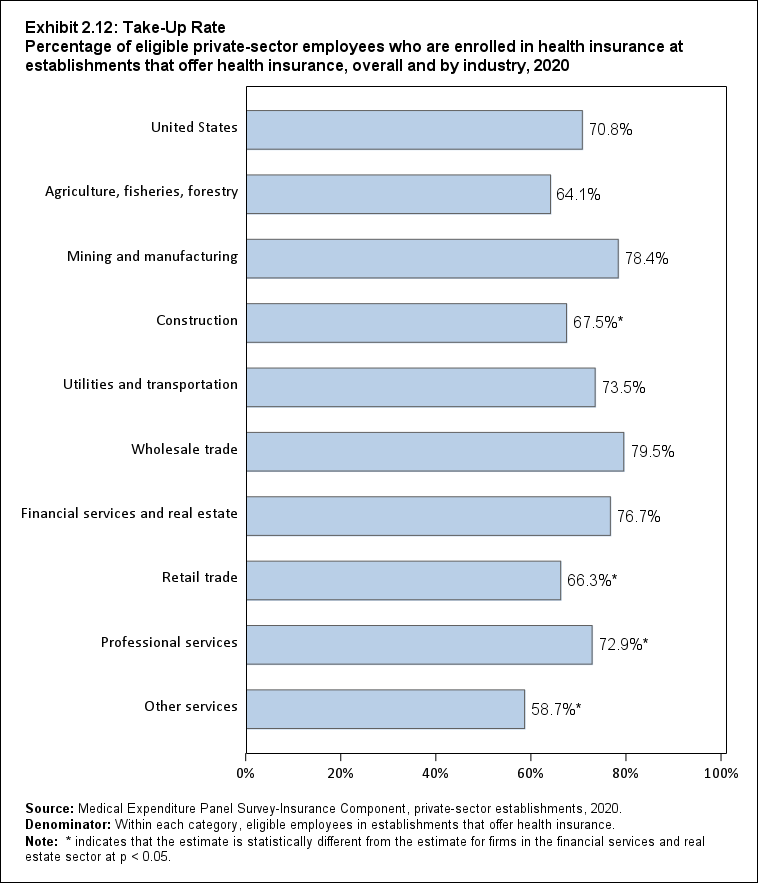

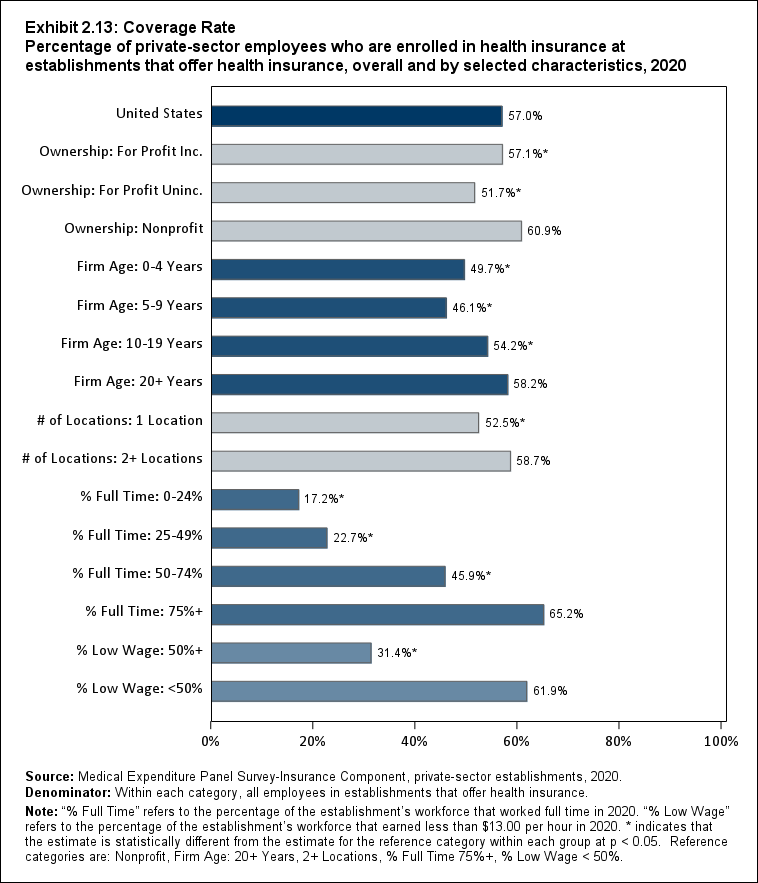

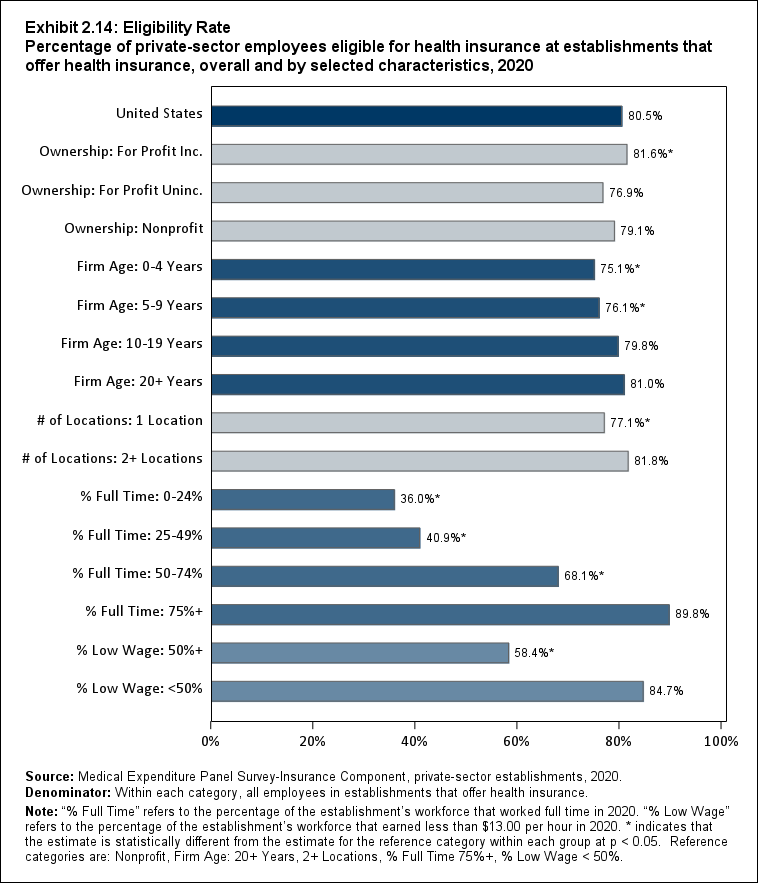

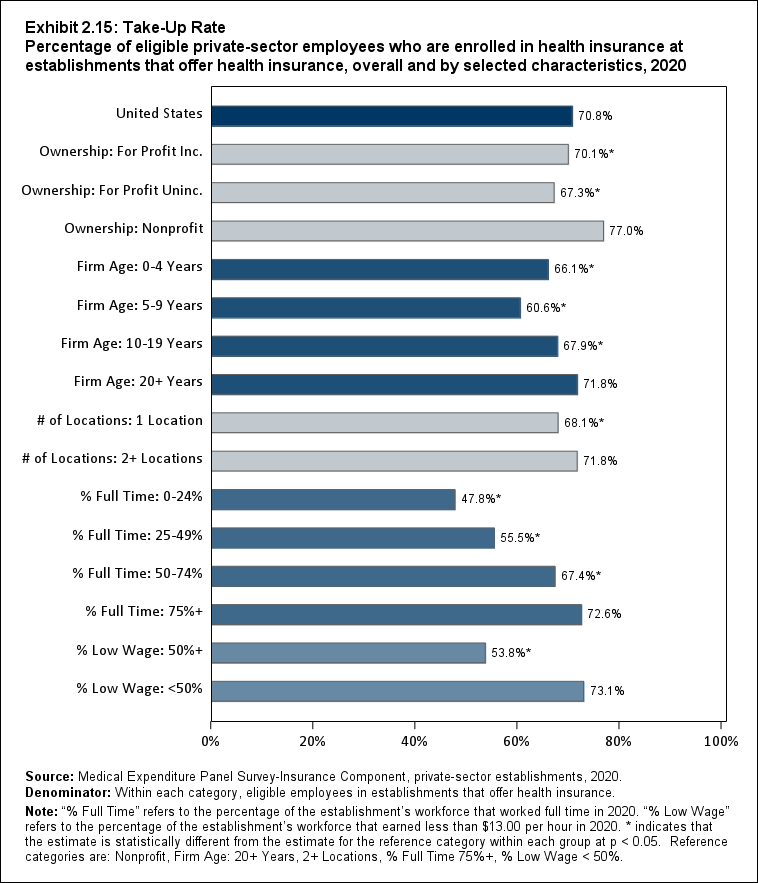

Among establishments that offered insurance, 57.0 percent of employees were enrolled in

coverage through their employer (the "coverage rate") and 80.5 percent were eligible for health

insurance (the "eligibility rate"). Among eligible employees, 70.8 percent were enrolled in their

employers health insurance (the "take-up rate") (Exhibits ES.3, ES.4, and ES.5).

| Number of Employees |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

| U.S. |

61.4% |

61.1% |

59.8%* |

59.4% |

58.9% |

58.2% |

57.8% |

57.0% |

56.0% |

56.5% |

56.5% |

55.8% |

57.0% |

| (Standard Error) |

(0.4%) |

(0.4%) |

(0.5%) |

(0.2%) |

(0.4%) |

(0.3%) |

(0.4%) |

(0.4%) |

(0.4%) |

(0.4%) |

(0.4%) |

(0.5%) |

(0.4%) |

| <50 |

59.7% |

59.6% |

59.2% |

58.6% |

57.7% |

57.1% |

56.8% |

57.0% |

55.5% |

55.4% |

56.2% |

53.9%* |

55.1%^ |

| (Standard Error) |

(0.2%) |

(0.4%) |

(0.6%) |

(0.5%) |

(0.5%) |

(0.5%) |

(0.6%) |

(0.6%) |

(0.6%) |

(0.6%) |

(0.6%) |

(0.6%) |

(0.7%) |

| 50-99 |

56.3% |

60.1%* |

55.9%* |

54.9% |

55.4% |

54.7% |

54.5% |

55.8% |

51.2%* |

52.2% |

50.3% |

53.8%* |

53.4%^ |

| (Standard Error) |

(1.0%) |

(1.0%) |

(0.8%) |

(1.0%) |

(1.2%) |

(0.8%) |

(1.3%) |

(1.2%) |

(1.2%) |

(1.2%) |

(1.2%) |

(1.2%) |

(1.3%) |

| 100+ |

62.4% |

61.6% |

60.4% |

60.0% |

59.5% |

58.8% |

58.3% |

57.1% |

56.6% |

57.1% |

57.1% |

56.4% |

57.7% |

| (Standard Error) |

(0.5%) |

(0.6%) |

(0.6%) |

(0.3%) |

(0.4%) |

(0.3%) |

(0.5%) |

(0.5%) |

(0.5%) |

(0.5%) |

(0.5%) |

(0.6%) |

(0.5%) |

Source: Medical Expenditure Panel Survey-Insurance Component, private-sector establishments, 2008-2020.

Denominator: Within each category, all employees in establishments that offer health insurance.

Note: * indicates the estimate is statistically different from the previous year at p < 0.05. ^ indicates that the estimates for firms with <50 and 50-99 employees are statistically different from the estimate for firms with 100+ employees at p < 0.05. This test is conducted for 2020 only. |

Return to Table of Contents

From 2019 to 2020, there was no significant change in the coverage rate overall, and no

significant change in the coverage rate within small, medium, or large firms (Exhibit ES.3).

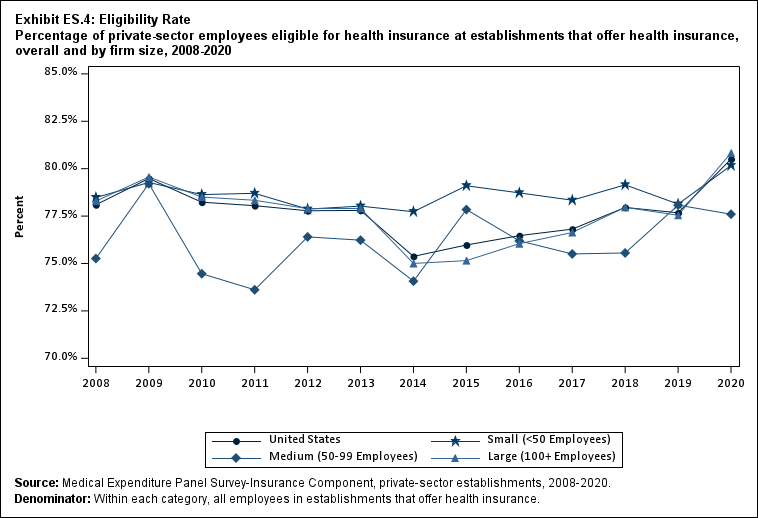

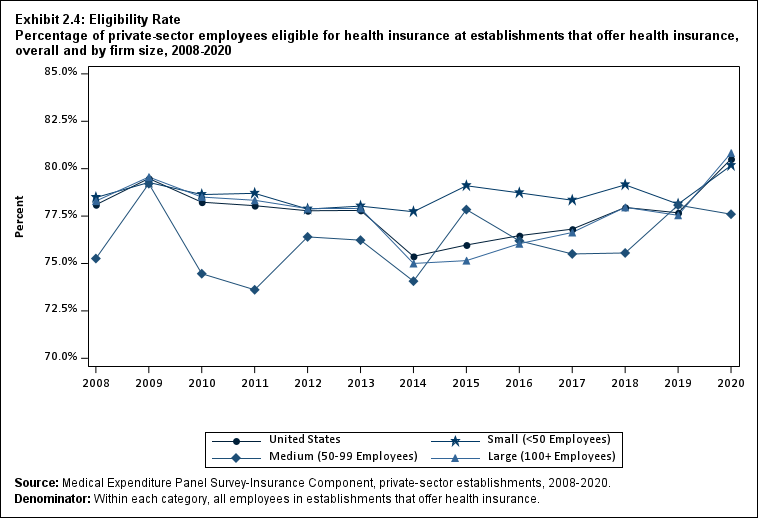

The overall eligibility rate for employees at private-sector establishments that offered insurance

increased from 77.7 percent in 2019 to 80.5 percent in 2020. The eligibility rate for small employers increased from 78.1 percent to 80.2 percent, and the eligibility rate for large firms

increased from 77.5 percent to 80.8 percent (Exhibit ES.4).

| Number of Employees |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

| U.S. |

78.1% |

79.5%* |

78.2%* |

78.0% |

77.8% |

77.8% |

75.4%* |

76.0% |

76.5% |

76.8% |

78.0%* |

77.7% |

80.5%* |

| (Standard Error) |

(0.4%) |

(0.3%) |

(0.5%) |

(0.4%) |

(0.3%) |

(0.2%) |

(0.4%) |

(0.4%) |

(0.4%) |

(0.4%) |

(0.4%) |

(0.4%) |

(0.4%) |

| <50 |

78.5% |

79.3% |

78.6% |

78.7% |

77.9% |

78.0% |

77.7% |

79.1% |

78.7% |

78.3% |

79.1% |

78.1% |

80.2%* |

| (Standard Error) |

(0.4%) |

(0.5%) |

(0.5%) |

(0.6%) |

(0.5%) |

(0.4%) |

(0.6%) |

(0.6%) |

(0.6%) |

(0.6%) |

(0.6%) |

(0.6%) |

(0.6%) |

| 50-99 |

75.3% |

79.2%* |

74.5%* |

73.6% |

76.4% |

76.2% |

74.1% |

77.8%* |

76.2% |

75.5% |

75.6% |

78.1% |

77.6%^ |

| (Standard Error) |

(1.3%) |

(0.8%) |

(0.6%) |

(1.0%) |

(1.2%) |

(0.8%) |

(1.4%) |

(1.2%) |

(1.2%) |

(1.2%) |

(1.2%) |

(1.2%) |

(1.4%) |

| 100+ |

78.3% |

79.6%* |

78.5% |

78.3% |

77.9% |

77.9% |

75.0%* |

75.2% |

76.0% |

76.6% |

78.0% |

77.5% |

80.8%* |

| (Standard Error) |

(0.4%) |

(0.5%) |

(0.6%) |

(0.4%) |

(0.3%) |

(0.3%) |

(0.5%) |

(0.5%) |

(0.4%) |

(0.5%) |

(0.5%) |

(0.5%) |

(0.5%) |

Source: Medical Expenditure Panel Survey-Insurance Component, private-sector establishments, 2008-2020.

Denominator: Within each category, all employees in establishments that offer health insurance.

Note: * indicates the estimate is statistically different from the previous year at p < 0.05. ^ indicates that the estimates for firms with <50 and 50-99 employees are statistically different from the estimate for firms with 100+ employees at p < 0.05. This test is conducted for 2020 only. |

Return to Table of Contents

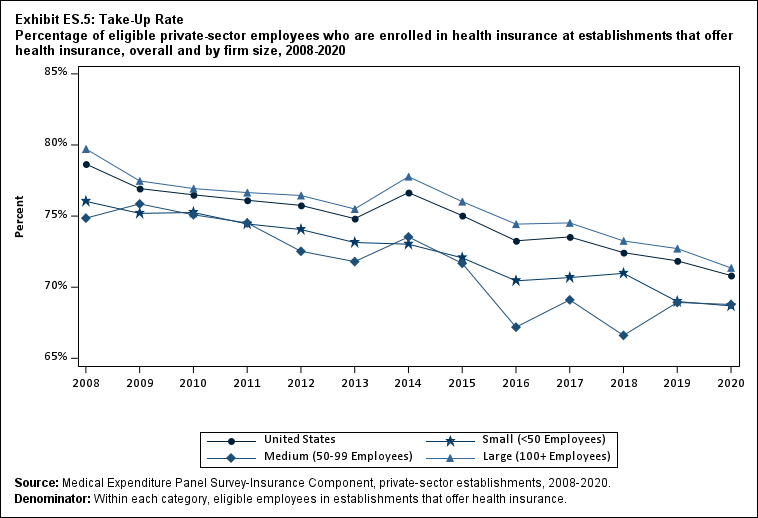

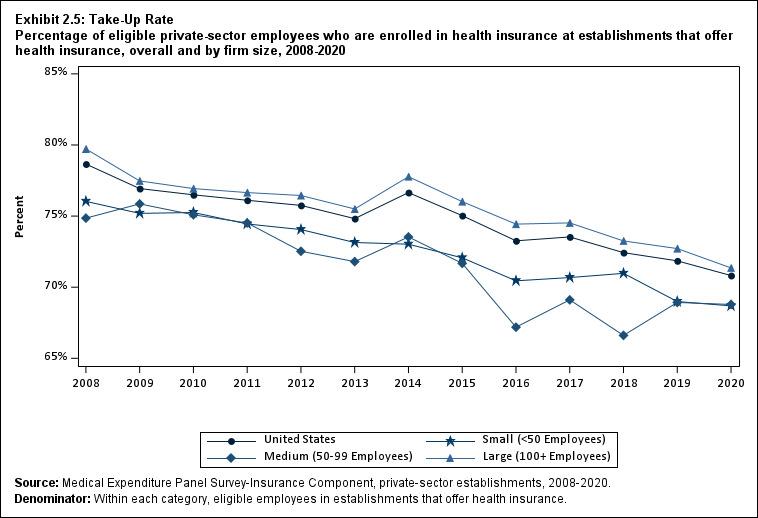

Among large employers (100 or more employees), take-up rates fell from 72.7 percent to 71.4

percent (Exhibit ES.5). Despite the decline, the take-up rate among large firms (71.4 percent)

remained higher than in medium (68.8 percent) and small firms (68.7 percent), as has been true

in almost every year from 2008 through 2020.

| Number of Employees |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

| U.S. |

78.7% |

76.9%* |

76.5% |

76.1% |

75.8% |

74.8%* |

76.7%* |

75.0%* |

73.3%* |

73.5% |

72.4%* |

71.9% |

70.8%* |

| (Standard Error) |

(0.3%) |

(0.3%) |

(0.2%) |

(0.3%) |

(0.3%) |

(0.2%) |

(0.3%) |

(0.3%) |

(0.3%) |

(0.3%) |

(0.4%) |

(0.4%) |

(0.4%) |

| <50 |

76.0% |

75.2%* |

75.3% |

74.4% |

74.1% |

73.1% |

73.0% |

72.1% |

70.4%* |

70.7% |

71.0% |

69.0%* |

68.7%^ |

| (Standard Error) |

(0.3%) |

(0.3%) |

(0.6%) |

(0.4%) |

(0.4%) |

(0.6%) |

(0.5%) |

(0.5%) |

(0.5%) |

(0.6%) |

(0.6%) |

(0.6%) |

(0.6%) |

| 50-99 |

74.9% |

75.9% |

75.1% |

74.5% |

72.5% |

71.8% |

73.5% |

71.7% |

67.2%* |

69.1% |

66.6% |

68.9% |

68.8%^ |

| (Standard Error) |

(0.5%) |

(0.9%) |

(0.7%) |

(0.6%) |

(0.8%) |

(1.0%) |

(1.0%) |

(1.1%) |

(1.2%) |

(1.1%) |

(1.1%) |

(1.0%) |

(1.0%) |

| 100+ |

79.7% |

77.5%* |

76.9% |

76.7% |

76.4% |

75.5%* |

77.8%* |

76.0%* |

74.4%* |

74.5% |

73.3%* |

72.7% |

71.4%* |

| (Standard Error) |

(0.4%) |

(0.5%) |

(0.3%) |

(0.3%) |

(0.4%) |

(0.3%) |

(0.3%) |

(0.3%) |

(0.4%) |

(0.4%) |

(0.4%) |

(0.5%) |

(0.4%) |

Source: Medical Expenditure Panel Survey-Insurance Component, private-sector establishments, 2008-2020.

Denominator: Within each category, all employees in establishments that offer health insurance.

Note: * indicates the estimate is statistically different from the previous year at p < 0.05. ^ indicates that the estimates for firms with <50 and 50-99 employees are statistically different from the estimate for firms with 100+ employees at p < 0.05. This test is conducted for 2020 only. |

Return to Table of Contents

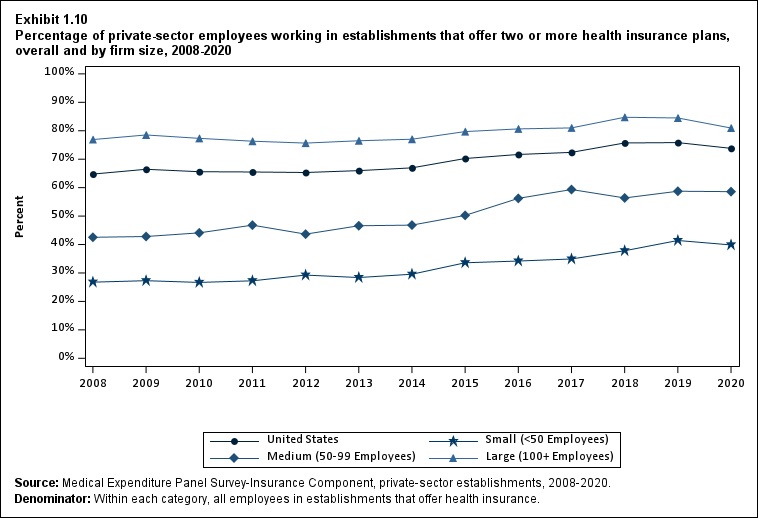

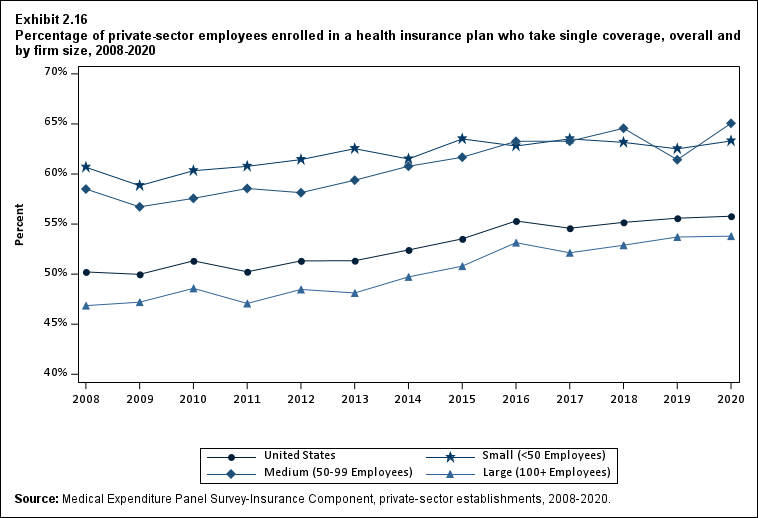

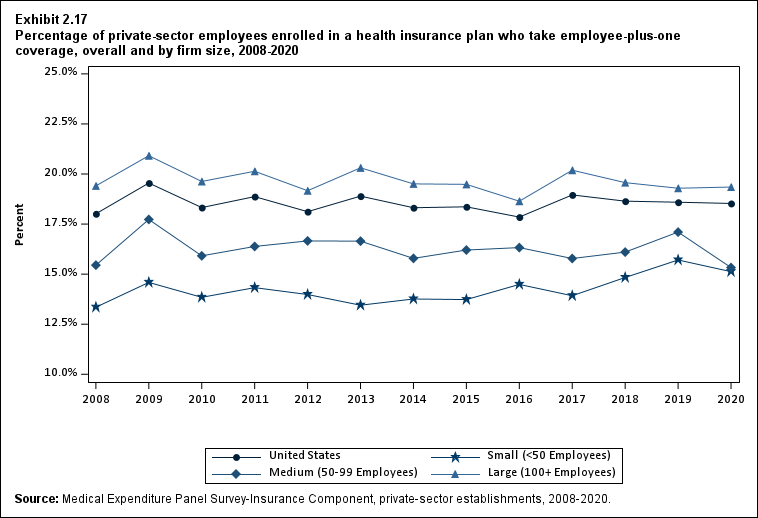

Choice of Plans

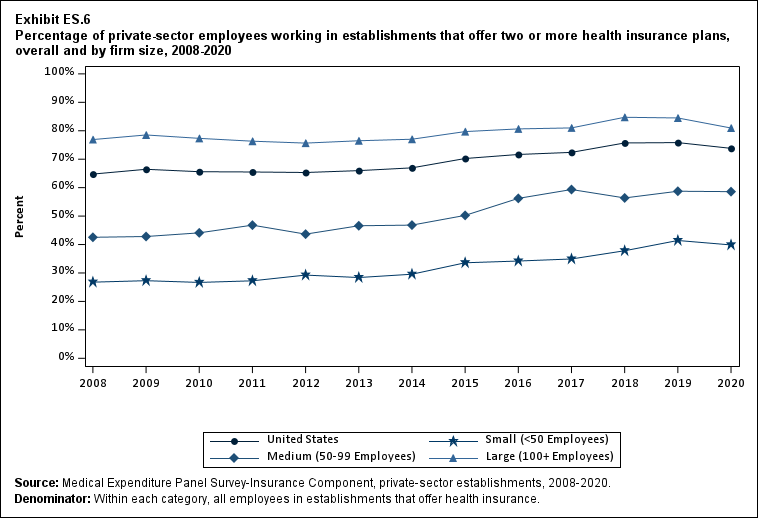

The overall share of employees at health insurance-offering firms who were offered a choice of

two or more health plans fell from 75.8 percent in 2019 to 73.8 percent in 2020. This decline was

driven by firms with 100 or more employees, where the share of employees offered a choice of

plans fell from 84.5 percent in 2019 to 81.0 percent in 2020 (Exhibit ES.6).

In all years from 2008 to 2020, the likelihood that a worker at an offering establishment had a

choice of plans increased with firm size. In 2020, the percentage of workers with a choice of

plans was 39.9 percent in firms with fewer than 50 employees, 58.6 percent in firms with 50 to

99 employees, and 81.0 percent in firms with 100 or more workers.

| Number of Employees |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

| U.S. |

64.8% |

66.5% |

65.6% |

65.5% |

65.3% |

66.0% |

67.0% |

70.2%* |

71.7% |

72.4% |

75.7%* |

75.8% |

73.8%* |

| (Standard Error) |

(0.6%) |

(0.7%) |

(0.8%) |

(0.5%) |

(0.7%) |

(0.6%) |

(0.6%) |

(0.5%) |

(0.5%) |

(0.5%) |

(0.5%) |

(0.5%) |

(0.6%) |

| <50 |

26.8% |

27.3% |

26.7% |

27.2% |

29.3% |

28.4% |

29.6% |

33.6%* |

34.2% |

34.9% |

37.8%* |

41.4%* |

39.9%^ |

| (Standard Error) |

(0.7%) |

(0.9%) |

(0.8%) |

(0.9%) |

(0.8%) |

(1.0%) |

(0.9%) |

(1.1%) |

(1.0%) |

(1.0%) |

(1.0%) |

(1.1%) |

(1.1%) |

| 50-99 |

42.5% |

42.8% |

44.1% |

46.8% |

43.7% |

46.6% |

46.8% |

50.2% |

56.2%* |

59.3% |

56.4% |

58.7% |

58.6%^ |

| (Standard Error) |

(1.7%) |

(2.0%) |

(1.9%) |

(2.2%) |

(1.7%) |

(2.2%) |

(2.1%) |

(2.2%) |

(2.0%) |

(1.9%) |

(1.9%) |

(2.0%) |

(2.1%) |

| 100+ |

76.9% |

78.5% |

77.3% |

76.3% |

75.7% |

76.5% |

77.0% |

79.7%* |

80.7% |

81.0% |

84.7%* |

84.5% |

81.0%* |

| (Standard Error) |

(0.7%) |

(0.7%) |

(1.0%) |

(0.7%) |

(0.7%) |

(0.7%) |

(0.6%) |

(0.6%) |

(0.6%) |

(0.6%) |

(0.5%) |

(0.6%) |

(0.6%) |

Source: Medical Expenditure Panel Survey-Insurance Component, private-sector establishments, 2008-2020.

Denominator: Within each category, all employees in establishments that offer health insurance.

Note: * indicates the estimate is statistically different from the previous year at p < 0.05. ^ indicates that the estimates for firms with <50 and 50-99 employees are statistically different from the estimate for firms with 100+ employees at p < 0.05. This test is conducted for 2020 only. |

Return to Table of Contents

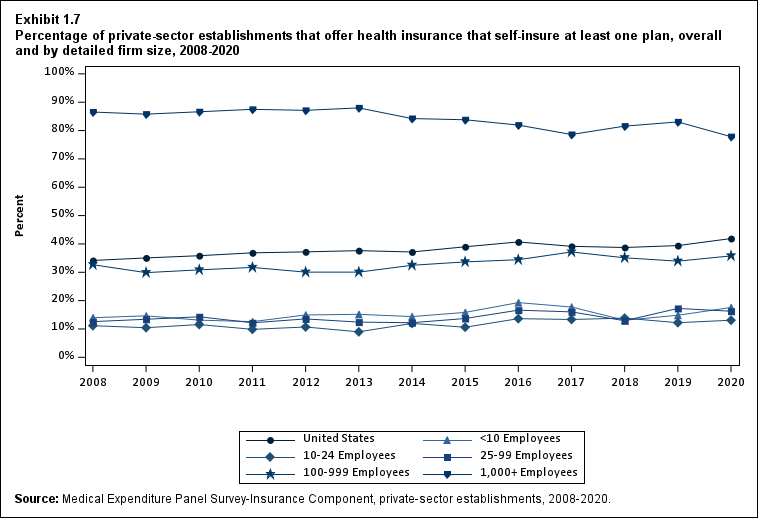

Self-Insured Plans

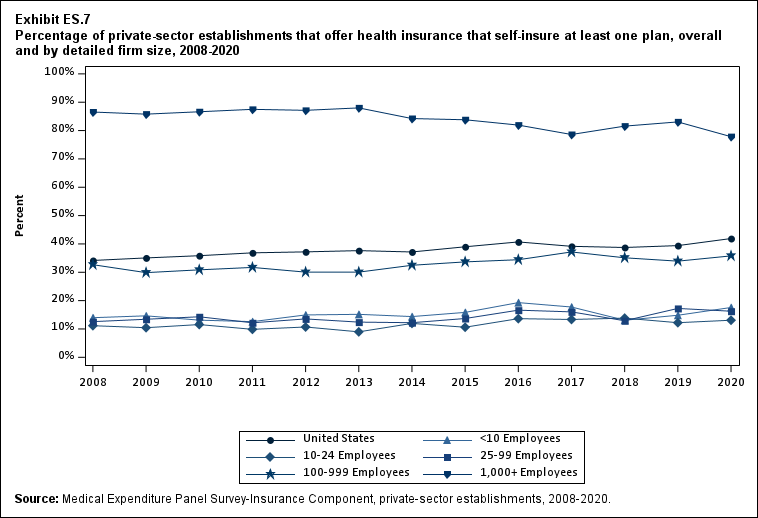

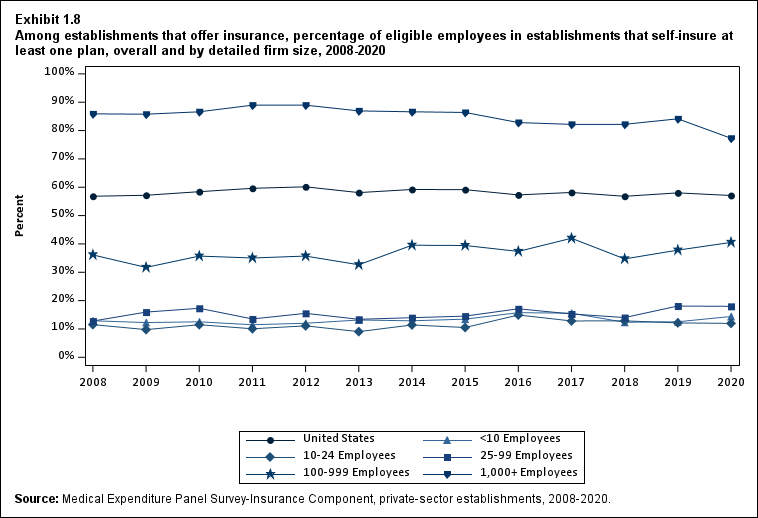

Between 2019 and 2020, the overall percentage of offering establishments that self-insured at

least one plan increased from 39.4 percent to 41.9 percent. This increase occurred despite a

decrease (from 83.1 percent to 77.8 percent) among establishments in firms with 1,000 or more

employees (Exhibit ES.7).

| Number of Employees |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

| U.S. |

34.2% |

35.1% |

35.8% |

36.9% |

37.2% |

37.6% |

37.2% |

39.0%* |

40.7%* |

39.2% |

38.7% |

39.4% |

41.9%* |

| (Standard Error) |

(0.4%) |

(0.4%) |

(0.5%) |

(0.5%) |

(0.5%) |

(0.5%) |

(0.5%) |

(0.5%) |

(0.6%) |

(0.6%) |

(0.6%) |

(0.6%) |

(0.7%) |

| <10 |

14.0% |

14.6% |

13.1% |

12.6% |

14.9% |

15.2% |

14.4% |

15.8% |

19.3%* |

17.7% |

13.1%* |

14.8% |

17.6%^ |

| (Standard Error) |

(0.8%) |

(0.7%) |

(0.5%) |

(0.8%) |

(0.9%) |

(0.4%) |

(0.8%) |

(1.0%) |

(1.4%) |

(1.4%) |

(1.1%) |

(1.3%) |

(1.7%) |

| 10-24 |

11.1% |

10.4% |

11.6% |

9.9% |

10.7% |

9.0% |

12.0%* |

10.6% |

13.6%* |

13.3% |

13.8% |

12.2% |

13.1%^ |

| (Standard Error) |

(0.9%) |

(0.4%) |

(0.8%) |

(0.7%) |

(0.7%) |

(0.7%) |

(1.0%) |

(1.0%) |

(1.1%) |

(1.2%) |

(1.2%) |

(1.1%) |

(1.2%) |

| 25-99 |

12.6% |

13.4% |

14.3% |

12.2%* |

13.5% |

12.4% |

12.2% |

13.7% |

16.6%* |

16.0% |

12.9%* |

17.2%* |

16.3%^ |

| (Standard Error) |

(0.8%) |

(0.7%) |

(0.7%) |

(0.7%) |

(0.7%) |

(0.7%) |

(0.8%) |

(0.9%) |

(0.9%) |

(0.9%) |

(0.8%) |

(0.9%) |

(0.9%) |

| 100-999 |

32.7% |

29.9% |

30.9% |

31.7% |

30.1% |

30.1% |

32.5% |

33.7% |

34.4% |

37.2% |

35.1% |

33.9% |

35.8%^ |

| (Standard Error) |

(1.3%) |

(0.7%) |

(0.9%) |

(1.1%) |

(0.8%) |

(1.0%) |

(1.2%) |

(1.2%) |

(1.2%) |

(1.3%) |

(1.2%) |

(1.1%) |

(1.2%) |

| 1,000+ |

86.5% |

85.8% |

86.6% |

87.5% |

87.1% |

88.0% |

84.2%* |

83.8% |

81.9% |

78.6%* |

81.6%* |

83.1% |

77.8%* |

| (Standard Error) |

(0.5%) |

(0.4%) |

(0.6%) |

(0.5%) |

(0.7%) |

(0.5%) |

(0.8%) |

(0.8%) |

(0.8%) |

(0.8%) |

(0.8%) |

(0.8%) |

(0.9%) |

Source: Medical Expenditure Panel Survey-Insurance Component, private-sector establishments, 2008-2020.

Note: * indicates the estimate is statistically different from the previous year at p < 0.05. ^ indicates that the estimates for firms with <10, 10-24, 25-99, and 100-999 employees are statistically different from the estimate for firms with 1,000+ employees at p < 0.05. This test is conducted for 2020 only. |

Return to Table of Contents

Premiums

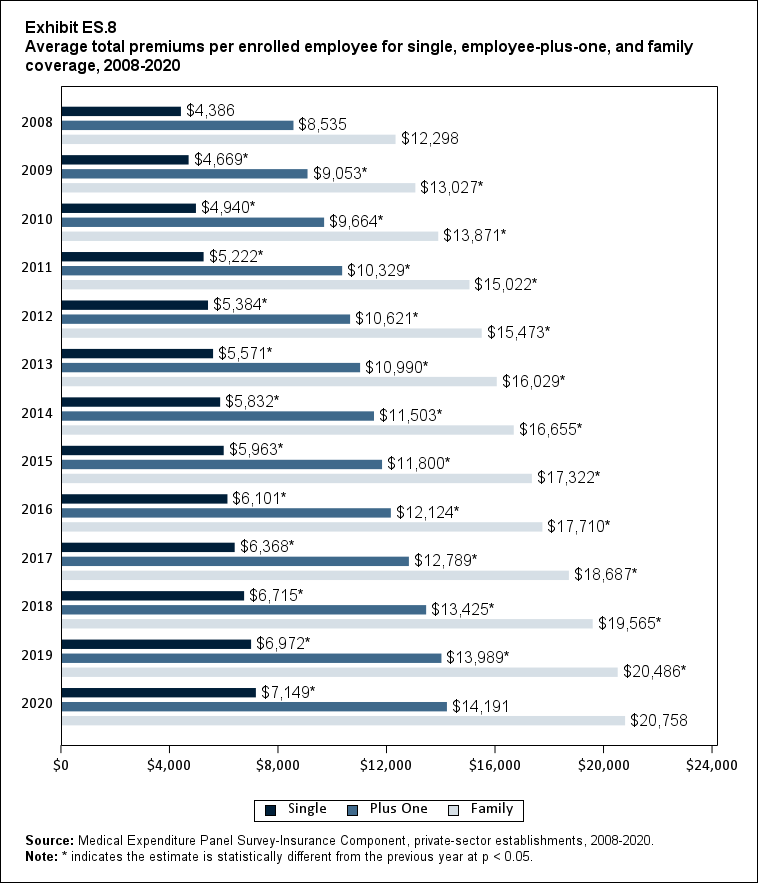

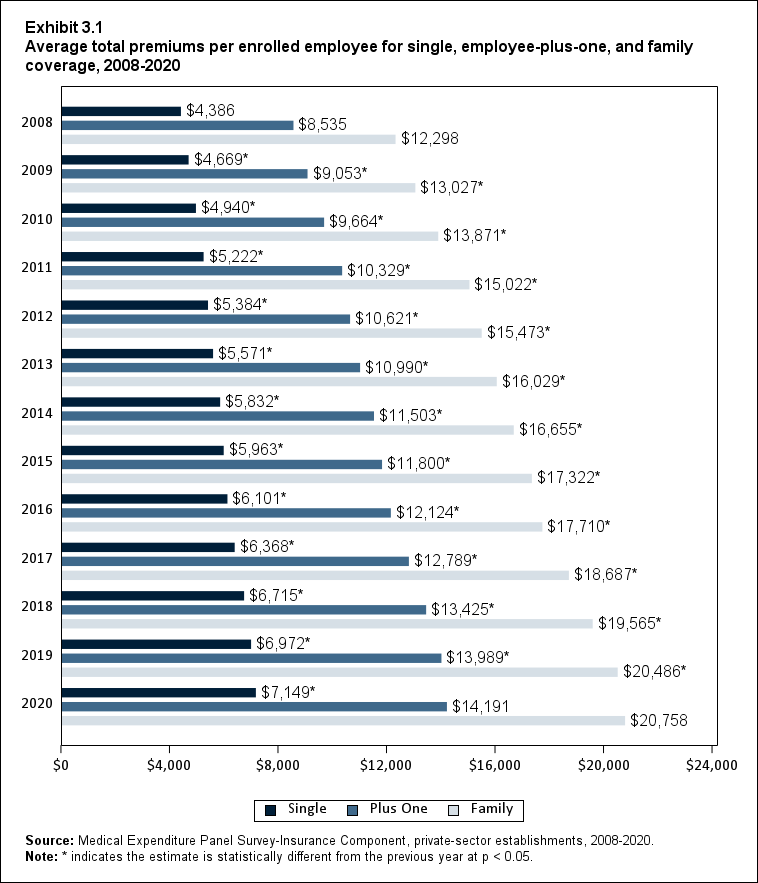

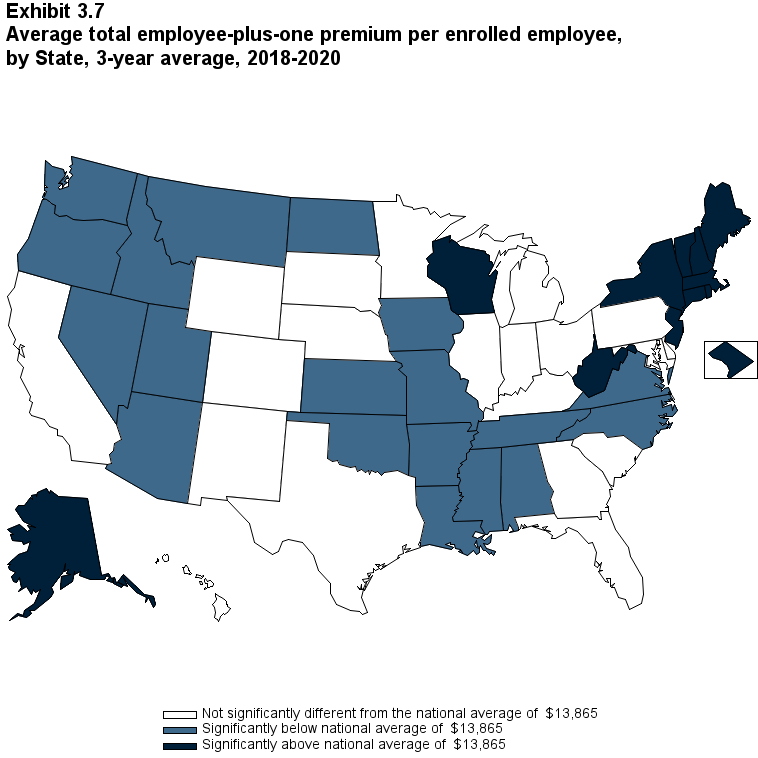

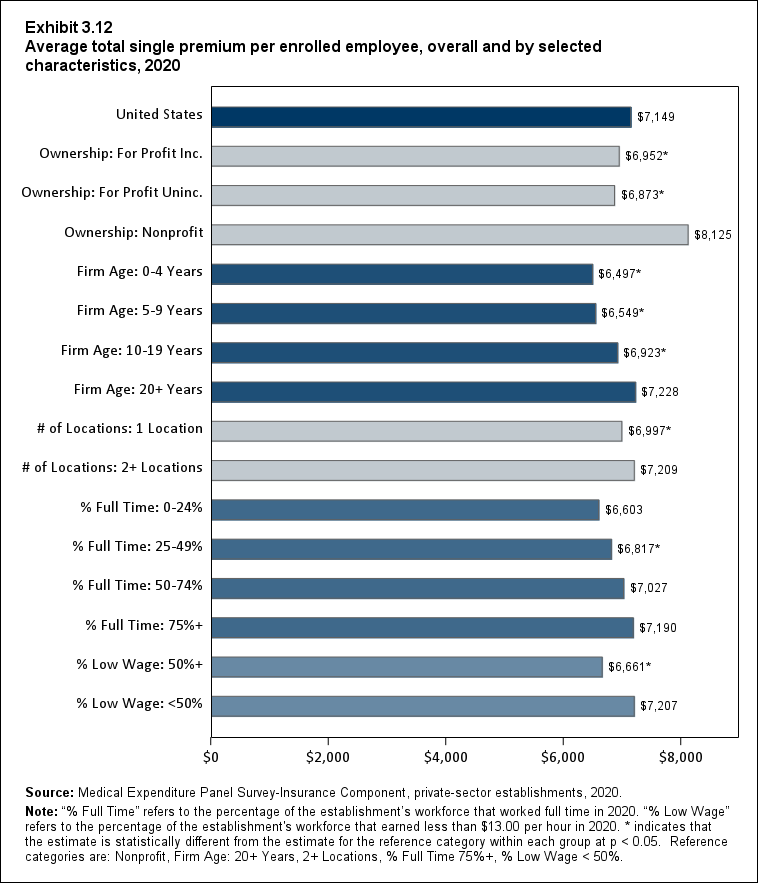

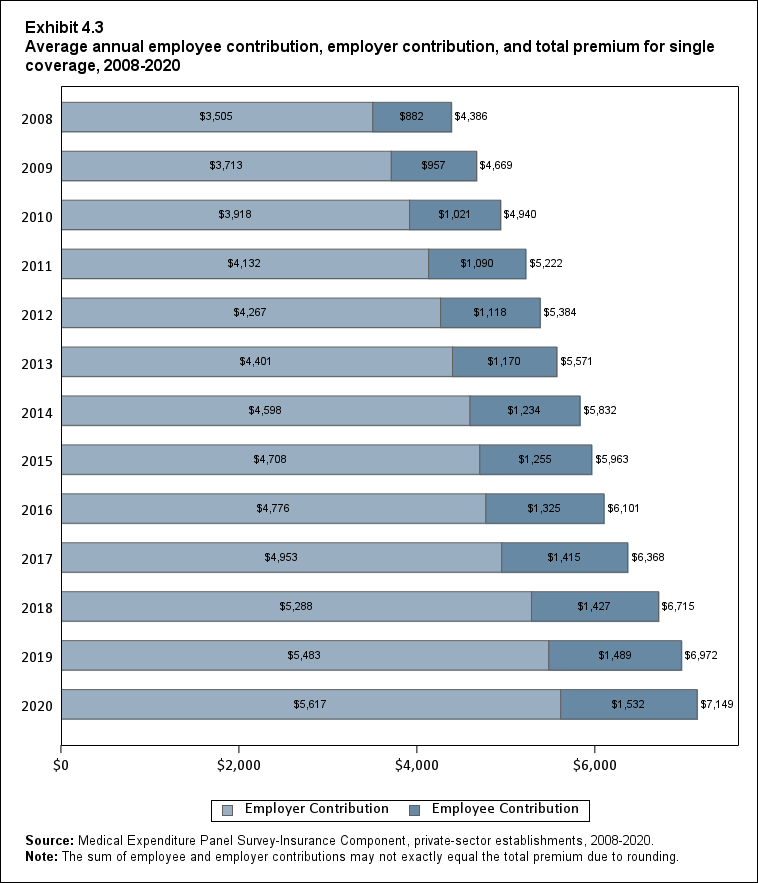

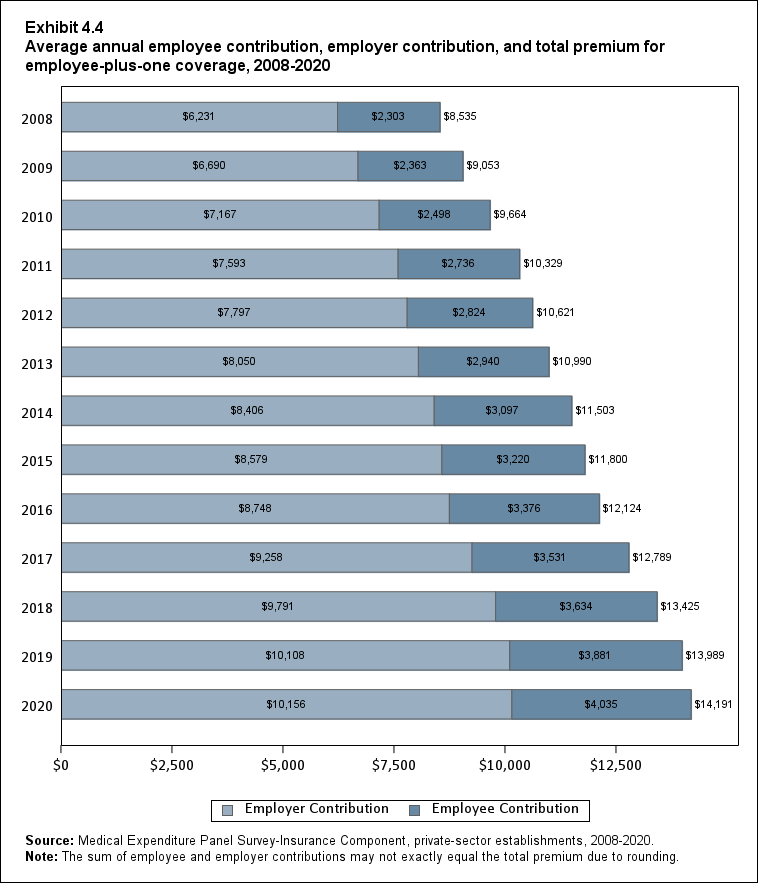

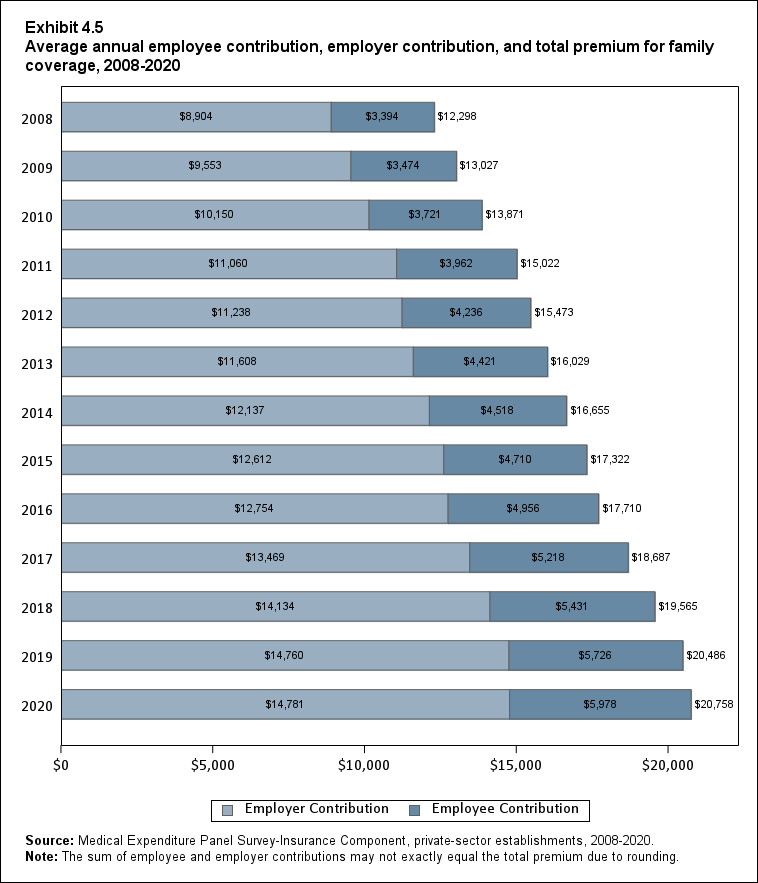

In 2020, average health insurance premiums were $7,149 for single coverage, $14,191 for

employee-plus-one coverage, and $20,758 for family coverage (Exhibit ES.8).

| Coverage |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

| Single |

$4,386 |

$4,669* |

$4,940* |

$5,222* |

$5,384* |

$5,571* |

$5,832* |

$5,963* |

$6,101* |

$6,368* |

$6,715* |

$6,972* |

$7,149* |

| (Standard Error) |

($15) |

($21) |

($22) |

($26) |

($28) |

($23) |

($25) |

($26) |

($27) |

($28) |

($31) |

($35) |

($35) |

| Plus One |

$8,535 |

$9,053* |

$9,664* |

$10,329* |

$10,621* |

$10,990* |

$11,503* |

$11,800* |

$12,124* |

$12,789* |

$13,425* |

$13,989* |

$14,191 |

| (Standard Error) |

($43) |

($34) |

($60) |

($105) |

($56) |

($54) |

($60) |

($58) |

($60) |

($70) |

($70) |

($83) |

($93) |

| Family |

$12,298 |

$13,027* |

$13,871* |

$15,022* |

$15,473* |

$16,029* |

$16,655* |

$17,322* |

$17,710* |

$18,687* |

$19,565* |

$20,486* |

$20,758 |

| (Standard Error) |

($81) |

($25) |

($75) |

($98) |

($95) |

($61) |

($79) |

($95) |

($84) |

($105) |

($104) |

($125) |

($124) |

Source: Medical Expenditure Panel Survey-Insurance Component, private-sector establishments, 2008-2020.

Note: * indicates the estimate is statistically different from the previous year at p < 0.05. |

Return to Table of Contents

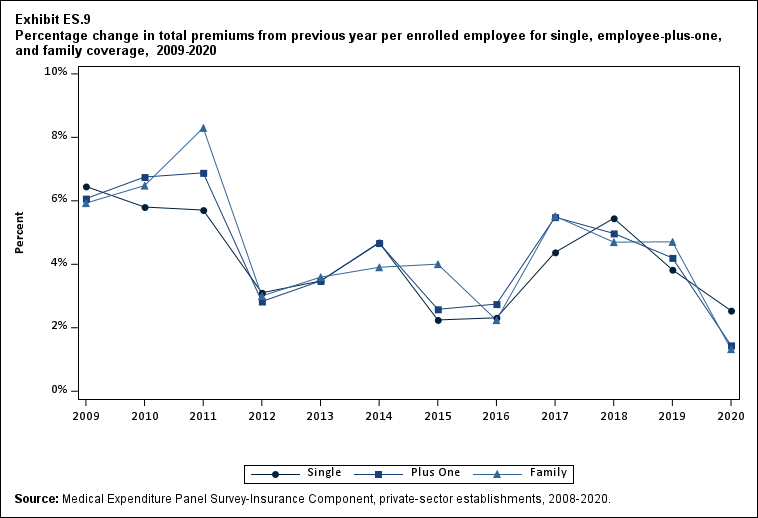

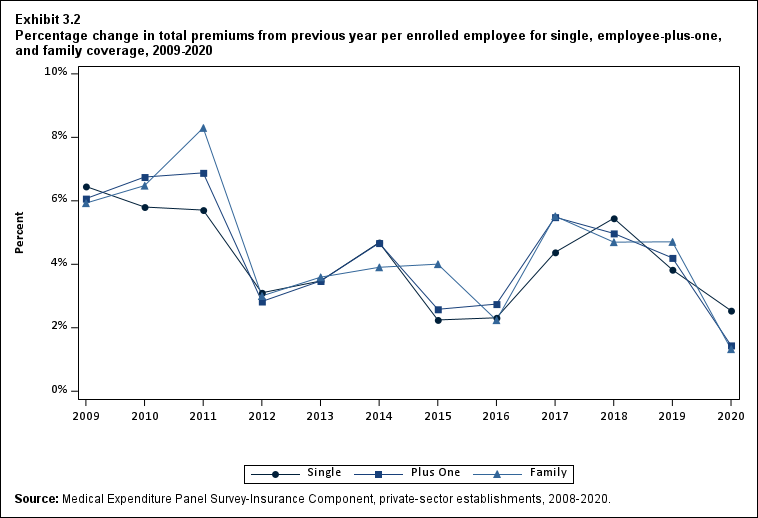

From 2019 to 2020, average single premiums increased by 2.5 percent (Exhibit ES.9). This 1-year percentage increase was significantly lower than the average annual growth rate (4.2

percent) for single premiums from 2008 to 2020 (data not shown). Average premiums for

employee-plus-one coverage ($14,191) and family coverage ($20,758) were not significantly

different from their 2019 levels. This was the first time in the 2008 to 2020 period that there was

not a statistically significant increase in these premiums.

| Year |

Single |

Plus one |

Family |

| 2009 |

6.5%* |

6.1%* |

5.9%* |

| (Standard Error) |

($0.6%) |

($0.7%) |

($0.7%) |

| 2010 |

5.8%* |

6.7%* |

6.5%* |

| (Standard Error) |

($0.7%) |

($0.8%) |

($0.6%) |

| 2011 |

5.7%* |

6.9%* |

8.3%* |

| (Standard Error) |

($0.7%) |

($1.3%) |

($0.9%) |

| 2012 |

3.1%* |

2.8%* |

3.0%* |

| (Standard Error) |

($0.7%) |

($1.2%) |

($0.9%) |

| 2013 |

3.5%* |

3.5%* |

3.6%* |

| (Standard Error) |

($0.7%) |

($0.7%) |

($0.7%) |

| 2014 |

4.7%* |

4.7%* |

3.9%* |

| (Standard Error) |

($0.6%) |

($0.7%) |

($0.6%) |

| 2015 |

2.2%* |

2.6%* |

4.0%* |

| (Standard Error) |

($0.6%) |

($0.7%) |

($0.8%) |

| 2016 |

2.3%* |

2.7%* |

2.2%* |

| (Standard Error) |

($0.6%) |

($0.7%) |

($0.7%) |

| 2017 |

4.4%* |

5.5%* |

5.5%* |

| (Standard Error) |

($0.7%) |

($0.8%) |

($0.8%) |

| 2018 |

5.4%* |

5.0%* |

4.7%* |

| (Standard Error) |

($0.7%) |

($0.8%) |

($0.8%) |

| 2019 |

3.8%* |

4.2%* |

4.7%* |

| (Standard Error) |

($0.7%) |

($0.8%) |

($0.8%) |

| 2020 |

2.5%* |

1.4% |

1.3% |

| (Standard Error) |

($0.7%) |

($0.9%) |

($0.9%) |

Source: Medical Expenditure Panel Survey-Insurance Component, private-sector establishments, 2008-2020.

Note: * indicates the estimate is statistically different from zero at p < 0.05. |

Return to Table of Contents

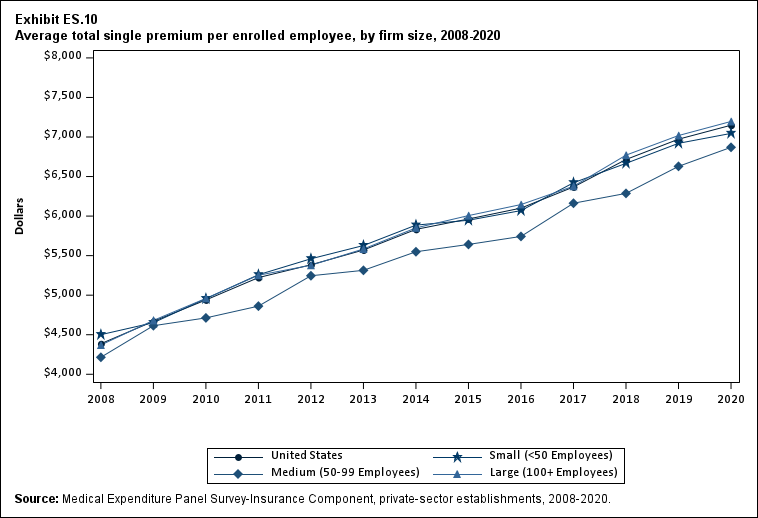

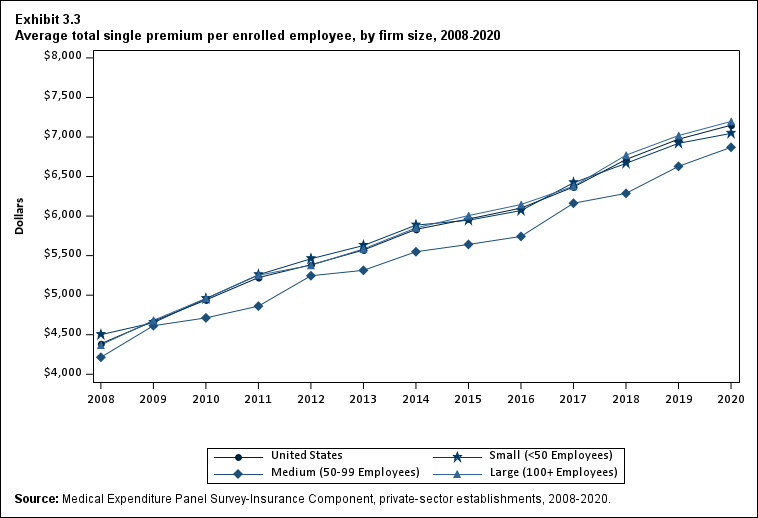

In 2020, average single premiums were lower in medium firms ($6,870) than in large firms

($7,197) (Exhibit ES.10).

| Number of Employees |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

| U.S. |

$4,386 |

$4,669* |

$4,940* |

$5,222* |

$5,384* |

$5,571* |

$5,832* |

$5,963* |

$6,101* |

$6,368* |

$6,715* |

$6,972* |

$7,149* |

| (Standard Error) |

($15) |

($21) |

($22) |

($26) |

($28) |

($23) |

($25) |

($26) |

($27) |

($28) |

($31) |

($35) |

($35) |

| <50 |

$4,501 |

$4,652* |

$4,956* |

$5,258* |

$5,460* |

$5,628* |

$5,886* |

$5,947 |

$6,070 |

$6,421* |

$6,667* |

$6,920* |

$7,045 |

| (Standard Error) |

($31) |

($31) |

($34) |

($39) |

($60) |

($39) |

($55) |

($55) |

($53) |

($61) |

($63) |

($73) |

($70) |

| 50-99 |

$4,215 |

$4,614* |

$4,713 |

$4,861 |

$5,246* |

$5,314 |

$5,549* |

$5,642 |

$5,743 |

$6,163* |

$6,287 |

$6,629* |

$6,870^ |

| (Standard Error) |

($37) |

($82) |

($52) |

($75) |

($39) |

($73) |

($82) |

($104) |

($96) |

($121) |

($111) |

($99) |

($129) |

| 100+ |

$4,370 |

$4,681* |

$4,959* |

$5,252* |

$5,378* |

$5,584* |

$5,851* |

$6,006* |

$6,146* |

$6,377* |

$6,770* |

$7,019* |

$7,197* |

| (Standard Error) |

($26) |

($38) |

($23) |

($31) |

($28) |

($29) |

($30) |

($31) |

($32) |

($33) |

($37) |

($42) |

($41) |

Source: Medical Expenditure Panel Survey-Insurance Component, private-sector establishments, 2008-2020.

Note: * indicates the estimate is statistically different from the previous year at p < 0.05. ^ indicates that the estimates for firms with <50 and 50-99 employees are statistically different from the estimate for firms with 100+ employees at p < 0.05. This test is conducted for 2020 only. |

Return to Table of Contents

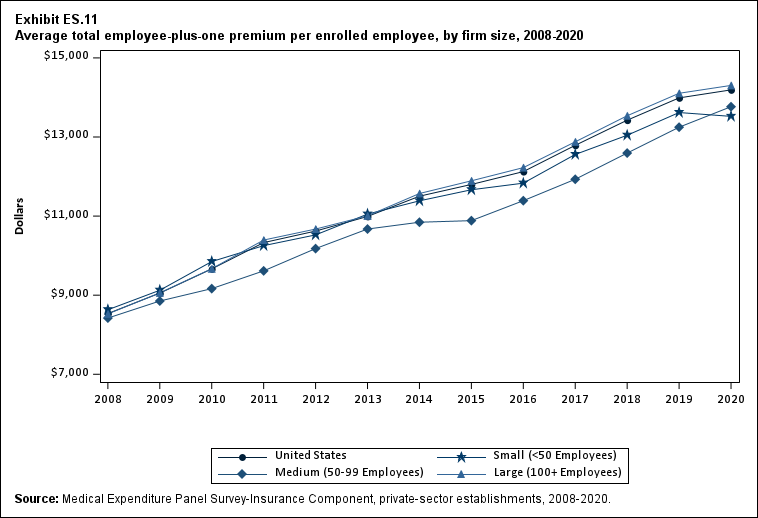

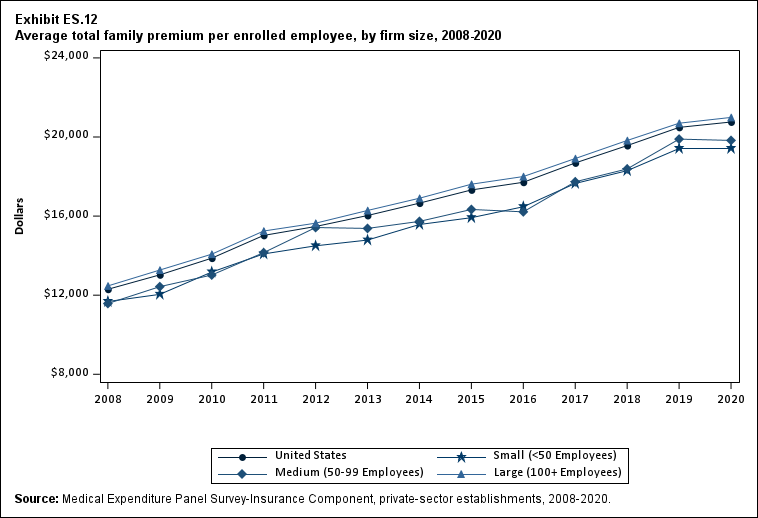

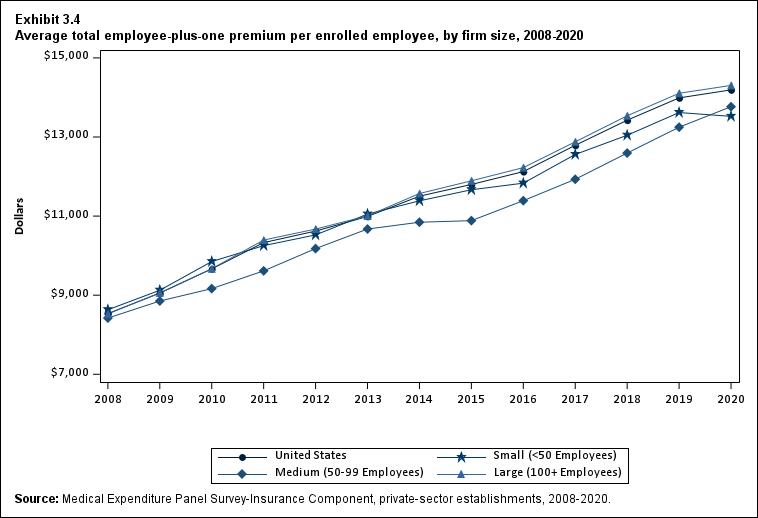

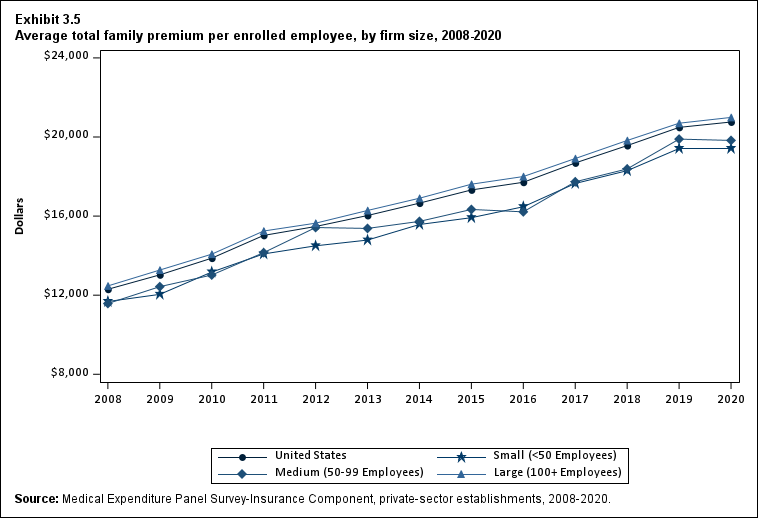

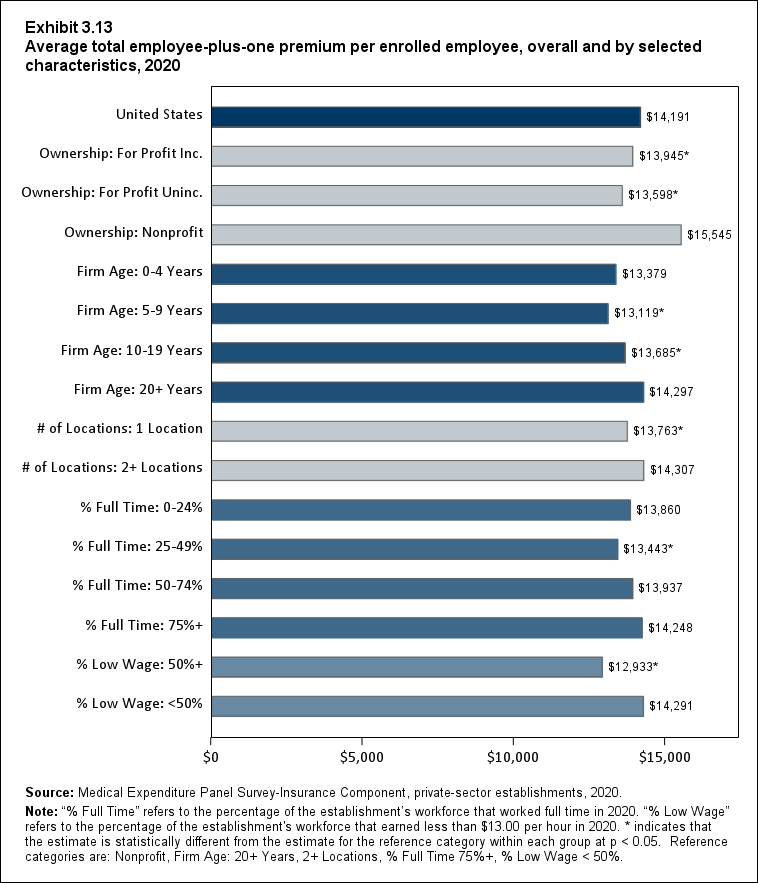

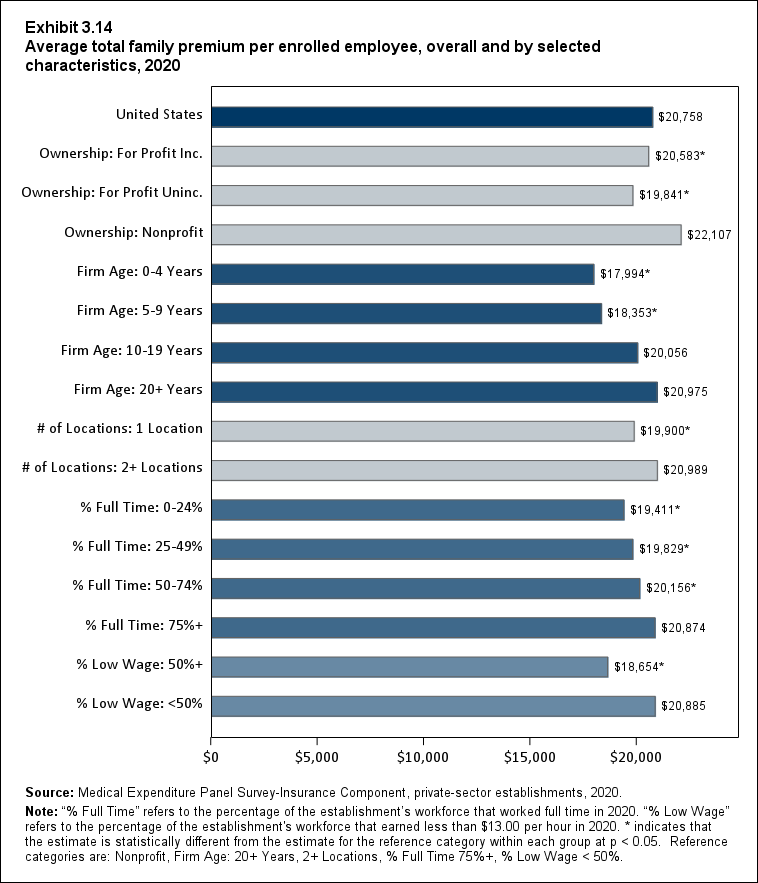

In 2020, average total premiums for both types of dependent coverage (employee-plus-one and

family) were higher in large firms ($14,304 and $20,990) than in small ($13,522 and $19,416))

and medium firms ($13,766 and $19,827) (Exhibits ES.11 and ES.12).

| Number of Employees |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

| U.S. |

$8,535 |

$9,053* |

$9,664* |

$10,329* |

$10,621* |

$10,990* |

$11,503* |

$11,800* |

$12,124* |

$12,789* |

$13,425* |

$13,989* |

$14,191 |

| (Standard Error) |

($43) |

($34) |

($60) |

($105) |

($56) |

($54) |

($60) |

($58) |

($60) |

($70) |

($70) |

($83) |

($93) |

| <50 |

$8,631 |

$9,124* |

$9,850* |

$10,253* |

$10,524 |

$11,050* |

$11,386 |

$11,666 |

$11,833 |

$12,558* |

$13,044* |

$13,619 |

$13,522^ |

| (Standard Error) |

($110) |

($119) |

($80) |

($104) |

($121) |

($92) |

($163) |

($158) |

($156) |

($170) |

($176) |

($248) |

($212) |

| 50-99 |

$8,421 |

$8,852* |

$9,166 |

$9,615* |

$10,178* |

$10,673 |

$10,845 |

$10,885 |

$11,389 |

$11,931 |

$12,593* |

$13,248 |

$13,766^ |

| (Standard Error) |

($88) |

($148) |

($124) |

($192) |

($185) |

($330) |

($187) |

($198) |

($227) |

($232) |

($236) |

($321) |

($246) |

| 100+ |

$8,527 |

$9,058* |

$9,669* |

$10,394* |

$10,672* |

$11,006* |

$11,571* |

$11,892* |

$12,225* |

$12,878* |

$13,537* |

$14,105* |

$14,304 |

| (Standard Error) |

($60) |

($34) |

($62) |

($113) |

($70) |

($59) |

($68) |

($66) |

($68) |

($79) |

($79) |

($92) |

($106) |

Source: Medical Expenditure Panel Survey-Insurance Component, private-sector establishments, 2008-2020.

Note: * indicates the estimate is statistically different from the previous year at p < 0.05. ^ indicates that the estimates for firms with <50 and 50-99 employees are statistically different from the estimate for firms with 100+ employees at p < 0.05. This test is conducted for 2020 only. |

Return to Table of Contents

| Number of Employees |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

| U.S. |

$12,298 |

$13,027* |

$13,871* |

$15,022* |

$15,473* |

$16,029* |

$16,655* |

$17,322* |

$17,710* |

$18,687* |

$19,565* |

$20,486* |

$20,758 |

| (Standard Error) |

($81) |

($25) |

($75) |

($98) |

($95) |

($61) |

($79) |

($95) |

($84) |

($105) |

($104) |

($125) |

($124) |

| <50 |

$11,679 |

$12,041 |

$13,170* |

$14,086* |

$14,496 |

$14,787 |

$15,575* |

$15,919 |

$16,471 |

$17,649* |

$18,296* |

$19,417* |

$19,416^ |

| (Standard Error) |

($182) |

($129) |

($111) |

($145) |

($181) |

($89) |

($177) |

($212) |

($207) |

($192) |

($231) |

($303) |

($283) |

| 50-99 |

$11,578 |

$12,431* |

$13,019* |

$14,151* |

$15,421* |

$15,376 |

$15,732 |

$16,336 |

$16,214 |

$17,735* |

$18,386 |

$19,893* |

$19,827^ |

| (Standard Error) |

($128) |

($229) |

($153) |

($168) |

($273) |

($268) |

($274) |

($335) |

($348) |

($327) |

($473) |

($435) |

($422) |

| 100+ |

$12,468 |

$13,271* |

$14,074* |

$15,245* |

$15,641* |

$16,284* |

$16,903* |

$17,612* |

$18,000* |

$18,911* |

$19,824* |

$20,697* |

$20,990 |

| (Standard Error) |

($95) |

($33) |

($85) |

($117) |

($114) |

($82) |

($91) |

($110) |

($95) |

($122) |

($118) |

($143) |

($139) |

Source: Medical Expenditure Panel Survey-Insurance Component, private-sector establishments, 2008-2020.

Note: * indicates the estimate is statistically different from the previous year at p < 0.05. ^ indicates that the estimates for firms with <50 and 50-99 employees are statistically different from the estimate for firms with 100+ employees at p < 0.05. This test is conducted for 2020 only. |

Return to Table of Contents

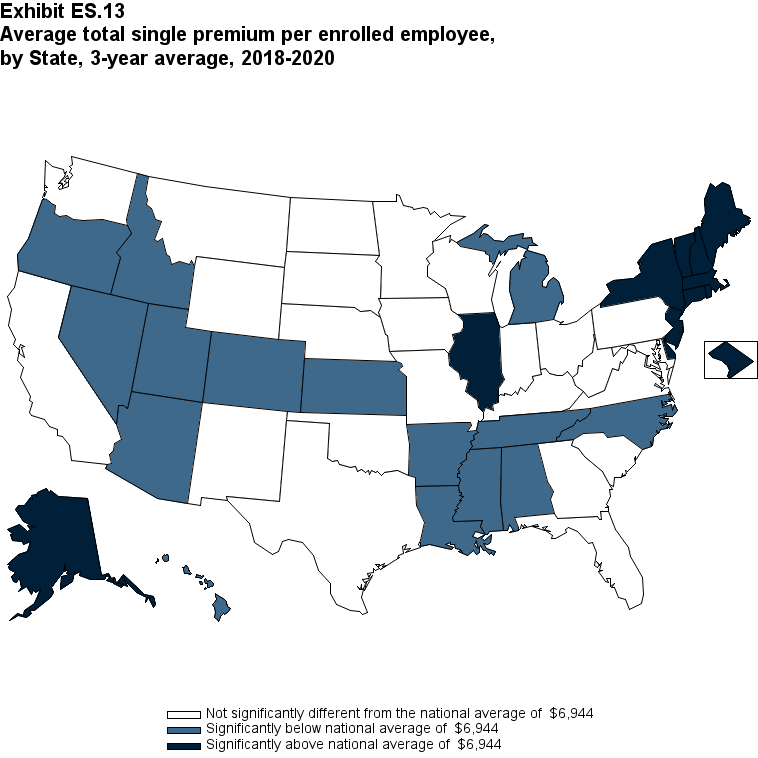

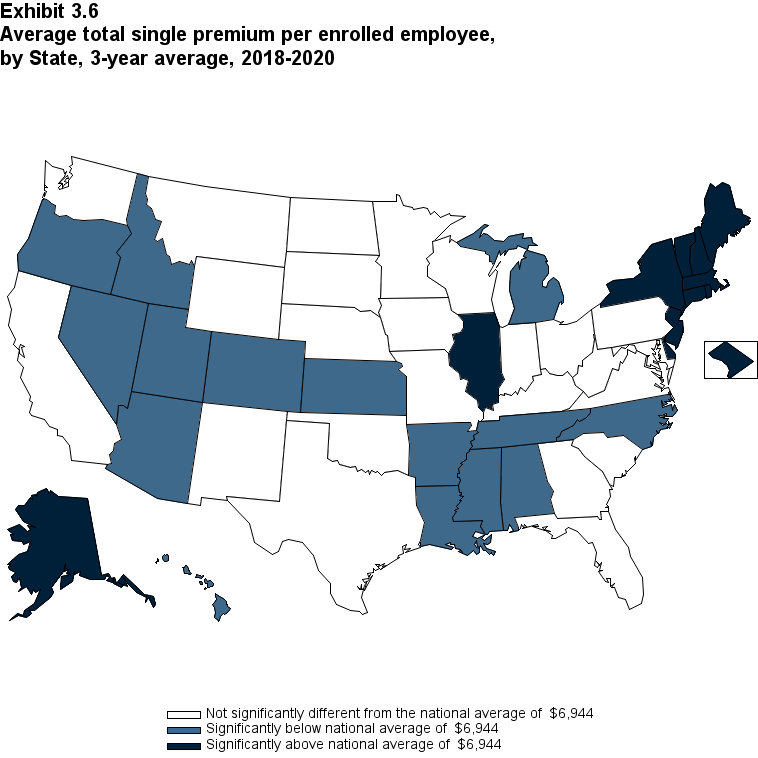

For the 3 years from 2018-2020, the overall average annual single premium was $6,944. Fifteen

States, with average annual premiums ranging from $6,152 in Arkansas to $6,731 in Hawaii,

were significantly below the national average. Twelve States, with average annual premiums

ranging from $7,208 in Rhode Island to $8,672 in Alaska, were significantly above the national

average (Exhibit ES.13).

| Alabama |

$6,336* |

Kentucky |

$6,770 |

North Dakota |

$6,841 |

| (Standard Error) |

($102) |

(Standard Error) |

($100) |

(Standard Error) |

($75) |

| Alaska |

$8,672* |

Louisiana |

$6,666* |

Ohio |

$6,995 |

| (Standard Error) |

($206) |

(Standard Error) |

($106) |

(Standard Error) |

($98) |

| Arizona |

$6,453* |

Maine |

$7,261* |

Oklahoma |

$6,807 |

| (Standard Error) |

($88) |

(Standard Error) |

($89) |

(Standard Error) |

($103) |

| Arkansas |

$6,152* |

Maryland |

$7,048 |

Oregon |

$6,669* |

| (Standard Error) |

($107) |

(Standard Error) |

($116) |

(Standard Error) |

($113) |

| California |

$6,884 |

Massachusetts |

$7,477* |

Pennsylvania |

$7,059 |

| (Standard Error) |

($72) |

(Standard Error) |

($114) |

(Standard Error) |

($87) |

| Colorado |

$6,662* |

Michigan |

$6,564* |

Rhode Island |

$7,208* |

| (Standard Error) |

($94) |

(Standard Error) |

($100) |

(Standard Error) |

($81) |

| Connecticut |

$7,426* |

Minnesota |

$6,865 |

South Carolina |

$6,950 |

| (Standard Error) |

($104) |

(Standard Error) |

($108) |

(Standard Error) |

($95) |

| Delaware |

$7,427* |

Mississippi |

$6,256* |

South Dakota |

$7,058 |

| (Standard Error) |

($151) |

(Standard Error) |

($91) |

(Standard Error) |

($86) |

| District of Columbia |

$7,370* |

Missouri |

$6,875 |

Tennessee |

$6,358* |

| (Standard Error) |

($95) |

(Standard Error) |

($107) |

(Standard Error) |

($79) |

| Florida |

$6,830 |

Montana |

$6,871 |

Texas |

$6,849 |

| (Standard Error) |

($113) |

(Standard Error) |

($99) |

(Standard Error) |

($77) |

| Georgia |

$6,848 |

Nebraska |

$7,007 |

Utah |

$6,315* |

| (Standard Error) |

($131) |

(Standard Error) |

($110) |

(Standard Error) |

($93) |

| Hawaii |

$6,731* |

Nevada |

$6,365* |

Vermont |

$7,369* |

| (Standard Error) |

($79) |

(Standard Error) |

($110) |

(Standard Error) |

($84) |

| Idaho |

$6,428* |

New Hampshire |

$7,544* |

Virginia |

$6,780 |

| (Standard Error) |

($104) |

(Standard Error) |

($124) |

(Standard Error) |

($86) |

| Illinois |

$7,217* |

New Jersey |

$7,554* |

Washington |

$6,996 |

| (Standard Error) |

($76) |

(Standard Error) |

($115) |

(Standard Error) |

($114) |

| Indiana |

$7,016 |

New Mexico |

$6,932 |

West Virginia |

$6,988 |

| (Standard Error) |

($102) |

(Standard Error) |

($107) |

(Standard Error) |

($132) |

| Iowa |

$6,791 |

New York |

$7,937* |

Wisconsin |

$7,021 |

| (Standard Error) |

($94) |

(Standard Error) |

($105) |

(Standard Error) |

($94) |

| Kansas |

$6,417* |

North Carolina |

$6,723* |

Wyoming |

$7,205 |

| (Standard Error) |

($93) |

(Standard Error) |

($72) |

(Standard Error) |

($133) |

Source: Medical Expenditure Panel Survey-Insurance Component, private-sector establishments, 2020.

Note: * Statistically different from national average of $6,944 at p < 0.05. Note that the standard error on the national estimate of $6,944 is $19.15. |

Return to Table of Contents

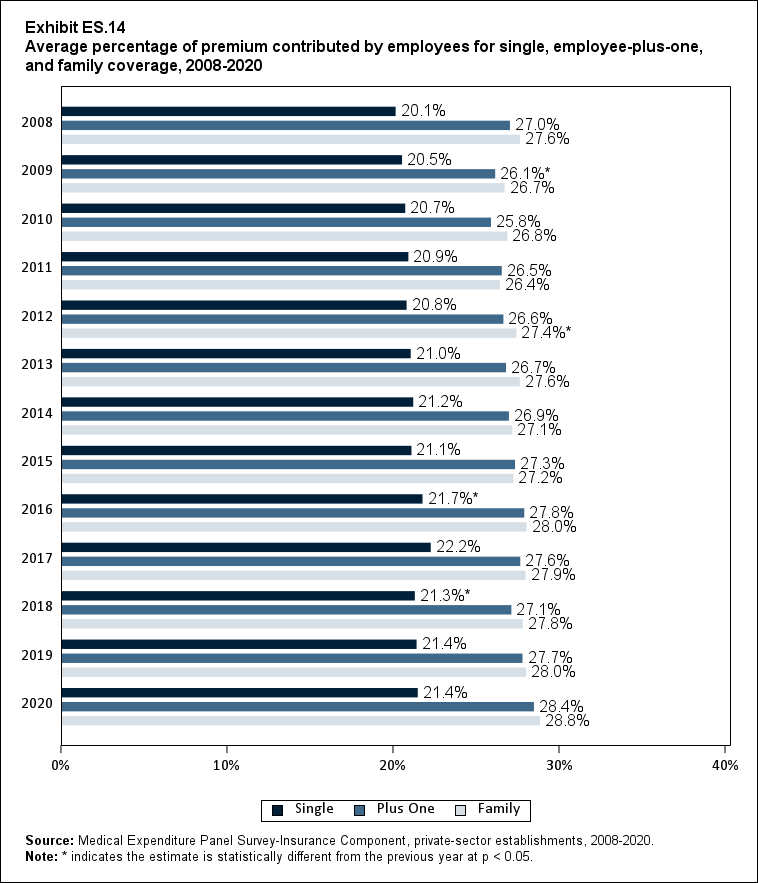

Employee Premium Contributions

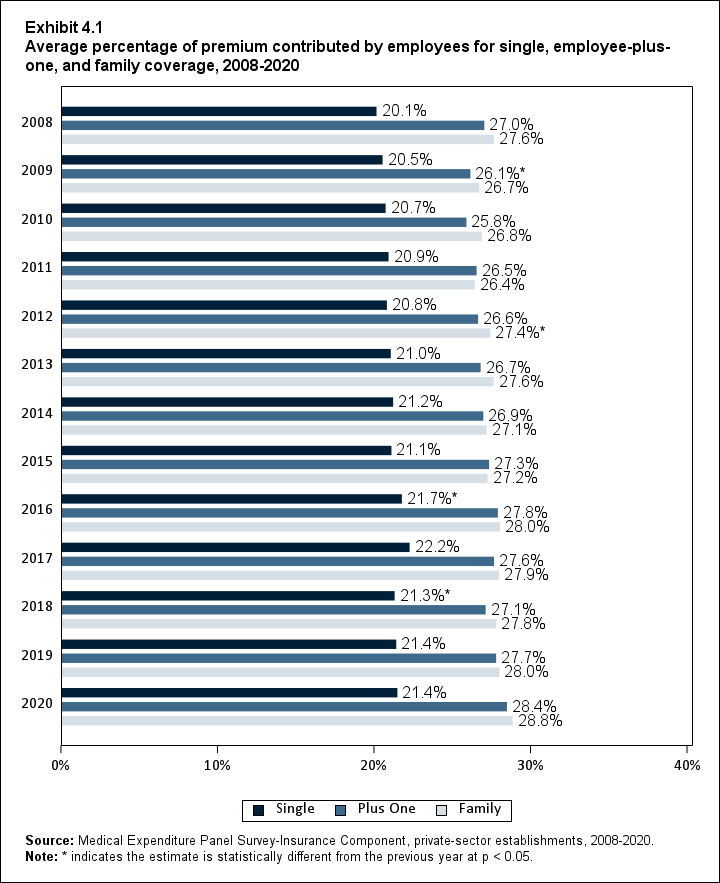

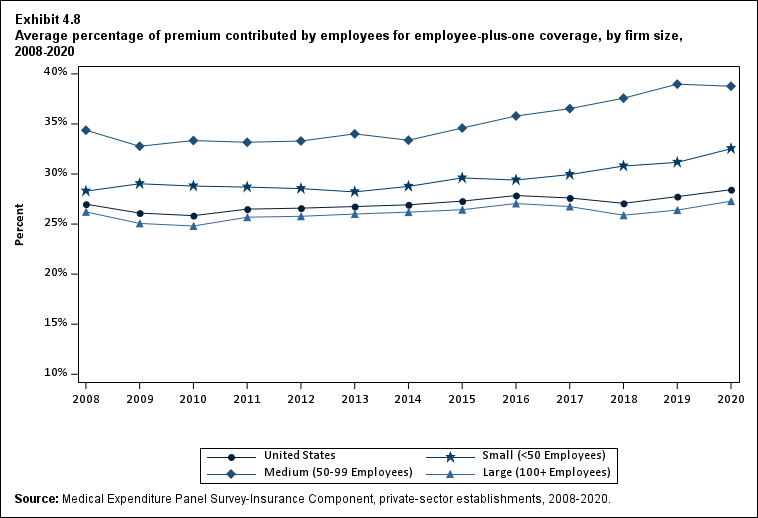

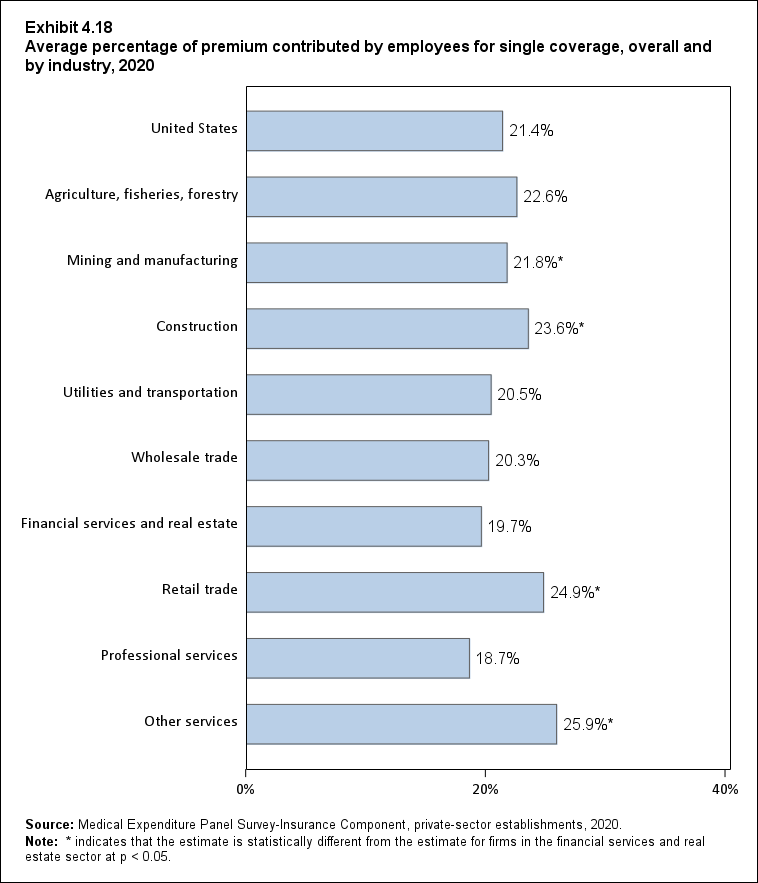

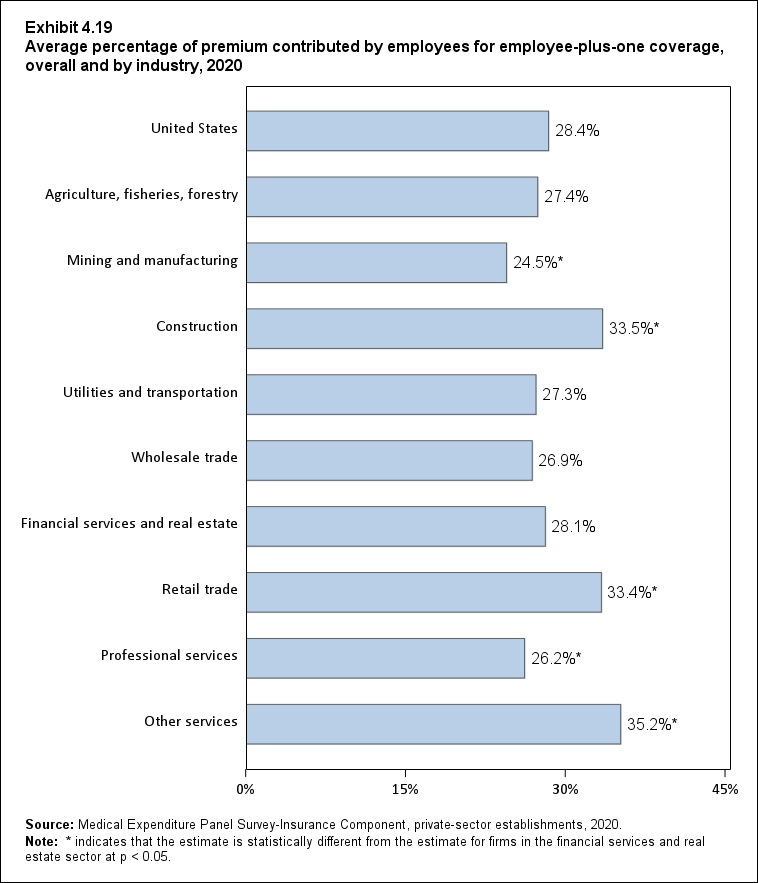

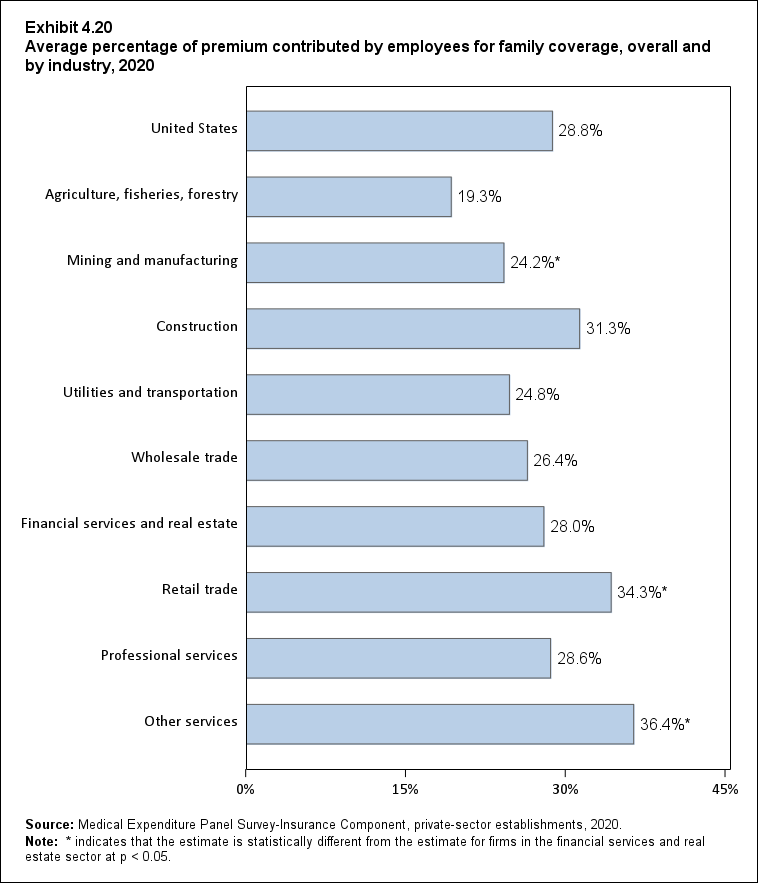

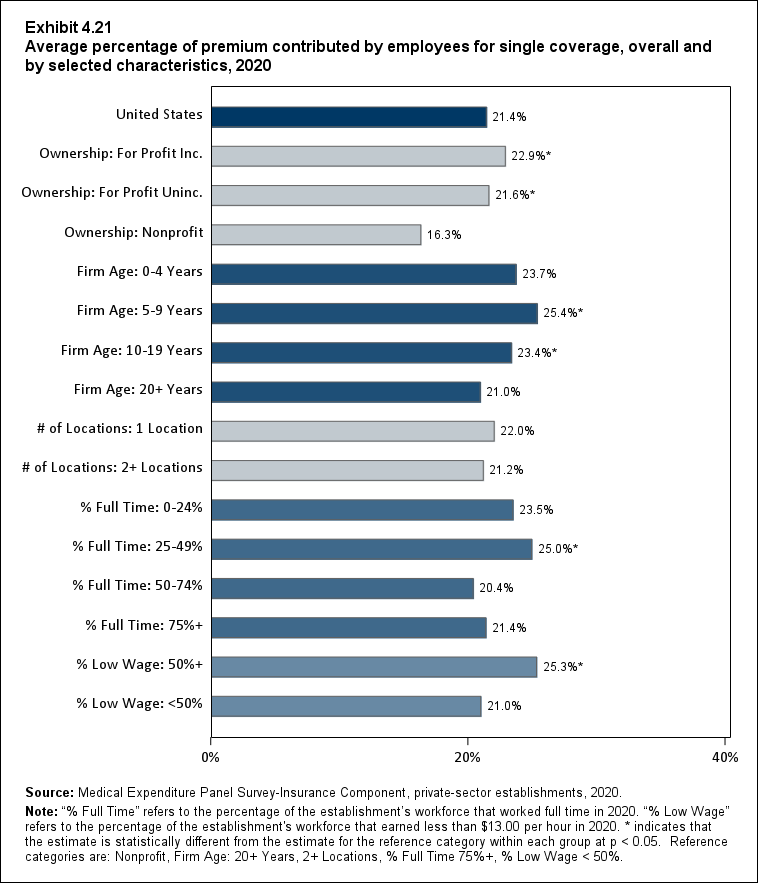

In 2020, enrolled employees paid on average 21.4 percent of total premiums for single coverage,

28.4 percent for employee-plus-one coverage, and 28.8 percent for family coverage. In line with

longer term trends, these shares were not significantly different from their 2019 levels (Exhibit

ES.14).

From 2008 to 2020, the percentage of premiums contributed by employees increased by 1.3

percentage points, 1.4 percentage points, and 1.2 percentage points for single, employee-plus-one, and family coverage, respectively (Exhibit ES.14). There were few significant year-to-year

increases, or decreases, in the employee share for any of the three types of coverage, indicating

that employee and employer premium contributions typically increased at similar rates during

this period.

| Coverage |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

| Single |

20.1% |

20.5% |

20.7% |

20.9% |

20.8% |

21.0% |

21.2% |

21.1% |

21.7%* |

22.2% |

21.3%* |

21.4% |

21.4% |

| (Standard Error) |

(0.2%) |

(0.3%) |

(0.2%) |

(0.2%) |

(0.3%) |

(0.3%) |

(0.2%) |

(0.2%) |

(0.2%) |

(0.2%) |

(0.2%) |

(0.3%) |

(0.2%) |

| Plus One |

27.0% |

26.1%* |

25.8% |

26.5% |

26.6% |

26.7% |

26.9% |

27.3% |

27.8% |

27.6% |

27.1% |

27.7% |

28.4% |

| (Standard Error) |

(0.3%) |

(0.3%) |

(0.3%) |

(0.3%) |

(0.4%) |

(0.2%) |

(0.3%) |

(0.3%) |

(0.3%) |

(0.3%) |

(0.3%) |

(0.4%) |

(0.4%) |

| Family |

27.6% |

26.7% |

26.8% |

26.4% |

27.4%* |

27.6% |

27.1% |

27.2% |

28.0% |

27.9% |

27.8% |

28.0% |

28.8% |

| (Standard Error) |

(0.4%) |

(0.3%) |

(0.4%) |

(0.3%) |

(0.4%) |

(0.3%) |

(0.3%) |

(0.3%) |

(0.3%) |

(0.4%) |

(0.3%) |

(0.4%) |

(0.4%) |

Source: Medical Expenditure Panel Survey-Insurance Component, private-sector establishments, 2008-2020.

Note: * indicates the estimate is statistically different from the previous year at p < 0.05. |

Return to Table of Contents

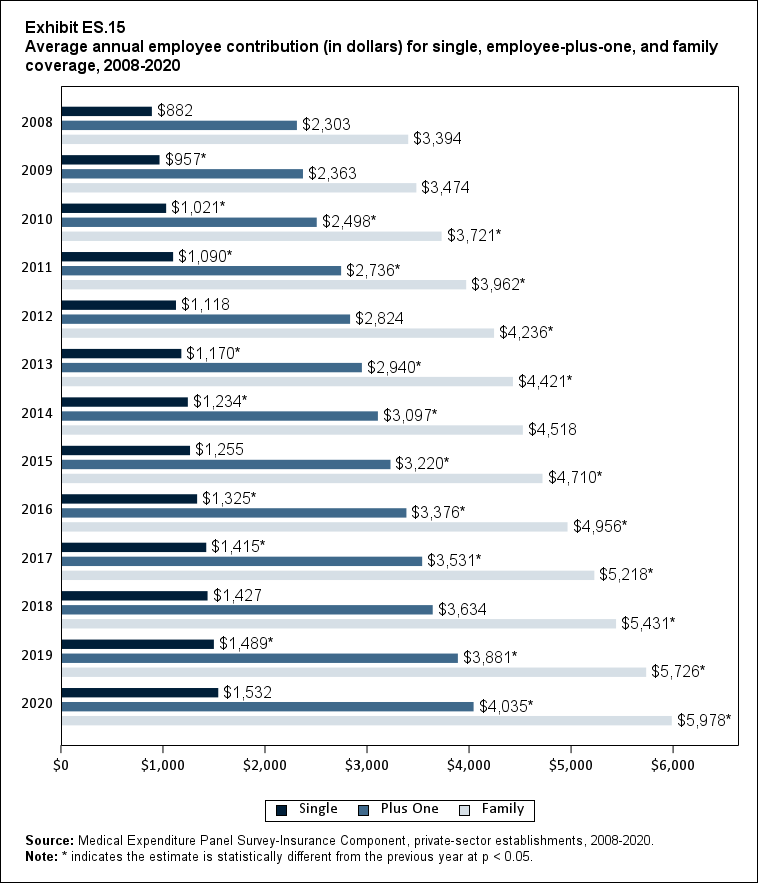

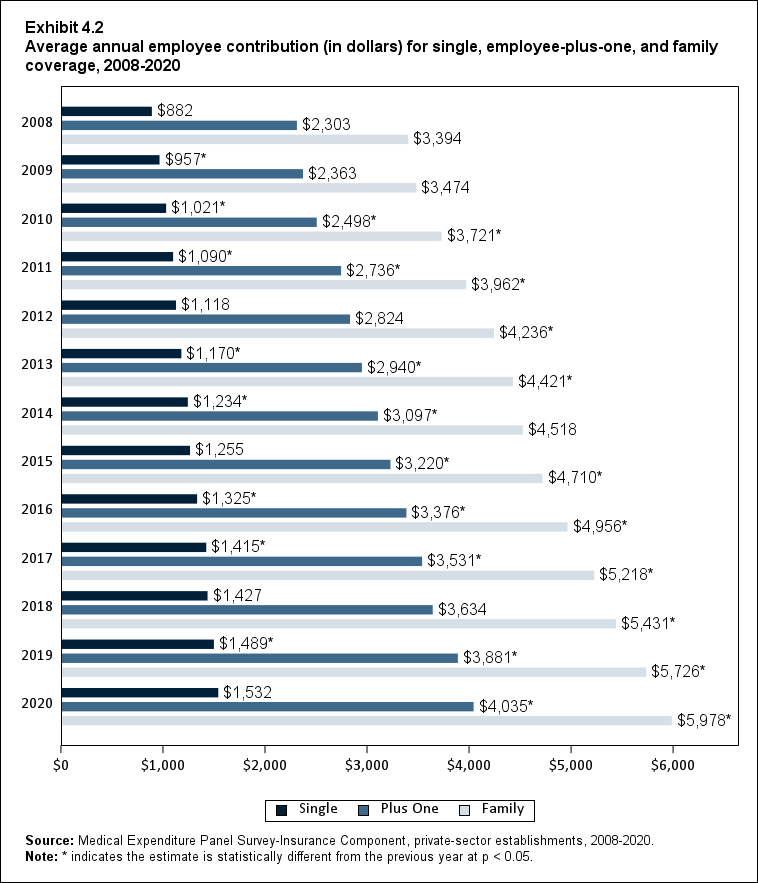

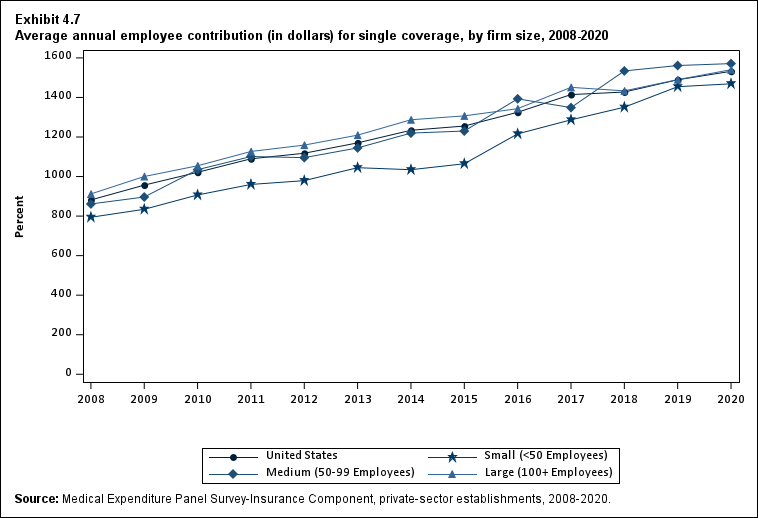

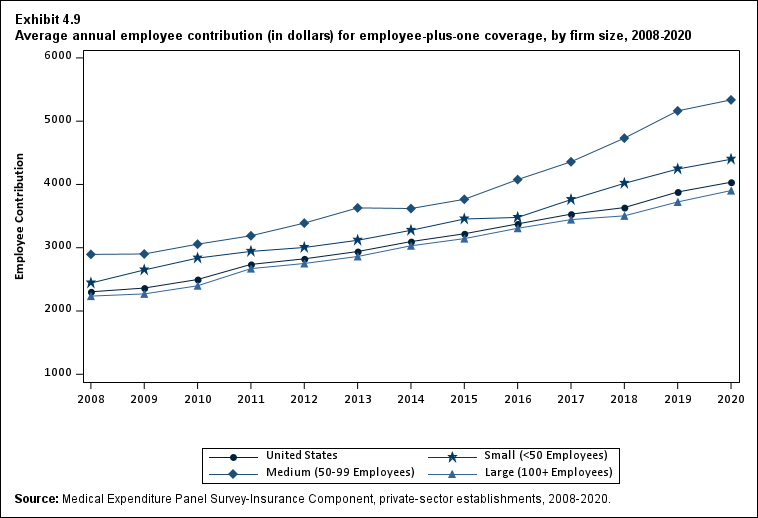

In 2020, the average employee contribution was $1,532 for single coverage, which was not

statistically different from the 2019 level (Exhibit ES.15). Average employee contributions for

employee-plus-one coverage ($4,035) and family coverage ($5,978) were 4.0 percent and 4.4

percent, respectively, above their 2019 levels. These 1-year increases in contributions were in

line with the average annual rate of increase (4.8 percent for both employee-plus-one and family

coverage) from 2008 to 2020.

| Coverage |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

| Single |

$882 |

$957* |

$1,021* |

$1,090* |

$1,118 |

$1,170* |

$1,234* |

$1,255 |

$1,325* |

$1,415* |

$1,427 |

$1,489* |

$1,532 |

| (Standard Error) |

($6) |

($13) |

($14) |

($9) |

($14) |

($16) |

($13) |

($14) |

($13) |

($15) |

($14) |

($18) |

($16) |

| Plus One |

$2,303 |

$2,363 |

$2,498* |

$2,736* |

$2,824 |

$2,940* |

$3,097* |

$3,220* |

$3,376* |

$3,531* |

$3,634 |

$3,881* |

$4,035* |

| (Standard Error) |

($22) |

($27) |

($42) |

($36) |

($46) |

($23) |

($40) |

($35) |

($36) |

($39) |

($39) |

($54) |

($52) |

| Family |

$3,394 |

$3,474 |

$3,721* |

$3,962* |

$4,236* |

$4,421* |

$4,518 |

$4,710* |

$4,956* |

$5,218* |

$5,431* |

$5,726* |

$5,978* |

| (Standard Error) |

($54) |

($44) |

($53) |

($42) |

($69) |

($50) |

($48) |

($56) |

($56) |

($64) |

($63) |

($82) |

($76) |

Source: Medical Expenditure Panel Survey-Insurance Component, private-sector establishments, 2008-2020.

Note: * indicates the estimate is statistically different from the previous year at p < 0.05. |

Return to Table of Contents

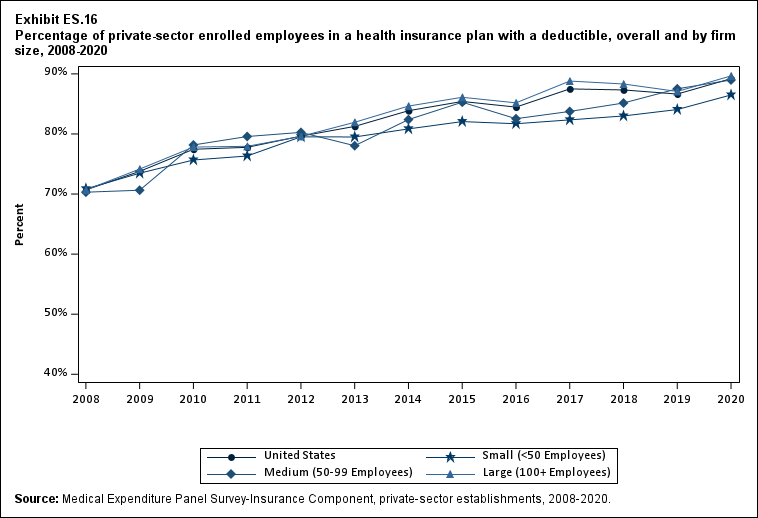

Plan Benefits: Deductibles

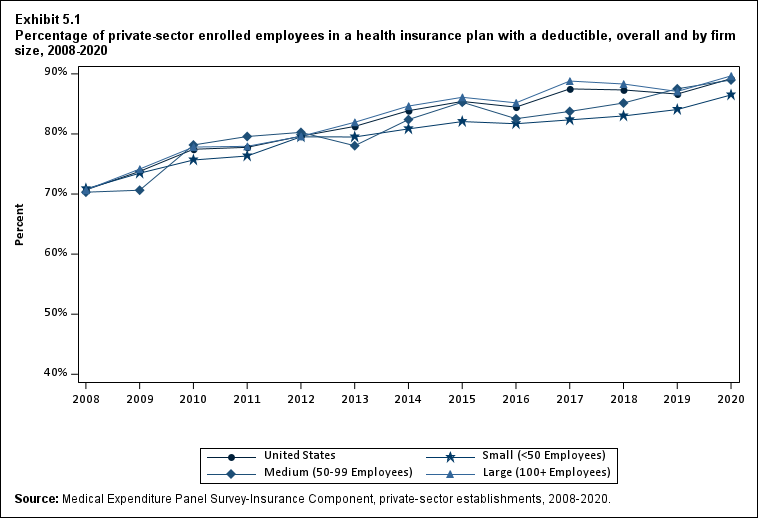

From 2019 to 2020, the percentage of enrollees in a health insurance plan with a deductible

increased overall (86.6 percent to 89.2 percent), among small employers (84.1 percent to 86.5

percent), and among large employers (87.1 percent to 89.7 percent) (Exhibit ES.16). In the last

12 years, the overall percentage of enrollees with a deductible increased by 18.5 percentage

points (from 70.7 percent in 2008 to 89.2 percent in 2020), but there was no significant change in

this percentage from 2017 to 2019.

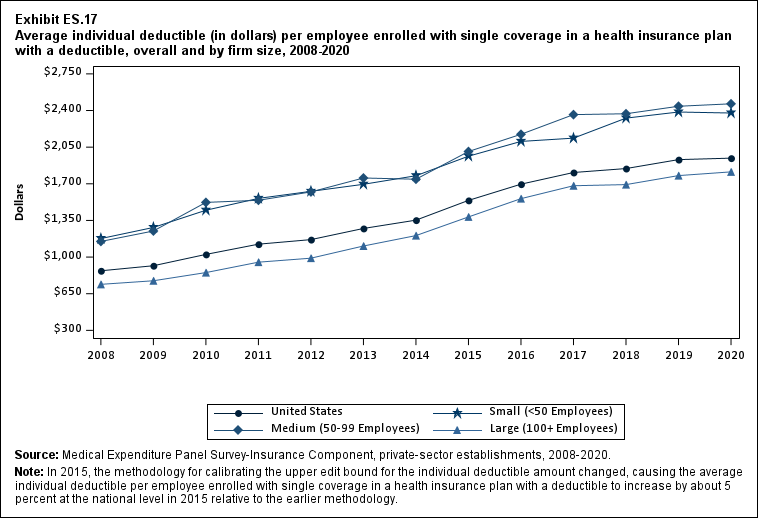

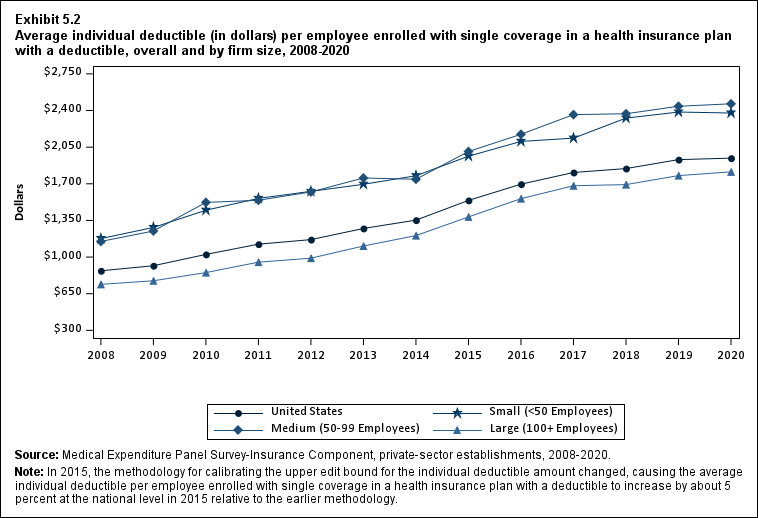

From 2019 to 2020, there were no significant changes in average deductible levels for single

coverage overall, or within any of the three firm sizes (Exhibit ES.17). Similarly, there was no

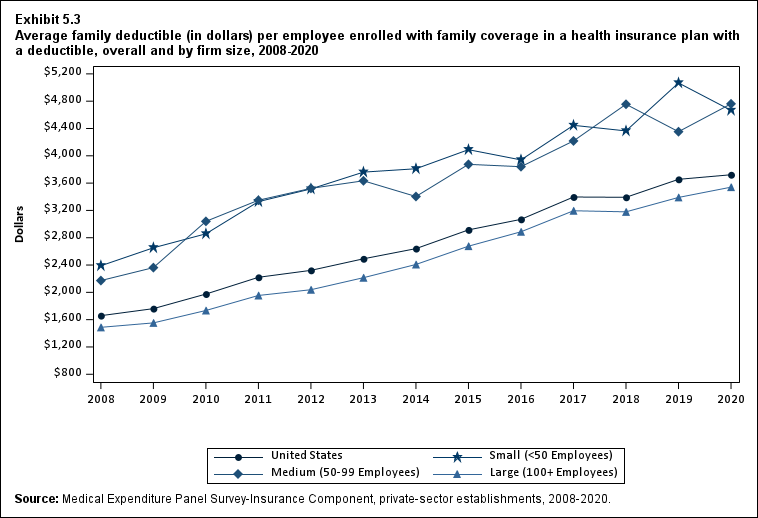

significant change in overall average deductibles for family coverage, and there was a 7.9

percent decrease in deductibles ($5,067 to $4,666) among small employers (Section 5, Exhibit

5.3). In the 2008 to 2020 period, single and family coverage deductibles showed overall

increases in every year except 2018 and 2020.

Average individual deductibles were higher in small ($2,376) and medium firms ($2,464) than in

large firms ($1,814) in 2020 (Exhibit ES.17). Family deductibles were also higher in small

($4,666) and medium firms ($4,761) than in large firms ($3,540) in 2020 (Section 5, Exhibit

5.3).

| Number of Employees |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

| U.S. |

70.7% |

73.8%* |

77.5%* |

77.8% |

79.6%* |

81.3% |

83.9%* |

85.4%* |

84.5% |

87.5%* |

87.3% |

86.6% |

89.2%* |

| (Standard Error) |

(0.5%) |

(0.5%) |

(0.3%) |

(0.7%) |

(0.6%) |

(0.7%) |

(0.5%) |

(0.5%) |

(0.5%) |

(0.4%) |

(0.4%) |

(0.5%) |

(0.4%) |

| <50 |

70.9% |

73.5%* |

75.7%* |

76.3% |

79.5%* |

79.5% |

80.8% |

82.1% |

81.7% |

82.3% |

83.0% |

84.1% |

86.5%*^ |

| (Standard Error) |

(0.7%) |

(0.7%) |

(0.7%) |

(0.4%) |

(1.0%) |

(0.8%) |

(0.8%) |

(0.8%) |

(0.8%) |

(0.8%) |

(0.8%) |

(0.9%) |

(0.8%) |

| 50-99 |

70.3% |

70.6% |

78.2%* |

79.6% |

80.3% |

78.0% |

82.4%* |

85.3% |

82.5% |

83.7% |

85.1% |

87.5% |

89.0% |

| (Standard Error) |

(1.4%) |

(1.9%) |

(1.5%) |

(1.7%) |

(1.4%) |

(1.1%) |

(1.5%) |

(1.5%) |

(1.5%) |

(1.6%) |

(1.4%) |

(1.5%) |

(1.5%) |

| 100+ |

70.7% |

74.2%* |

77.8%* |

77.9% |

79.6% |

81.9%* |

84.6%* |

86.1% |

85.2% |

88.8%* |

88.3% |

87.1% |

89.7%* |

| (Standard Error) |

(0.6%) |

(0.6%) |

(0.3%) |

(1.0%) |

(0.7%) |

(0.7%) |

(0.6%) |

(0.6%) |

(0.6%) |

(0.4%) |

(0.5%) |

(0.5%) |

(0.5%) |

Source: Medical Expenditure Panel Survey-Insurance Component, private-sector establishments, 2008-2020.

Note: * indicates the estimate is statistically different from the previous year at p < 0.05. ^ indicates that the estimates for firms with <50 and 50-99 employees are statistically different from the estimate for firms with 100+ employees at p < 0.05. This test is conducted for 2020 only. |

Return to Table of Contents

| Number of Employees |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

| U.S. |

$869 |

$917* |

$1,025* |

$1,123* |

$1,167* |

$1,273* |

$1,353* |

$1,541* |

$1,696* |

$1,808* |

$1,846 |

$1,931* |

$1,945 |

| (Standard Error) |

($7) |

($9) |

($18) |

($12) |

($8) |

($20) |

($13) |

($16) |

($16) |

($17) |

($17) |

($18) |

($18) |

| <50 |

$1,177 |

$1,283* |

$1,447* |

$1,561* |

$1,628 |

$1,695 |

$1,777* |

$1,964* |

$2,105* |

$2,136 |

$2,327* |

$2,386 |

$2,376^ |

| (Standard Error) |

($13) |

($24) |

($21) |

($26) |

($25) |

($24) |

($28) |

($35) |

($34) |

($35) |

($36) |

($35) |

($39) |

| 50-99 |

$1,149 |

$1,249 |

$1,522* |

$1,543 |

$1,622 |

$1,755 |

$1,744 |

$2,008* |

$2,173 |

$2,361 |

$2,369 |

$2,441 |

$2,464^ |

| (Standard Error) |

($62) |

($46) |

($57) |

($49) |

($64) |

($49) |

($59) |

($62) |

($64) |

($85) |

($65) |

($67) |

($67) |

| 100+ |

$740 |

$774* |

$852* |

$951* |

$989* |

$1,106* |

$1,205* |

$1,383* |

$1,558* |

$1,681* |

$1,692 |

$1,778* |

$1,814 |

| (Standard Error) |

($8) |

($7) |

($20) |

($14) |

($10) |

($19) |

($14) |

($18) |

($18) |

($20) |

($19) |

($21) |

($20) |

Source: Medical Expenditure Panel Survey-Insurance Component, private-sector establishments, 2008-2020.

Note: In 2015, the methodology for calibrating the upper edit bound for the individual deductible amount changed, causing the average individual deductible per employee enrolled with single coverage in a heath insurance plan with a deductible to increase by about 5 percent at the national level in 2015 relative to the earlier methodology. * indicates the estimate is statistically different from the previous year at p < 0.05. ^ indicates that the estimates for firms with <50 and 50-99 employees are statistically different from the estimate for firms with 100+ employees at p < 0.05. This test is conducted for 2020 only. |

Return to Table of Contents

Return to Table of Contents

Conclusion

AHRQ produces this chartbook to make MEPS-IC data more readily usable by providing trends

nationally and by firm size, by presenting national and State-level estimates in one document,

and by providing additional firm-size cross-tabulations relevant to recent policy changes. More

information is available at www.meps.ahrq.gov. AHRQ welcomes feedback on additional ways

to make the data more usable.

Return to Table of Contents

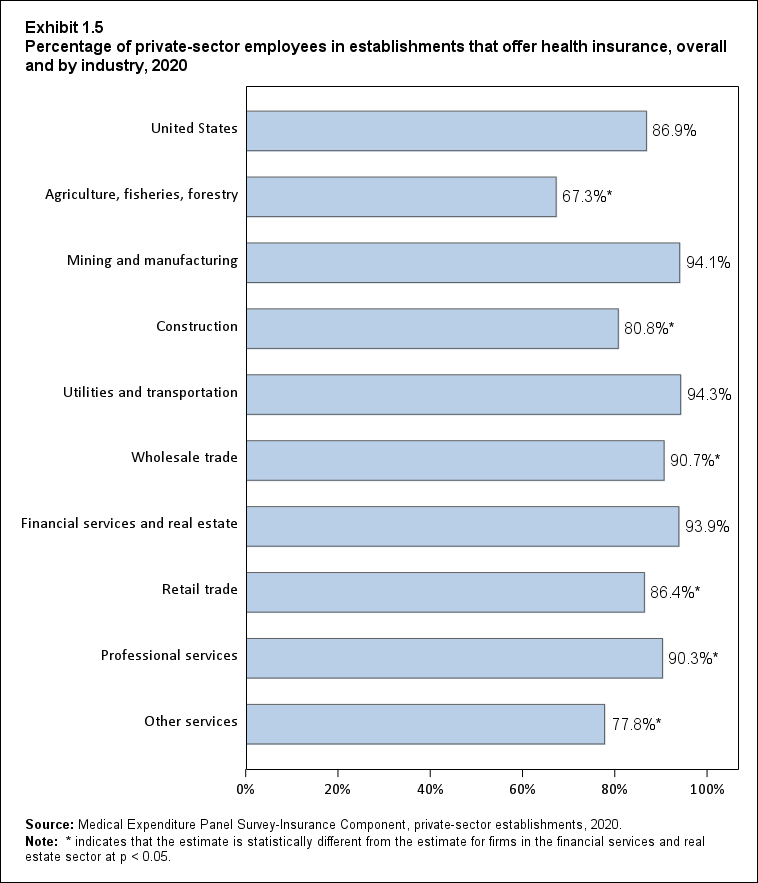

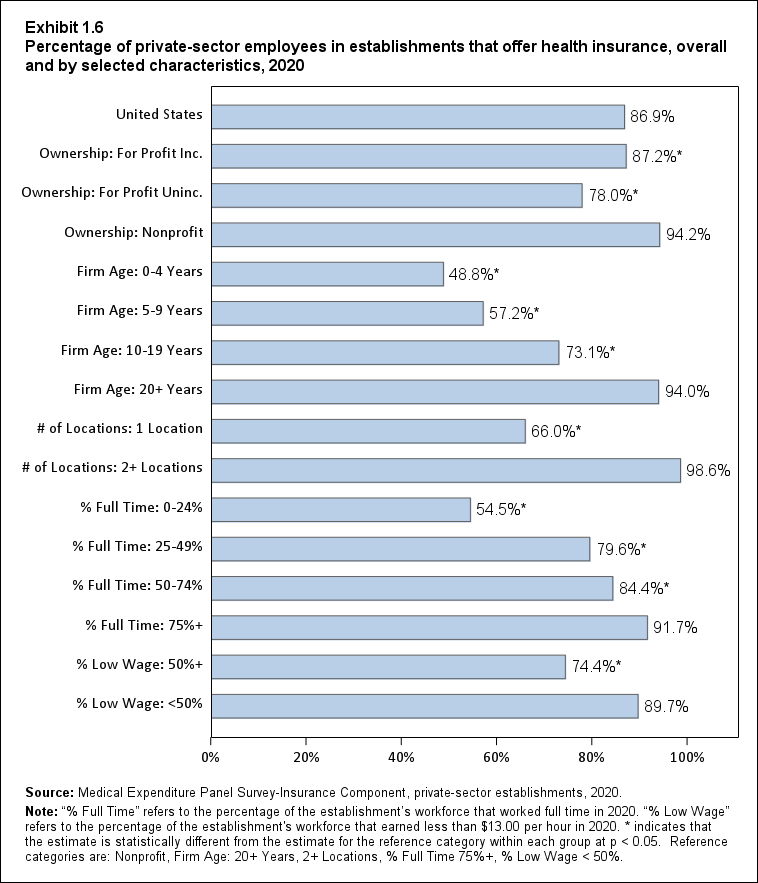

Health Insurance Offer Rates

This section presents estimates of the percentage of employees who worked where coverage was

offered (the "offer rate"), by firm size, State, establishment characteristics (i.e., industry,

ownership type, firm age, number of locations, percentage of workers who are full time, and

percentage of workers with low wages). It also shows interactions of the percentage of workers

with low wages and firm size and State. In addition, this section provides information on the

prevalence of self-insured plans, availability of dependent coverage, and availability of retiree

coverage by firm size. Finally, it shows the percentage of establishments that offer two or more

plans, by firm size and establishment characteristics.

In the MEPS IC survey, respondents are asked whether their organization offers, or makes

available, any health insurance plans to its active employees. Health insurance plans are defined

as policies that provide hospital or physician coverage. The plan may provide this coverage for

the employee only, or it may also provide coverage for the employee's dependents through

employee-plus-one or family coverage.

Many organizations offer more than one plan. For example, an organization may offer both a

high and standard option of a given plan, or it may offer coverage under a health maintenance

organization (HMO) and a preferred provider organization (PPO) from the same or a different

insurance company. A health plan is self-insured when the financial risk for the enrollee's

medical claims is assumed partially or entirely by the organization offering the plan.

Employers' decisions about offering coverage depend on a range of characteristics associated

with productivity, workforce demand for coverage, State policy, and other factors. Historically,

firm size has been a key determinant of the offer rate, with smaller employers being less likely to

offer health insurance coverage than larger employers for a number of reasons, including:

- Smaller risk pools, which result in higher premium costs (holding benefits constant),

- Higher administrative costs, and

- Lack of dedicated staff to select and administer health benefits.

Highlights

- The percentage of employees working at insurance-offering establishments increased from

85.3 percent in 2019 to 86.9 percent in 2020, even as the offer rate within small, medium,

and large firms remained stable over the same period (Exhibit 1.1). These findings reflect a

marked reduction in small-firm employment relative to medium- and large-firm employment,

causing a compositional shift in employment from small firms with low offer rates to

medium and large firms with high offer rates.*

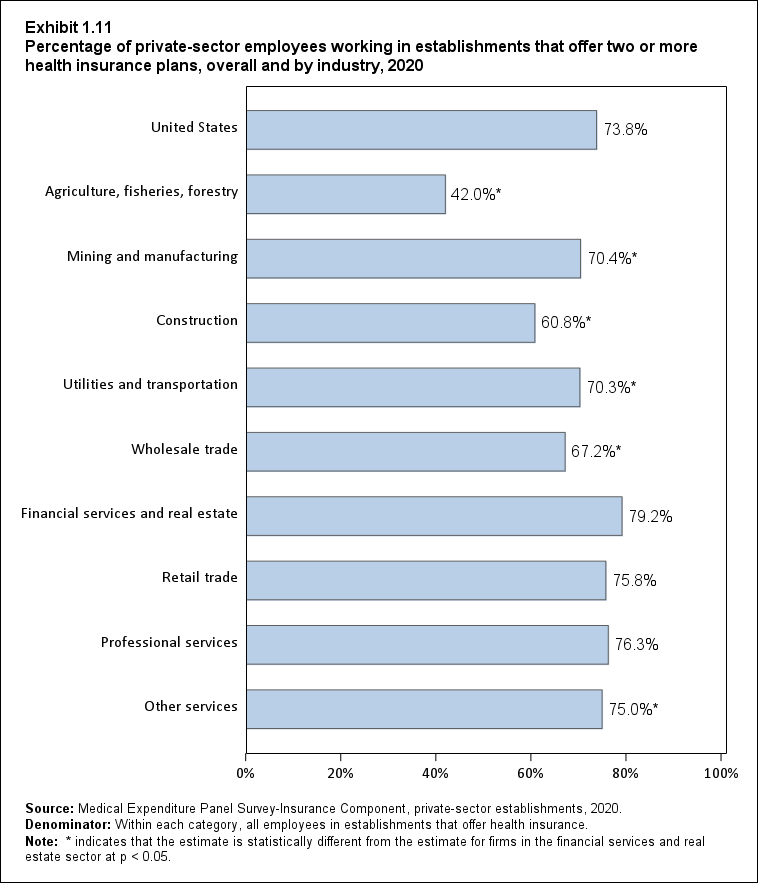

- The overall share of employees at health insurance-offering firms who were offered a choice

of two or more health plans fell from 75.8 percent in 2019 to 73.8 percent in 2020. This decline was driven by 100+ employee firms, where the share of employees offered a choice

of plans fell from 84.5 percent in 2019 to 81.0 percent in 2020 (Exhibit 1.10).

- Overall, the average annual offer rate for 2018-2020 was 85.6 percent for all firms and 49.5

percent for small firms (fewer than 50 employees). Offer rates showed substantial variation

across the United States for both groups of employers (Exhibits 1.2 and 1.3):

- Among all firms, the average annual offer rate ranged from 69.7 percent in Montana to

96.4 percent in Hawaii.

- Among small firms, 15 States, with average annual offer rates ranging from 35.5 to 44.4

percent, were significantly below the national average. Another 15 States, with average

annual offer rates ranging from 53.7 to 90.2 percent, were significantly above the national

average for small firms.

Key Trends

Beyond the key highlights presented above, many longstanding trends related to insurance

coverage offers continued in 2020. Establishments in small firms continued to have a

significantly lower offer rate relative to other firms. In addition, small-firm establishments that

did offer insurance were less likely to self-insure their plans, less likely to offer dependent

coverage, less likely to offer a choice of two or more plans, and less likely to offer retiree

coverage.

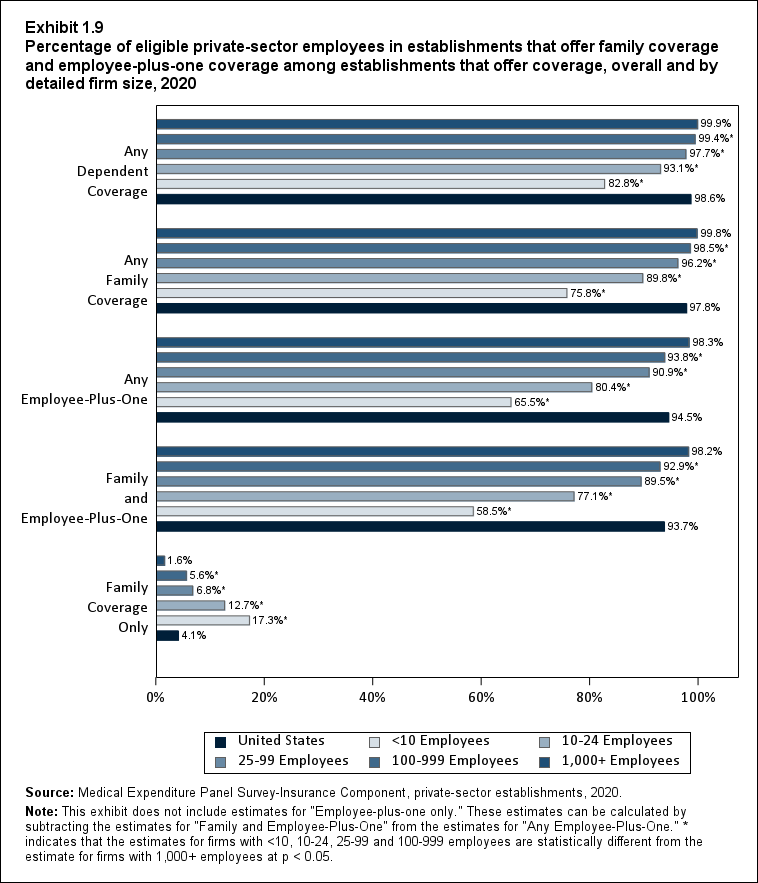

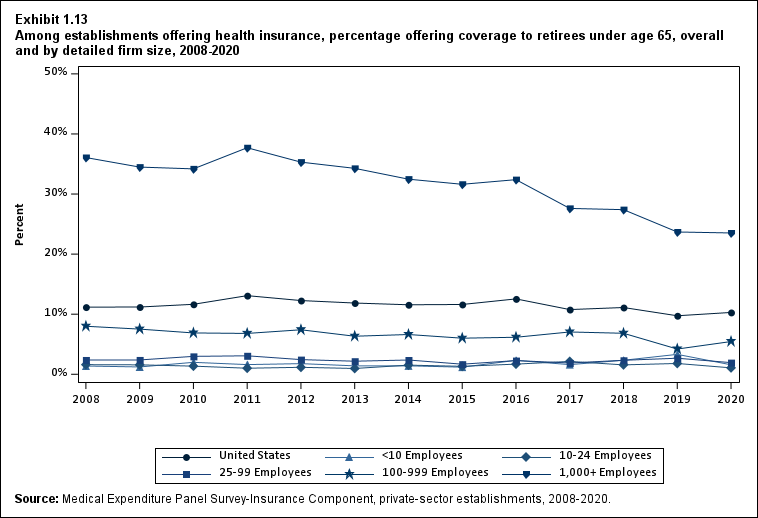

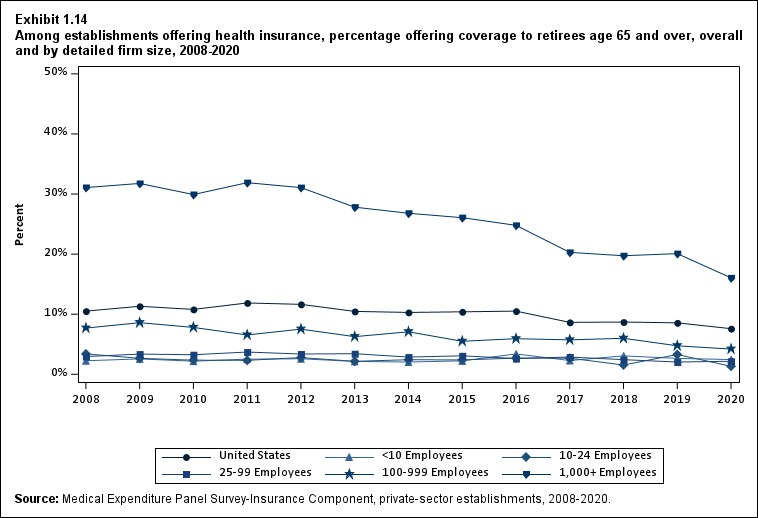

Dependent coverage, as in prior years, was available at very high rates wherever health insurance

was offered. Availability of retiree coverage of all kinds remained low and very rare outside of

large firms.

* These findings may be affected by measurement issues related to the 2020 MEPS-IC employment and related

estimates. For a discussion of these issues, see the MEPS IC 2020 user note.

Return to Table of Contents

| Number of Employees |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

| U.S. |

87.7% |

87.6% |

86.5%* |

85.3%* |

84.7% |

84.9% |

83.2%* |

83.8% |

84.3% |

84.5% |

84.6% |

85.3%* |

86.9%* |

| (Standard Error) |

(0.3%) |

(0.2%) |

(0.2%) |

(0.2%) |

(0.3%) |

(0.3%) |

(0.3%) |

(0.2%) |

(0.2%) |

(0.2%) |

(0.2%) |

(0.2%) |

(0.2%) |

| <50 |

61.6% |

59.6%* |

57.8%* |

54.7%* |

52.9%* |

53.1% |

49.8%* |

47.6%* |

47.7% |

48.3% |

47.3% |

50.7%* |

50.5%^ |

| (Standard Error) |

(0.5%) |

(0.5%) |

(0.5%) |

(0.4%) |

(0.6%) |

(0.7%) |

(0.6%) |

(0.6%) |

(0.6%) |

(0.6%) |

(0.6%) |

(0.7%) |

(0.7%) |

| 50-99 |

90.7% |

89.6% |

87.3% |

85.6% |

84.1% |

87.0% |

83.0%* |

85.3% |

88.6%* |

86.3% |

88.0% |

88.0% |

88.5%^ |

| (Standard Error) |

(0.9%) |

(1.3%) |

(0.9%) |

(1.0%) |

(1.4%) |

(1.0%) |

(1.3%) |

(1.2%) |

(1.0%) |

(1.2%) |

(1.1%) |

(1.1%) |

(1.2%) |

| 100+ |

98.2% |

98.8% |

98.5% |

98.1% |

98.2% |

98.0% |

97.3%* |

98.8%* |

98.9% |

98.9% |

99.0% |

99.0% |

98.8% |

| (Standard Error) |

(0.3%) |

(0.1%) |

(0.2%) |

(0.2%) |

(0.2%) |

(0.2%) |

(0.2%) |

(0.2%) |

(0.1%) |

(0.2%) |

(0.2%) |

(0.1%) |

(0.2%) |

Source: Medical Expenditure Panel Survey-Insurance Component, private-sector establishments, 2008-2020.

Note: * indicates the estimate is statistically different from the previous year at p < 0.05. ^ indicates that the estimates for firms with <50 and 50-99 employees are statistically different from the estimate for firms with 100+ employees at p < 0.05. This test is conducted for 2020 only. |

Return to Table of Contents

| Alabama |

87.8%* |

Kentucky |

86.8% |

North Dakota |

84.6% |

| (Standard Error) |

(0.8%) |

(Standard Error) |

(0.8%) |

(Standard Error) |

(0.8%) |

| Alaska |

76.1%* |

Louisiana |

83.7% |

Ohio |

86.8% |

| (Standard Error) |

(1.0%) |

(Standard Error) |

(1.1%) |

(Standard Error) |

(0.7%) |

| Arizona |

86.7% |

Maine |

80.4%* |

Oklahoma |

84.7% |

| (Standard Error) |

(0.9%) |

(Standard Error) |

(1.1%) |

(Standard Error) |

(0.8%) |

| Arkansas |

82.6%* |

Maryland |

86.8% |

Oregon |

82.1%* |

| (Standard Error) |

(0.9%) |

(Standard Error) |

(0.9%) |

(Standard Error) |

(0.9%) |

| California |

85.8% |

Massachusetts |

89.9%* |

Pennsylvania |

88.5%* |

| (Standard Error) |

(0.5%) |

(Standard Error) |

(0.8%) |

(Standard Error) |

(0.6%) |

| Colorado |

81.9%* |

Michigan |

85.8% |

Rhode Island |

85.7% |

| (Standard Error) |

(1.1%) |

(Standard Error) |

(0.8%) |

(Standard Error) |

(0.9%) |

| Connecticut |

87.2%* |

Minnesota |

85.1% |

South Carolina |

84.0% |

| (Standard Error) |

(0.8%) |

(Standard Error) |

(0.9%) |

(Standard Error) |

(0.8%) |

| Delaware |

85.8% |

Mississippi |

84.5% |

South Dakota |

81.5%* |

| (Standard Error) |

(1.1%) |

(Standard Error) |

(0.9%) |

(Standard Error) |

(1.1%) |

| District of Columbia |

93.8%* |

Missouri |

85.9% |

Tennessee |

88.1%* |

| (Standard Error) |

(0.6%) |

(Standard Error) |

(0.8%) |

(Standard Error) |

(0.7%) |

| Florida |

84.3% |

Montana |

69.7%* |

Texas |

84.4% |

| (Standard Error) |

(0.7%) |

(Standard Error) |

(1.2%) |

(Standard Error) |

(0.7%) |

| Georgia |

85.8% |

Nebraska |

81.9%* |

Utah |

80.5%* |

| (Standard Error) |

(0.8%) |

(Standard Error) |

(1.0%) |

(Standard Error) |

(1.1%) |

| Hawaii |

96.4%* |

Nevada |

86.5% |

Vermont |

79.3%* |

| (Standard Error) |

(0.7%) |

(Standard Error) |

(0.9%) |

(Standard Error) |

(0.9%) |

| Idaho |

76.1%* |

New Hampshire |

86.4% |

Virginia |

86.7% |

| (Standard Error) |

(1.2%) |

(Standard Error) |

(0.8%) |

(Standard Error) |

(0.9%) |

| Illinois |

87.3% |

New Jersey |

86.8% |

Washington |

84.6% |

| (Standard Error) |

(0.8%) |

(Standard Error) |

(0.8%) |

(Standard Error) |

(0.9%) |

| Indiana |

85.5% |

New Mexico |

78.8%* |

West Virginia |

84.7% |

| (Standard Error) |

(0.7%) |

(Standard Error) |

(1.1%) |

(Standard Error) |

(0.8%) |

| Iowa |

87.1%* |

New York |

87.1%* |

Wisconsin |

84.6% |

| (Standard Error) |

(0.7%) |

(Standard Error) |

(0.5%) |

(Standard Error) |

(0.8%) |

| Kansas |

86.2% |

North Carolina |

82.3%* |

Wyoming |

72.1%* |

| (Standard Error) |

(0.8%) |

(Standard Error) |

(0.9%) |

(Standard Error) |

(1.3%) |

Source: Medical Expenditure Panel Survey-Insurance Component, private-sector establishments, 2020.

Note: * Statistically different from the national average of 85.6 percent at p < 0.05. Note that the standard error on the national estimate of 85.6 percent is 0.1 percent. |

Return to Table of Contents

| Alabama |

54.9%* |

Kentucky |

49.4% |

North Dakota |

56.3%* |

| (Standard Error) |

(2.3%) |

(Standard Error) |

(2.6%) |

(Standard Error) |

(2.1%) |

| Alaska |

35.5%* |

Louisiana |

50.2% |

Ohio |

50.0% |

| (Standard Error) |

(2.3%) |

(Standard Error) |

(2.5%) |

(Standard Error) |

(2.4%) |

| Arizona |

45.5% |

Maine |

45.0% |

Oklahoma |

50.2% |

| (Standard Error) |

(2.7%) |

(Standard Error) |

(2.4%) |

(Standard Error) |

(2.3%) |

| Arkansas |

40.4%* |

Maryland |

56.8%* |

Oregon |

48.2% |

| (Standard Error) |

(2.5%) |

(Standard Error) |

(2.4%) |

(Standard Error) |

(2.1%) |

| California |

50.2% |

Massachusetts |

62.5%* |

Pennsylvania |

55.6%* |

| (Standard Error) |

(1.4%) |

(Standard Error) |

(2.5%) |

(Standard Error) |

(1.9%) |

| Colorado |

46.1% |

Michigan |

50.5% |

Rhode Island |

56.1%* |

| (Standard Error) |

(2.4%) |

(Standard Error) |

(2.3%) |

(Standard Error) |

(2.5%) |

| Connecticut |

57.8%* |

Minnesota |

49.2% |

South Carolina |

40.8%* |

| (Standard Error) |

(2.3%) |

(Standard Error) |

(2.4%) |

(Standard Error) |

(2.4%) |

| Delaware |

50.5% |

Mississippi |

45.6% |

South Dakota |

50.1% |

| (Standard Error) |

(2.9%) |

(Standard Error) |

(2.6%) |

(Standard Error) |

(2.1%) |

| District of Columbia |

70.4%* |

Missouri |

49.2% |

Tennessee |

48.3% |

| (Standard Error) |

(2.6%) |

(Standard Error) |

(2.4%) |

(Standard Error) |

(2.5%) |

| Florida |

41.7%* |

Montana |

37.6%* |

Texas |

47.4% |

| (Standard Error) |

(2.1%) |

(Standard Error) |

(2.1%) |

(Standard Error) |

(1.7%) |

| Georgia |

41.1%* |

Nebraska |

41.2%* |

Utah |

38.1%* |

| (Standard Error) |

(2.5%) |

(Standard Error) |

(2.3%) |

(Standard Error) |

(2.5%) |

| Hawaii |

90.2%* |

Nevada |

51.3% |

Vermont |

46.1% |

| (Standard Error) |

(1.3%) |

(Standard Error) |

(2.9%) |

(Standard Error) |

(2.0%) |

| Idaho |

39.9%* |

New Hampshire |

55.3%* |

Virginia |

50.8% |

| (Standard Error) |

(2.3%) |

(Standard Error) |

(2.3%) |

(Standard Error) |

(2.3%) |

| Illinois |

53.7%* |

New Jersey |

57.1%* |

Washington |

50.1% |

| (Standard Error) |

(2.0%) |

(Standard Error) |

(2.3%) |

(Standard Error) |

(2.2%) |

| Indiana |

43.9%* |

New Mexico |

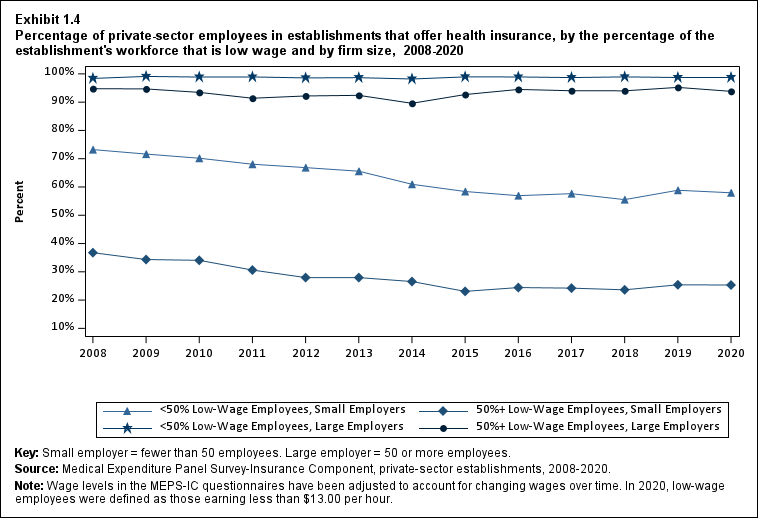

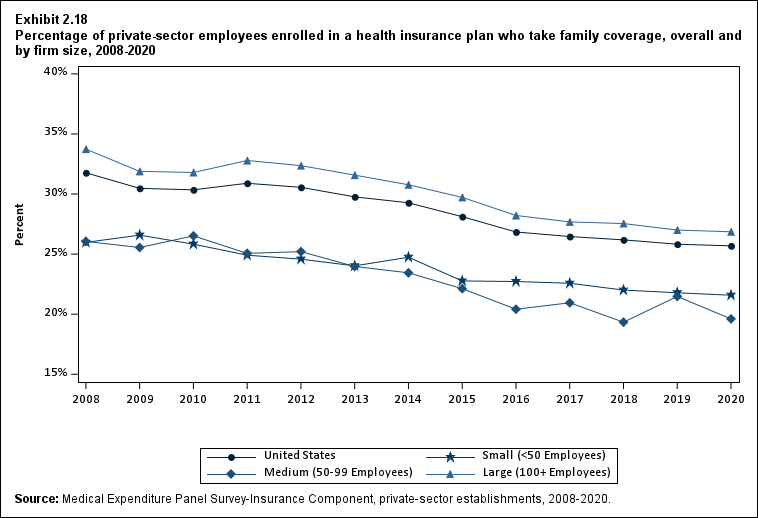

40.9%* |

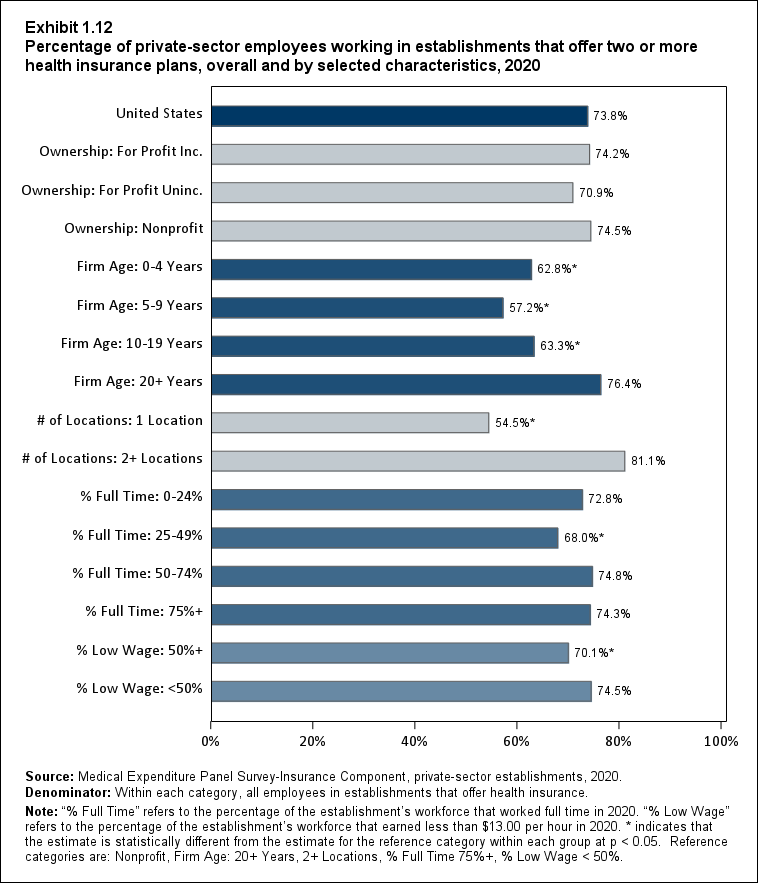

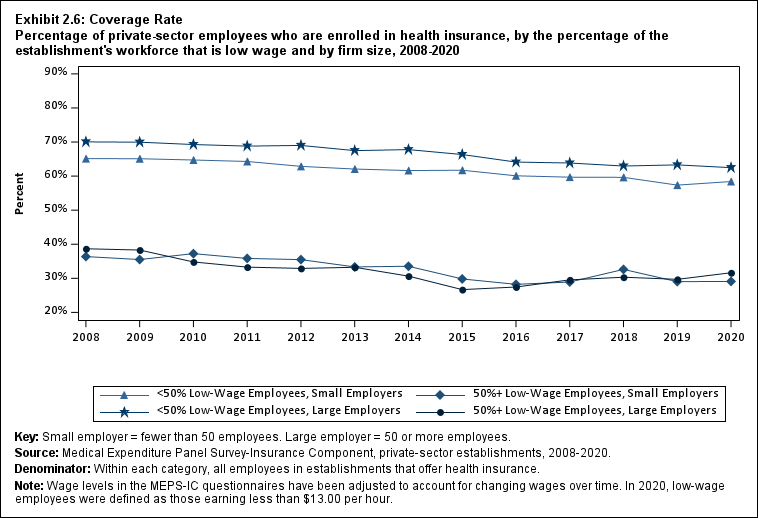

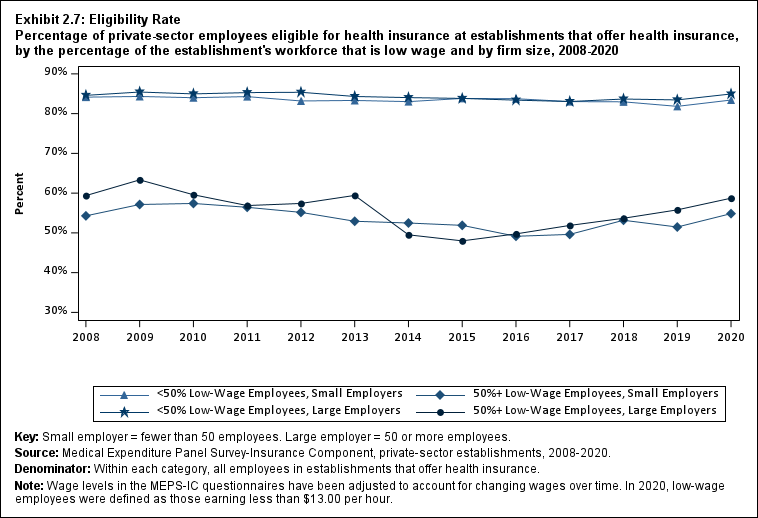

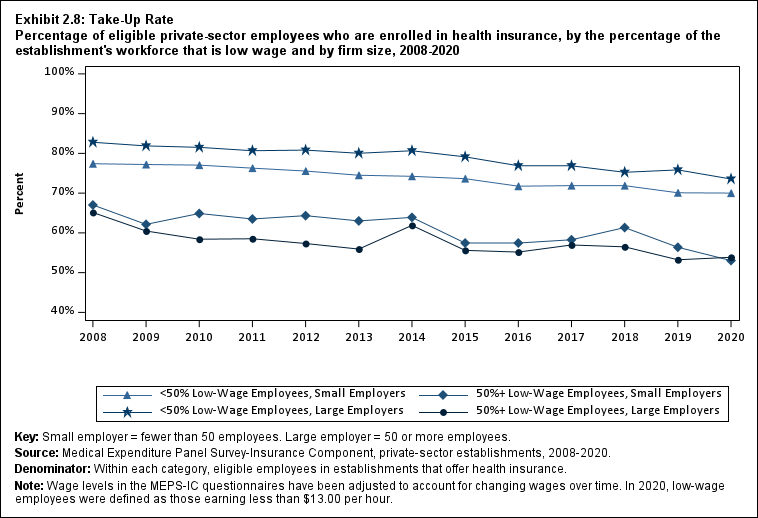

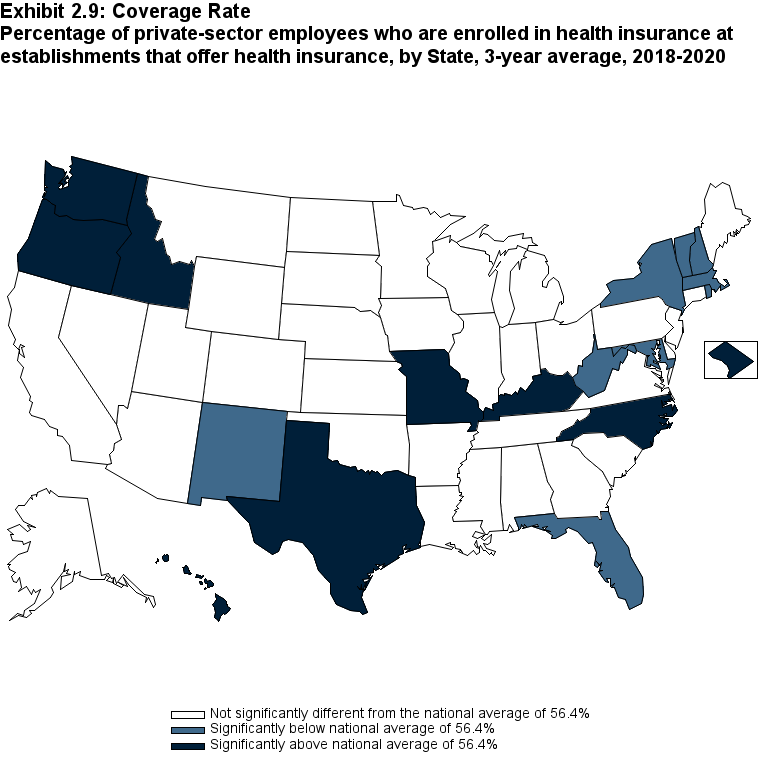

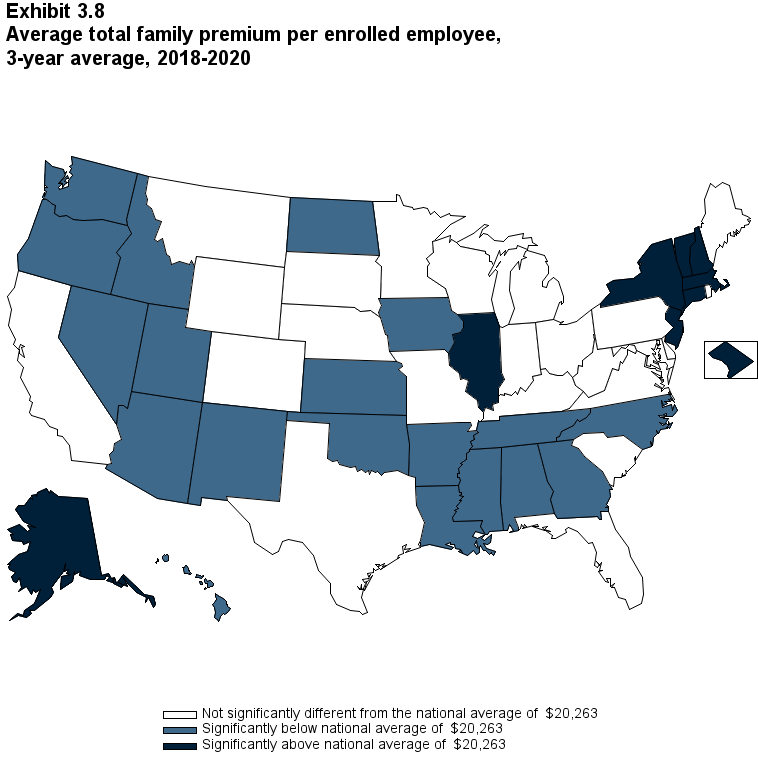

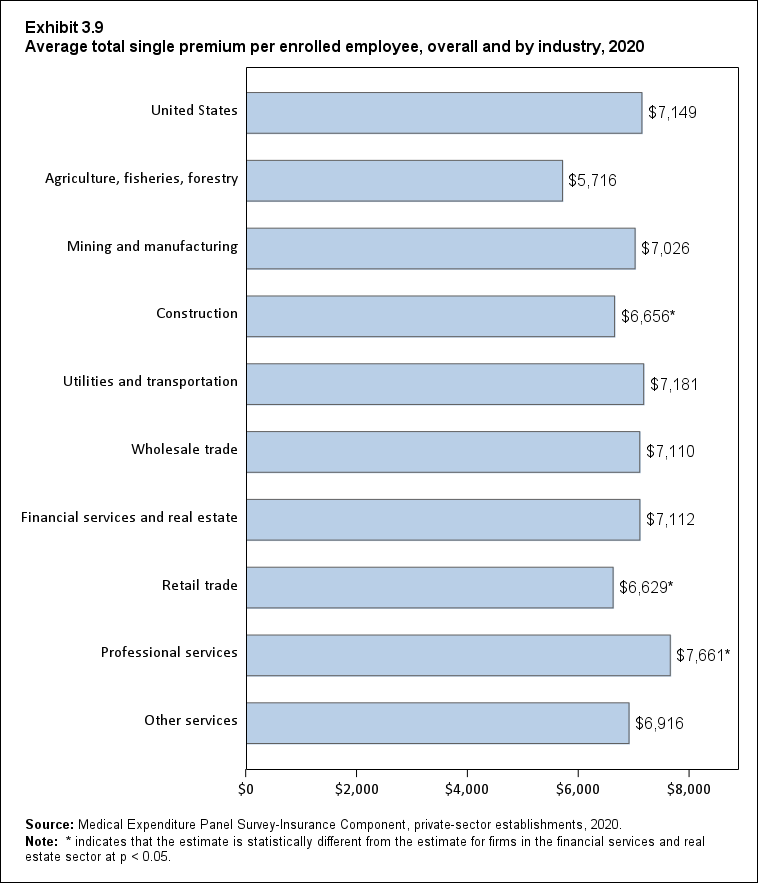

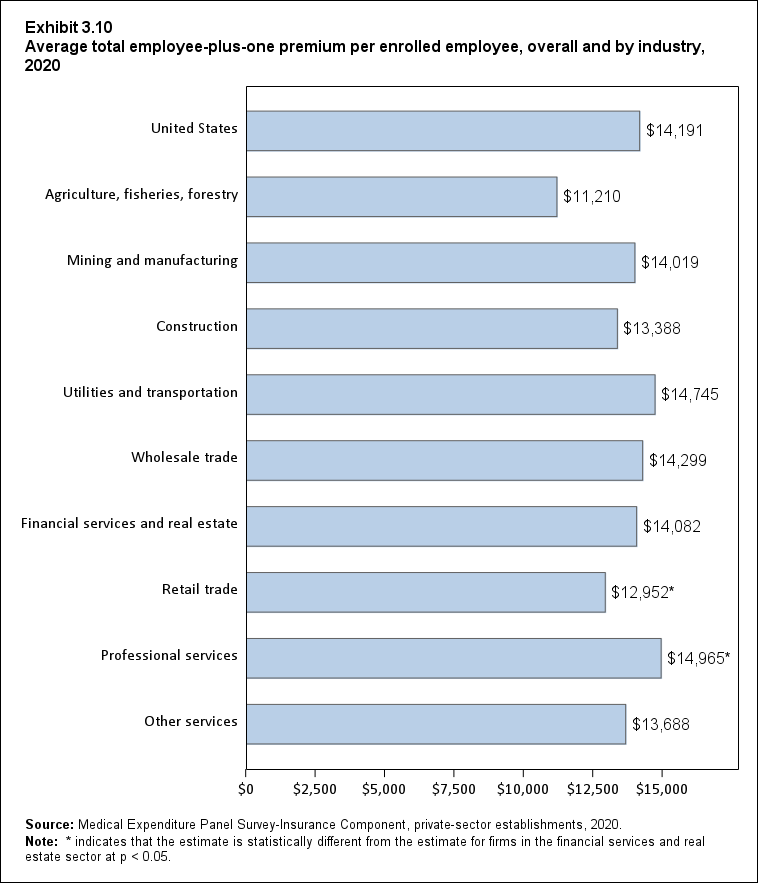

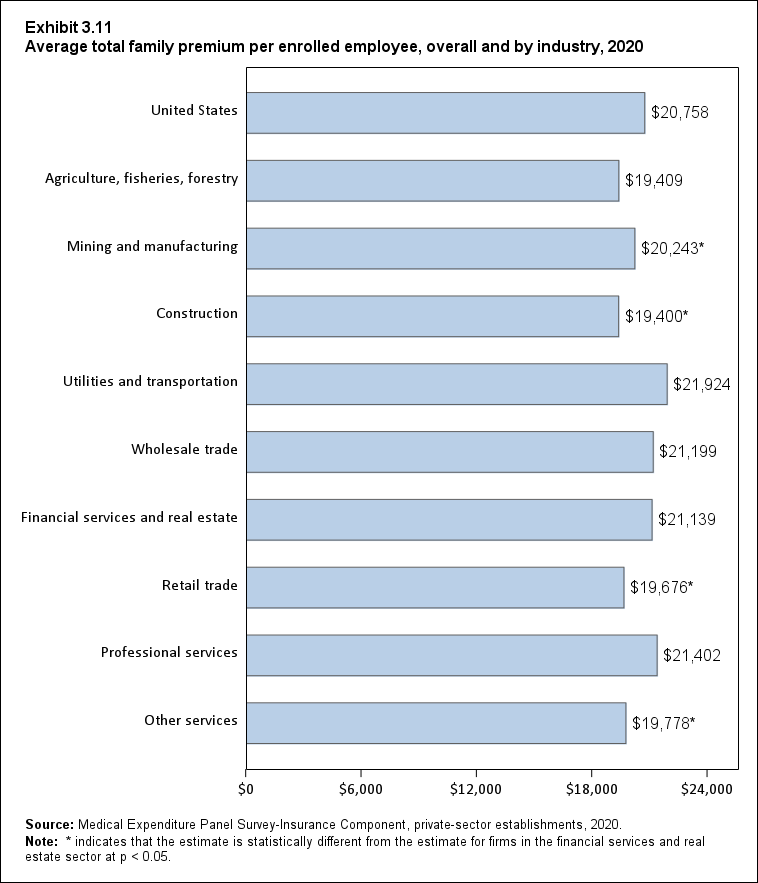

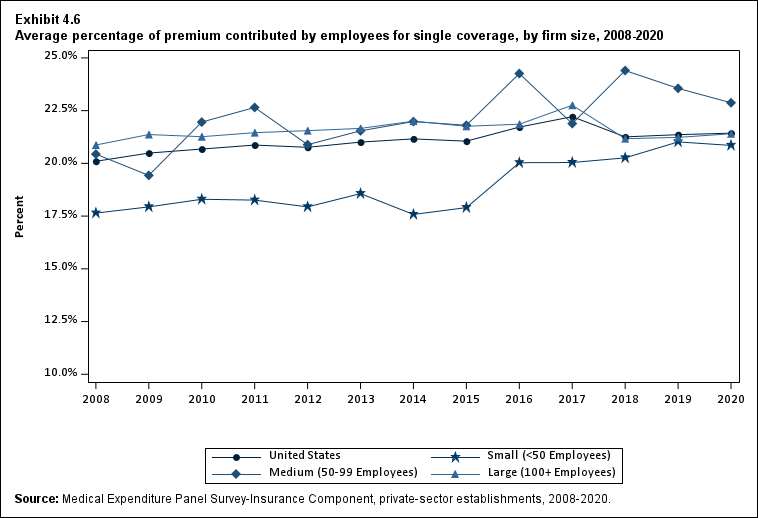

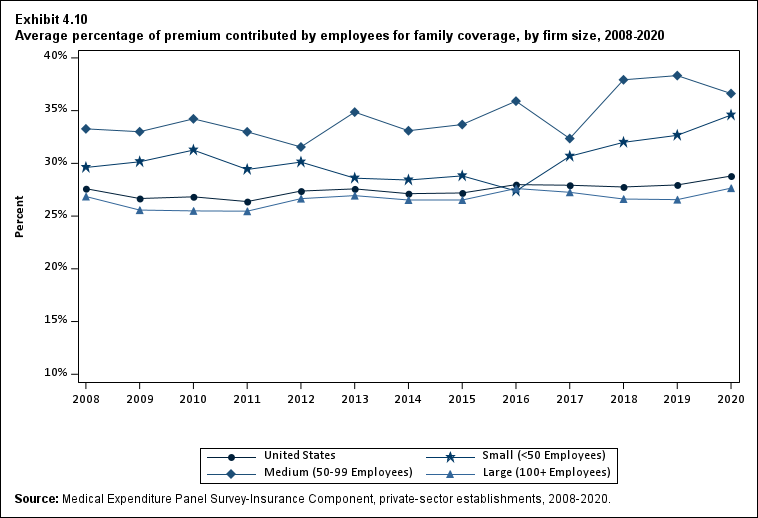

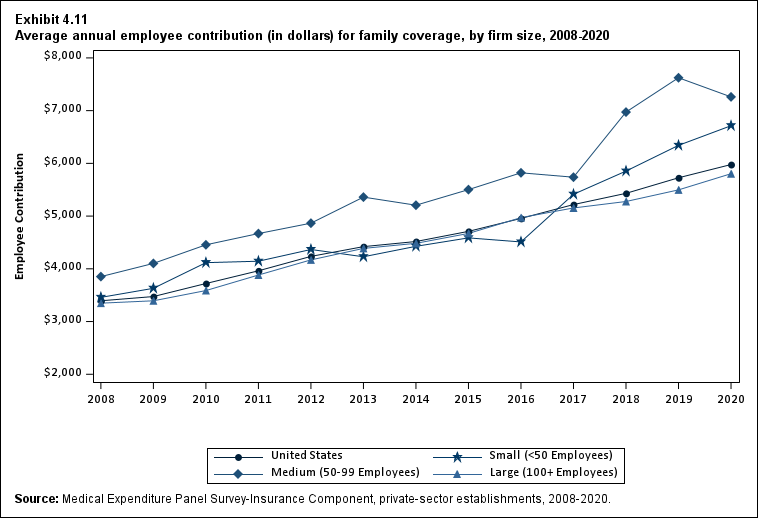

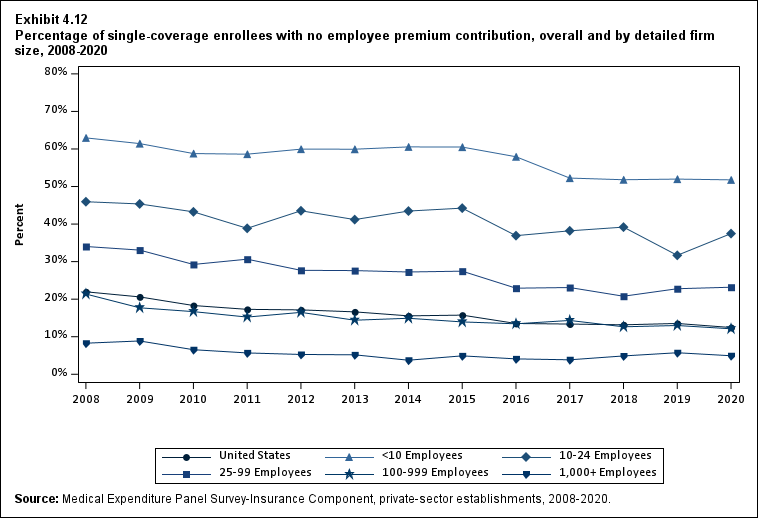

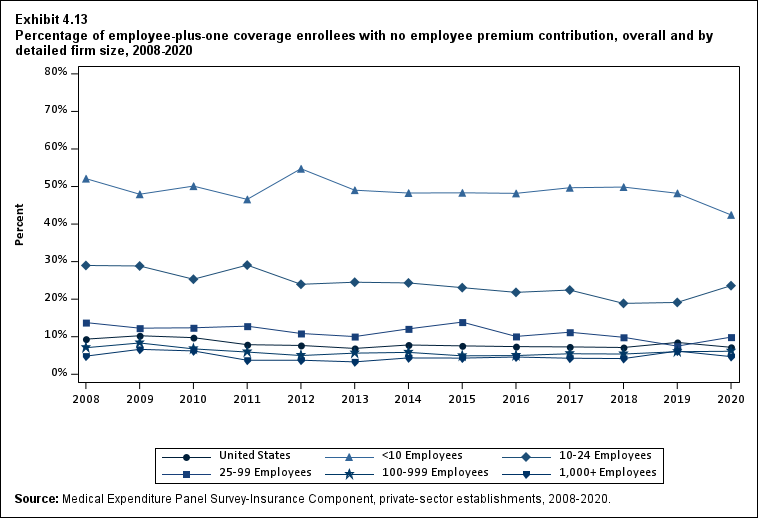

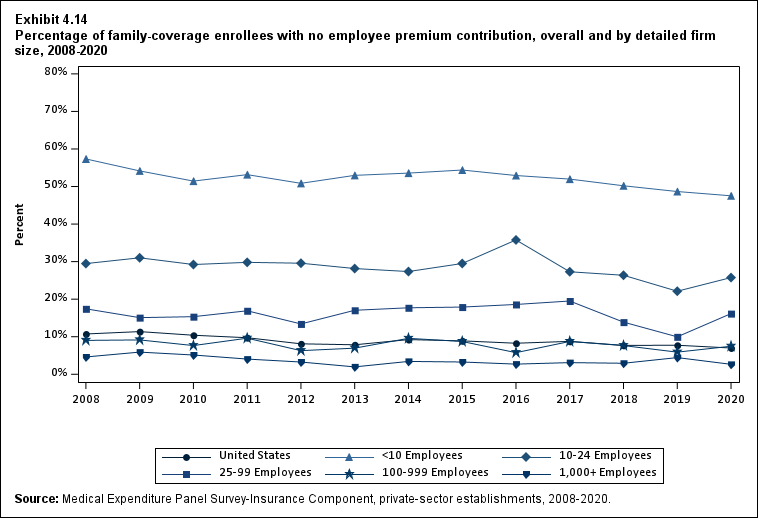

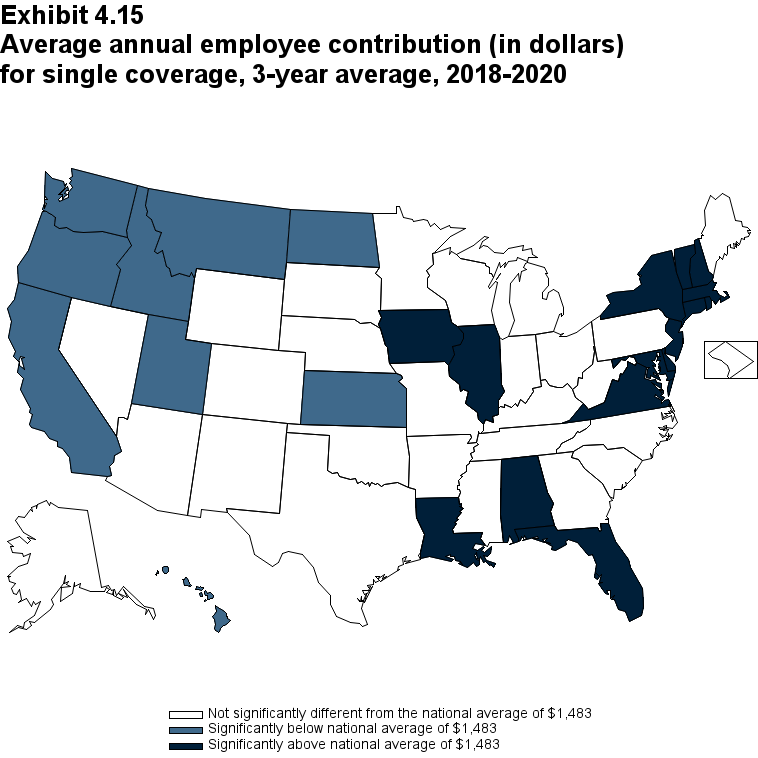

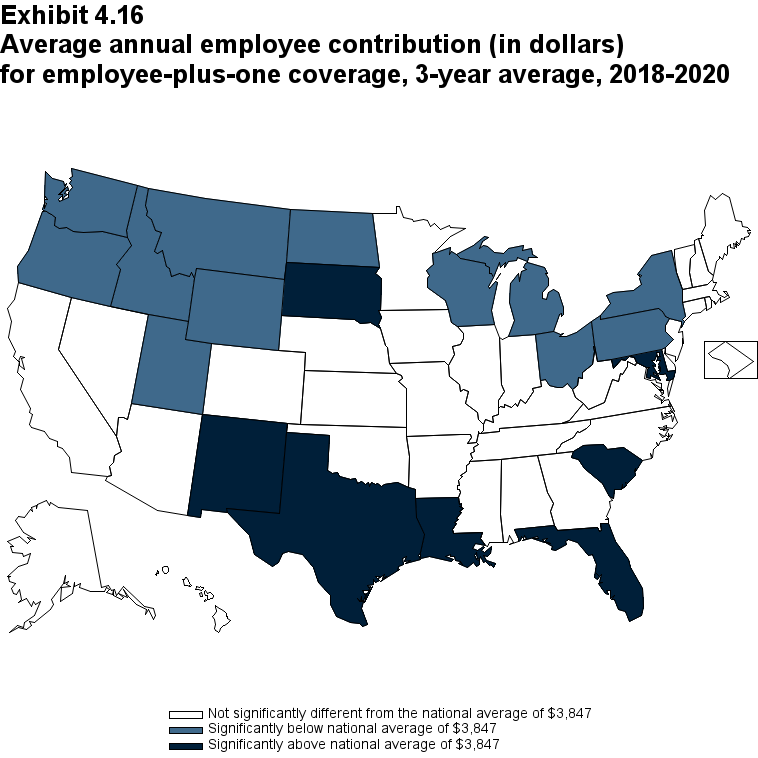

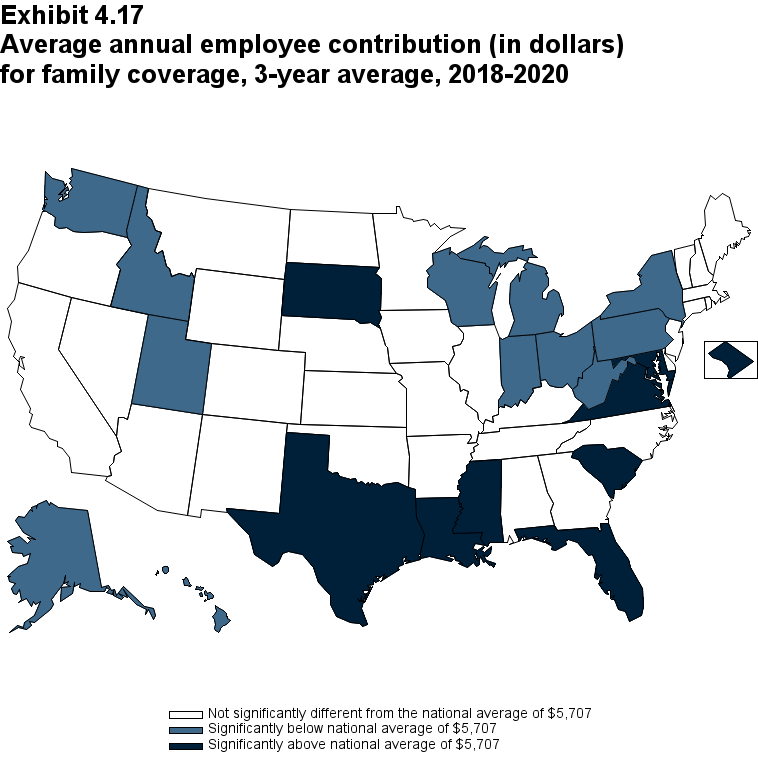

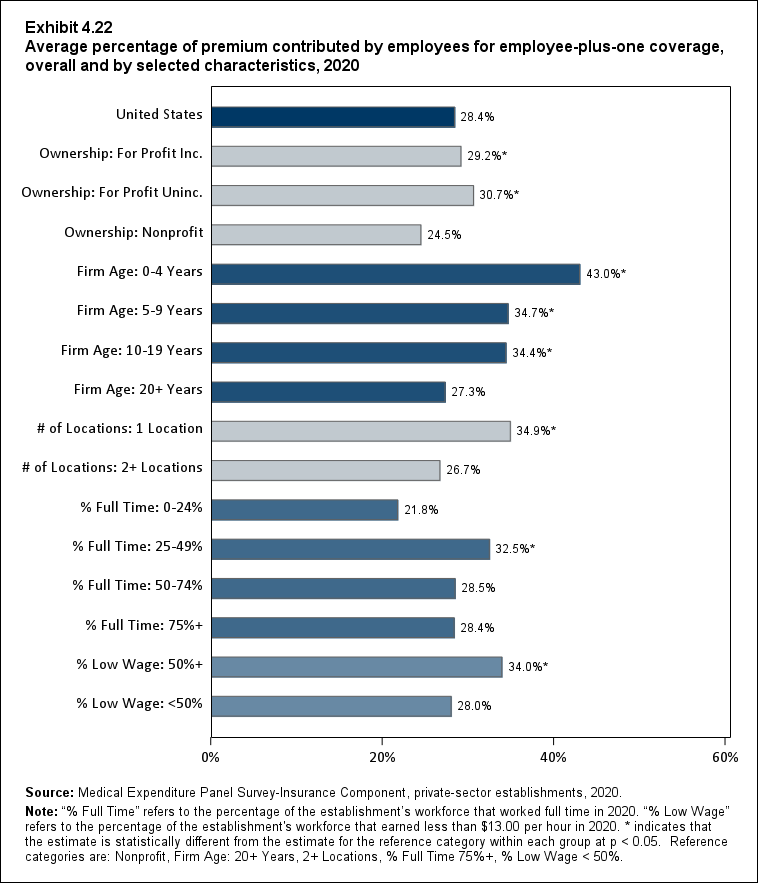

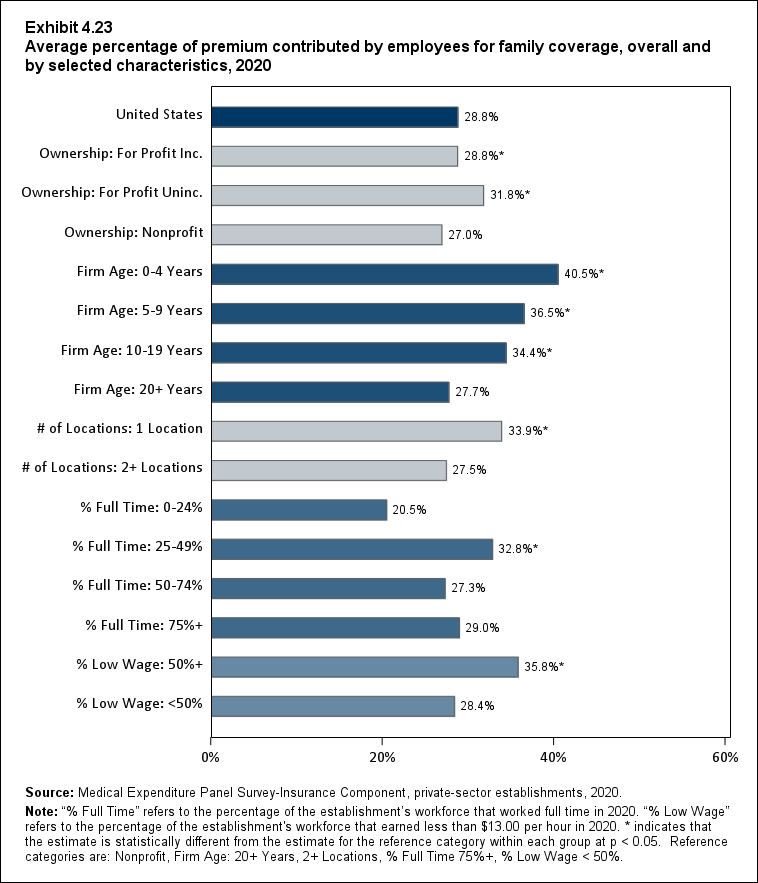

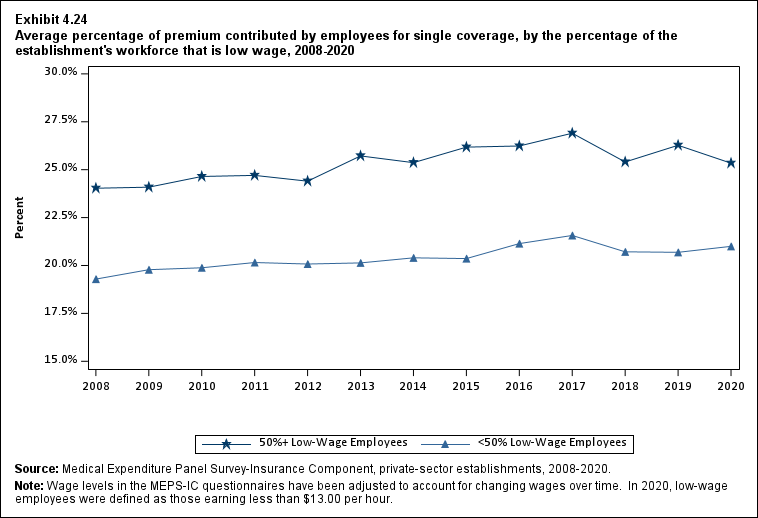

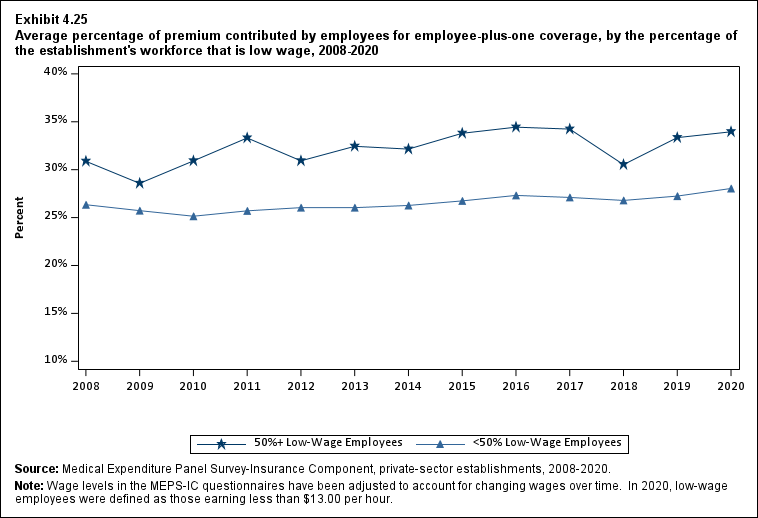

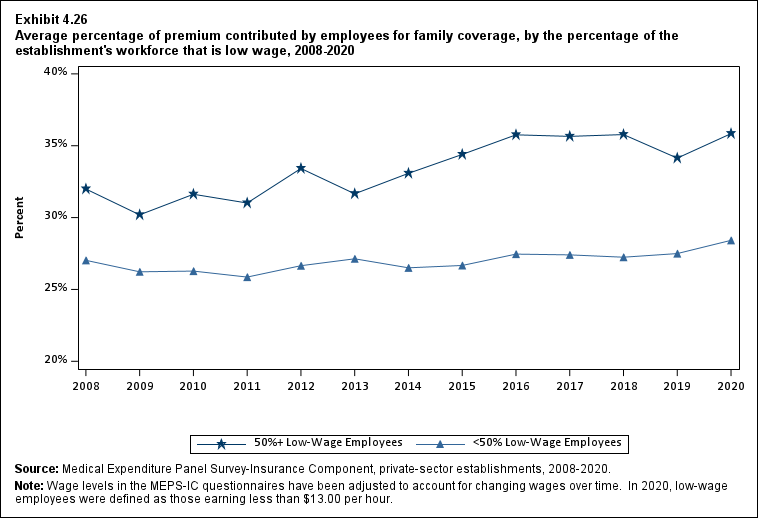

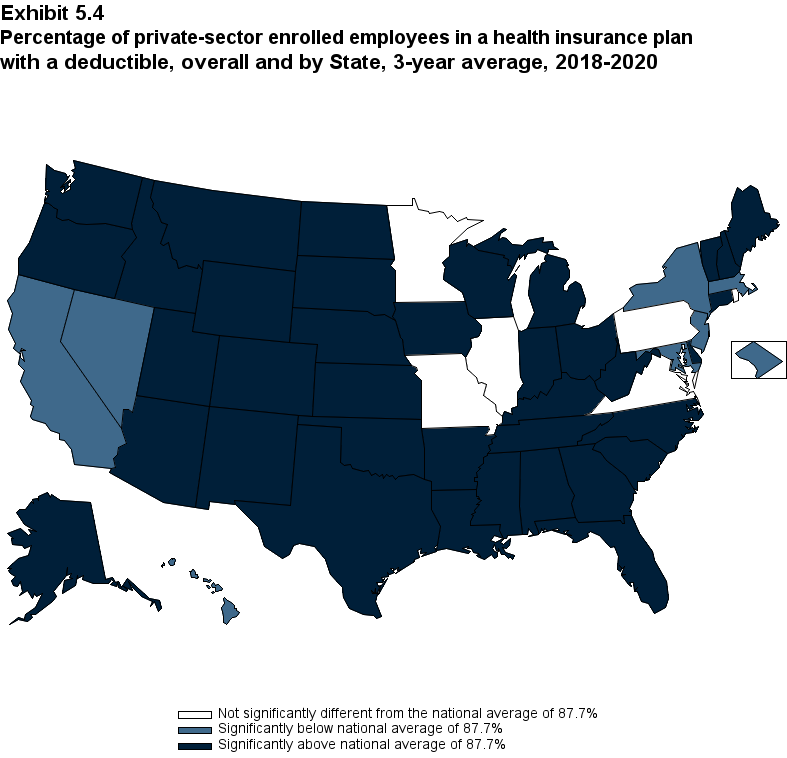

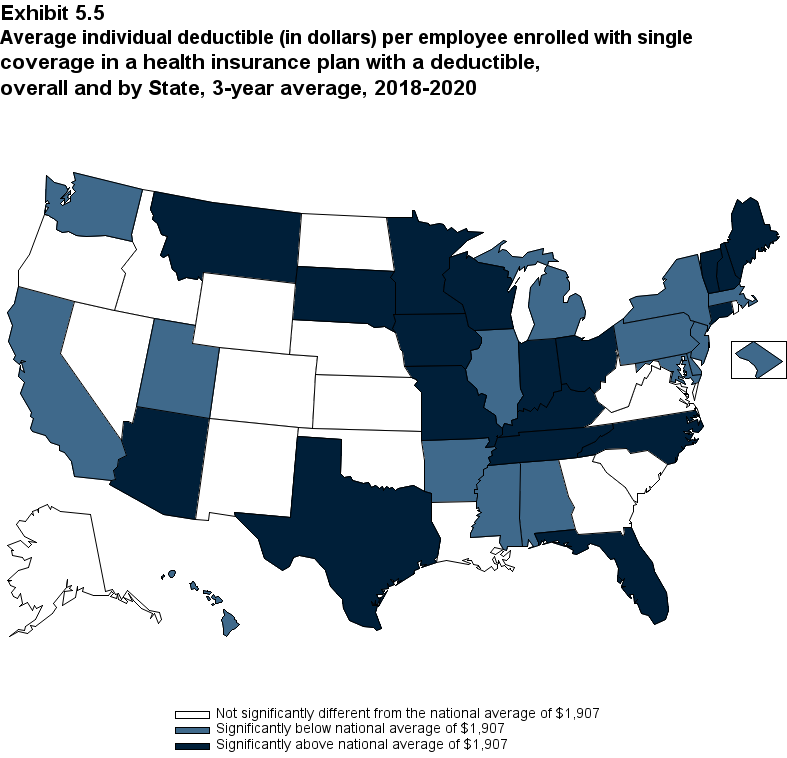

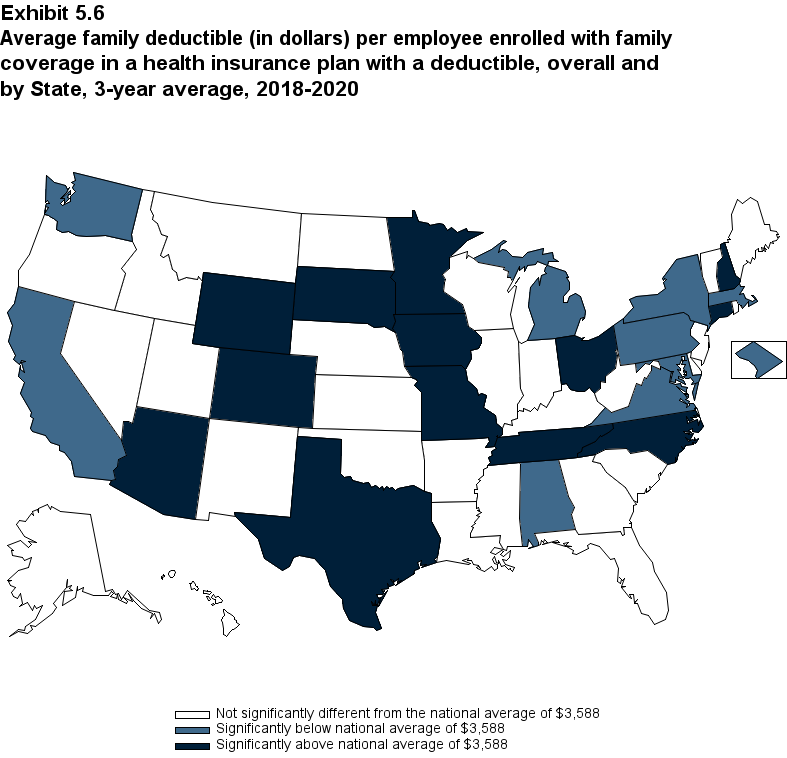

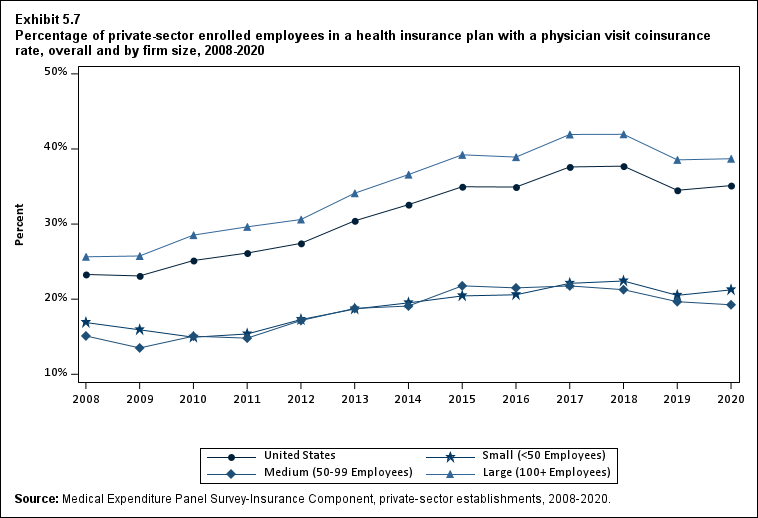

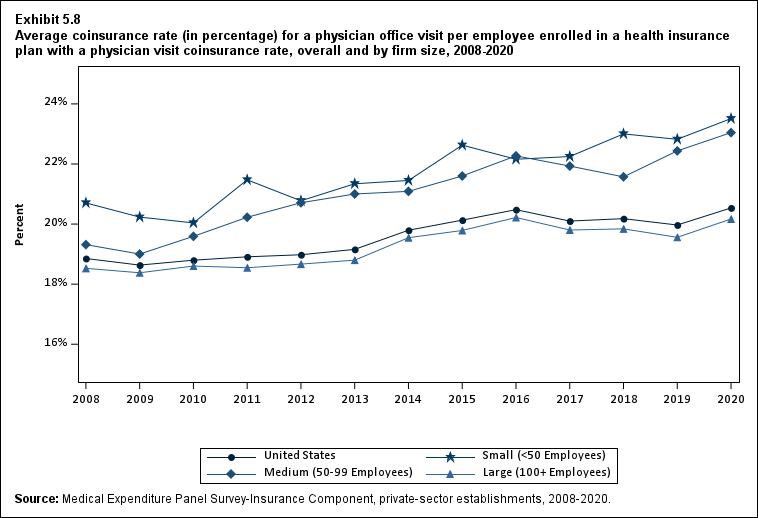

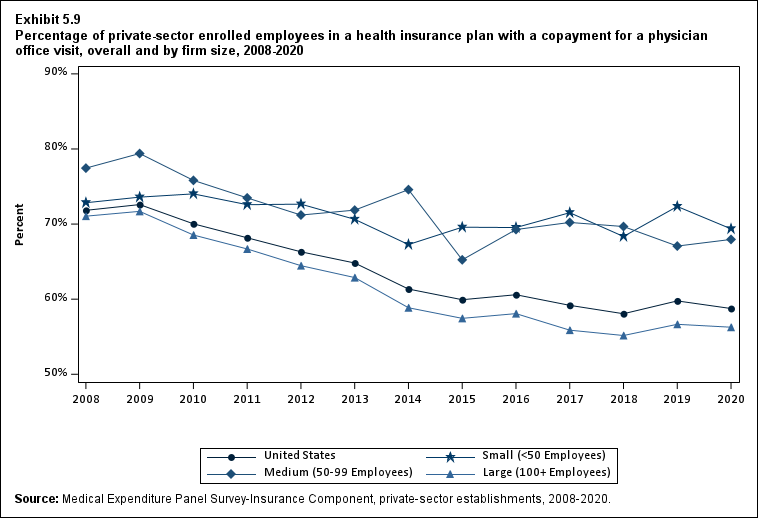

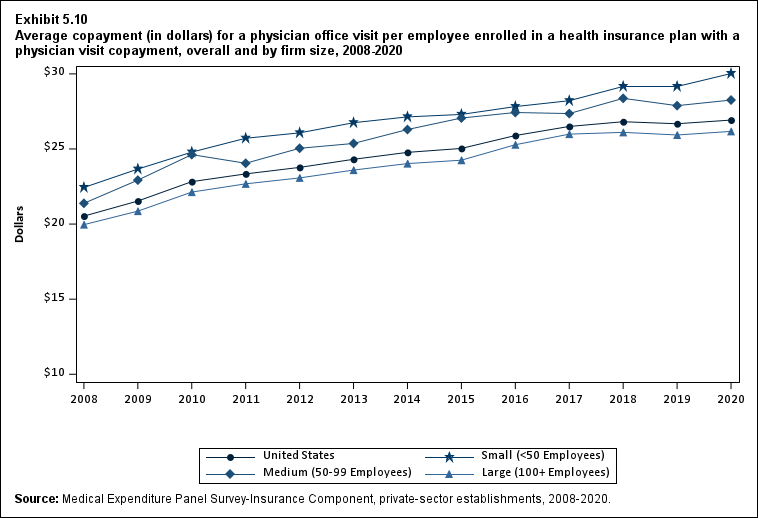

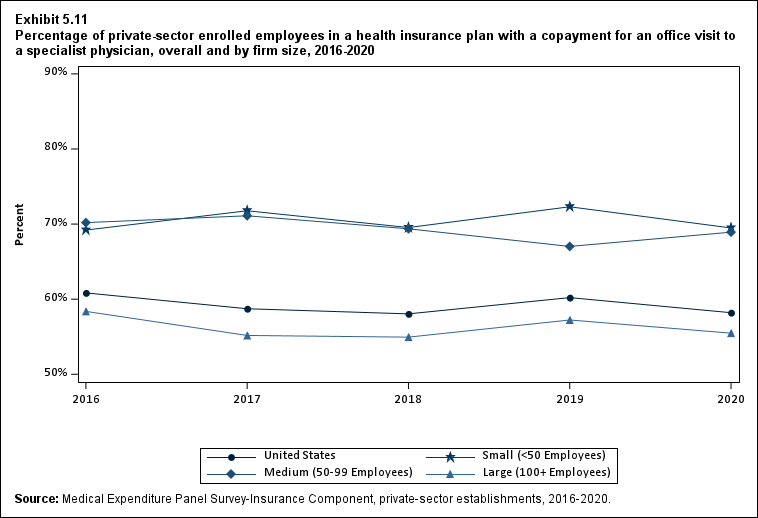

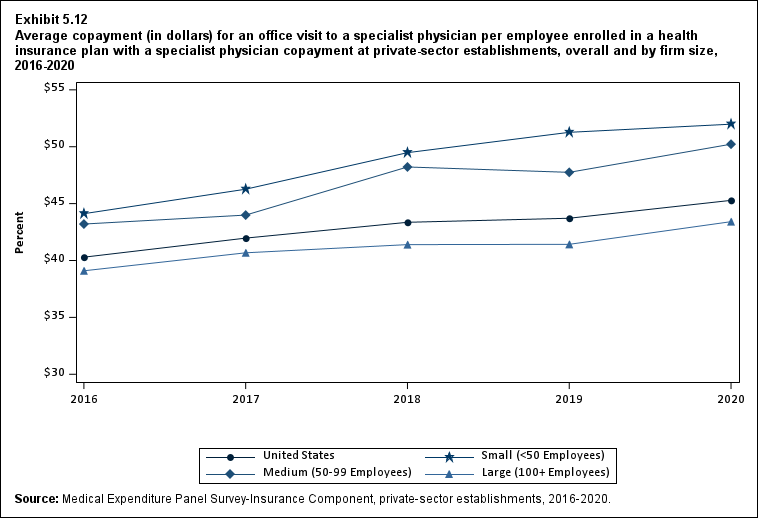

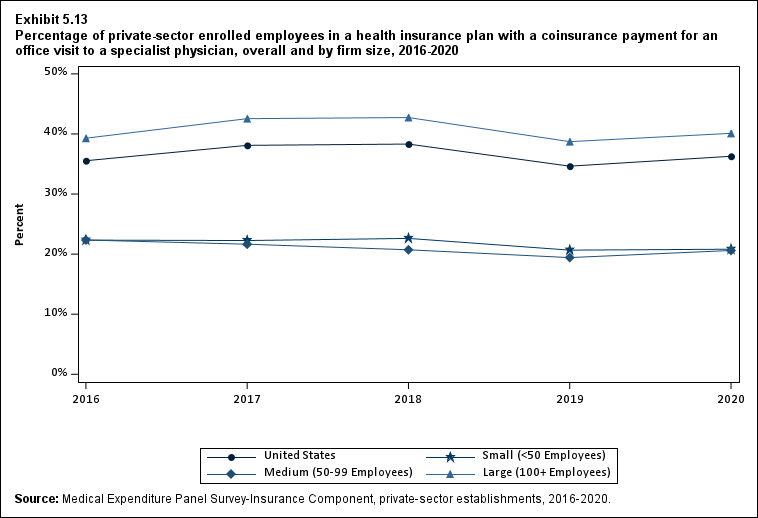

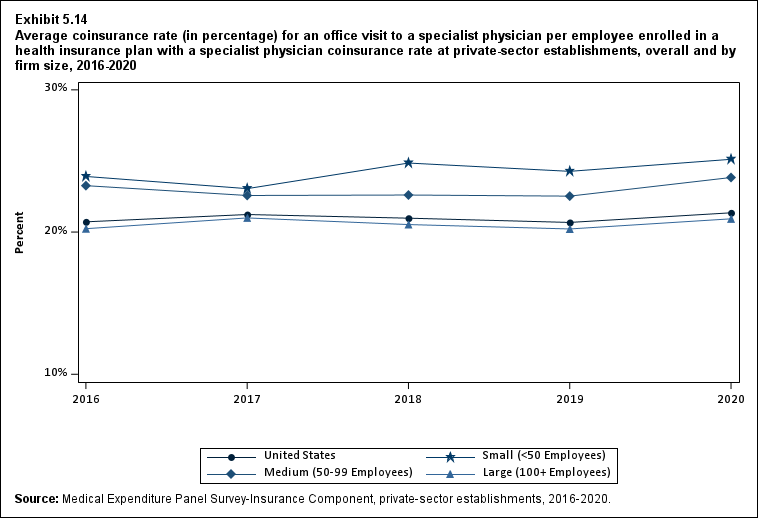

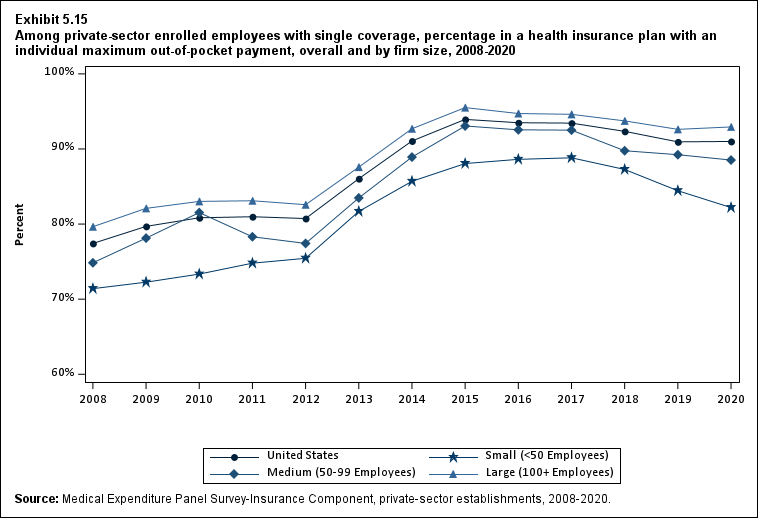

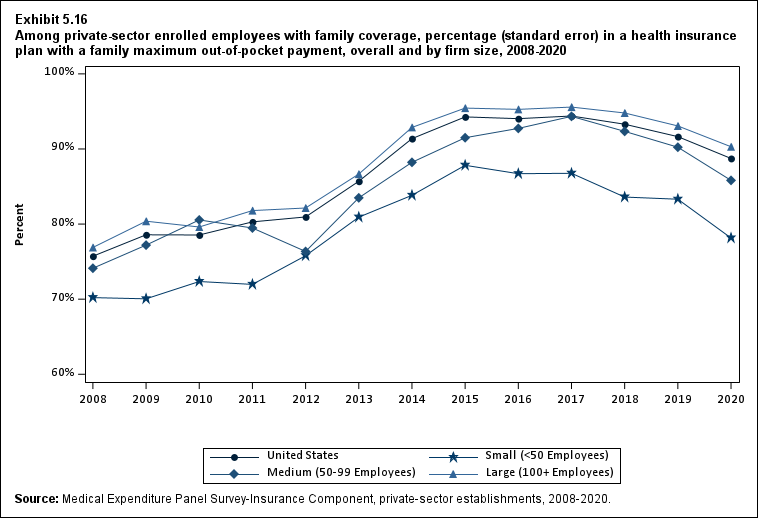

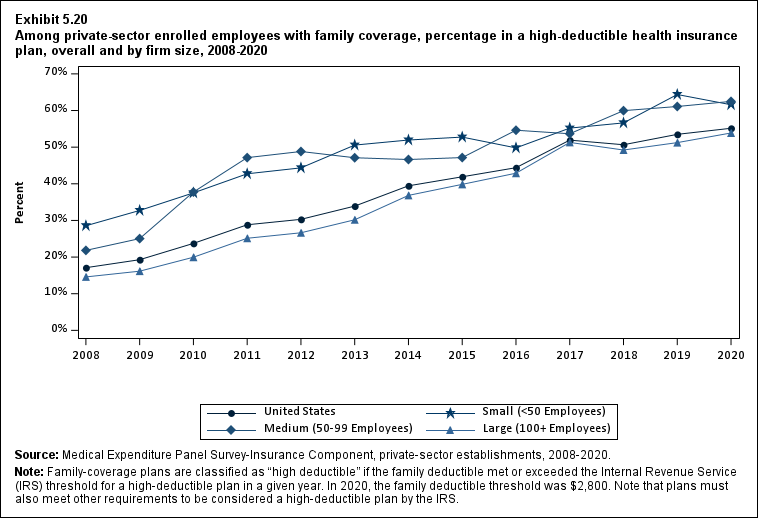

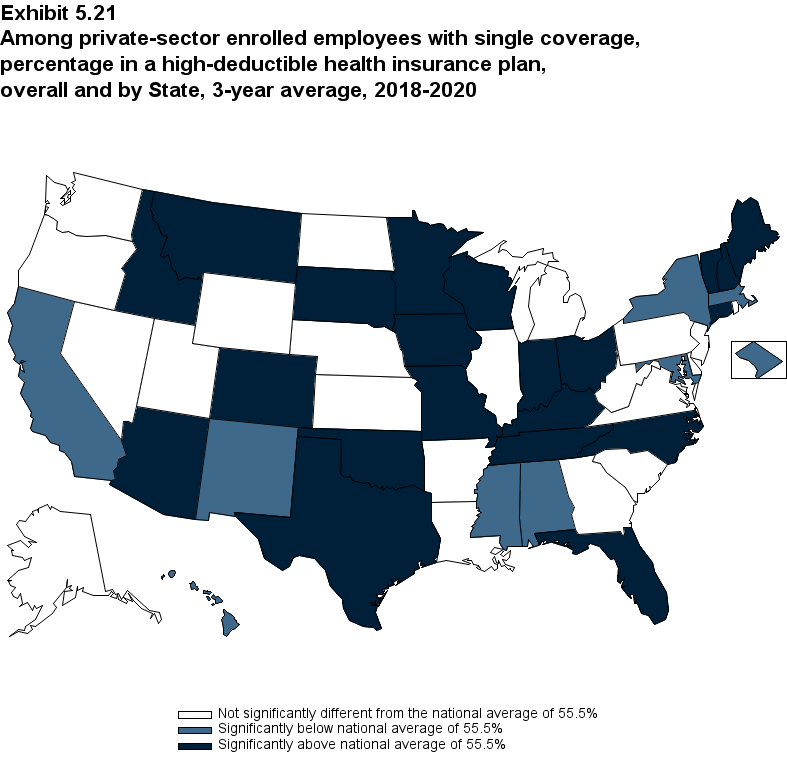

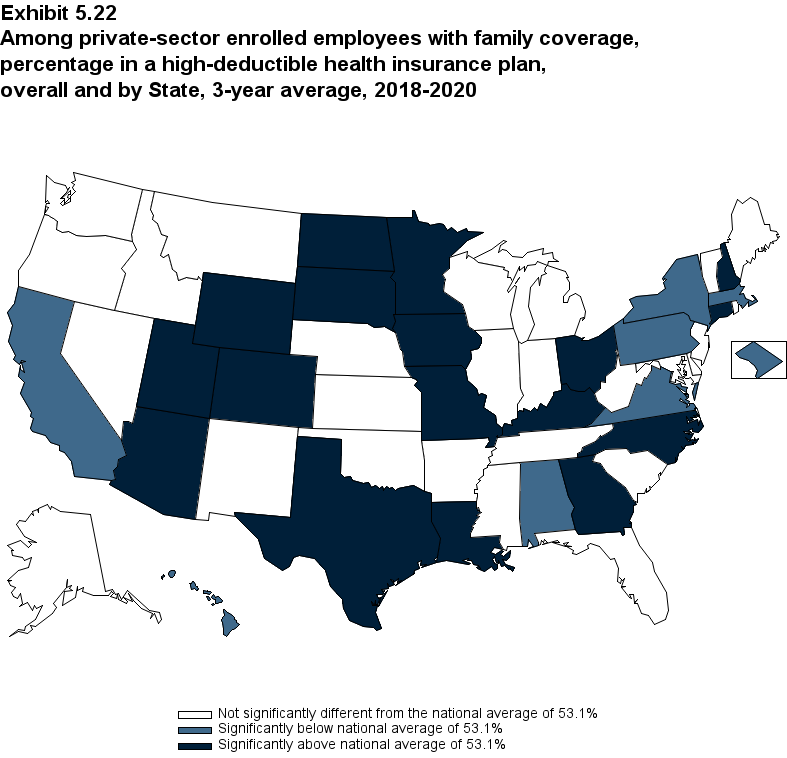

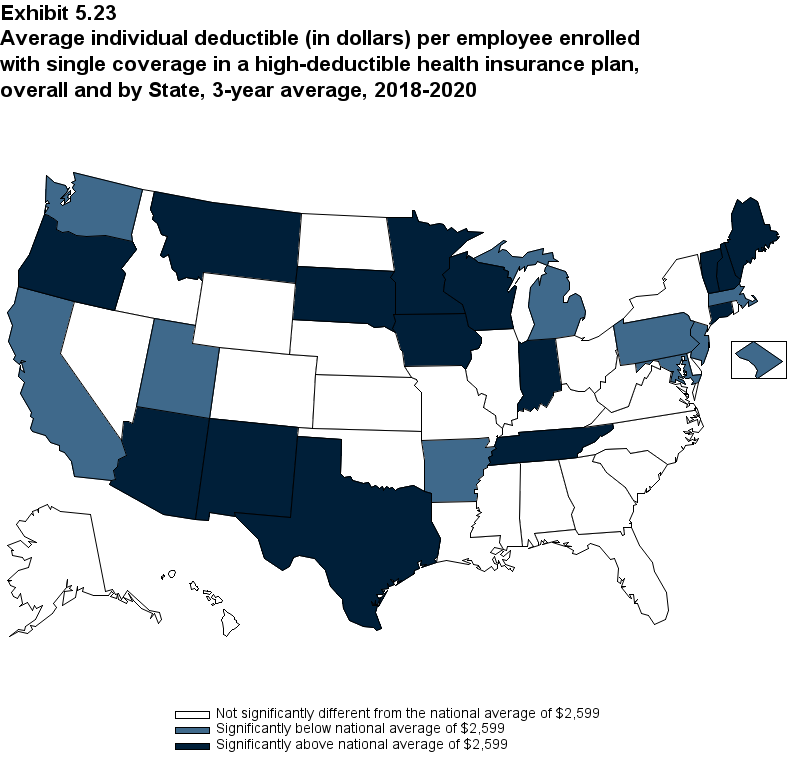

West Virginia |